Stir-up Sunday started back in Victorian times, and was a tradition where families would come together to get their fruit puddings stirred up, steamed and stored ahead of Christmas. Each member of the family would take a turn to give all the ingredients a good mix, whilst making a wish and help tick off the first task of the festive season.

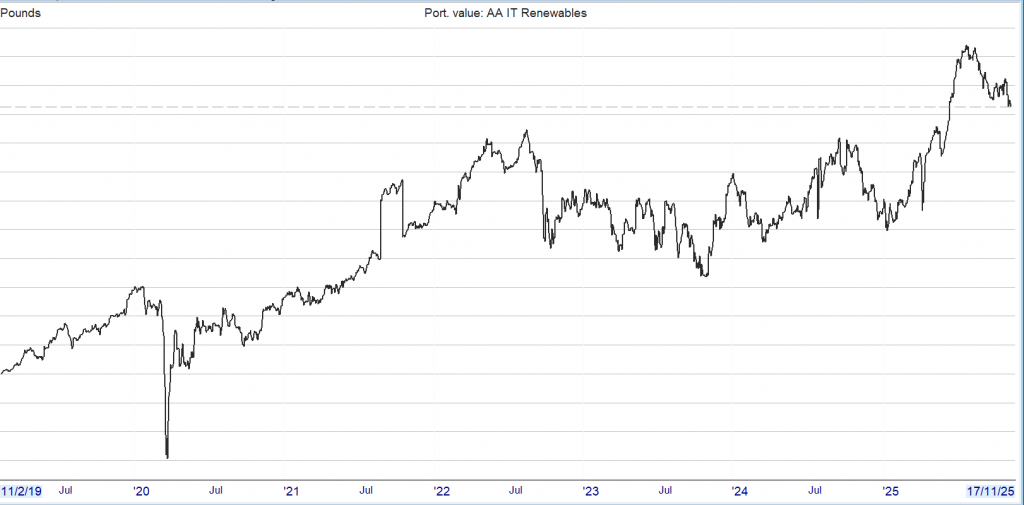

The portfolio was started because my son who is a huge climate warrior wanted to move his pension and I suggested a portfolio of Renewable Trusts.

He decided to move his pension elsewhere but I have maintained the portfolio, updating it once or twice a month. I have copied the performance in the posts below, so you can see how it all plays out, warts and all.

Note the loss during the Covid crash, which turned out to be a plus for the portfolio because as the price falls the yield rises. One traders disaster is another’s opportunity.

Low on chart £85,215.00 and the current price £146,282.00. The portfolio value is of no interest as the plan is to use the dividend stream as an ‘annuity’, unless an unexpected event happens and then you still have access to your cash, which you wouldn’t if you bought an annuity.

The current blended yield is around 10% which would provide an ‘annuity’ next year of around 15% on seed capital of 100k.

Leave a Reply