I Wouldn’t Want To Retire Without The 3 Most Undervalued Income Machines

Feb. 13, 2026 BIZD, MAIN, CSWC, ARCC, HTGC, GBDC, BXSL, OBDC, VNQ, O, NNN, MAA, CPT, AMH, INVH, GLD, XLB, XLE, AMLP, KMI, WMB, EPD, ET, MPLX, PAGP

Samuel Smith Investing Group

Summary

- Three income powerhouses are trading at very compelling valuations right now.

- Each offers attractive income with substantial upside potential.

- Here’s why I’m overweighting them while the market is still giving them away at a discount.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios.

When looking to retire on passive income, I look to build a portfolio diversified by sector that is filled with high-yielding, high-quality businesses that have durable defensive business models, strong balance sheets, high and sustainable yields that are well-covered by underlying cash flows, and have the potential to either grow at a rate that meets or beats inflation or generate excess income that can be reinvested to generate growing income to offset the corrosive impacts of inflation.

While diversification is a sacred pillar of my investment strategy, at the same time, as a value investor, I do tend to overweight sectors that are opportunistically valued at the time. This is how I’ve been able to generate outsized total returns with below-market beta over time. With that in view, in this article, I’m going to detail what I think are three of the most undervalued, attractive, retirement-friendly income machines right now.

The Most Undervalued High-Yield Sector That Is Hated Right Now

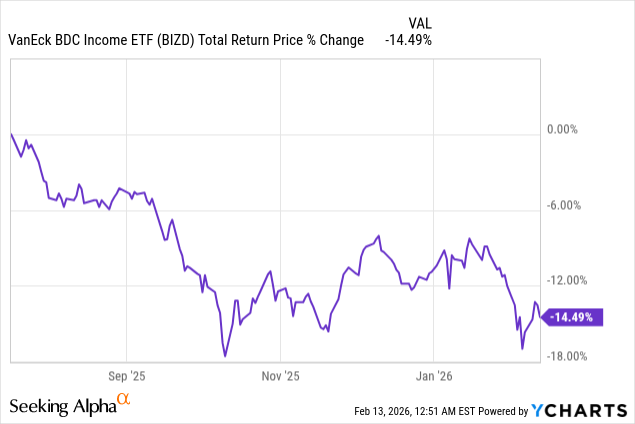

The most undervalued high-yield sector right now is the business development company sector (BIZD), as it has sold off pretty aggressively since last July:

While there certainly are concerns about private credit in general due to the influx of capital into this space in recent years, the compressing spreads, the muted M&A activity, and, most recently, concerns about AI disruption of software, which does have a substantial place in many BDCs’ lending portfolios, I think that overall these concerns are largely overblown. This is especially true in the leading quality underwriters, as their portfolios continue to deliver strong underwriting performance and their internal risk metrics are not showing any material signs of growing weakness and potential credit defaults.

Within the BDC space, there are quite a few opportunities right now that offer attractive and sustainable yields that I would have no issues buying if I were an income-focused retiree as part of a well-diversified portfolio. If you want to go with the bluest of the blue chips, Main Street Capital Corporation (MAIN), Capital Southwest (CSWC), and Ares Capital (ARCC) are three great names to choose from, though I do not view them as being particularly cheap at the moment. If you want to move further into tech, you can go with the leading blue-chip Hercules Capital, Inc. (HTGC), which is a solid opportunity, albeit trading near fair value, in my view.

However, if you want to go after more undervalued names while still insisting on quality, I think names like Golub Capital BDC (GBDC), Blackstone Secured Lending Fund (BXSL), Blue Owl Capital Corporation (OBDC), and several others offer an attractive combination of yields and value right now. While it is entirely possible that some of these BDCs – such as BXSL and OBDC – will cut their dividends in the coming quarters, it is also important to keep in mind that their current yields are high enough that even a 10-20% cut in their dividend would still leave them yielding over 10%. This is similar to how GBDC recently cut its dividend by 15%, yet still yields over 10%. This reduced dividend rate would then be quite sustainable, barring a very aggressive pace of rate cuts from the Fed and/or a material economic downturn. Meanwhile, their substantial discounts to net asset value, strong underlying balance sheets, and defensive portfolio posture, along with strong underlying performance, set them up to be dependable and relatively defensive income machines.

Why Residential REITs Could Be Near A Major Inflection Point

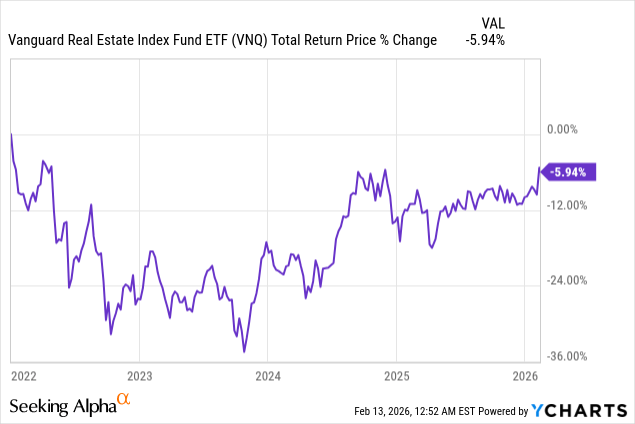

The second most undervalued high-yield income machine right now, in my view, can be found in the real estate investment trust space (VNQ), as it has been in the doldrums ever since interest rates began rising aggressively in 2022.

While triple-net lease is typically the bastion of sustainable income, with names like Realty Income Corporation (O) and NNN REIT, Inc. (NNN) headlining that space with fairly attractive yields, one of my favorite places to invest in the real estate sector right now is the residential space.

This is because there continues to be a general housing shortage in many markets in the United States, and rental rate dynamics in key Sunbelt markets are about to hit an inflection point where I think they will likely increase materially later this year and into 2027, as new supply is expected to be weak moving forward while demand continues to grow due to strong in-migration into these markets. Some of the most attractive ways to play it right now are Mid-America Apartment Communities, Inc. (MAA) for multifamily, along with Camden Property Trust (CPT) as another attractive option, and then in the single-family space, American Homes 4 Rent (AMH) and Invitation Homes Inc. (INVH) are both deeply undervalued as well.

All four of these REITs offer pretty solid dividend yields with strong dividend growth track records backed by rock-solid balance sheets, diversified portfolios of quality residential real estate in good markets, and yet all four of them trade at deep discounts to net asset value. Between their essential nature, attractive long-term growth prospects, status as a real asset inflation hedge, and deep value, I think these make for a very compelling place to allocate capital right now, especially in an environment where many other real asset investments, especially in the precious metals space (GLD) and commodity materials space (XLB), as well as increasingly the energy sector (XLE), have recently undergone strong rallies, making this one of the few real asset value plays remaining.

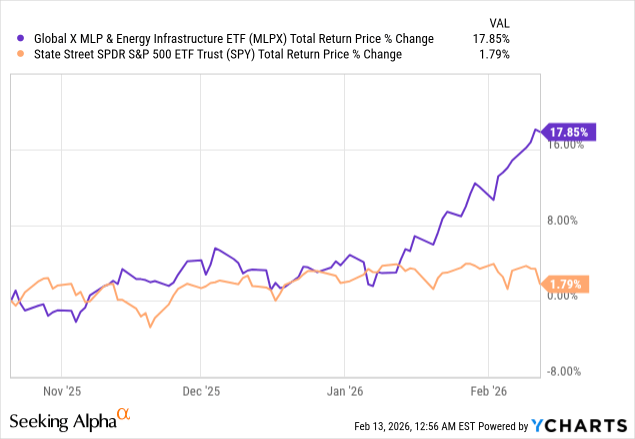

High Yields With Inflation-Resistant Growth

The third most undervalued high-yielding retirement income machine right now is midstream infrastructure (AMLP). Now, some midstream infrastructure is not discounted at all, such as Kinder Morgan, Inc. (KMI) and The Williams Companies, Inc. (WMB), which are quite richly priced after strong recent rallies. However, there are some attractive opportunities in this space yet that combine high yield with inflation-beating growth, very strong balance sheets, well-diversified and high-quality asset bases, and good management teams.

In particular, Enterprise Products Partners L.P. (EPD), Energy Transfer LP (ET), MPLX LP (MPLX), and several other K-1-issuing MLPs look very attractive right now, and in the 1099-issuing midstream side of things, there are also a few attractive opportunities, such as Plains GP Holdings, L.P. (PAGP). While they’re not as cheap as they were this past October, when I was pounding the table on them as my highest conviction pick at the moment, they still offer very attractive combinations of yield and inflation-resistant growth, as well as defensiveness thanks to their longer-duration, highly contracted cash flow profiles.

As a result, I think they still are a must-own as a substantial allocation in any income-focused retirement portfolio.

Risks & Investor Takeaway

While I’m very bullish on select undervalued high-quality BDCs, REITs, and midstream companies right now, none of them is risk-free. As already mentioned, BDCs are facing a plethora of headline and fundamental headwinds, whereas REITs remain highly interest rate sensitive, and residential REITs in particular need to work through some oversupply conditions in certain markets, which I think will happen soon. Finally, midstream infrastructure companies are mostly prone to commodity price volatility, impacting their equity valuations, even if their underlying cash flows are fairly resistant to it. Additionally, they have operational risk as they end up investing in growth projects that need to be executed on time and within budget to generate attractive returns.

Thanks to the attractive income yields and risk-reward profiles, these are three sectors where I currently have substantial allocations and very likely will continue to allocate capital to in the coming months, as long as they remain undervalued high-quality sources of attractive income and growth at High Yield Investor.

Leave a Reply