The Income Method: How To Use Cash Flow To Fund Your Retirement

Feb. 09, 2026

Rida Morwa Investing Group Leader

Summary

- We prioritize investments that pay us to wait, ensuring our retirement isn’t dependent on “finding a fool” to buy our shares at a higher price.

- By targeting a 9% average yield, we align our portfolios with historical total market returns while receiving our profits in cash.

- Diversification is our “only free lunch.” Holding 42-plus individual securities ensures that a single dividend cut is a minor speed bump rather than a catastrophic event.

- Automatic compounding: We advocate for reinvesting at least 25% of all distributions, allowing your “paycheck” to grow year-over-year without additional labor.

- Business ownership mindset: Like a landlord collecting rent, we judge our success by the total income collected, not the fluctuating liquidation value on the screen.

Co-authored with Beyond Saving

We sit here writing about investments every day. For those of us who are deep into the investment world, it’s easy to lose sight of the reality that most people face: Managing your own investments is intimidating.

You worked your whole life in a business that probably had nothing at all to do with investing. You honed your skills and became an expert at something, which meant that you probably weren’t spending much time learning the difference between EPS, adjusted earnings, FCF, FFO, AFFO, CFFO, EBIT, EBITDA, and the rest of the alphabet soup that we investment nerds throw around.

Then you start thinking seriously about your retirement, and it’s important to you. It’s literally your quality of life that is at stake. It’s something that feels too important to just put into the hands of some stranger. So you make the decision that you’re going to manage your own investments.

You’re a smart person, so you do some reading, and you find yourself being pulled in numerous directions. For every stock that you find, someone is screaming that it’s a wonderful buy, and someone else is screaming that it’s a horrible pick. And they’re throwing out numbers and alphabet soup to prove their point.

The result that we often see is that people end up with directionless portfolios. They buy whatever ticker caught their eye, without any clear purpose. Many people can’t answer the question, “How is this investment helping you achieve your goals?” Many can’t even succinctly answer the question, “What are your goals?”

One of the things we’ve really emphasized here at High Dividend Opportunities is communicating our strategy and why we do what we do. Yes, we provide picks like every other service out there, but we believe that teaching members to fish is every bit as important as throwing out a shopping list.

The Income Method 101

It has been an incredible 15 years for the equity markets. If we examine the annualized three-year return for the S&P 500 since 2012, it has consistently been above 10% and is currently over 20%.

That’s a long time for the equity markets to be consistently up. Investors have started accepting that such returns from equities are “normal” and that they should be expected. Yet, history tells us a different story. Consider that the all-time average for the S&P 500 is near 10%. In other words, returns from equities in the S&P 500 have been above average for 15 years and counting.

Many investors enter retirement with the plan of selling stocks for higher prices than they paid and using those gains to fund their lifestyle. The risk is that if prices decline, investors won’t have as much money as they think they have when they retire.

Equities Have Outperformed Recently

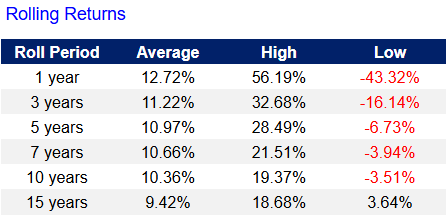

Here’s a look at rolling returns of the S&P 500 as measured by Vanguard 500 Index Fund;Investor (VFINX) since January 1985:

The current 15-year return is 14.86%. History doesn’t tell us this is normal. History tells us that this is well above average. For many investors today, 15 years accounts for the entirety of their experience in the market. Many investors, even on Wall Street, have never known anything different.

As a result, investors today feel invincible. They have accepted that the stock market “always goes up.” It’s something I’ve seen a few times over the decades. In the 1990s, there was a similar sentiment. In the 2000s, everyone was buying real estate and lending at 140% loan-to-value on houses because real estate would “always go up” – nothing “always goes up.” That simply is not how the real world works.

It’s important to keep in perspective that stock prices can go up in two ways. First, they can go up because the company is earning more money per share. That’s great because it means the company itself is growing, and whether it keeps going up is dependent upon the company’s ability to continue growing.

The second factor is valuation. This is the price relative to earnings per share. For each $1 a company is expected to earn over the following year, how much is that $1 worth?

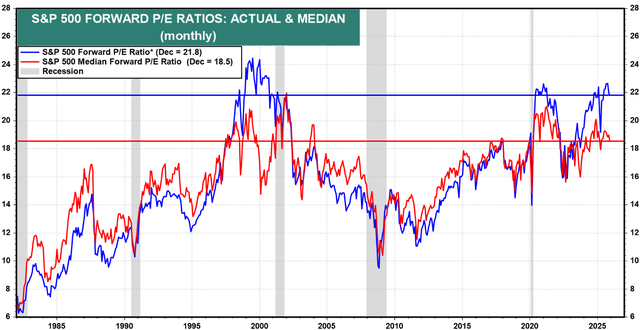

In 2010, $1 in earnings in the S&P 500 translated to a share value of about $14. Today, $1 in earnings in the S&P 500 translates to a share price of about $22: Source

This is important to keep in perspective because while it’s plausible that earnings might continue to grow, it’s not plausible that valuations will continue to climb indefinitely. To get the same benefit of valuation expansion, the S&P 500 would have to climb to about 35x P/E.

Is that going to happen? Probably not. Realistically, one of two things will happen:

- Equities will continue to increase in price at a pace matching earnings growth, but with minimal increase in valuation.

- Valuations will decline, and share prices will decline even if earnings are climbing.

In short, it’s very unreasonable for a person retiring today to expect that their equity portfolio will continue to grow at a pace similar to what they’ve seen over the past decade. The risk that prices could materially decline cannot be ignored. In the past, the stock market has gone for 10-plus years without having any capital gains.

The plan of selling shares to fund your retirement is great if you can sell those shares at a higher price and higher valuation than when you bought them. It’s a plan that is very limiting if you are forced to sell shares at lower prices and lower valuations.

Our Solution: Cash Flow Over Price

We approach the stock market differently from most people. When you retire, do you need $1 million, $2 million, or $5 million? No. You do not need a lump sum of cash, and if you have a lump sum of cash, odds are you are going to take that cash and invest it somewhere.

When you retire, you are losing an income stream. Specifically, the paycheck that you received on a regular basis and that you used to pay your monthly bills. The paycheck stops coming, but the monthly bills continue to come, and they will continue for the rest of your life. What you need is a source of cash flow that will cover those bills, and you need that source of cash flow to continue in perpetuity.

When we invest in the stock market, ultimately, we’re investing in businesses. If you were a landlord renting houses, would you sit there checking Zillow every month to see if you made money? Of course not. You check to make sure your tenants paid rent. If you’re running a restaurant, are you hiring an appraiser to assess the potential liquidation value every month? No. You’re looking at your revenue and expenses to determine if you’re making a profit. Anyone who owns and operates a business is going to be focused on the cash flows the business is producing. They aren’t constantly assessing it to determine what the business could be sold for today. They aren’t making decisions based on what they think the business might sell for in the future.

Why do we treat owning part of a publicly traded business differently?

Our goal isn’t to own a business that someone might pay us a higher price for in the future. Our goal is to own businesses that are generating significant recurring cash flows and are sending a portion of that cash flow to us in the form of interest payments or dividends. If we sell a stock, we’re just going to buy a different stock. We certainly enjoy it when that opportunity arises, but our primary goal isn’t that some fool will offer us a valuation that we think is entirely too high. Our primary goal is to generate cash flow from our portfolios that is substantial enough to fully replace the paycheck we lose when we retire.

The price that a stock is trading at only matters at two points: the minute you buy and the minute you sell. Every other price that falls in between is at best an interesting factoid.

The Income Method

We call our investment strategy the Income Method. It’s a strategy that focuses on investing in companies that produce significant cash flow and provide our portfolios with cash flow through interest and dividend payments. Our goal is to increase the cash that is flowing into our portfolio. We want enough cash flow that is high enough to support regular withdrawals and some excess so that we can reinvest. Reinvesting will help grow our income even if companies aren’t raising dividends. It also provides a cushion to ensure that turmoil in the market does not threaten our ability to pay bills. The electric company doesn’t care that the stock market is down or that dividends were cut—they want you to pay the bill anyway.

It isn’t a complicated idea, and it’s one that everyone who has ever managed a budget should be familiar with.

- You generate recurring income.

- You pay bills using your recurring income.

- You invest the excess for your future.

Does that sound familiar? It should because it’s what you’ve been doing your entire life. When you were working, you didn’t buy furniture so that you could sell it later to pay your rent. That would be silly. Yet in retirement, so many have readily accepted that you should sell assets, betting that the price of your remaining assets will grow fast enough that you won’t run out of things to sell.

Your retirement can be just like your working years. The only change is that your recurring income, which was being generated through your labor, is now being generated by the capital you have invested in stocks and bonds. You’re still generating an income, you’re still using that income to pay bills, and you’re still investing for your future. Instead of selling off assets every month, you are still buying more assets every month.

Some people would call that common sense.

The Guidelines

The structure of the Income Method follows a few guidelines to ensure that we’re achieving our goals today and in the future. Getting a ton of income today isn’t useful if it isn’t sustainable. You can’t go out there and just buy the highest-yielding investments and expect things to end well.

Buy Investments That Produce Significant Recurring Cash Flow:

Typically, we target having a portfolio that is producing an average yield of 9%. That’s a target that’s consistent with the long-term returns of the stock market. We expect that somewhere around 100% of our total returns will be coming in the form of interest/dividends, so we target an average yield that will be consistent with the long-term total returns investors can expect businesses to generate.

Diversify Among Asset Classes and Companies:

Nobody bats a thousand in the stock market. The reality is that you will sometimes make an investment that you thought had a safe income stream, and then something happens—the dividend is cut or even eliminated. When you were working, your income was likely tied to the one company you worked for. If you lost your job, you lost all your income until you found a new one.

Fortunately, as a retiree, it’s easy to diversify your income sources. We suggest a minimum of 42 different investments; we call it our Rule of 42. This means you have 42 different streams of income, so that if any one is disrupted, it isn’t a big deal.

Additionally, we suggest having a combination of common equities and fixed-income investments. The total return on common equities is often higher during periods like we’ve seen recently, where stock prices go up a lot. However, fixed-income like bonds and preferred equity will provide your portfolio with stable income year after year.

Investing as a retiree isn’t about getting the maximum possible. It’s about managing the risk to ensure that your portfolio has the best probability of meeting your needs.

Plan on Reinvestment:

When you look at stock market returns like the S&P 500, that’s always assuming you’re reinvesting 100% of your dividends and that you aren’t selling anything. When you’re in the building phase and working a career, that’s realistic. When you’re retired and using your portfolio as a source of income, that isn’t realistic at all.

Where a liquidation strategy means you are selling shares every year, the Income Method encourages you to use the interest and dividends your portfolio is producing to fund both your withdrawals and your reinvestment without selling a single share.

We suggest planning on reinvesting a minimum of 25%. So, if you want to withdraw $75,000/year from your portfolio, then you will need your portfolio to be producing over $100,000/year before you retire.

By reinvesting, you will own more shares and collect more interest and dividends next year. Allowing you to take out more to keep pace with inflation and providing a cushion in a Black Swan event like COVID-19.

Make Your Decisions Based on Improving Your Income:

When we make a decision to buy or sell investments, we look at it through the same lens that any business owner who makes decisions. What decision will make our income higher? More stable? Safer?

Sometimes, it isn’t possible to have everything. Maybe selling one investment to buy another will result in less income, but it’s something we judge to be safer. Or maybe we decide to take an intentional risk to buy something where the dividend is questionable but much higher. This isn’t different from any other investment style. Investing is about estimating the risk and balancing it against the potential reward and then determining what is best for you.

Some who follow the Income Method take a very conservative approach and focus on building up a large portfolio of fixed-income investments, avoiding any holdings that are “drama.” Others like to allocate a portion of their portfolios to “battleground” stocks where prices are very depressed, and yields are extraordinarily high.

Our job is to identify the opportunities and assess which investments will produce significant cash flow and which won’t.

Conclusion

The Income Method isn’t a “get rich quick” strategy. It isn’t an investment style that is trying to make homerun swings to see huge triple-digit returns. It’s a strategy that seeks to build an income stream methodically to reach a point where the interest and dividends are high enough to pay your bills, with an ample excess to reinvest so that you never have to sell an investment to survive. If you sell, you are selling because you believe there is an investment that is a better risk/reward.

We follow the macroeconomic news, but we don’t have to be reactive. We focus on the fundamentals of the companies we invest in. How much money are they making today, how much will they make in the future, and is the company going to continue providing a portion of those profits to us?

We take a long-term outlook and don’t worry about the short-term swings of the stock market. Our concern isn’t what someone in the future will pay for our shares – our concern is how much profit the businesses we own a piece of are going to generate. Valuations come and go, and right now they’re very high for a portion of the market. In our portfolio, we’re focused on the cash flow that we are collecting today, tomorrow, and next year. Whether the stock market is up or down doesn’t change our cash flow.

Stop treating your stocks like trading cards, hoping someone wants to pay more than you were willing to pay. Treat them like the businesses they are that are either producing cash flow for you or they aren’t.

Have a direction. Know what types of investments you are looking for and what benefit they provide your portfolio in the context of your overall strategy. Our method isn’t the only way to make money in the market, but it is the best strategy for us, and it’s a strategy that thousands have been able to successfully implement to achieve their goals.

Leave a Reply