Top Beaten-Down Data Center Infrastructure Stocks

Dec. 21, 2025 AMD, APLD, FN, JCI

Steven Cress, Quant Team

SA Quant Strategist

Summary

- Tech volatility has surged in Q4, hammering AI and data center names, creating pockets of opportunity for buyers.

- Data centers sit at the heart of AI infrastructure, with the market forecast to grow about 25.6% annually through 2034.

- SA Quant has identified four key data center infrastructure stocks with Quant “Strong Buy” ratings and excellent factor grades that have fallen off their 52-week highs.

- I am Steven Cress, Head of Quantitative Strategies at Seeking Alpha. I manage the quant ratings and factor grades on stocks and ETFs in Seeking Alpha Premium. I also lead Alpha Picks, which selects the two most attractive stocks to buy each month, and also determines when to sell them.

AI Rally Stalls on Bubble Fears

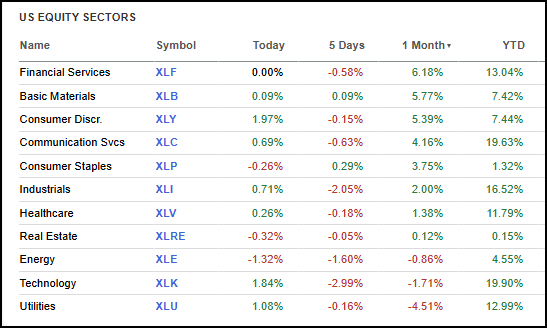

Tech sector volatility has surged in Q4 of 2025, as discussed in my recent piece, impacting AI names that have had incredible run-ups year-to-date. Information technology has been one of the worst-performing sectors on a trailing one-month basis, as profit-taking in mega-cap leaders and uncertainty over Fed rate cuts caused a rise in index volatility. Tech stocks experienced strong sell-offs despite solid fundamentals, as investors questioned whether the current levels of AI capex would translate into earnings.

Tech has been the second-worst-performing sector on a trailing one-month basis.

Seeking Alpha: As of 12/18/2025.

The Nasdaq slid as much as 2% on Dec. 12, weighed down by Broadcom’s (AVGO) margin warning and a delayed Oracle–OpenAI (ORCL) data center timeline. Companies supporting data centers have suffered in tandem, with recent sessions marked by declines. Even as many suppliers and operators remain long-term beneficiaries of the AI boom, their shares have faced short-term pressure, creating opportunities in a notoriously stretched sector.

Data Centers: The 21st Century Gold Rush

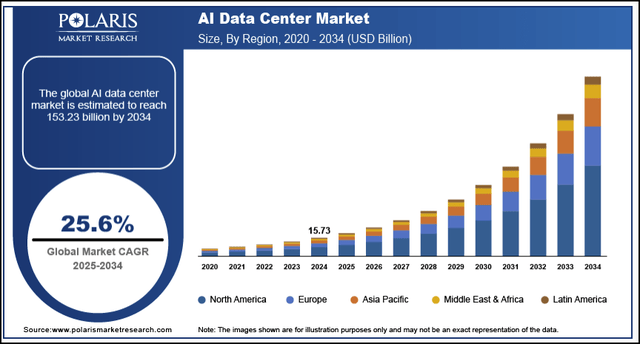

Back in October, I highlighted three stocks driving the next wave of data center expansion. Data centers are the backbone of the AI ecosystem, housing the servers, GPUs, and other infrastructure required to power its massive computational workloads. The global AI data center market is projected to grow at a 25.6% CAGR through 2034, and McKinsey forecasts that AI workloads will account for roughly 70% of total data center demand by 2030.

Source Link: Polaris Market Research

There’s an old saying: “During a gold rush, sell shovels,” with the idea being that it’s often more profitable to supply the tools and services rather than chase the opportunity itself. In the current AI boom, that means focusing on data center component providers instead of downstream hyperscalers. This approach has paid off in the Alpha Picks portfolio, where one of the biggest winners, Celestica (CLS), a key supplier of data centers, has returned more than 900% to the portfolio. The data center market is vast, supported by a broad ecosystem of vendors that ensure operations run smoothly. Below, I’ll highlight four top Quant-rated data center stocks that have recently pulled back amid market volatility.

How I Chose My Top Data Center Infrastructure Stocks

The data center stock universe is drawn directly from the largest data center ETFs, which are built by professional portfolio managers and analysts whose role is to identify leading companies in the space. I aggregated all the securities in those ETFs and loaded them into the Seeking Alpha Quant Screener, which ranked the stocks using our quant metrics and emphasizing names that score well across factor grades. Finally, using the Seeking Alpha Stock Screener, I evaluated stocks trading off their 52-week range to pinpoint Strong Buys that have recently pulled back amid the latest bout of volatility.

1. Advanced Micro Devices, Inc. (AMD)

- Sector: Information Technology

- Industry: Semiconductors

- Quant Sector Ranking (as of 12/19/2025): 18 out of 537

- Quant Industry Ranking (as of 12/19/2025): 5 out of 68

- Market Capitalization: $327.33B

- Quant Rating: Strong Buy

AMD sells high‑performance CPUs, GPUs, and networking chips for cloud, enterprise, and AI data centers. As a core upstream hardware supplier, AMD provides the compute that sits at the heart of data center infrastructure, enabling processing and data movement. In its Q3 earnings call, management emphasized that data centers are a main growth area:

“Our record third quarter performance marks a clear step up in our growth trajectory as the combination of our expanding compute franchise and rapidly scaling data center AI business drives significant revenue and earnings growth.”

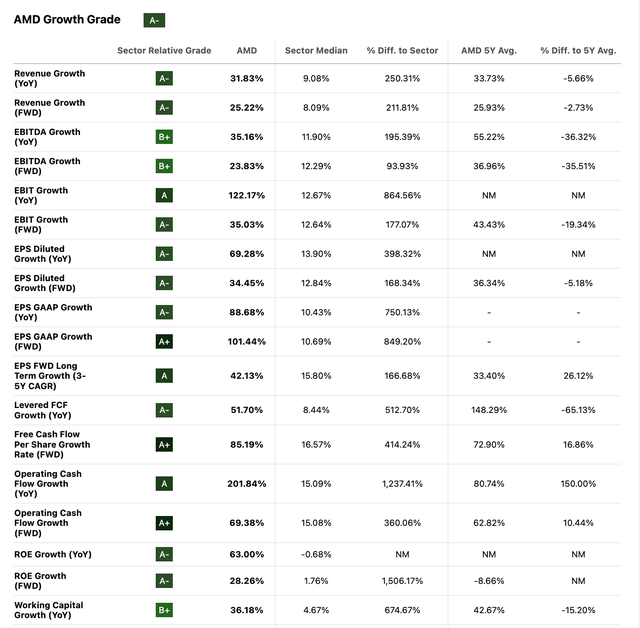

The stock has suffered amid broader sector volatility, declining nearly 8% in the last month. However, this has only added to AMD’s value story. Its grade has improved from a D three months ago to a C, supported by a forward PEG of just 1.2x (a 30% discount to the sector median).

AMD’s remaining fundamentals are sound, with an EBITDA margin that is 83% above the sector median and ‘A’ range grades across nearly every growth category. Notably, the EPS FWD long-term growth (3-5Y CAGR) is 166% above the sector median, demonstrating confidence in the company’s long-term trajectory.

AMD Growth Grade

AMD is a strong data center growth play, supported by robust profitability and an improving value profile that together underscore the company’s quality.

2. Applied Digital Corporation (APLD)

- Sector: Information Technology

- Industry: Internet Services and Infrastructure

- Quant Sector Ranking (as of 12/19/2025): 14 out of 537

- Quant Industry Ranking (as of 12/19/2025): 1 out of 22

- Market Capitalization: $6.83B

- Quant Rating: Strong Buy

APLD operates data centers built to house infrastructure for both AI and blockchain workloads. Despite the stock’s recent pullback, the company has delivered a remarkable 172% return over the last year. APLD recently entered a credit facility to fund early-stage planning and construction of new AI-focused data center campuses, which will directly support its growth. From a Quant perspective, the company delivers 129% forward EBITDA growth compared with 12.32% for the sector. While Applied Digital’s earnings remain negative, the company’s financial trajectory is improving as major data center contracts begin to ramp up.

“With the CoreWeave lease supporting roughly half a billion in annual net operating income and Polaris Forge 2 poised to significantly increase that figure, we are laying the foundation to reach our stated goal of $1 billion of NOI run rate within five years. And this is just the beginning,” said APLD CEO West Cummins.

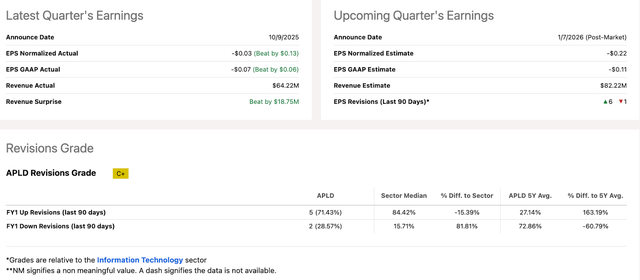

Despite robust momentum, the company’s valuation grade improved from an ‘F’ three months ago to a ‘D’ today. In addition to improving fundamentals, the company showcases analyst enthusiasm, with five FY1 Up Revisions in the last 90 days vs. two downward.

APLD Earnings Revisions Grade

Applied Digital’s strategic presence in North Dakota positions the company to capitalize on the region’s low construction and operational costs, abundant energy, and a favorable climate that keeps its data centers cool. These factors, combined with the company’s excellent fundamentals and recent pullback, make APLD a solid data center stock.

3. Fabrinet (FN)

- Sector: Information Technology

- Industry: Electronic Manufacturing Services

- Quant Sector Ranking (as of 12/19/2025): 28 out of 538

- Quant Industry Ranking (as of 12/19/2025): 4 out of 19

- Market Capitalization: $16.21B

- Quant Rating: Strong Buy

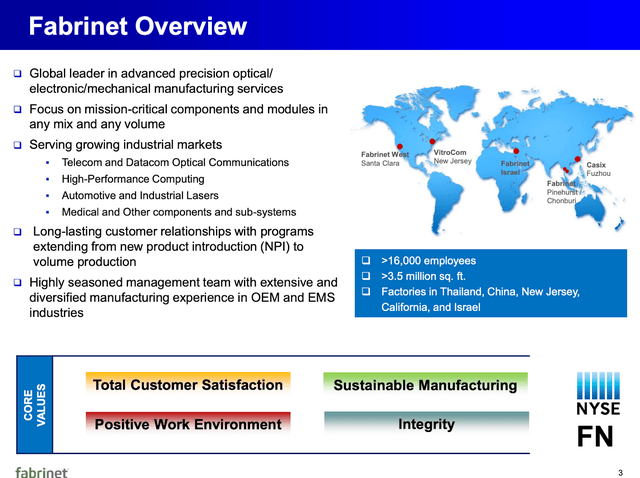

Fabrinet is an upstream hardware player in the data center market, providing advanced manufacturing and packaging services for complex optical and electronic components. In addition to a strong foothold in the data centers, the company also serves a diverse set of industrial markets, including automotive applications and advanced medical equipment.

Source Link: FN Q1 2026 Investor Presentation

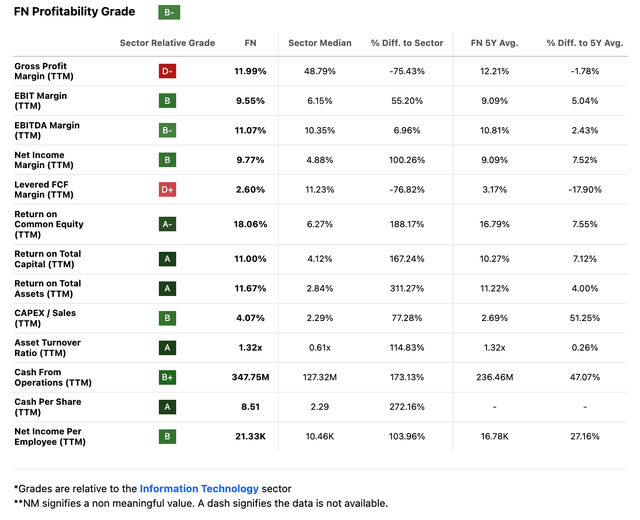

The company delivered a record Q1 FY26, with revenue up 22% year-over-year to $978 million, driven by strong telecom demand and its high-performance computing category, which management expects to scale rapidly in Q2. This growth has translated to exceptional profitability. FN offers an ROE that is 188% above the sector median while boasting an incredible $8.51 in cash per share.

FN Profitability Grade

The stock’s ‘A’ grade momentum has been a steady march forward, returning 77% in the last six months alone. Despite the gains, the stock still trades in line with the sector. Although Fabrinet is broadly higher over the past month, its more recent dip offers a more attractive entry point for those looking to initiate a position.

4. Johnson Controls International plc (JCI)

- Sector: Industrials

- Industry: Building Products

- Quant Sector Ranking (as of 12/19/2025): 43 out of 615

- Quant Industry Ranking (as of 12/19/2025): 1 out of 40

- Market Capitalization: $71.96B

- Quant Rating: Strong Buy

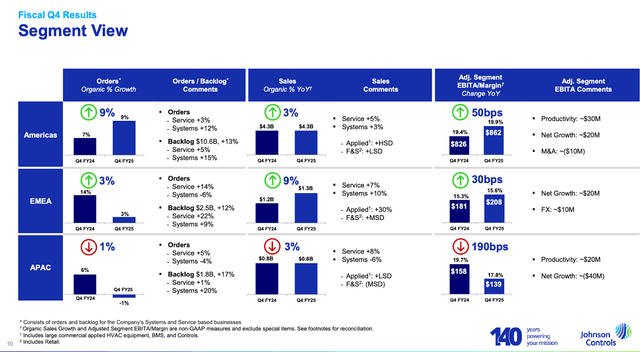

JCI’s cooling and controls solutions are critical for managing the energy use of high‑performance AI workloads, helping operators cut power and water consumption while maintaining uptime. In its Q4 earnings call, management cited data centers as one of the fastest‑growing verticals in its record backlog, contributing to 9% growth in the Americas segment in Q4.

Source Link: JCI Q4 2025 Conference Call

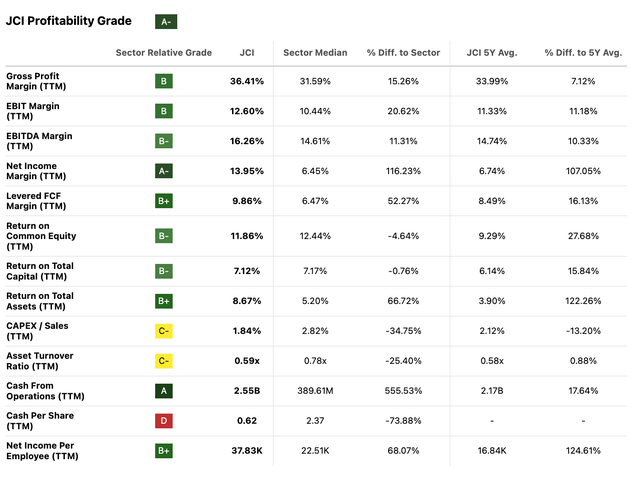

The company delivered strong profitability, with segment margins expanding and adjusted EPS growing double-digits above guidance. From a Quant perspective, highlights include an incredible $2.55B in cash from operations vs. the sector’s $390 million and a net income margin that is 116% above the sector.

JCI Profitability Grade

The company boasts a record backlog of $15B and improved free cash flow, suggesting solid forward growth potential. While JCI still screens as somewhat stretched on several traditional valuation metrics, it currently trades at a 16% discount on a forward PEG basis, suggesting the shares may have further room to run. Underpinned by solid fundamentals and a robust pipeline, JCI offers investors focused exposure to the fast‑growing data center service and maintenance market.

Concluding Summary

Tech has come under pressure in Q4 2025, as profit‑taking and Fed uncertainty have fueled volatility. AI leaders and data center names have sold off sharply despite solid fundamentals, creating an opportunity in a segment with notoriously stretched valuations. SA Quant has identified four top Quant-ranked data center stocks that have fallen off their 52-week highs. Advanced Micro Devices, Inc., Applied Digital Corporation, Fabrinet, and Johnson Controls International plc offer a mix of strong profitability, value, growth, momentum, and earnings revisions for investors looking for exposure to the data center ecosystem in the recent pullback.

Leave a Reply