How a stock market crash could boost passive income potential by 33%

Jon Smith points out why the ability for investors to enhance passive income from dividend shares can increase when the market falls.

Posted by Jon Smith

Published 1 February

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

Chatter about a market wobble is growing louder amid a spike in geopolitical tensions. Of course, no one can predict what might cause a crash (if they could, it would take away the surprise). Therefore, the next best thing is to have a clear game plan for when (or if) a crash does happen. When it comes to passive income, here’s an approach investors can consider.

Enhanced yield potential

For all of the carnage that a stock market crash causes, there are actually some positives to take from it. One relates to the rise in dividend yields. If we break it down, the dividend yield is made up of the share price and the dividend per share. Logically, if the share price falls but the dividend stays the same, the yield will increase.

Let’s say a stock is trading at 100p with a 5p dividend. The yield is 5%. If a crash causes the stock to fall to 75p, but the dividend stays the same, the yield is now 6.66%. In terms of the change, it’s a 33% boost!

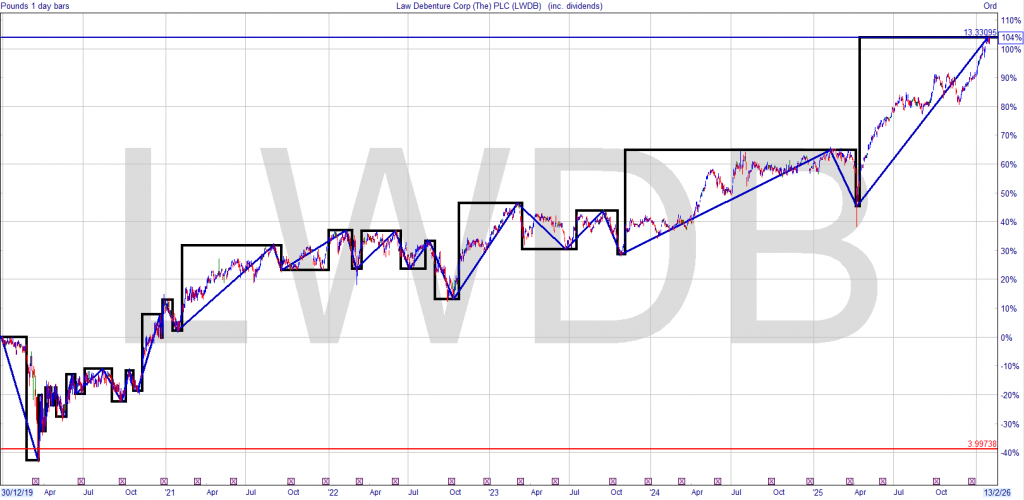

This means that shrewd income investors can pick up dividend stocks that fall during a crash and benefit from this added yield. Of course, if the dividend gets cut in the future due to the company being negatively impacted by whatever caused the crash, that’s a problem. But during a market rout, some stocks fall simply because investors panic. Some firms are unaffected by the cause of the fall but still experience a short-term drop. Those are the stocks to target.

Over the medium term, we could see share prices recover, with dividends remaining unchanged. Of course, there’s no guarantee this will happen, and it ‘ a risk that needs to be acknowledged.

You could buy the enhanced yield with earned dividends but you could boost your Snowball if have a list of coveted shares you would like to buy if the yield was better.

The SNOWBALL recommends a blended yield of 7%, because if you can add your dividends at a rate of 7% you income doubles every ten years.

If you want a safe fund, money market or a short dated gilt to maturity, you could use that to buy a share you coveted.

Leave a Reply