Case study: GCP Infrastructure Investments (GCP)

Launched: 2010

Manager: Gravis Capital Management Ltd

Ongoing charges: 1.2%

Investment policy: GCP Infrastructure Investments (GCP) seeks to provide shareholders with regular and sustained long-term dividend income whilst preserving the capital value of its investments through investing in a diversified portfolio of UK infrastructure projects with long-term, public-sector-backed revenues, with a focus on debt.

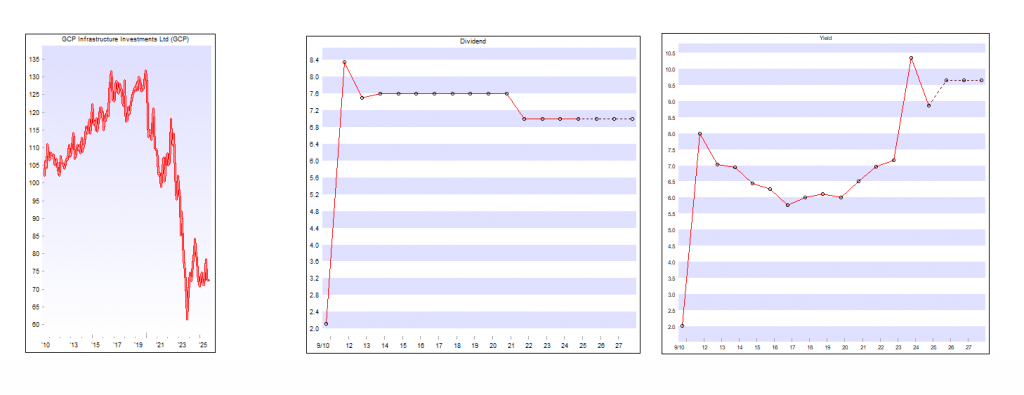

GCP Infrastructure Investments (GCP) was launched in 2010 to provide investors with reliable government-backed income, secured against essential UK infrastructure.

Unlike equity-focused funds, GCP lends to a diversified portfolio of infrastructure projects benefiting from long-term, government-backed cash flows, often with an element of inflation-linkage. These revenues tend to be resilient through economic cycles, offering investors both stability and diversification with a lower correlation to bond and equity markets.

The UK infrastructure landscape has undergone a significant transformation over the past 15 years. GCP’s diversified approach and early-mover strategy have enabled it to evolve with market dynamics, capturing enhanced returns and mitigating sector-specific risks. For example, within the renewables sector, the trust was able to lock in 9-10% yields from early investments in solar energy (in 2011), and anaerobic digestion (2013), significantly above the prevailing 0.5% base rate and the low single-digit yields offered to later lenders.

As solar and wind infrastructure markets have matured and risk-adjusted returns have fallen, GCP has reoriented its portfolio to take advantage of new opportunities, such as anaerobic digestion. This approach has helped GCP construct a portfolio that now generates enough clean energy to power almost a million homes each year.

Against a favourable policy backdrop, including the UK’s new £725 billion ten-year infrastructure strategy, GCP is well-positioned to benefit from rising public and private investment. With structural drivers such as decarbonisation, deglobalisation, ageing demographics and digital connectivity accelerating, the trust offers investors access to long-term trends through a defensive, income-oriented lens.

1) What is the investment trust’s goal?

To provide consistent, long-term dividend income and preserve capital through investing in a diversified portfolio of UK infrastructure assets that benefit from public-sector-backed cash flows, with a focus on debt.

2) Are investment decisions driven by a particular investment style?

GCP focuses on providing exposure to a diversified range of infrastructure assets in the UK which are underpinned by public-sector-backed cash flows, focusing on debt. These assets range from renewables, with revenues predominantly underpinned by government subsidies, PFI/PPP with unitary charge payments backed by the UK government, and public-sector-backed lease income from the supported living assets within the portfolio. Around half of the current portfolio is inflation-protected.

The team focuses on assets with high barriers to entry, monopolistic characteristics and low sensitivity to economic cycles. Rather than chasing capital growth, the trust prioritises risk-adjusted returns and capital preservation, seeking assets that deliver reliable income irrespective of the macro environment, with the diversified nature of the portfolio supporting this ambition.

GCP also favours projects with high upfront capital expenditure and limited ongoing operating risk, supporting dependable long-term returns, with just 1% of the portfolio exposed to construction.

3) How many assets does the trust typically hold?

GCP holds a well-diversified portfolio of almost 50 investments spanning 17 infrastructure sectors. Around 60% of the portfolio is invested in renewables (primarily solar, biomass, wind and anaerobic digestion), just over a quarter in PFI projects (with healthcare and education as the largest constituents), with supported living making up the remainder.

In terms of capital structure, the majority of the portfolio is invested in senior and subordinated debt, which offers greater security than equity exposure.

4) What is the trust’s dividend policy?

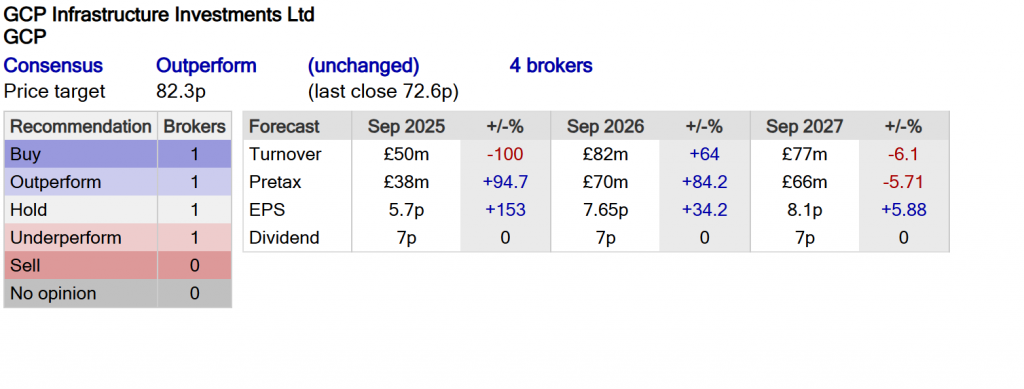

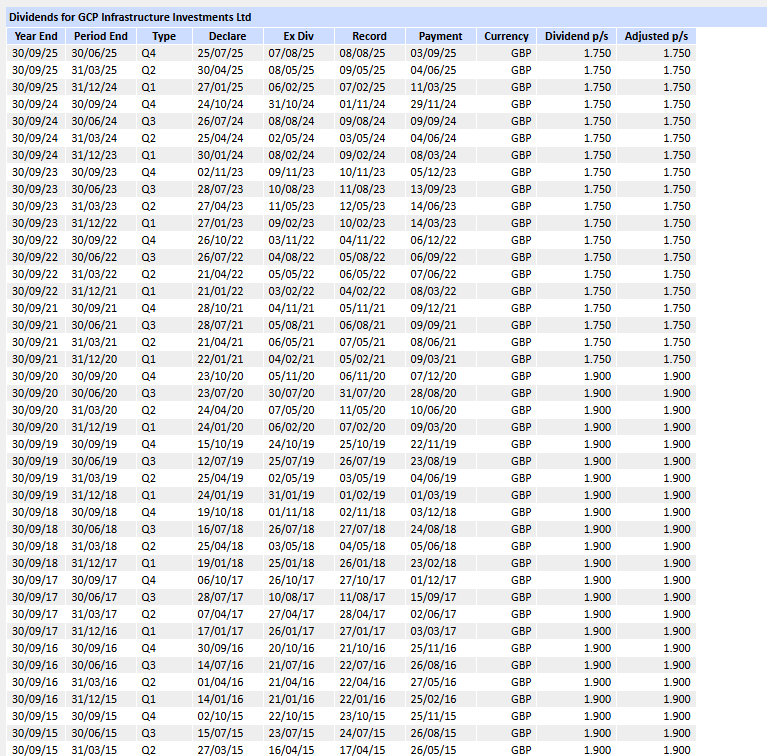

GCP has delivered consistent dividends for the last 15 years and is currently trading at a dividend yield of just over 9% (as at 08/08/2025). It set a medium-term 7.0 pence per share dividend target in 2020 and continues to deliver on this.

5) What are the trust’s ongoing charges?

GCP has an ongoing charge of 1.2% per annum (which is deducted from the net asset value and not from the shareholder).

6) Does the investment trust have performance fees?

No.

7) Does the investment trust use gearing and, if so, is it structural or opportunity-led?

GCP has a maximum allowable structural gearing of 20%, although this has typically been in the 10-15% range in recent years. It reported a net debt position of £36 million as of 30 June 2025, equivalent to 4.2% of NAV.

KEPLER

GCP Infra is pleased to announce a dividend of 1.75 pence per ordinary share for the period from 1 July 2025 to 30 September 2025. This is in line with the Company’s annual dividend target of 7.00 pence per ordinary share. The dividend will be paid on 9 December 2025 to holders of ordinary shares recorded on the register as at the close of business on 14 November 2025.

Expected timetable:

| Shares quoted ex-dividend | 13 November 2025 |

| Record date for dividend | 14 November 2025 |

| Dividend payment date | 9 December 2025 |

If you buy just before an xd date, you could receive 5 dividends in just over a year. With GCP that could equate to a yield of 12%. That would create a problem for next year but a lot of water to flow under a lot of bridges before then.

You’ve sparked my interest in this topic.

Great job simplifying something so complex.