Dunedin Income Growth: positioning for resilient returns across market cycles

Ben Ritchie and Rebecca Maclean outline recent portfolio changes, mid-cap opportunities and how Dunedin Income Growth balances income, quality and sustainability.

Kepler Trust Intelligence

Updated 07 Jan 2026

Disclaimer

This is a non-independent marketing communication commissioned by Aberdeen. The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

Video

Ben Ritchie and Rebecca Maclean, co-managers of Dunedin Income Growth Investment Trust (DIG), discuss recent portfolio changes, including additions such as Tesco, Softcat and Experian, alongside exits where fundamentals have weakened. They explore why UK mid-cap valuations look compelling, the impact of interest rates, geopolitics and investor flows, and how a focus on cash generation, dividend growth and a differentiated sustainable investment approach underpins the Trust’s long-term income and return objectives.

Transcript

Hi, my name is Ben Ritchie. I’m the co-manager of Dunedin Income Growth Investment Trust. We’ve made quite a lot of changes to the portfolio in the last six months. And I think that reflects two things. One, the ongoing compelling valuations that we’re able to find in the UK and European equity market. And secondly, the strength of the idea generation that we have within our wider team of UK equity specialists. We’ve added a number of really interesting companies to the portfolio that have a combination of enduring long-term growth potential and very attractive implied returns combined with strong cash generation and the ability to pay high and growing dividends back to investors.

Just to give you a flavor of some of those, we’ve added Tesco into the portfolio, the UK supermarket, a business with a tremendously strong market position that we think is going to get only stronger from here, will be increasing its returns, growing its margins, accelerating its top line development and ultimately returning that back to investors in the shape of dividends and buybacks.

We’ve also initiated some smaller positions in Experian and Compass Group. Experian is the credit rating agency and data provider, very significant businesses in the United States, but also strong positions in the UK and Latin America. That’s a business that we think is going to grow very nicely, particularly on the back of enabling AI and its products. We see strong, consistent revenue growth, again, resulting in cash generation and good, consistent dividends back to investors.

Compass is another business we like, the global specialist in contract catering, a very difficult business to compete in. They are by far the global number one, dominant positions in a wide range of markets. And a company that we think can grow at high single digits, expand its margins, make acquisitions, buy back stock, and ultimately grow earnings at a good double digit clip on a relatively consistent basis.

The thing that pulls these companies together is that they are relatively acyclical. Yes, economics matters. But ultimately, we expect these businesses to be able to grow regardless of the economic cycle. And we think that’s a really important point. Having had a pretty extended period of relatively ok markets, when things get tougher, we think these companies are in a good position to be able to continue to perform very well.

On the other side of that, we’ve been tending to some of the businesses that have found life a little bit more difficult. And while we’re long-term investors and we want to back businesses for the long term, ultimately, sometimes it does just get a little bit too difficult. So, we’ve exited out of chemical distributor Xalys, which has found significant end market declines as consumption of chemicals across the world has been put under pressure, partly by Chinese production, but also by the relatively subdued economic environment and that’s put pressure on their business model.

And the other company which we’ve exited during the period would be Novo Nordisk, a well-known firm, a specialist in diabetes provision and also in obesity treatment, but where they seem to have lost the race to dominate the obesity category with Eli Lilly and we took the opportunity to sell out of that in the middle of the year. And that capital which we freed up, we’ve been able to reinvest back into some of those more compelling opportunities that I’ve talked about.

So, a pretty active period for us within the portfolio. We still see plenty of opportunities. The hopper of new ideas has never been fuller. We see compelling opportunities across the market cap spectrum and really we’re pretty excited about what awaits over the next six months as well.

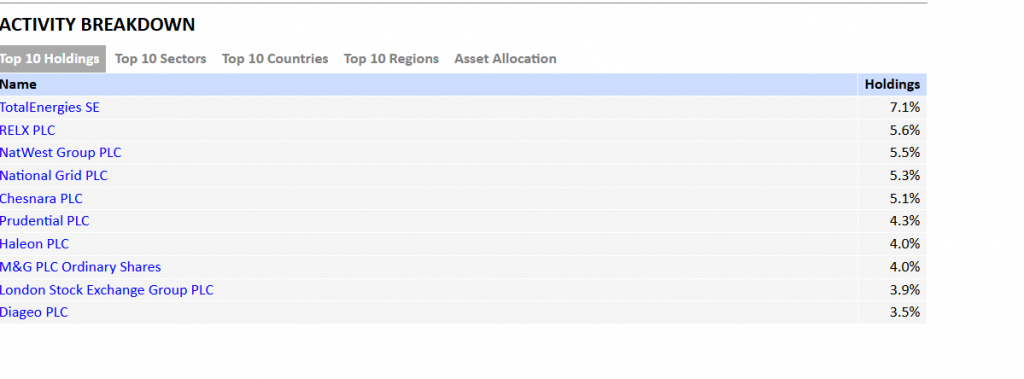

Hello, I’m Rebecca Maclean and I co-manage Dunedin Income Growth Investment Trust. So, one of the aspects of the strategy is that we invest across the market cap spectrum. So, we have currently about 45 % of the portfolio in companies with a market cap below £10 billion and we’re seeing lots of opportunities within the mid-cap space.

And actually, if you look at the valuation of the mid-cap market in the UK, the FTSE 250, it’s showing quite an unusual yield signal. So, the dividend yield on the mid-cap index is now higher than the large-cap index, which is very unusual given historically the level of dividend growth that we have seen out of smaller businesses compared to larger companies, which are typically in more mature markets. So, valuation is certainly signaling interesting opportunities within the MidCap space.

We have a number of holdings within this, so one is Softcat, which is the UK’s leading value-added reseller of technology to SMEs in the UK. It’s benefiting from structural growth in terms of demand for technology. But it’s also gaining market share because it has a broad offering, it’s meeting its customers’ needs in terms of helping them find what technology solutions will be best for them and they’ve got a very strong culture too. So this is a company which has delivered excellent growth historically and we expect strong growth in the future, it’s cash generative and this supports an attractive and growing dividend plus special dividends too given the strength of their balance sheet.

In terms of what are the catalysts to help mid-caps going forward after a period of underperformance compared to their large cap peers, I think there are a couple that I’d highlight. The first would be to look at the macro because the mid-cap area is more domestically focused. And I think if we saw an improvement in economic activity, consumer confidence and business confidence, this will certainly help some of those cyclical sectors, whether it’s house building and real estate, which are currently trading towards the trough of their cycle.

The second catalyst is interest rates. So typically these businesses are more interest rate sensitive. And if we look at the inflation data that’s been printing in the UK, this is supporting our economist view that interest rates will continue to be cut. So our economists are expecting another 25 basis points cut in December and another three basis points, three cuts in 2026. So this will be supportive for the mid-cap part of the market. And finally, the picture has been clouded in the UK by persistent outflows out of UK equities. And this has disproportionately impacted smaller and mid-sized businesses compared to large-cap companies.

So I think if we saw a shift in terms of investors allocation towards the UK and an inflow into UK activities, this would be supportive for that part of the market. We certainly see mid caps as being attractive hunting grounds for looking for quality and resilient businesses, which are now screening to be at an attractive valuation.

Well, geopolitics is always a big driver of companies within the portfolio. And I would say it has been a headwind overall over the past few years. I’d pick out three specific developments. First of all, within the UK, we’ve certainly seen a consistent degree of political tumult. We’ve seen indecision around economic decisions from both the previous government and the current government. And that has been unhelpful, particularly for domestic-facing companies. At the same time, we’ve seen Donald Trump and the global tariff trade war, again, has been unhelpful for businesses looking to export and do business overseas and again that has been a headwind.

And one of the drags that’s been ongoing and continuous both I think affecting companies we don’t own and to some degree affecting companies and the wider market in which we do invest has been the Ukraine conflict. The Ukraine conflict has certainly driven up inflation in Europe and the UK and has also significantly boosted the defence sector, a sector which we can’t access given our sustainability criteria.

So these geopolitical elements have been something of a headwind for the Dunedin portfolio over recent times. But the good news is we think that some of these things are starting to ease. Tariffs will annualise as we move through 2026. We don’t think that’s going to happen again. If anything, they may become looser. And that, we think, will benefit those overseas international companies. And we’ve tended to favour those types of global businesses with wider reach and better growth prospects.

I think again when we think about the Ukraine, perhaps it’s more likely that we’ll see a resolution there. And that could be very helpful in terms of energy and commodity prices, both in the UK and abroad. And both of those elements could also come together in terms of helping to generate a little bit of weakness in sterling as well, which has been very strong and again acted as a bit of a headwind. And in terms of the domestics, we don’t have great expectations for this government. We don’t have great expectations for the economy.

But I don’t think anybody else does either. And the opportunity to create some form of stability that companies can work with and build off is definitely there. By the time you’re listening to this, we will have had the budget. We hope that at the very least, it doesn’t make things more difficult for UK corporates, but we think it’s very much unlikely to have the same negative impact which we saw from the same event 12 months ago. And so if we can see stability on the domestic front, we think there’s a big prize to go for.

From the Bank of England potentially being able to reduce interest rates, which could be a significant tailwind for the UK economy and the Dunedin portfolio. We’re optimistic about 2026 and the impact of tariffs and there could even be some benefits to come through from a resolution to the conflict in the Ukraine. And so the geopolitical environment having been unhelpful over the last two to three years could turn, if not into a tailwind, then certainly into a much more neutral platform for the portfolio.And that could be very good news for us.

So one of the points of differentiation for the need in income growth is that the Trust does have a sustainable investing approach, which is unique in the UK Income Investment Trust market. And as a reminder, there are three-pronged approach. So there are exclusions in place which are in place in order to reduce the portfolio’s exposure to parts of the market which face the highest environmental, social and governance risks.

We also have a positive allocation to companies that we see are leaders in ESG, companies that provide sustainable solutions, but also companies that we believe are going to participate in a transition and improve their sustainability performance over time. And thirdly, we look to engage in our portfolio, so meeting our companies regularly, discussing these issues with them in order to understand their concerns, the risks and the opportunities and support these businesses through their journey.

So, part of the element of the approach is to have exclusions. It’s about 25 % of the FTSE All-Share, which is excluded according to this policy. And if you look at the impact of that on the investable universe, we see no impact on their ability to generate income from looking at that investable universe that’s screened from our sustainability perspective. So, that’s supportive.

From a performance perspective, there have been parts and times when the sustainability screen has been a headwind. So I’d point to the start of 2022 after the Ukraine war where we saw a spike up in commodity prices. This did lead to a headwind in terms of relative performance of that investable universe versus the benchmark. And this year again, when we look at the aerospace and defense sector, which is up over 85 % the year to date, then, and that’s part of the sector of the market that we don’t invest in, that has been a headwind.

But if we look over the longer term, we don’t see it as a material headwind to performance. Sustainability is very much aligned to our approach when we think about the quality of businesses. Indeed, it’s one aspect of quality which we assess when we’re looking to select the highest quality companies for the portfolio. And we’ll continue to do that in line with our investment strategy, which is to focus on total return, quality and resilient businesses that meet the company’s sustainable and responsible investment policy.

If you need any more information about Dunedin Income Growth Investment Trust, please visit our website for more information.

Dunedin Income Growth Investment Trust (DIG)

Leave a Reply