Disclaimer

Disclosure – Non-Independent Marketing Communication

This is a non-independent marketing communication commissioned by M&G Credit Income (MGCI). The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

Overview Overview Analyst’s View Portfolio Gearing Performance Dividend Management Discount Charges

MGCI can be thought of as the best of M&G fixed income

M&G Credit Income (MGCI) offers an alternative to an investment in the conventional bond sectors, generating a yield similar to a high-yield bond fund from a portfolio of investment-grade quality and with minimal duration. While credit spreads look tight by historic standards and the UK and European economies look troubled, MGCI generates a high-dividend yield while taking low credit risk. The historic yield is 8.5%.

Manager Adam English can invest across all public and private bond sectors to achieve his objective of an attractive yield with low NAV volatility. It is the investment in private debt that is key: private debt typically allows much higher yields to be earned by lending to companies with a given credit quality. The extra yield is compensation for the illiquidity and the complexity of the deals, which require a high level of expertise to participate in.

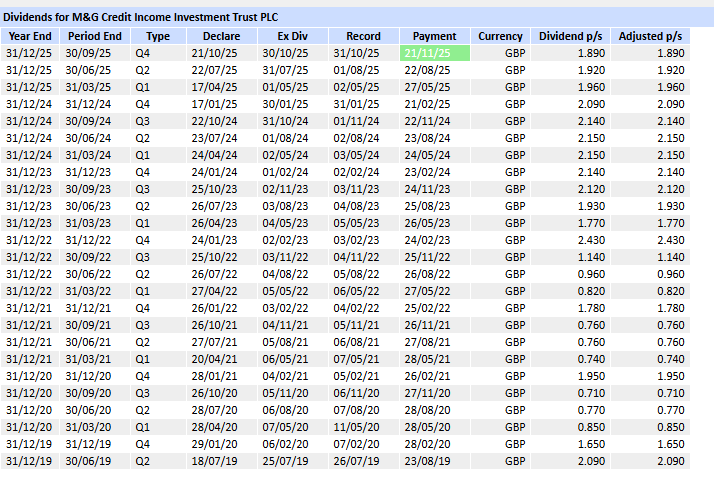

Adam allocates across these sectors with a relative value approach, looking for where the yield is attractive relative to the risks involved. Currently, he is cautiously positioned given that spreads generally look narrow across many sectors. That said, he is still able to generate a portfolio yield of 7.5% from a defensively positioned, 70% investment-grade-quality portfolio. The dividend target is SONIA (the interbank lending rate) plus 4% of NAV annualised, calculated quarterly. As we discuss in the Dividend section, this means the portfolio yield is currently not quite covering the dividend. However, the trust continues to pay its dividend target of SONIA plus 4%, making a small contribution from capital, and Adam is waiting for volatility to throw up better opportunities to add yield.

Analyst’s View

We think MGCI looks extremely attractive as an alternative to a high-yield fund at this juncture, given the current state of the markets and the different sources of risk in its portfolio. There isn’t really any hiding place in public-debt markets. Government bonds look vulnerable to concerns about fiscal sustainability, while inflation continues to erode what might seem like reasonable nominal yields: volatility seems certain. These factors may have driven investors to the corporate bond market, where they have driven in spreads to very narrow levels where they offer little yield pick-up. To generate a high yield in public markets requires braving the sub-investment-grade space, where narrow spreads could easily come under pressure if the UK and European economies continue to weaken. MGCI has a portfolio of investment-grade-quality debt, which offers a yield equivalent to a high-yield fund, and a duration of less than one compared to 7.7 in the investment-grade market, meaning it should be much less exposed to volatility in the rates market. Investors should remember that there is no free lunch, and the extra yield comes from the illiquidity and complexity of the portfolio, but we think M&G is ideally placed to assess and manage those risks given its size and expertise across the fixed income and private assets space.

The portfolio yield being below the dividend target is something to watch but not to worry about in our view. Adam argues that low NAV volatility and a conservative approach are both key things investors expect from the fund, and he won’t compromise on that in the short term. His view is that volatility and opportunities are inevitable, and this should allow him to boost the portfolio yield above target in the fullness of time without having to accept prices he thinks aren’t attractive for the risks he has to take.

Bull

- High yield linked to interest rates, with average investment-grade-quality credit

- Offers access to private-debt markets, providing attractive risk/return characteristics and diversification

- NAV should prove resilient due to many defensive characteristics

Bear

- Complexity makes it harder for investors to understand exposures

- Limited capital gain potential, including from duration

- Portfolio yield below dividend target

Leave a Reply