23 RGL-room to grow in 2026

Top Voted Idea by Readers – so it joins the picks for 26

Dear reader

I previously wrote “Sometimes a share moves (back) to a tempting level.”

Well 99.8p a share is tempting for sure here.

So much so that CEO Mr Inglis has bought £100k more shares in the past 3 months, and a new NED at RGL bought £10k too. Shallower pockets maybe.

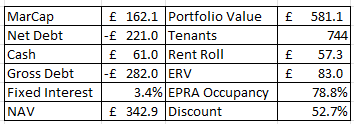

At a 52.7% discount to the book value of its assets and a fully covered and growing 10% yield is this a tempting level?

Based on a recent further sale of a £13m property sold for 1% above book (not 52.7% below), that was leased for ~£0.6m per year at 65% occupancy that’s yet another great result.

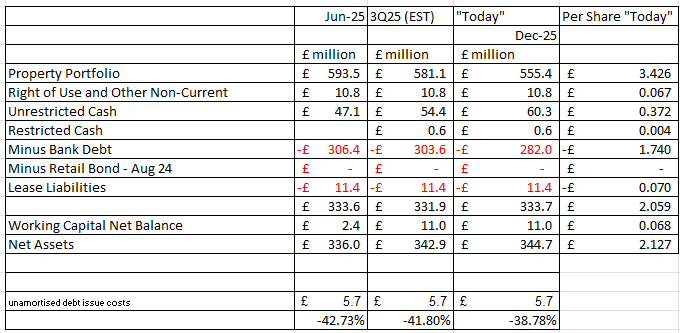

RGL gets you an estimated £3.43 worth of property (at book value) for a net -£1.30 of debt to give you just over £2.10 of “stuff” for just a pound.

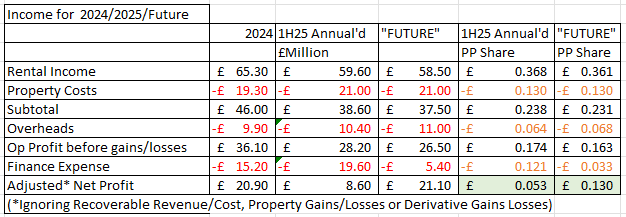

“Stuff” that delivers 5p today of rental income, and prospectively 13p in the future.

The above estimate is based on disposals but also execution of its renovation strategy to get more of its offices into a better grade of Energy Performance but also modernised and tarted up.

No more Tea around the Tea Urn, we are talking Barista Coffee makers, and no more open office we are talking aesthetic glass pods and collaboration spaces.

No more smoke stack view of the city, we are talking Costa Rican jungle paradise backdrops. Oh wait, maybe I’m exaggerating on that one – but you get the idea. Aesthetics matter.

(RGL year end is 31st December)

Disposals

I will admit to scepticism as to the speed of disposals. In the past it had been slow. Yet in 2025 I was wrong. RGL have been successful (as at 23rd December 2025) in exceeding their target and disposing of over £51m of property during FY25 at slightly above book value (before sale costs).

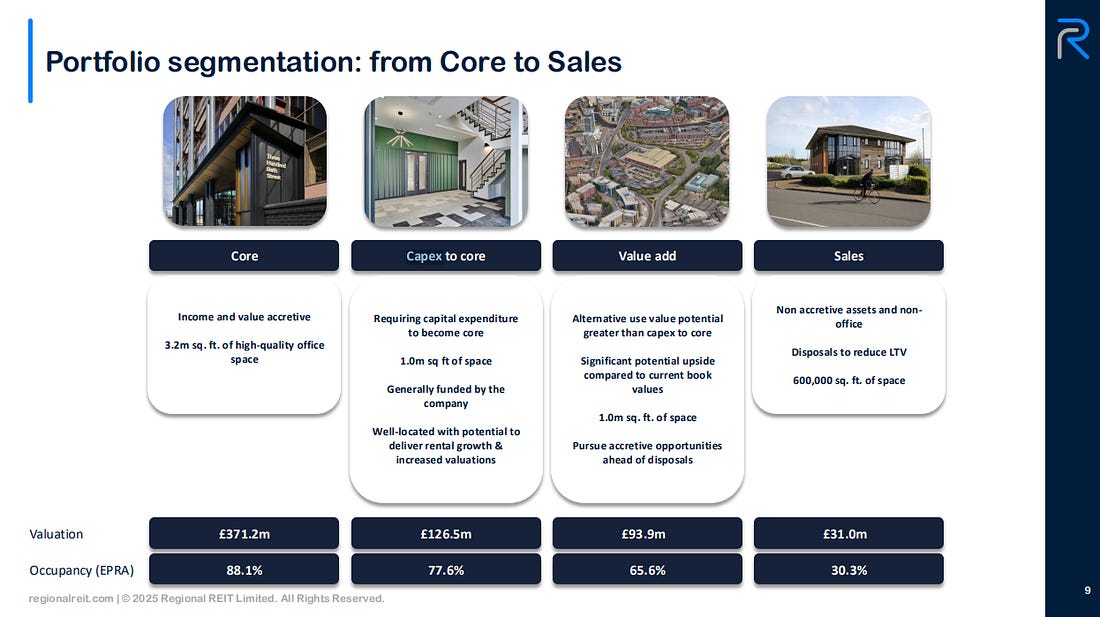

So it’s achieved success in selling 40% of its dustbin “Sales” segment of a £93.2m valuation at slightly above that valuation and driving up its occupation levels. That’s really, really, encouraging.

If the dustbin is being sold slightly above book that implies the Core and Capex to Core (once it becomes Core) could be worth quite a bit more than book value.

Disposals (net of costs) were £28.6m in 2024 (at a -£3m loss) and £25m in 2023 (at a -£1m loss) so the 2025 result is well ahead of previous years suggesting a strengthening market particularly the fact that the sales price is ahead of book value (albeit only by small amounts). Post costs RGL will at best break even to that gain or up to a -£1m net loss on disposal – net of selling costs.

But disposals are not being discounted by 53% as the REIT currently is.

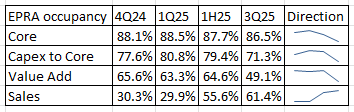

RGL’s “Core” segment are now at a 86.5% level. It is true it fell slightly in 3Q25 ahead of Rachel’s budget. Boo.

It was not just RGL that suffered falling occupancy levels in 3Q25. The whole sector Trinity Capital, Schroders, Picton Property, Apex Capital all reported a similar issue of uncertainty ahead of the budget as well as Rachel’s prior Employers NI tax of +2%.

But Rachel’s new taxes in the 2025 budget largely did not materialise. No horrors in that budget for Offices and REITs. Well one actually – but one that benefits RGL. The government have introduced a tier of above and below £500k rateable value which will hit London offices with a higher multiplier and drive demand to cities outside the Big Smoke (more typically rateable below £500k which will henceforth enjoy lower mutlipiers.

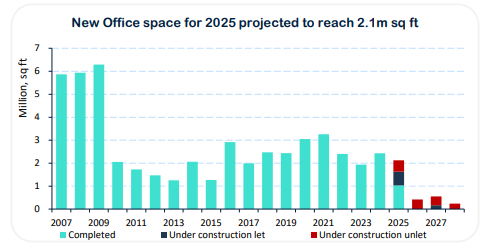

Outside London Grade A availability of offices is tightening, and the word shortages of prime stock is now being spoken of. That word hasn’t been spoken of for a long while.

Just like Rachel’s pal Kier there are two tiers emerging where low quality offices in low quality locations remain unloved and low value. But ESG-compliant offices in key cities outside London are seeing a definite uptick. RGL’s strategic of refurbishment and upgrade to achieve higher EPC and improve aesthetics is well situated for this “K curve” dynamic to offices – and the market hasn’t woken up to this – yet.

Capex To Core

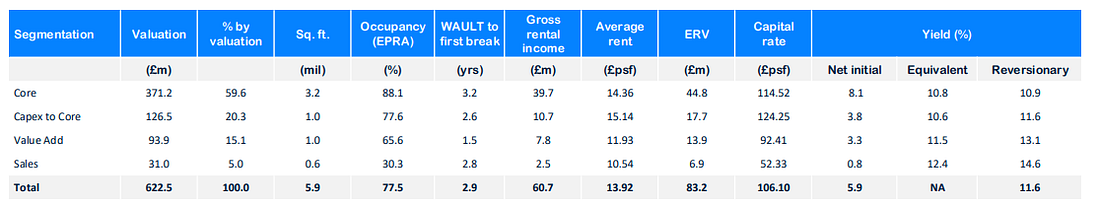

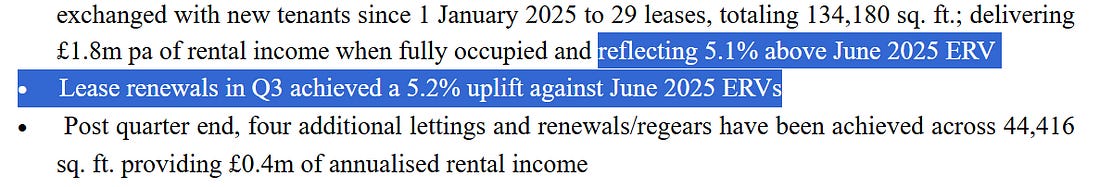

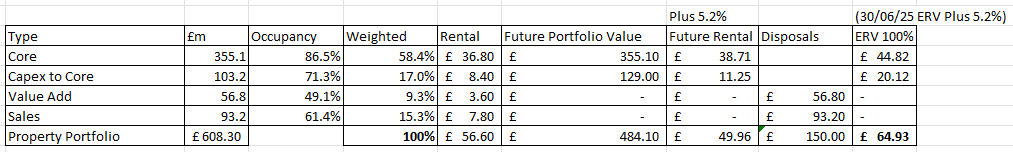

RGL’s “Capex to Core” segment are the properties that shall be upgraded and therefore become core and enjoy a higher per square foot rental. £9m has been spent on capex during 2025. I’m assuming post conversion (as has thus far proved) a 25% increase in rate can be achieved and that the occupancy moves from 77.6% to 88.1%.

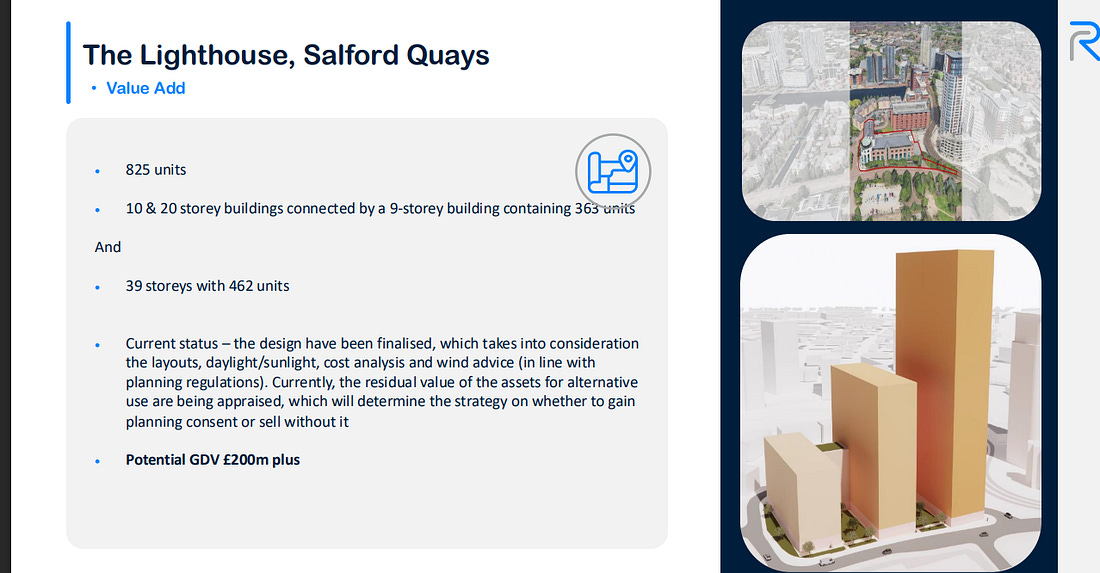

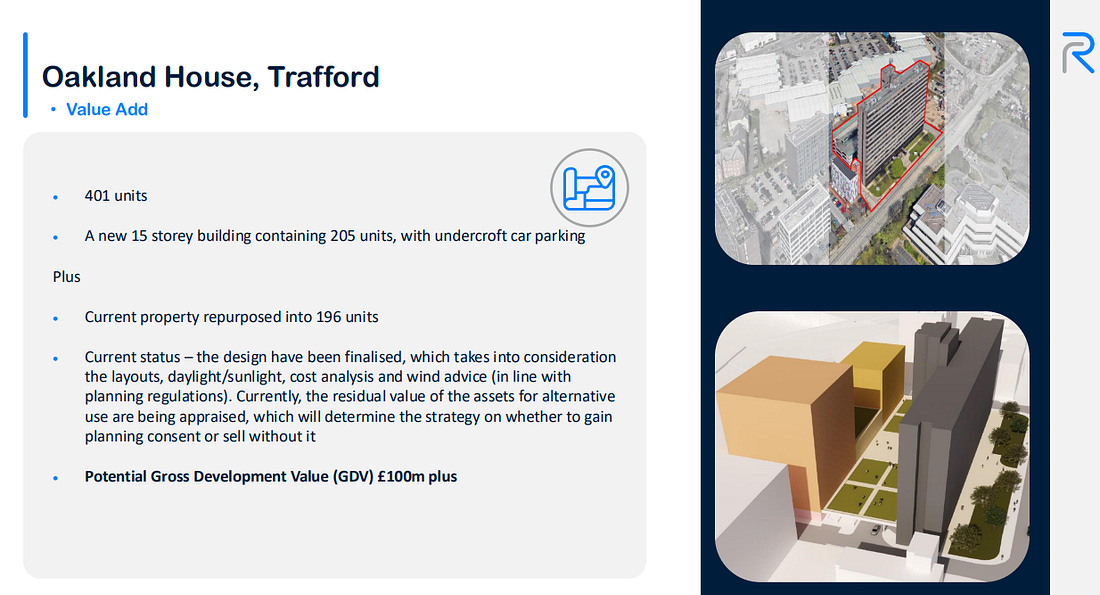

The third type “Value Add” are all about adding value and doing stuff to achieve a higher disposal value than its current book value. This will typically be a change of use and potentially involve obtaining planning permission. RGL speak of “greater potential” and quote examples with strong upside.

I’d assumed the “Sales” segment meanwhile would lose about 20% of their value i.e. they get realised for 80% of their valuation – so far that’s far from the case.

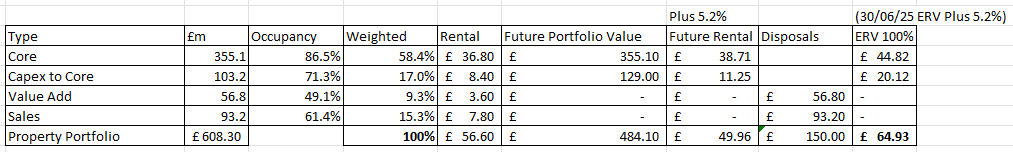

If the Value Add and Sales can be sold at book value only (i.e. Value Add adds no value ironic huh?) then here’s the result:

£150m of disposals (from Value Add and Sales) means a -£150m reduction in debt. That would leave net debt below -£100m once that sales programme is complete.

The Capex to Core is assumed to rent at 25% above current levels and the 5.2% increase already seen in 2025 is used to model the “future rental” based on current occupancy. Even after disposal (to nearly no debt) the rent roll pays nearly £50m a year.

If we then consider the ERV at 100% occupancy then we actually get to a £65m rent roll – or £90m if the value add and sales segments were not fully disposed and instead fully occupied at the ERV price point.

None of that potential income increase is anywhere in the price today.

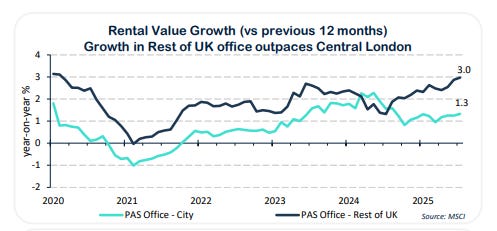

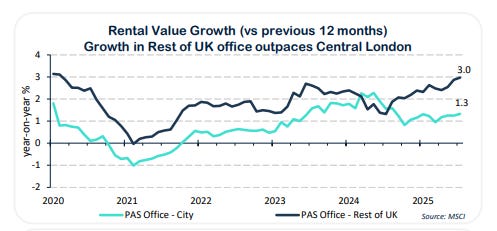

Of course that model assumes a single increase of 5.2%. What if actual increases are accumulating at up to 3% per year – as MSCI tell us is currently the case?

There is a substantial slow down meanwhile in the supply of new office space. What does rising demand and declining supply mean for the price of UK regional Offices do you think?

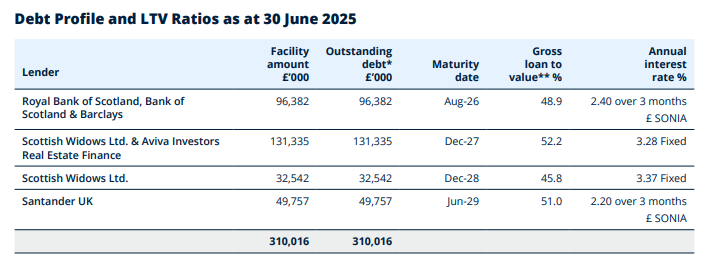

Covenants and Debt

With gross debt now at an estimated -£282m (net -£221m est.) and LTV at just under 40% (est) it is true that only 8 months remain until the 1st tranche of debt needs to be rolled. 2.4% + SONIA is 6.7% so it is likely that interest costs will remain static in 2026 with a potential -£2m to -£3m of additional costs in 2027 as the 3.28% fixed gets renewed. Less repayments through disposals between now and then.

If RGL can dispose another £40m-£50m in 2026 then its net debt might be an estimated circa -£160m in 12 months.

Under a sub £100m debt model then there is over 3 years until the Scottish Widows £32.5m debt needs to be renewed.

This kind of freedom and indeed achieving sub 40% LTV is something unrecognisable to a RGL-er from a few years ago where “Covenant Breach” was a constant concern. An acute concern.

Circumstances might determine that minimising debt is not the way RGL needs to go.

Despite Andrew Bailey’s hesitancy there is every chance that interest costs will continue to fall. Evidence for a UK recession is growing. Will inflation remain sticky or will we see that fall further in 2026? Unemployment hit 5% recently, GDP growth is decelerating, most forecasters see today’s UK 3.75% BoE rate falling to 3% by 2027.

At 3.75% plus 2.2% that’s debt costing sub 6%. Such leverage should be inherently profitable in a robust rental market.

Rents

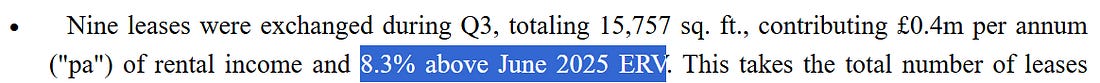

Evidence exists meanwhile that the ERV (Estimated Rental Value – the value of the current market rent) is growing fast. New leases were 8.3% above ERV, and have been consistently above ERV by 5.1% in 2025, including on renewals.

Remember ERV is the theoretical market value – not RGL’s current rate – think of it as the potential upside. So “above ERV” think upside to the upside.

Consider the gap between the £56.7m actual gross rent in 1H25 vs the £82.9m ERV.

If that 5.1% above ERV is the “true ERV” then that means the ERV is approximately £87.2m; and that would mean up to a £30.5m per year difference to future rents….

…..that’s a potential 53.8% uplift to rental income!

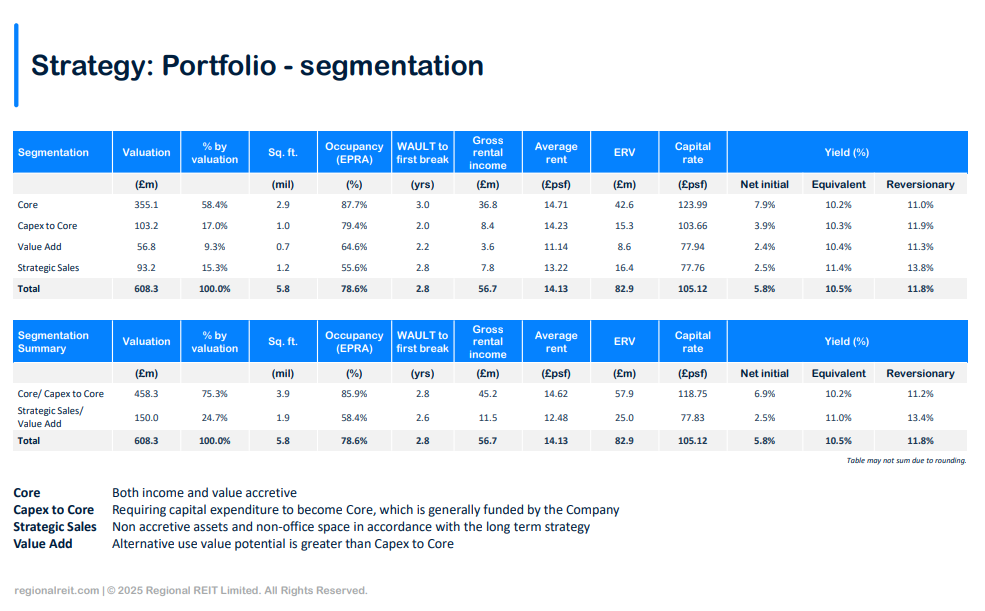

If we consider the expiry profile let’s see what that means for income.

Assuming It would increase the ERV by the 5.1% YTD with the 8% achieved in 3Q25 being the 2026 value, and a further 2% per year after that.

Nearly £6m is added to the ERV of the annual rent potential by 2035, even at a modest 2% rise.

But this is based on the rent already being at ERV. But it’s not.

If RGL can achieve the same 5.1% uplift PLUS grow occupancy/rents to its ERV levels then the increase in rental income is dramatic.

Plus £32.3m pre tax income per year.

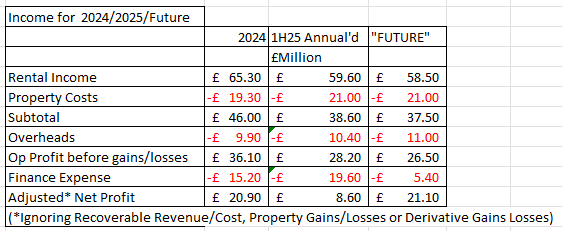

A +£32.3m per annum difference over the medium-long term (i.e. 10 years) and +£9m per annum difference in the near term – as shown below – i.e. based on disposing of the “Value Add” and “Sales” segments of property.

A risked model.

If we take the £65m future ERV less 10% (i.e. based on 90% occupancy) and assume disposals are complete then we see a more than doubling of profit from today.

This assumes no gains (or losses) from the portfolio and ignores pass through costs. It assumes property costs at a much higher rate than today (i.e. -£21m on a much smaller footprint post disposals).

The below model is based on an interest bill of 6% on £90m of borrowings, and assuming only a 90% lettings rate (i.e. not 100%)

£21m on £100m market cap is a 21% yield remember!

Is Zero Gains and Perpetual Losses to Commercial Property Capital Values Realistic?

RGL-ers have become so used to property portfolio capital losses the idea of this reversing one day is anaethema. However it shall revert. It always does.

Demand and supply eventually dictate that it shall. Is “eventually” now?

The replacement cost of commercial property and the rewards for improving property clearly show that upside can be obtained. With rising rental prices it makes no sense for capital costs to continue to fall. Yield percentages would grow at a double speed until they do stop falling.

Even a 5% per annum capital gain on a ~£500m portfolio is worth an additional £25m or ~15p per share per year to each RGL-er.

What if RGL throws the dice on its “Value Add”?

Another view of reduced debt (and assumed it is refinanced with the same levels of headroom) is that RGL gets £200m+ of headroom “to do something”.

Perhaps RGL might directly develop one or more of its assets under the “value add” category – although there’s no evidence yet that they shall.

But if they did using existing debt headroom and cash to fund one or two potential GDVs of gross development values of £100m+ and £200m+ on properties that today are valued circa £10m, that leaves potential for RGL plus a developer to make a mutual return. OB idea Watkin Jones is one such example of a potential partner.

Valuation

RGL has always been a good dividend payer and its recent news to increase the dividend to 2.5p per quarter means 10p a year and that’s a 10% yield at today’s prices.

But then you must compound the expectations that a ~£500m property portfolio of mainly freehold offices can expect to appreciate in value too. By 5% a year? That’s a £25m gain on top.

10% yield becomes a 25% ROE. Now we’re talking.

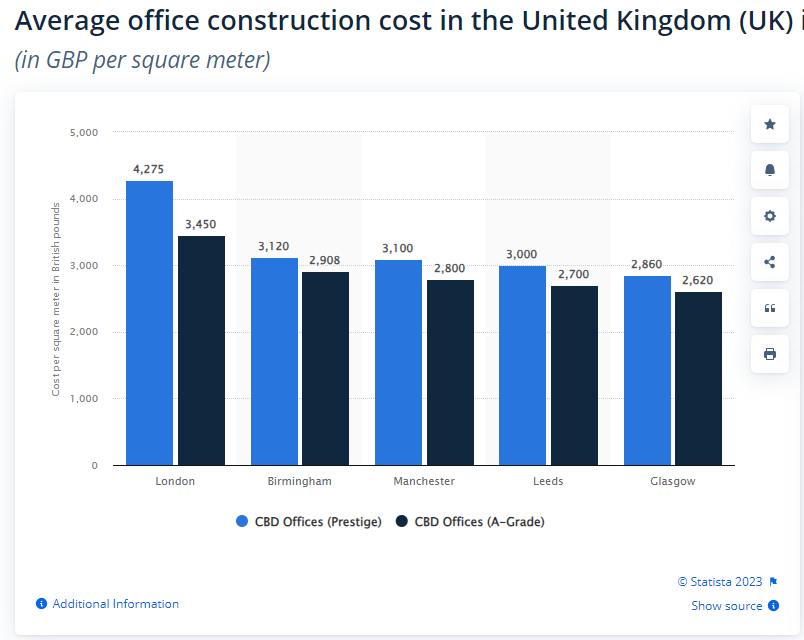

The ~£500m of property are valued at £106.1m per square foot. That’s £1,141 per square metre. That’s about 60% BELOW the replacement cost of building an office. These construction cost numbers are from 2023 so are proably higher in 2025 too.

Conclusion

The fall in share price for RGL despite the turning of the tide we are beginning to see, makes this an interesting idea to include in the picks for 26 despite being much unloved.

Rents outside London are growing at 3%. We have seen repeated evidence in RGL’s lease renegotiations with tenants that the market is recovering.

RGL was so unloved it was the also most voted for. Hence here it is. Either the contrarian in me is also the contrarian in my readers – or my substack is full of wind up merchants who voted for this. Should you believe in the wisdom of crowds? You decide.

Regards

The Oak Bloke

Disclaimers:

This is not advice – you make your own investment decisions.

Micro cap and Nano cap holdings including REITs might have a higher risk and higher volatility than companies that are traditionally defined as “blue chip”.

Leave a Reply