When The Correction Arrives, These Are The Corners To Stash Away

Nov. 12, 2025

JR Research

Summary

- Capital is already rotating from speculative, high-momentum AI and tech stocks toward value and defensive plays as market froth shows signs of unwinding.

- Berkshire Hathaway is positioned for relative outperformance, with disciplined capital allocation and renewed investor attention amid market rotation.

- The consumer defensive sector is showing early signs of reversing underperformance, offering potential protection as risk-off sentiment grows.

- Stay cautious on low-quality, speculative stocks and consider reallocating to high-quality names like BRK and defensives to mitigate downside risks.

Is Capital Starting To Rotate Away From Irrational Exuberance?

It’s less than a week since we saw glimpses of the wheels coming off for the money-losing speculative companies that I surfaced in a market outlook. To rub salt further into the wounds of these investors, CoreWeave stock (CRWV) has nearly plunged down further to its September lows. Many in the speculative basket are still trying to hang on for dear life, but I reckon this thin thread (of relying on momentum, because they have no proven fundamentals yet) might just give way if the reallocation or rotation trade gains traction.

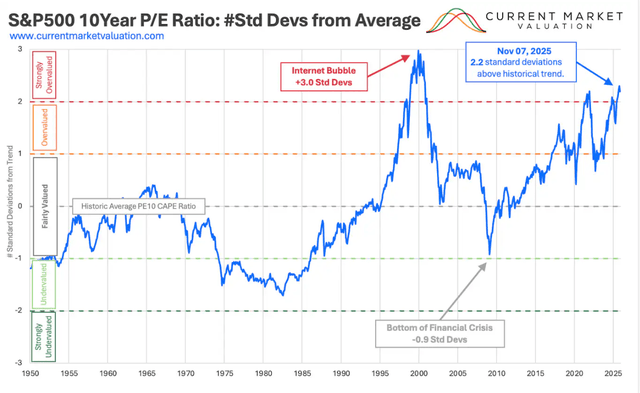

What rotation? What reallocation am I referring to? Surely, I don’t think I need to remind you that the S&P 500 10Y P/E CAPE ratio has surpassed the +2 standard deviation from its average. Incidentally, the 2021 peak has also been taken in the process, as investors piled into the risk on AI trade that has arguably driven the market recovery from Trump’s Liberation Day lows in April 2025.

Hence, with the tech sector (XLK) printing a forward P/E of >30x, don’t you think we need to be more scrupulous when assessing both sides of the AI narrative pushed by the ebullient investors and also the hawkish bears such as the likes of Michael Burry? These bulls litigate that this multiyear buildout has several more years to go as big tech and their peers rush to scale toward the multi trillion dollar AI infra mark. In contrast, these bears contend that such an aggressive cadence couldn’t be sustained without extending CapEx depreciation (disingenuously) or without matching it with more tactile proof from enterprise monetization to validate the burgeoning CapEx footprint.

Which is going to pan out? Sorry to disappoint you, but I don’t have a crystal ball to tell you who’s absolutely right and who’s horrendously wrong. Yet, I also want to allude to a classic observation from legendary investor George Soros. He said, “When I see a bubble forming, I rush in to buy, adding fuel to the fire. That is not irrational.” What’s the takeaway? “Knowing when to get out.”

Time To Survey Your Options Early In The Big Rotation Trade

I would attempt to add further to his astute observation that we must also survey the battlefield earlier to size up our options so that we know where to reallocate or rotate our capital before we get out (knowing that markets might move very quickly and abruptly; just look at CRWV’s battering). Knowing that the Magnificent Seven has become the single most important basket of stocks, driving up the S&P 500’s (SPX) (SPY) market cap in recent times, we must also bear in mind that if the narrative were to flip on its head, expect significant turbulence that may border on the extremely painful scenario plays.

Warren Buffett, in his final letter posted this week as the CEO of Berkshire Hathaway (BRK.A) (BRK.B), aptly pointed out that he believes the conglomerate “has less chance of a devastating disaster than any business [he] know[s].” Yet, he also offered an opportune reminder that “our (Berkshire) stock price will move capriciously, occasionally falling 50% or so, as has happened three times in 60 years under present management.”

Was it meant to be a shoutout to the AI warriors who are feverishly exposing their portfolio to the narratives championed by the exuberant AI bulls that don’t think the market’s momentum could shift against them without warning?

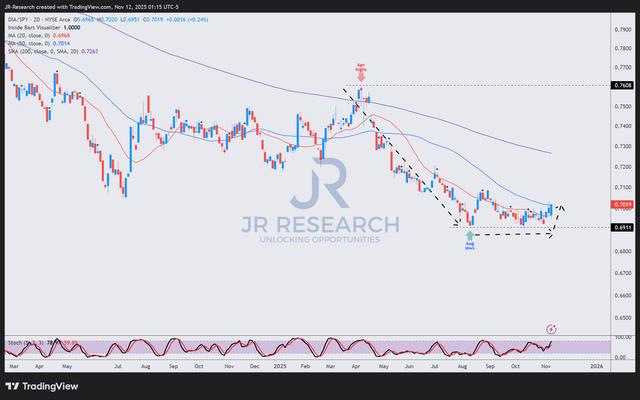

Well, that thesis has already been put to the test in recent days, as the less expensive Dow Jones Industrials (DIA) (DJI) have outperformed their S&P 500 peers this week. Brewing signs of a consolidation are starting to take hold, and note that the sideways moving price action has been gaining clout since August. Yes, August! In other words, the one way traffic (in favor of the S&P 500 as compared to the DJI) looks primed for a reversal, as the rotation arc takes shape.

Well, I don’t think a big bear market is imminent, unless the economy is expected to fall into a hard landing. That will most certainly spur a compression in the well extended multiples, and it’s hard to downplay that growth and tech stocks will bear the brunt of such selling. Sans a recessionary outlook, a corrective wave to shake out froth from the most irrationally exuberant corners of the market looks more likely than not, as this capital coming out from these air pockets seeks other opportunities aside from the Mag 7 plays.

So, where could investors take their money to? If there are signs of a reversal already manifesting in the DJI, I’m quite sure that we could also ascertain similar signals from other sectors/plays (presumably the less expensive ones?) Let’s take a look at two of these, which I thought were credible candidates to help investors contemplating some form of diversification from the risk-on setup.

Why Not Consider Putting More Faith In Berkshire Hathaway?

First up, Berkshire Hathaway. Look at the one way traffic that also stymied Berkshire’s performance relative to the market since April. It seems as if the market has completely digested the Buffett premium. Buffett seems to have also recognized the ambivalence and informed shareholders that he intends to “keep a significant amount of “A” shares until Berkshire shareholders develop the comfort with Greg that Charlie and I long enjoyed,” which he also added “shouldn’t take long.”

As a shareholder, I’m not perturbed with Buffett stepping down but still assured that he has gone out of his way to placate investors that the precepts, tenets, and principles that have made Berkshire what it is today wouldn’t be cast out of the window even after he steps down as CEO by the end of this year. Berkshire is built to last, and we know that Buffett’s disciplined capital allocation amidst the current market valuations should provide a boost to relative outperformance should investors start rotating away from the broad market.

We already see that happening in recent times since the end of October, as Berkshire stock outperformed the market. Is this a coincidence with that of the DJI observation I indicated earlier? I don’t think so, and I believe we are in the early innings of the market recognizing that they have ignored Berkshire stock for the past six months, and it’s time to take serious notice.

Defensives Looking For A Timely Reversal

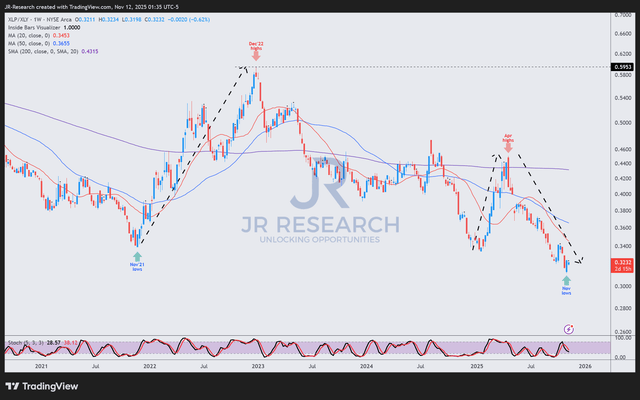

Next, consumer defensive (XLP). These are your Walmart (WMT), Costco (COST), Procter & Gamble (PG), and Coca-Cola (KO), to name a few. In a mega risk-on run up like the one we have experienced in the past six months, I wouldn’t be surprised to see defensives as a whole underperform. And that was exactly how it panned out.

Yet, don’t downplay the benefits of having XLP exposure during times of significant market stress like the pandemic bubble bust (2021-22) and the early 2025 mayhem. Both times saw the XLP outperform consumer discretionary peers (XLY) significantly until the risk-on sentiments regained control of the arc.

In the current context, it appears as if we are starting to see signs of a reversal favoring the XLP over its XLY peers, even though the print isn’t conclusive yet. In other words, pay close attention, as the one way traffic could be approaching an inflection point, which could cause the risk-on trade to turn around quickly into a risk-off one.

We have already gleaned signals from the speculative stocks mayhem, the Dow Jones Industrials starting to reassert strength, and Berkshire stock regaining momentum.

These aren’t isolated incidents, in my view. Rather, they represent critical observations suggesting that a more profound shakeout is still in the making, and one that might not be far from being actualized or panning out. In any case, remember to stay away from low quality and lean in on high quality to mitigate downside risks on your portfolio.

Leave a Reply