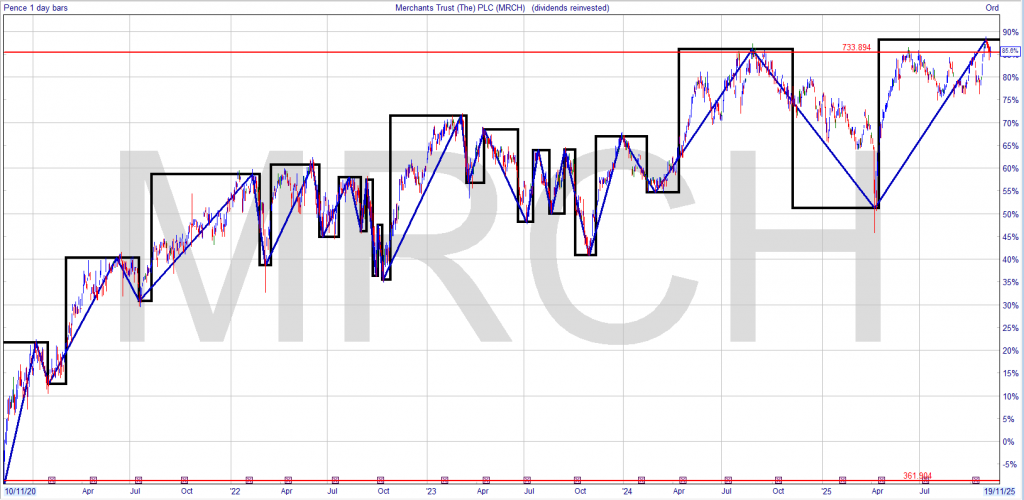

7 Nov ’20 – 08:14 – 5 of 580 Edit | 0 0 |

If u bought 10k of MRCH yielding 8%, it’s easier to switch

to a cash equivalent so £800 pa.

If u assume the dividend is unchanged over 10 years

but the share price doubles, u will still earn £800 pa

but it will only now yield 4%

(still 8% on buying price)

If u sold your MRCH shares say roughly 20k plus dividends earned

of 8k and re-invested in a share say a Renewable yielding 6%

your dividend would rise to £1,680 pa

If the share price doesn’t rise keep re-investing in MRCH for as long

as they don’t change their dividend policy, your dividend take

after 10 years would be £1,440, more if the share price fell as

the yield would rise.

Above is a post that I made 5 years ago, note the yield on MRCH today 5.1% and the yield on the renewables sector.

You’ve sparked my interest in this topic.

I’ve bookmarked this post for future reference. Thanks again!

addis ababa city tours Leah R. The Bosphorus cruise was a lovely way to see Istanbul’s skyline. https://www.sisidunia.com/23/bosphorus-tour-in-istanbul-exploring-the-heart-of-the-city-by-water/