Investing just £25 a month could have netted you £6,300 in 10 years

Thursday, February 12

Director of Personal Finance

Related news

When people think of investors they may imagine people with private yachts or thousands of pounds in the bank, but investing doesn’t have to mean big sums or expert timing to deliver decent results.

Putting away just £25 a month could grow into a sizeable investment pot over time, and the figures highlight the powerful impact of investing little and often. Over the past decade, even modest monthly contributions to global and US markets could have turned spare change into more than £6,000, underlining how time in the market can matter far more than the amount you start with.

If you put away just £25 a month, less than £1 a day, you could build up a tidy pot after a few years. Assuming 6% a year investment growth after charges, you’d have £1,793 after five years and £4,191 after 10 years. If you kept up the trend for 15 years, assuming those same 6% a year investment returns, you’d have just over £7,400 in your investment pot, or almost £11,700 after 20 years. The figures show how investing little and often can really add up.

Give your portfolio a pay rise

Often when people start investing they start small and set up a direct debit with the money invested automatically every month, making the process hassle free. This is a great way to reduce the time it takes to invest and means you don’t have to worry about trying to time the market. But the danger is that you start at £25 and never increase that amount, even when your earnings grow.

Typically, people’s wages grow over time, so you could also increase your contributions over your investment journey, to boost your investment pot over the long term. You could give your investment contributions a 5% pay rise every year, meaning they’d rise to £26.25 in the second year, up to around £38.75 a month by year 10. If you do this your portfolio benefits from a pay rise boost. If we assume the same 6% a year investment returns, you’d have £1,970 in your investment pot after five years, or £5,150 after 10 years. After 15 years that pot would have risen to £10,101 before hitting £17,612 after 20 years – almost £6,000 more than if you left the monthly savings at a static £25 a month.

Real world returns

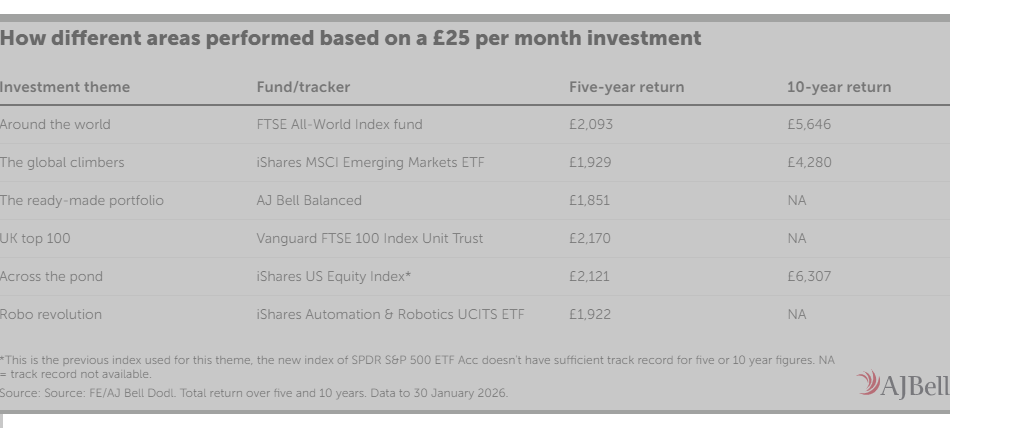

If you want to start investing little and often you may find a simple tracker fund a good option, with many investment providers, like AJ Bell’s Dodl app, making it easy to choose from a range of funds and ETFs tracking a basket of assets.

Investing £25 a month into the FTSE All World Index Acc fund, Dodl’s global tracker of choice, 10 years ago would have left you with £5,646 today. Even if you’d only started five years ago, you’d be sitting on £2,093 today.

If you’d opted for a US focus, with the iShares US Equity Index, and invested £25 a month over the past 10 years you’d be sitting on £6,307 in your investment pot, or £2,121 if you’d invested over the past five years.

Tips for first-time investors

Before investing you’ll want to make sure that you’ve paid down any pricey debt, otherwise the interest you’re racking up on your credit card or overdraft will probably more than wipe out the gains you make investing.

Investing is also generally only suitable for money that you don’t plan to spend for five years or more. So, make sure that you’ve got your emergency savings in cash, as well as any money you’ll need in five years – for a big holiday, a new car or your first home, for example. Any savings goal that’s further out than five years could be ideal for investing.

Investing for the first time can feel daunting. If you don’t feel confident picking which countries or sectors to invest in you can defer asset allocation decisions to a professional. You can buy so-called ‘all in one’ or multi-asset funds that spread your money between different regions and across various asset classes, with an option of having more or less in stock markets versus bonds, gold and cash, depending on your risk appetite. Alternatively, first-timers could buy a cheap ‘tracker’ fund, which mimics the performance of a broad global index, such as the MSCI World.

Investors also need to make sure they understand what they’re buying, and why they think it will make money – whether it’s a fund or a share. All too often investors are lured in by the promise of high returns or invest because a friend has recommended it, but you need to make sure you understand how the investment works and all the risks before you commit your money.

Leave a Reply