Flash update from Kepler Trust Intelligence

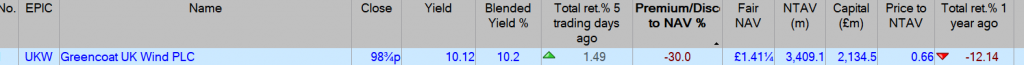

The Department for Energy Security and Net Zero has launched a consultation on proposed changes to the inflation indexation used in the Renewable Obligation (RO) and Feed-in Tariff (FiT) schemes. This has hit share prices across the renewables sector. It is important to realise that this is only a consultation, and not necessarily an inevitable change. The net result of a previous consultation in 2023, which covered fixed price certificates and included indexation arrangements, was that no amendments were made to indexation (or anything else). Whilst this recent news has added to the already challenging backdrop for the sector, the share price move for UKW seems extreme, such that the worst outcomes would appear to be more than accounted for by the current share price discount to NAV.

10/11/2025

Kepler View

If either proposal in the consultation were implemented, it would likely translate into a one-off hit to NAV. However, whilst UKW is clearly 100% exposed to the UK government subsidy regime (rather than other geographies), it has a mix of revenues streams across Renewable Obligation Certificates (ROCs), other subsidy schemes (such as CfDs) and market power prices. It is only the indexation mechanism on the RO and not value of the certificate itself that is up for debate within the consultation. The potential negative effects will also be mitigated by the relatively short remaining life of the ROCs in the portfolio (average remaining duration c. 7yrs) and we also note the structurally high dividend cover of UKW’s model. UKW also derives a significantly lower proportion of its revenues from the Renewables Obligation than solar peers, and so we would expect UKW to be significantly less affected than many in the listed peer group.

Fundamentally, UKW appears resilient. UKW’s structurally high dividend cover means that it has options to deploy surplus cashflows towards new investments, buybacks or reducing debt. We note that UKW continues to buy shares back, illustrating the confidence the board has in strength of the balance sheet. UKW’s conservative approach means there are likely to be considerable levers to pull in order to mitigate a sizeable amount of any potential impact.

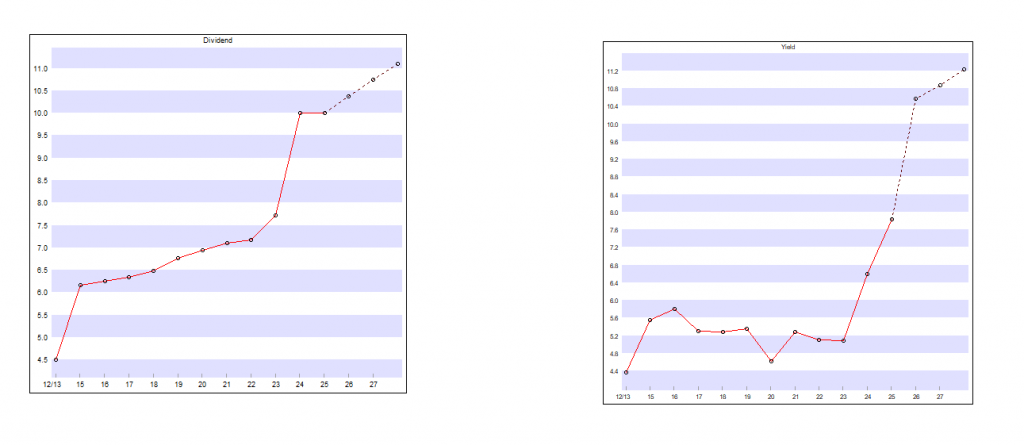

Greencoat UK Wind FY25 total dividend target 10.35p vs 10p YoY

Leave a Reply