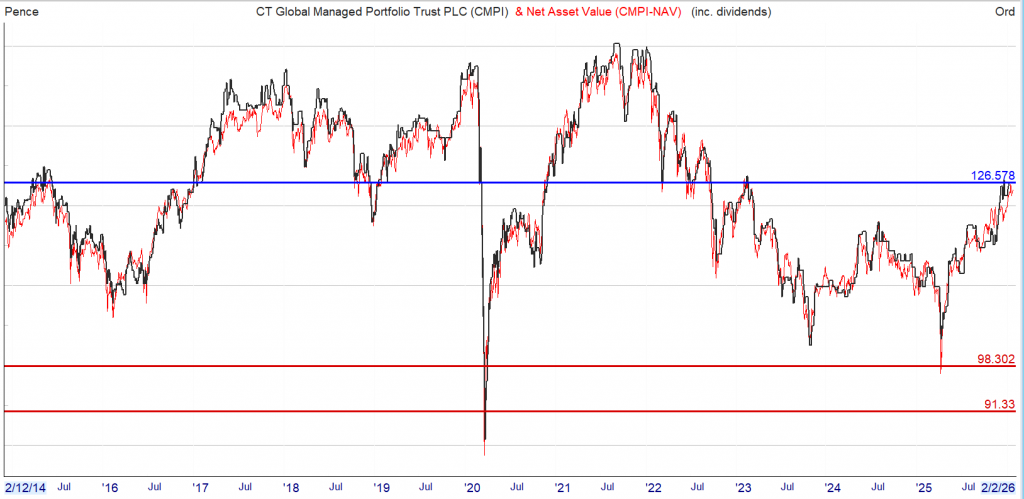

As you can see from the chart, there is a risk to capital but as the intention is never to sell as you need the dividend to pay your bills, it matters not, to you anyway.

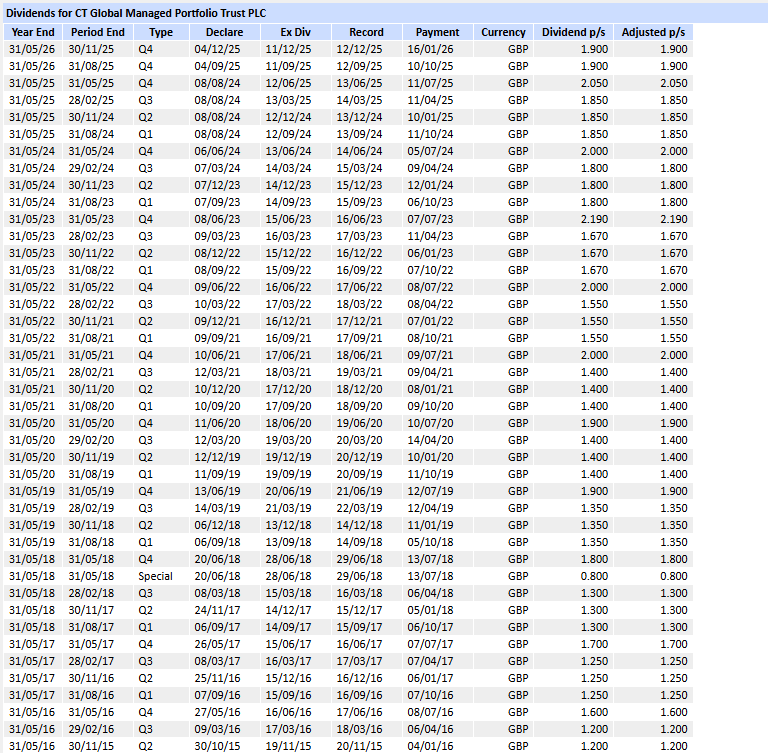

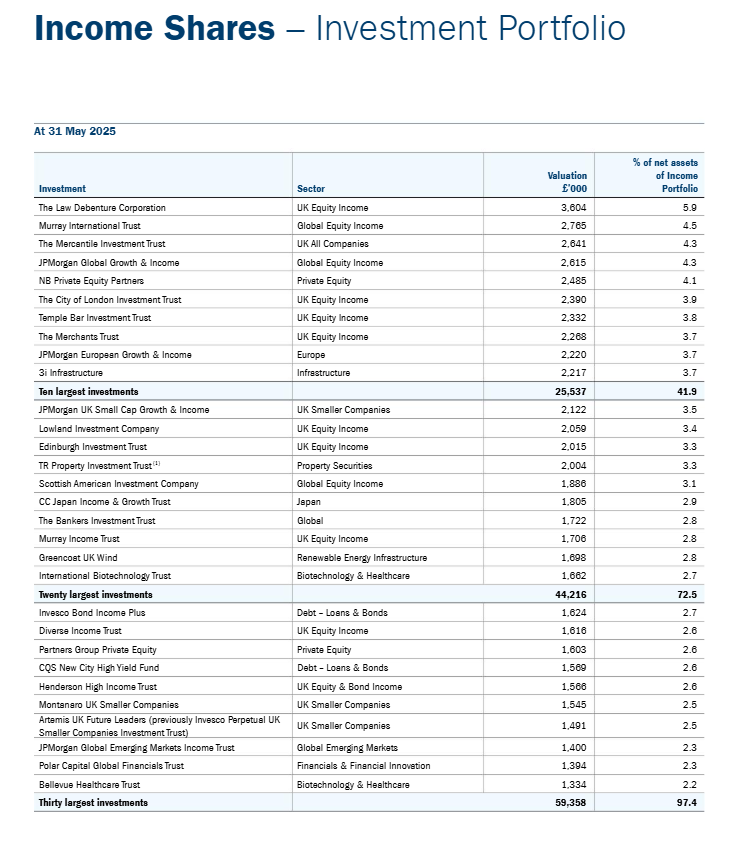

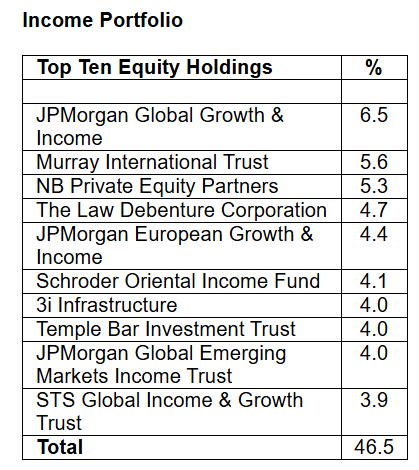

The risk is spread over most of the IT income generating shares so the dividend is fairly ‘secure’.

Latest top ten holdings.

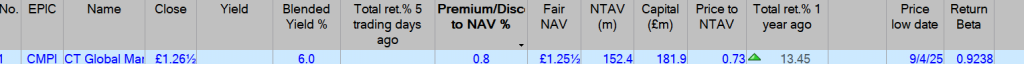

The dividend fcast is 7.6p

CT Global Managed Portfolio Trust PLC (the “Company”) announces a second interim dividend in respect of the financial year to 31 May 2026 of 1.90 pence per Income share.

This dividend is payable on 16 January 2026 to shareholders on the register on 12 December 2025, with an ex-dividend date of 11 December 2025.

The normal pattern for the Company is to pay four quarterly interim dividends per financial year.

As previously announced, in the absence of unforeseen circumstances, it is the Board’s intention to pay four quarterly interim dividends, each of at least 1.90 pence per Income share, so that the aggregate dividends for the financial year to 31 May 2026 will be at least 7.60 pence per Income share (2025: 7.60 pence per Income share).

Anyone who bought at 100p are now receiving a yield of 7.6%

Investor Presentation via Investor Meet Company

CT Global Managed Portfolio Trust PLC (the ‘Company’) is pleased to announce that Adam Norris and Paul Green, Fund Managers, will provide a live presentation which will look back on 2025 and then update investors on both the Income Portfolio and Growth Portfolio going into 2026 via the Investor Meet Company platform on Wednesday 4 February 2026 at 10:00 am GMT.

The presentation is open to all existing and potential shareholders. Questions can be submitted pre-event via your Investor Meet Company dashboard up until 9:00 am GMT on Tuesday 3 February 2026 or at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and add to meet CT Global Managed Portfolio Trust PLC via:

https://www.investormeetcompany.com/ct-global-managed-portfolio-trust-plc/register-investor

Total return over one year 13%

Leave a Reply