The Dark Side Of REIT Investing

Nov. 15, 2025 GMRE, ABR, BDN, BXP, DEA, GNL, ARI, SVC,

ILPT, BYLOF, GMRE.PR.A, GNL.PR.A, GNL.PR.B, GNL.PR.D, GNL.PR.E,

Jussi Askola, CFA

Summary

- I invest most of my capital in REITs.

- Even then, I’m bearish on a lot of them.

- This is a sector in which you need to be very selective to succeed.

I’m a strong proponent of REIT investing (VNQ). I invest about half of my own portfolio in REITs and regularly write bullish articles on them here on Seeking Alpha. Some of you may even call me a REIT cheerleader.

But even then, I’m objective enough to recognize that not everything is sunshine and rainbows in the REIT sector.

In fact, I would go as far as to say that the REIT sector has a dark side, which represents a large fraction of it, and should be avoided at all costs.

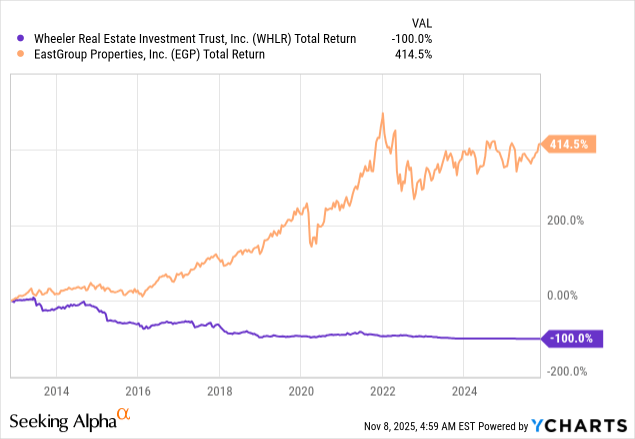

This is a vast and versatile sector, and just because two companies share the REIT acronym does not mean that they have anything in common. To give you a good example, consider the case of Wheeler REIT (WHLR) vs. EastGroup Properties (EGP). Both are REITs. Yet, one would have earned you a little fortune, while the other one would have lost you everything.

In today’s article, I’m going to discuss this dark side of the REIT sector and how to avoid losers like Wheeler in the future.

Dividend Traps

The unfortunate reality is that a lot of REITs are paying dividends that are not sustainable.

Just in the past few years, I have correctly predicted nine REIT dividend cuts in my various articles. All of these have cut their dividend by at least 20% since then:

| Company | Prediction Article |

| Global Medical REIT (GMRE) | GMRE |

| Arbor Realty Trust (ABR) | ABR |

| Brandywine Realty Trust (BDN) | BDN |

| BXP (BXP) | BXP |

| Easterly Government Properties (DEA) | DEA |

| Global Net Lease (GNL) | GNL |

| Apollo Commercial Real Estate Finance (ARI) | ARI |

| Service Properties Trust (SVC) | SVC |

The reason why so many REITs end up overpaying is that their management teams and boards are trying to make their company as compelling as possible to REIT investors, most of whom are income-oriented.

They know that a higher dividend may help them reach a higher valuation, which could then give them access to equity markets to raise more capital and accelerate growth. This can then allow them to further hike the dividend.

But, in doing so, they often end up setting the dividend too high from the start, leaving little room for error in case of future setbacks.

Eventually, setbacks occur, the dividend becomes unsustainable, but management teams and boards will often still resist cutting the dividend for a while, knowing that it would disappoint investors and hurt their market sentiment.

This then forces them to take on more debt to fund their dividend, only putting them in a worse position.

Eventually, after delaying the inevitable for a while, they still have to rip off the Band Aid, which then often leads to sharp sell-offs as frustrated shareholders sell the stock.

Therefore, it’s crucial to assess the dividend sustainability of a REIT before investing in it.

And it’s not as easy as checking the payout ratio. There are lots of REITs with a relatively low dividend payout ratio that still cannot sustain their dividend.

You also need to look at the leverage, the capex requirements, the cash flow growth prospects, and the track record of the REIT.

Overleverage

Many REITs are also overleveraged, and again, this is often the result of conflicts of interest between the manager and shareholders.

REIT managers are generally incentivized to grow their FFO per share, and the easiest way to achieve that is to take on more leverage and buy additional properties. As long as the cap rate is higher than the interest rate, this should grow the FFO per share, granting REIT managers their performance-based bonuses.

But this only works for so long. Eventually, the REIT runs into some setbacks, and the losses are then amplified by the leverage, often forcing the REIT to sell assets, raise equity, and/or cut the dividend, all of which can then permanently impair equity value.

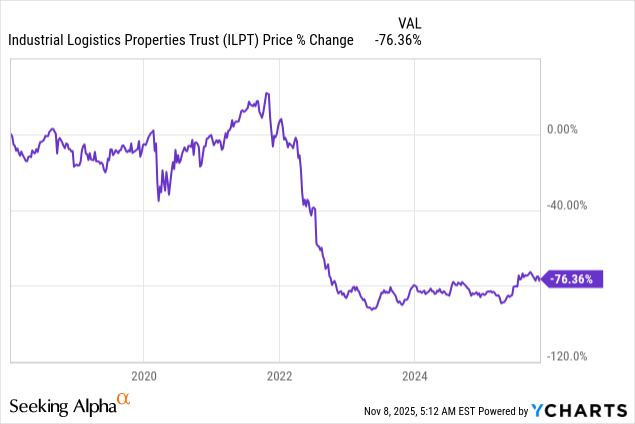

Take the example of Industrial Logistics Properties Trust (ILPT). The REIT owns great assets, but management took on too much leverage in an attempt to grow faster, and here are the results:

History has shown that the most rewarding REITs are those that are conservative with their leverage, as this leads to more consistent results across the cycle and allows the REITs to play offense during times of crisis, often acquiring properties for pennies on the dollar from distressed sellers.

I try to stick to REITs with LTVs below 50%, but ideally, closer to 30%. Some REITs in my portfolio, such as EastGroup Properties and Big Yellow Group (BYG/OTCPK:BYLOF), have LTVs as low as 10%. Naturally, this results in lower yields and higher valuation multiples, which is why many investors aren’t interested in them, but it also results in faster growth, lower risk, and higher total returns over time. The trade-off is well worth it, in my opinion.

Secular Headwinds

REITs invest in more than 20 different property sectors, and some of them are facing severe headwinds.

The office sector is the most obvious example. Vacancy rates are today at an all-time high of more than 20% as a result of the growing trend of remote and hybrid work. Moreover, I expect the AI revolution to only make things worse as it will lead to significant white collar job disruption, reducing the need for office space, and pushing tenants to require more flexible lease terms. This could then make it harder to finance these assets, pushing cap rates to higher levels, and leading to significant value destruction.

But it’s not just the office. Hotels are another sector with uncertain prospects. The post-COVID rise of Zoom (ZM) has permanently reduced business travel. It has also accelerated the growth of Airbnb (ABNB), which is leading to more supply, price competition, and ultimately lower margins. Finally, booking websites are also ever-growing, more powerful, and taking a greater share of the revenue as hotel flags lose value.

Most Class A malls are today doing surprisingly well, but as AI supercharges the growth of e-commerce with more powerful and personalized marketing, cheaper shipping, and an explosion in small e-commerce business formation (as it also reduces barriers to entry), I expect more pain for traditional retailers who fail to adapt, which could then lead to more trouble for malls.

Mortgage REITs also have a notoriously poor track record due to their businesses being too heavily dependent on macro factors that are out of their control. Even small changes in interest rates and spreads can make or break their businesses, which makes them quite unattractive, in my opinion.

And there are many other examples…

This is a sector in which you need to be highly selective because not all property sectors are well positioned for the long run.

Share Dilution

Finally, some REITs, especially those that are externally managed, will often issue new equity in an effort to buy more properties and grow the size of the portfolio, as this may justify higher management fees for themselves.

This is all fine as long as they are raising the equity at a price that’s high enough to earn a positive spread on new investments. The problem is that many of these REITs will not hesitate to issue equity even when they trade at a discount to NAV, resulting in a negative spread and diluting shareholders.

This can then negate all the potential benefits of the REIT, as constant dilution leads to poor performance.

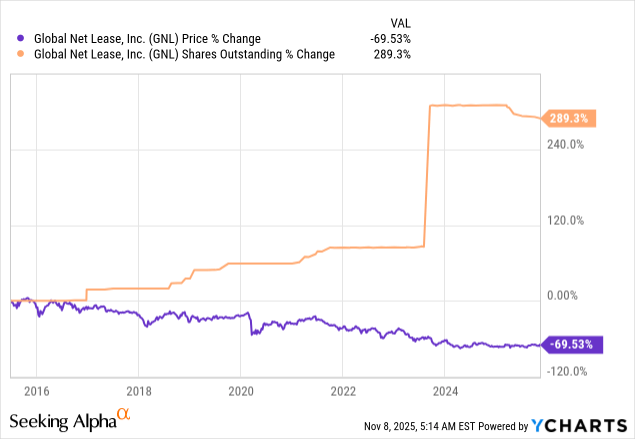

I think that Global Net Lease has been a victim of this in the past. Just look at the clear inverse correlation between its share price and its rising share count:

This is why I have previously argued that investors should always start their REIT analysis by taking a hard look at the management team. Nothing else matters if the management is going to dilute you time and time again.

Bottom Line

If you look at my past articles here on Seeking Alpha, you will note that I regularly cover REITs to avoid and others that are likely to cut their dividend.

I make it a point to cover the good and the bad because no sector is ever perfect, and knowing what not to buy is often just as important, if not more, than identifying good investment opportunities.

We, of course, aren’t perfect either. At High Yield Landlord, we have suffered quite a few losses in our portfolio lately. But fortunately, we have had many more winners over the years as well.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Leave a Reply