The $100,000 Dividend Plan

Cash Flow Is The Only Retirement Goal That Matters

Dec. 26, 2025

Rida Morwa

Investing Group Leader

Summary

- Avoid vague wealth goals; set specific, realistic targets for retirement.

- Portfolio value fluctuates wildly; rely on stable income generation instead.

- Don’t sell shares to pay bills; replace income with dividends.

- Reinvest 25% of income to grow your cash flow and safety margin.

- Track your income CAGR to ensure that you are on pace for retirement.

Co-authored with Beyond Saving

Today, I want to have a “back to the basics” article discussing an important topic for the upcoming year. The New Year is a time for us to look back at what we did right or wrong and look forward to what we want to achieve in the future.

Setting goals is an important component in any plan, so that you know what you are trying to achieve, you can track whether you are on pace to achieve it, and you know if what you’re doing is working.

When it comes to investing, the most common goal that people are trying to achieve is to be able to fund their retirement. Also, something that many people struggle with is coming up with a goal that is both specific and realistic.

The Importance of Being Specific

“I want to have billions” – ok, that’s nice, but are you going to make billions from having $500,000 in your portfolio and working a salary job that pays you $70,000/year? Probably not. Most people who have billions made millions by doing something extraordinary in their careers. They built companies that changed the world. If that’s your goal, great; I wish you the best of luck. The Elon Musks, Jeff Bezoses, and Mark Zuckerbergs of the world made their fortunes living a lifestyle that combined an absolute obsession for their work, a spark of genius, and made a significant impact on the entire world in a way that most of us won’t. They didn’t make $100 million because they made some crazy trade in the stock market; they built multi-billion/trillion-dollar companies in which they maintained a sizable ownership stake.

For most of us, that isn’t a practical goal. Most people have chosen careers where making tens of millions, let alone hundreds of millions of dollars, isn’t possible.

If you approach the stock market imagining that you’re going to make millions/billions while starting out at $100,000, that isn’t practical. You can’t always get what you want, and the stock market isn’t a place to get rich quickly. If you set some insane goals that aren’t achievable, you aren’t likely to achieve any goal. You are going to give up because you aren’t making any meaningful progress.

We want our goal to be specific. Something that you can look at every year and tell if you are moving closer or further away. As with any large project, the sooner you identify that you are falling behind, the easier it is to catch up.

We also want our goal to be practical. Something that can reasonably be achievable and can be broken into smaller bite-sized chunks.

Why Value Is a Poor Goal

The most common mistake I see among those looking to plan their retirement is that they set goals in terms of portfolio value. In the old days, it was always $1 million. It sounds like a lot of money, and it is. Yet today, many experts suggest that you need $2 million or $3 million to ensure that you have a comfortable retirement.

All this advice has one major problem: $1 million in stocks today is not the same as $1 million in stocks yesterday or tomorrow. Someone working on retiring in the 1990s might have been thrilled to hit their $1 million goal early and retire in January 2000.

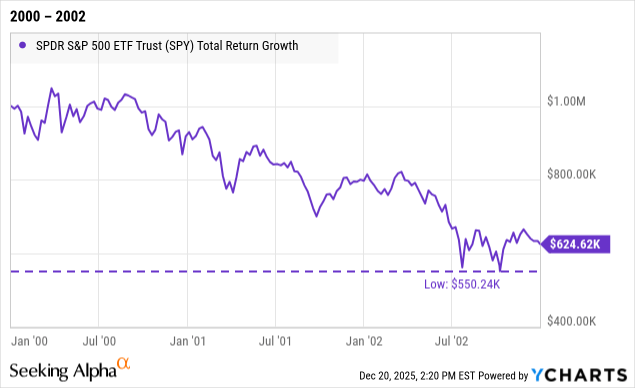

However, over the next three years, the market fell, and their $1 million became just ~$600k. This is even before we account for any money they needed to withdraw:

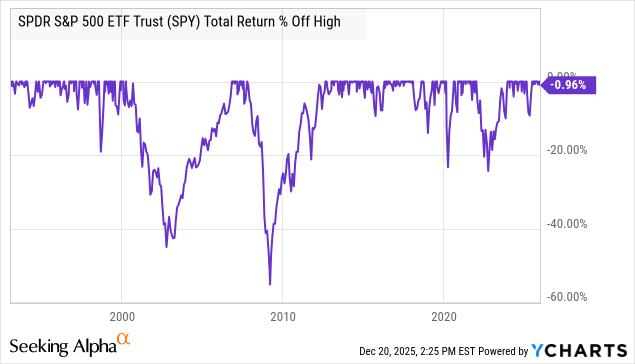

This isn’t an idle or theoretical risk. The stock market declines frequently, with 5-10% dips being very common. Dips of +40% are rare, but when they happen, it is usually many years before it goes back to all-time highs.

Yes, the stock market has trended upward over long periods, and it is a great generator of wealth for those who are willing to hang on through the swings. But for those who retired in 2000, thinking they had enough, seeing 40% of their retirement disappear in just three years is devastating. When you retire, you often can’t go back to a position that has comparable pay to what you were getting before you retired.

And are you comfortable taking out money when the stock market is far down? We’ve discussed in recent articles the potential risks of withdrawing too much. The response of experts in the field has been to generally suggest a very conservative withdrawal strategy. Many fall back on the work of William Bengen, who suggested that 4% withdrawals from a portfolio of 60% equity and 40% bonds, adjusting for inflation, were sustainable in any scenario.

If you are looking to be certain, then yes, the 4% rule is going to create a portfolio that will survive almost anything. As a result, it’s a very safe recommendation for those in the business to suggest because it does avoid the ultimate worst-case scenario of a retiree outliving their portfolio.

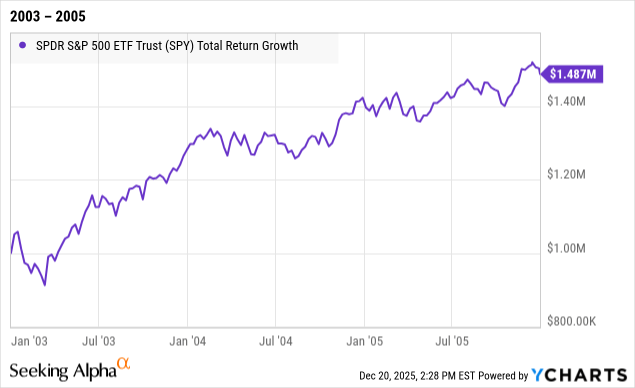

The problem with that rule is that in many cases, a retiree could withdraw a lot more and be just fine. The investor who retired at $1 million in 2003 can safely withdraw a lot more than the investor who retired at $1 million in 2000.

The challenge is to know how much you can withdraw in real time. The risk is that of living your life poorly, when you have built up a portfolio that is more than capable of supporting the lifestyle you want to live. Life is precious, and you only get to live it once. When you’re sitting there at 100 years old, you don’t want to be sitting on millions looking back at the life experiences you passed up on when you were younger and in better health—that is a risk. Maybe being completely broke is a worse scenario, but living in poverty to die wealthy is also a bad scenario.

The problem is that you can’t look at the value of your stock portfolio and know whether it is going to be safe to withdraw 7% or only 4%, because it really matters whether you are retiring in 1997, 2000, or 2003. $1 million in asset value is dramatically different for each year in terms of its ability to fund your retirement for the next 30 years.

Set an Income Goal

Stock market valuations and prices change frequently. Interest and dividends change more rarely, and in a diversified portfolio, by much smaller amounts. Whether market prices are relatively high or low isn’t particularly relevant to the income that a portfolio is generating.

You’ve spent your entire life working on a budget. You make $X in income. You made money from your job, maybe your spouse worked as well, maybe you owned a rental property, or other sources of income. You made money, and you spent less. It’s a process we are all familiar with. And that money wasn’t static. Who hasn’t lost a job, had variable hours, or worked on commissions or ran a business, having extremely variable income?

Why do we suddenly treat retirement differently? You have the same bills coming in every month. The only thing that’s changed is that you will no longer receive income from working. That income will be replaced by some combination of a pension, social security, and income derived from your retirement nest egg.

Many will sit there and tell you that you should maximize the value of your nest egg with the intent to sell it off in pieces, hoping that you don’t live too long or sell such small pieces of it that even in a crashing market, it won’t run out. If that idea fills you with dread, it’s because it isn’t natural and you have common sense. Selling assets to pay the bills is like the person who goes to the pawn shop to pay rent. It might solve the immediate problem, but that problem is going to come next month. Your bills don’t stop, and those shares you sold are gone forever.

It’s very difficult to know how big your nest egg has to be because you don’t know how the market value is going to change. It could go up or down 40% next year. That’s normal for the stock market, and normal things should be expected to happen. We shouldn’t retire and cross our fingers, hoping that normal things don’t happen.

How much income do you need to retire? Well, that’s easy. You can just look at the income you want to replace. You are still going to live on less, and you are still going to reinvest a portion of it for the future. Just because you are retired doesn’t mean life is over. You still have a future; you still need to invest in it!

We recommend planning on reinvesting at least 25% of your income. If you can reinvest more, that’s great because it will help your portfolio’s income grow faster and provide a larger cushion from disruption.

This provides you with a solid and tangible number to aim for. You know how much needs to be replaced, so you can track your path to get there.

Estimate Your CAGR

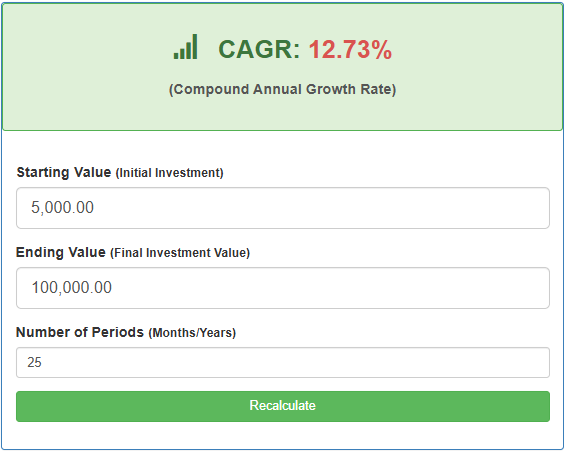

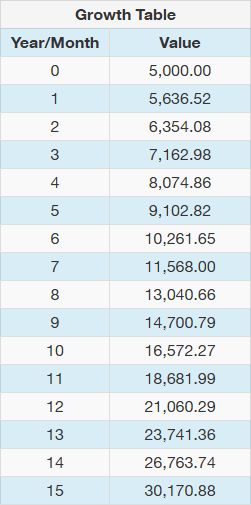

If your goal is to have $100,000/year in cash flow by the time you retire, and you are at $5,000/year now, that looks intimidating. However, if you are 40 and looking to retire by 65, you have 25 years to get there—so, you need to grow your cash flow at a pace of 12.7%/year. You can calculate this easily with a CAGR calculator. Source

You can then look to see what your trajectory should be to keep this pace:

So, your goal next year isn’t to get your cash flow “as high as possible”, it is to get it to a pace of ~$5,640/year. To the extent that you exceed that amount, you are on pace to exceed your $100k goal, allowing you to retire earlier or with more income.

If you fall behind because there are dividend cuts, investments don’t work out well, or you weren’t able to invest as much new money as you intended, you will know you are off pace immediately, and you can make relatively small changes.

You can use a calculator like this to figure out the pace you need to achieve your long-term goals. Put your current income, your target income, and how many years you want to achieve that goal within.

This will give you a tangible annual goal to target to ensure that you are on track to meet your 5, 10, or +20 year goals.

Ideas to Get You Started

So, you know how much income you need in 2026, but which picks to buy?

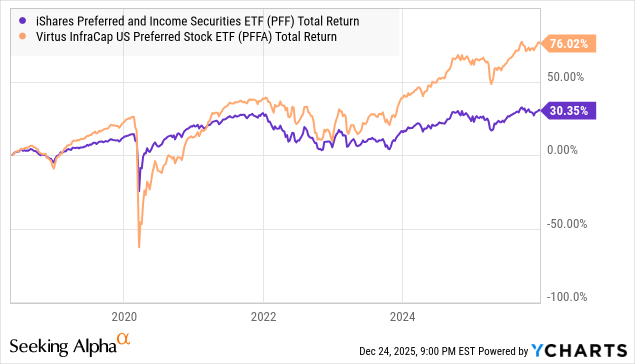

Virtus InfraCap U.S. Preferred Stock ETF (PFFA), which yields 9.4%, is an ETF that invests in preferred equities. PFFA is an ETF that is actively managed and uses leverage to amplify returns. As a result, PFFA management is frequently identifying opportunities that can outperform.

PFFA has materially outperformed peers that focus on following the index. We strongly encourage you to build up a portfolio of preferred equity and bonds as a base for your income portfolio. Yet that is a task that takes time. PFFA can provide quick diversification while you take the time to do your due diligence on individual picks.

Realty Income (O) is a REIT (Real Estate Investment Trust) yielding 5.8% that has trademarked “The Monthly Dividend Company”. It follows a business model of investing in triple-net leases, which make most property-level expenses the responsibility of the tenant. O has scaled up to become the largest company in its sector. O pays a dividend monthly and raises its dividend numerous times per year. It has increased its dividend every quarter since 1998. The raises often are not large, but they are frequent, and O highlights the power of compounding income.

Annaly Capital Management (NLY) is a 12.2% yielding mortgage REIT that invests in agency mortgage-backed securities, or MBS. Agency MBS is a unique asset class because the principal is guaranteed by agencies like Fannie Mae and Freddie Mac. NLY’s business strategy is to invest in agency MBS on a leveraged basis, profiting from the difference between the yield on MBS and its borrowing rate tied to SOFR. NLY’s business is very sensitive to interest rate changes but carries very little credit risk. As a result, NLY tends to outperform during periods when the stock market is crashing. In other words, it is countercyclical. Having a few countercyclical holdings can really help your portfolio during periods of economic turmoil.

We encourage investors to diversify and invest in at least 42 different holdings. This is just a list to get you started. Combined, the three have an average yield of 9.1%, which is what I target with my portfolio at High Dividend Opportunities.

Conclusion

Life is what happens when you are making other plans. So, it is very likely that you won’t achieve your annual goals every single year, and that’s ok. There are going to be challenges, and in a future article, we will discuss some typical challenges that income investors face and how to deal with them.

What’s important is that you determine what your personal goals are and chart a path to achieve them. We believe that setting a goal focused on cash flow is far more useful than one based on the big number in your portfolio. It provides something that is tangible and directly relates to your ability to withdraw cash from your portfolio. It is also less volatile. As you work towards retirement, you can’t know if you need $1 million, $3 million, or some other number, and you don’t really know if you’re making the right progress since your portfolio value will go up and down frequently.

You might decide that $100,000 in income isn’t enough, or maybe that you don’t really need that much. You are allowed to change your goals. But your pace towards achieving it will remain relatively stable. You’ll know the target you are aiming for every year, and if you get off pace or are ahead of pace, you will know it. And when you retire, you won’t be guessing how much you can withdraw any more than you were guessing how much you could spend when you were working. You have an income, spend less, and set aside a portion for the future. It’s common sense budgeting that everyone reading this knows how to do.

That’s the power of the Income Method.

Leave a Reply