Greencoat UK Wind PLC is pleased to announce that the Company has been named winner of the Renewables – Active category in the AJ Bell Investment Awards 2025.

AI Overview

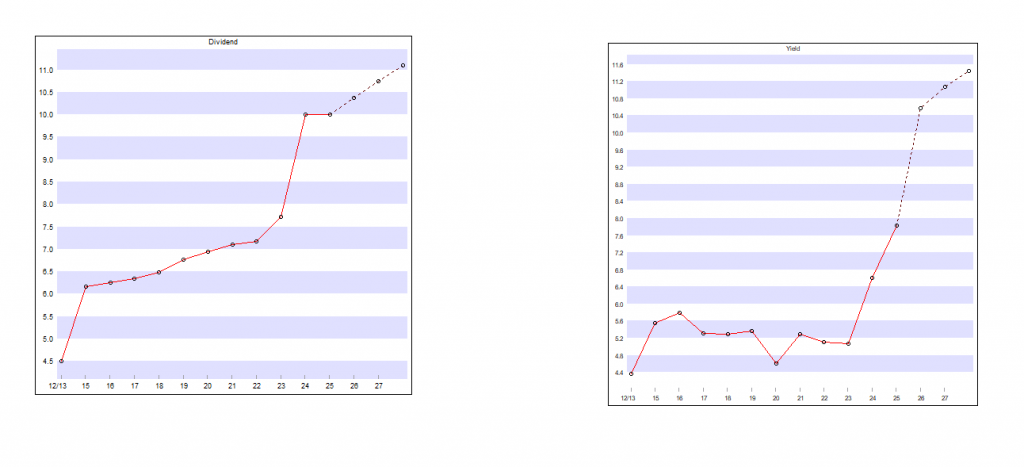

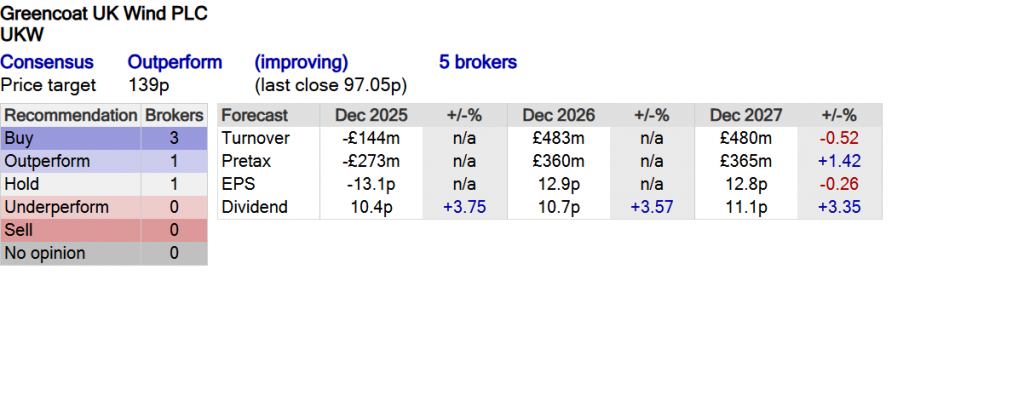

Greencoat UK Wind (UKW) is considered by some analysts to be an interesting investment due to its attractive dividend yield (around 10%), strong cash flows, inflation-linked revenue, and a discount to its Net Asset Value (NAV), potentially offering significant upside if rates fall and discounts narrow; however, recent performance has been hit by lower wind speeds and higher interest rates impacting sector valuations, though its long-term strategy focuses on outperformance through asset management and accretive investments, with recent refinancing showing resilience.

Potential Positives (Bull Case):

- High Dividend & Yield: Offers an attractive dividend yield, well-covered by earnings, and is linked to inflation (RPI), providing income growth.

- Discount to NAV: Trades at a discount to its underlying asset value, suggesting potential capital appreciation if the discount narrows.

- Strong Cash Flow: Generates significant surplus cash for reinvestment, enhancing long-term value.

- Inflation Protection: 60% of revenues are fixed and linked to inflation, protecting dividend growth.

- Long-Term Outperformance: Historically outperforms its sector over longer periods, despite recent headwinds.

- Management Expertise: Experienced team actively managing assets and pursuing accretive investments.

Potential Risks (Bear Case):

- Sector Headwinds: Rising interest rates and lower energy price forecasts have impacted the entire sector.

- Low Wind Speeds: Recent periods of low wind have affected generation and valuations.

- Discount Persistence: The discount to NAV could remain, limiting capital raising ability.

- Valuation Assumptions: Long-term NAV valuations rely on assumptions that might not always prove accurate.

Analyst Sentiment (Recent):

- Despite recent share price struggles and sector pessimism, some analysts see attractive forward-looking returns and believe the “baby has been thrown out with the bathwater”.

- Forecasts suggest significant total returns (price appreciation + dividends) are possible over the next year.

Conclusion:

Greencoat UK Wind presents a compelling case for income-focused investors seeking inflation-linked returns, but it’s not without risks tied to macro-economic factors and weather. Its valuation discount and strong cash flows make it interesting, but investors should be prepared for volatility, as highlighted by recent performance.

CANACCORD STARTS GREENCOAT UK WIND WITH ‘HOLD’

Dividend Policy and 2026 Dividend Target

The Company also announces a quarterly interim dividend of 2.59 pence per share with respect to the quarter ended 31 December 2025.

Dividend Timetable

Ex-dividend date 12 February 2026

Record date 13 February 2026

Payment date 27 February 2026

The Company has been reviewing its dividend policy in line with the range of potential outcomes from the RO Indexation Consultation. The Company has, for 12 consecutive years, increased its dividend by RPI or better, from a 6 pence dividend per share at IPO to 10.35 pence in respect of 2025. Dividend progression has been underpinned by strong cashflow generation.

The principal instrument from which the Company derives explicit RPI cashflow linkage is the RO scheme, which will now be indexed to CPI. The Company’s Contracts for Differences instruments also have explicit CPI linkage. The Board has therefore determined that its dividend policy will now be to aim to provide shareholders with an annual dividend that increases in line with CPI inflation.

Accordingly, the Company announces an increase in the target dividend for 2026 to 10.7 pence per share in line with CPI for December 2025 of 3.4%. The Company’s forward looking dividend cover expectations remain robust and are substantially unchanged.

For the avoidance of doubt, the quarterly interim dividend of 2.59 pence per share with respect to the quarter ended 31 December 2025 remains unchanged.

Leave a Reply