Strewth Bluey!

Considering the NRV at Bluefields

Dec 30, 2025

Dear reader,

BSIF

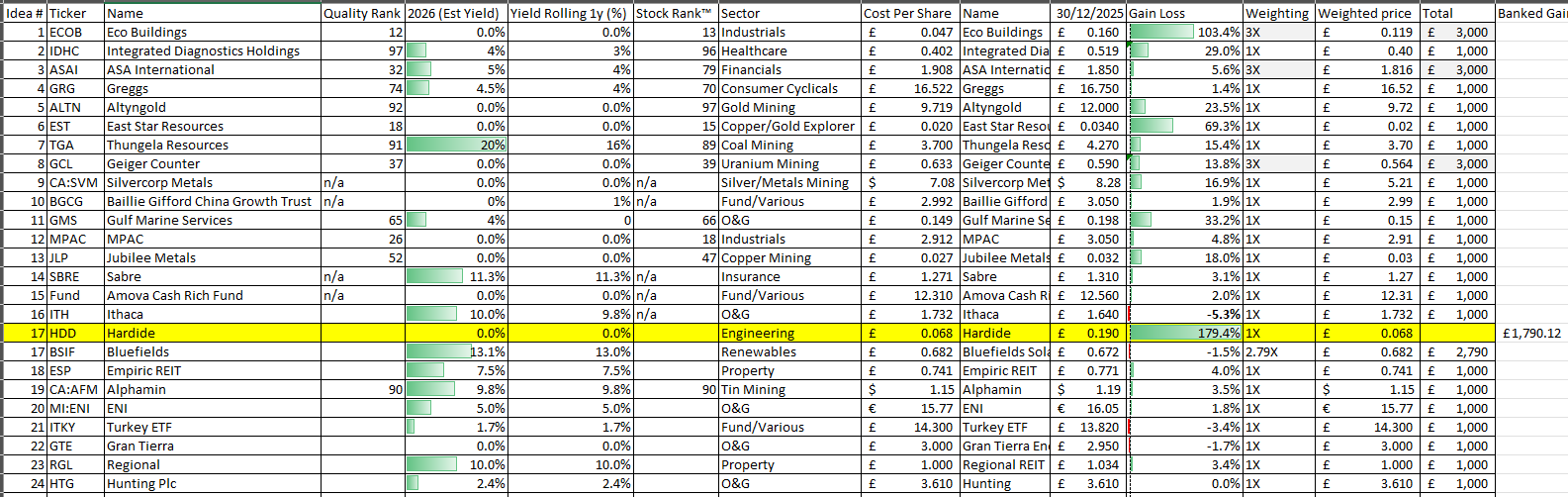

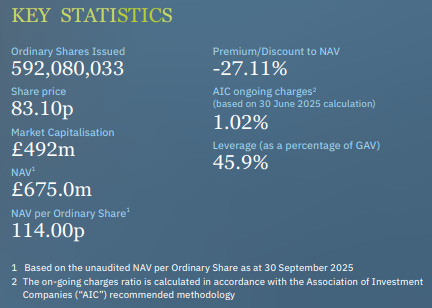

Pay £400m to get assets valued at £690.1m (as at 30/06) falling to £675m (as at 30/09) which pays a divi of 13.1% at today’s 68.60p buy. 9p a year. A slippery slope or an opportunity?

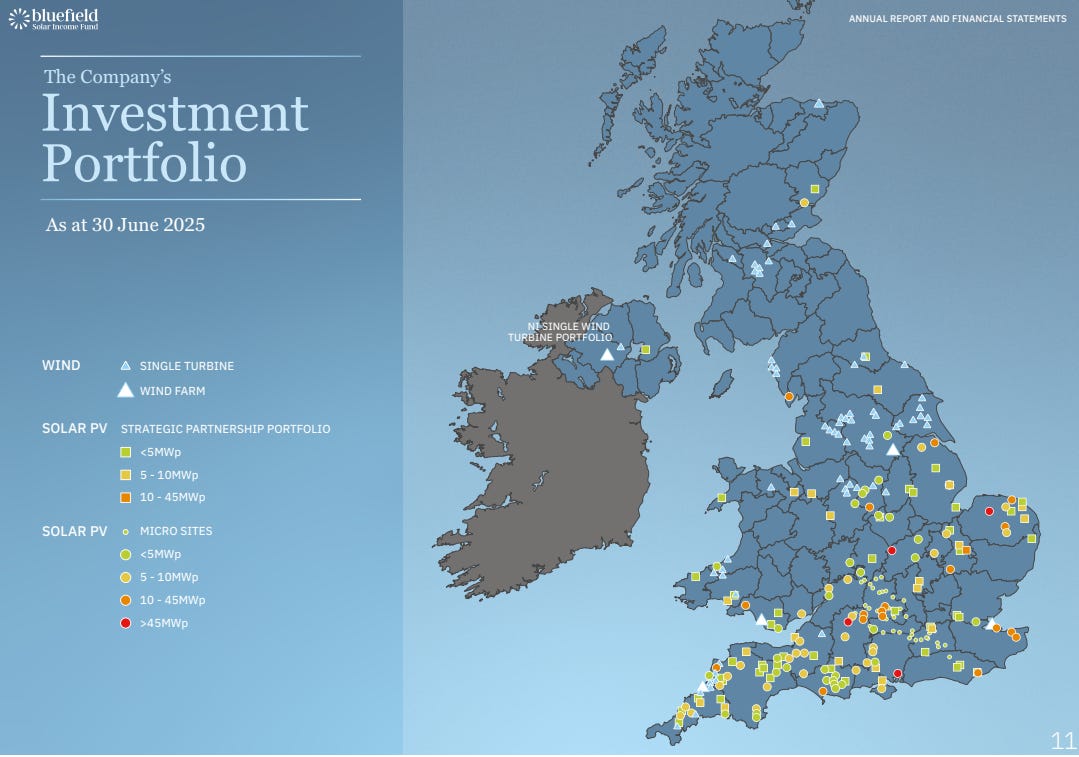

These are the assets: All within the UK. Mainly solar with attached BESS, plus some onshore wind assets.

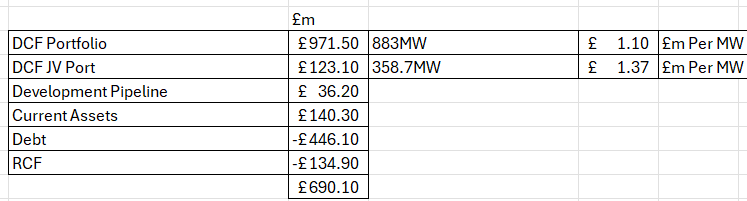

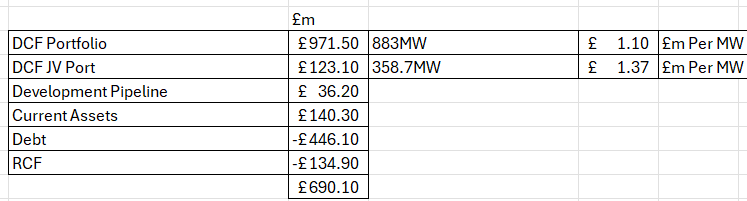

This is the composition of the NAV.

Bluefields (ticker BSIF) investment objective is to provide Shareholders with an attractive return, principally in the form of regular income distributions, by being invested primarily in solar energy assets located in the UK. The Company also invests a minority of its capital into other renewable assets including wind and energy storage.

BSIF is up for sale as a going concern. The sum of its parts exceeds its NAV according to potential buyers. Hmm.

If that’s true then investors soon won’t be Blue.

Today’s potential buyers at 68.6p buy price would be in the green – since that price implies a more than -40% discount, plus a 13.1% dividend yield meanwhile.

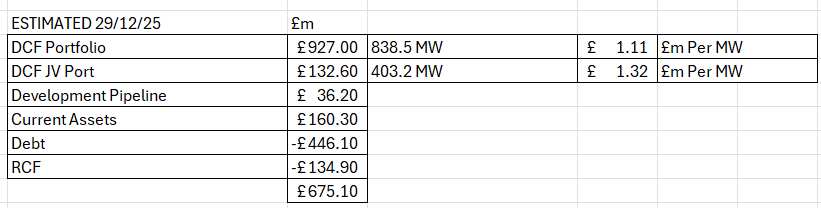

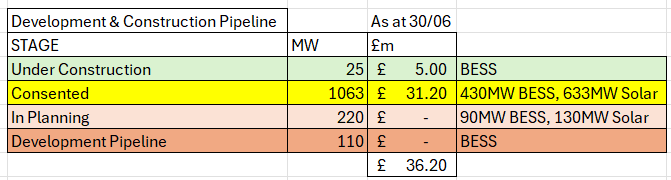

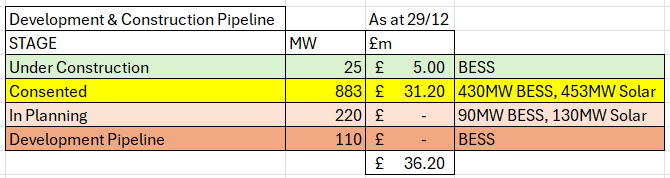

The main portfolio comprised at 30/06 of 883MW of solar and wind assets. These were valued at £1.1m per MW of generating capacity including the attached BESS (there is no separate valuation given to the BESS assets, strangely, only to the generating capacity. This capacity reduced by -44.5MW to 838.5MW in August 2025, as “Phase 3” of its strategic partnership completed, where the assets were sold at NAV to its JV.

Other assets which have no separate valuation value were transferred too. 25MW of BESS and 180MW of development portfolio comprising “four ready to build solar assets” were thrown in too. Three of these have CfD subsidies secured under the AR5 or AR6 schemes.

BSIF then owns 25% of that same JV valued at £123.1m which comprised of 358.7MW of capacity – equating to a valuation of £1.37m per MW. So 403.2MW post period.

So the estimated portfolio looks like this now:

Thrown in for Free? – Is that Fair Dinkum Bluey?

Yes, well, you see the way that BSIF “should” work is capital pours in and develops further assets generating further returns. But guess what?

The capital has dried up.

There is an inability to raise further funds at a discount to NAV, and debt grew expensive (albeit is falling in cost and is starting to look attractive again).

Certainly an outside buyer would be weighing up the numbers and rubbing their chin. Like I am.

Meanwhile a large pipeline is sat there largely unaddressed. The valuation of this is not in the price. 25MW of pre-construction BESS at £0.2m per MW is 60% below what GSF value theirs for (£0.5m per MW). Or 60% below what Harmony ticker HEIT (a BESS asset IT) sold for in mid 2025.

That alone is £7.5m of potential hidden value.

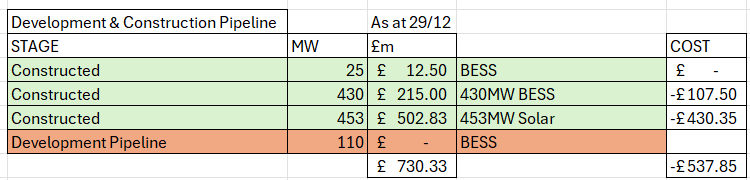

Solar Park construction costs per MW in 2025 range from £0.6m to £0.95m per MW while BESS is around £0.25m per MW (even though the batteries themselves are now £0.1m per MW again as indicated by GSF).

So taking into account the 180MW of consented we have this much remaining.

So if the Consented element were constructed (i.e. assigning zero value to In Planning and Development Pipeline and just considering the “Consented” yellow stuff) what would that mean?

A gain of around £150m. So not worth nothing…. if given away in a 25% JV then the upside is still around £40m…. or double today’s valuation in the NAV (of £36m).

Worth double even if it’s given away to a JV. Think about that.

Of course it’s not this simple, and the connection date matters too. These vary. So this isn’t a slam dunk to riches, but there is value to unlock. However HAVING a scheduled connection is worth a lot. There is a long queue for a newcomer to connect energy assets to the grid. That’s part of the hidden value here.

Leave a Reply