Even a poor plan is better than no plan, remember a plan without an end destination is a poor plan because it’s a gamble.

Three options when you want your hard earned to provide a pension.

An annuity

The best annuity rates of November 2025

The best annuity rate will vary depending on the value of your pension pot, the provider and your own personal information.

We asked retirement broker HUB Financial Solutions to crunch some numbers to get an idea of how much someone aged 65, 70 and 75 could generate from a £100,000 pension pot when purchasing an annuity. The quotes are based on someone living in the S66 postcode in England.

Its analysis shows that Legal and General is currently a market leader when it comes to annuity rates.

A 65-year-old could turn a £100,000 pension pot into an annual income of £7,732.80 by purchasing a single annuity. This changes to £8,459.88 if they have a medical condition, such as lifelong asthma in this scenario.

Older people can often access higher annuity rates. For example, that same £100,000 pot could generate an annual income of £9,957.60 from an annuity for a 75-year old, or £11,006.16 if there is a disclosed medical issue.

However, note that rates can vary and will change regularly.

A joint life escalation is £5,246.00

The 4% rule.

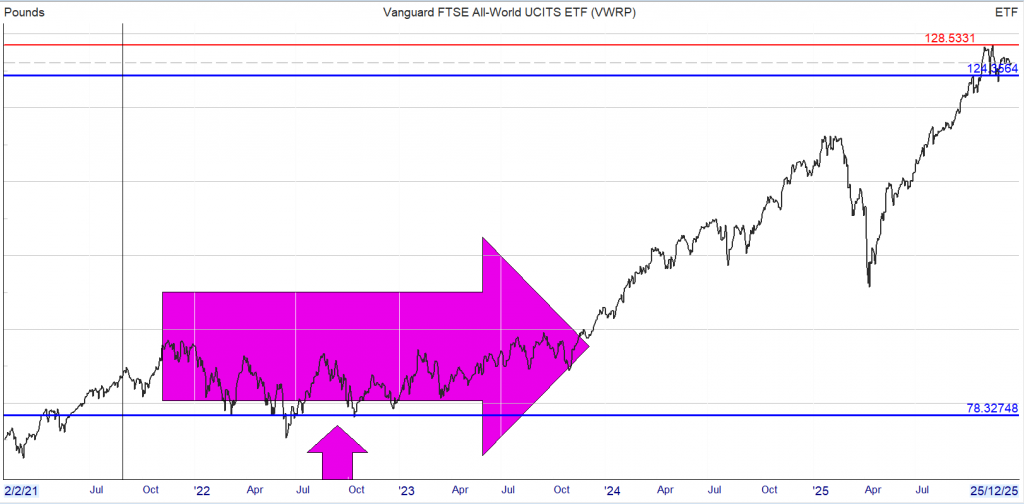

Above is the comparison share for the Snowball. Note the multi year sideways performance before it moves higher.

Current value £151,169.00 not too shabby.

Using the 4% rule it would provide a pension of £6,046.00

The Snowball will return income of over 10k this year, with a target of 10k for 2026.

So the options.

A joint life annuity of £5246.00. You have to surrender all your hard earned and the amount you will actually receive is a gamble on Gilt returns at the time. It could be lower or higher.

A 4% ‘pension’ currently £6,046.00. If the market crashes you may be forced to sell shares and the withdrawal amount will fall. It could of course be higher but you keep all of your capital

A dividend income stream currently 10k and should continue to increase and you also keep all of your capital.

You could include an ETF in your plan supported by your dividend paying shares. The choice my friend is yours.

Leave a Reply