3 passive income shares, trusts, and funds to consider !

Searching for ways to supercharge your dividends ? Royston Wild reckons these high-yield passive income shares are too good to ignore.

Posted by Royston Wild

Published 15 February

For me, the best way to make an abundant passive income is by buying dividend shares. Share prices continue to rally, which means dividend yields are moving in the other direction. Yet there are still stacks of terrific companies with sky-high yields to choose from.

But what about if you’re searching for double-digit dividend yields? No problem. Take the following three stocks: The Renewables Infrastructure Group (LSE:TRIG), Octopus Renewables Infrastructure Trust (LSE:ORIT), and JPMorgan Nasdaq Equity Premium Income ETF (LSE:JEPQ). Each has a forward dividend yield above 10%, and a long record of paying market-beating cash rewards.

And I’m confident they can continue delivering brilliant income streams to investors. Want to know why?

Tech titan

Exchange-traded funds (ETFs) can be a great way to source a passive income. These can hold a wide variety of assets, helping to protect shareholders from individual shocks and providing a smoother return.

The JPMorgan Nasdaq Equity Premium Income ETF — which has a 10.8% dividend yield — is one such diversified fund to consider. It holds Nasdaq 100 US tech stocks which it then sells covered calls on. When out-of-the-money call options are sold, the income is paid to investors in dividends.

It’s a more complicated way to make income from the stock market. A focus on growth shares also means the fund could drop sharply in value during economic downturns. Yet over time, the ETF has proved a great dividend generator and one I expect to keep outperforming.

Renewable energy giant

Investment trusts that focus on renewable energy are another top income source to consider. This is because interest rate pressures and worries over a slower-than-expected green transition have pushed prices lower, supercharging dividend yields.

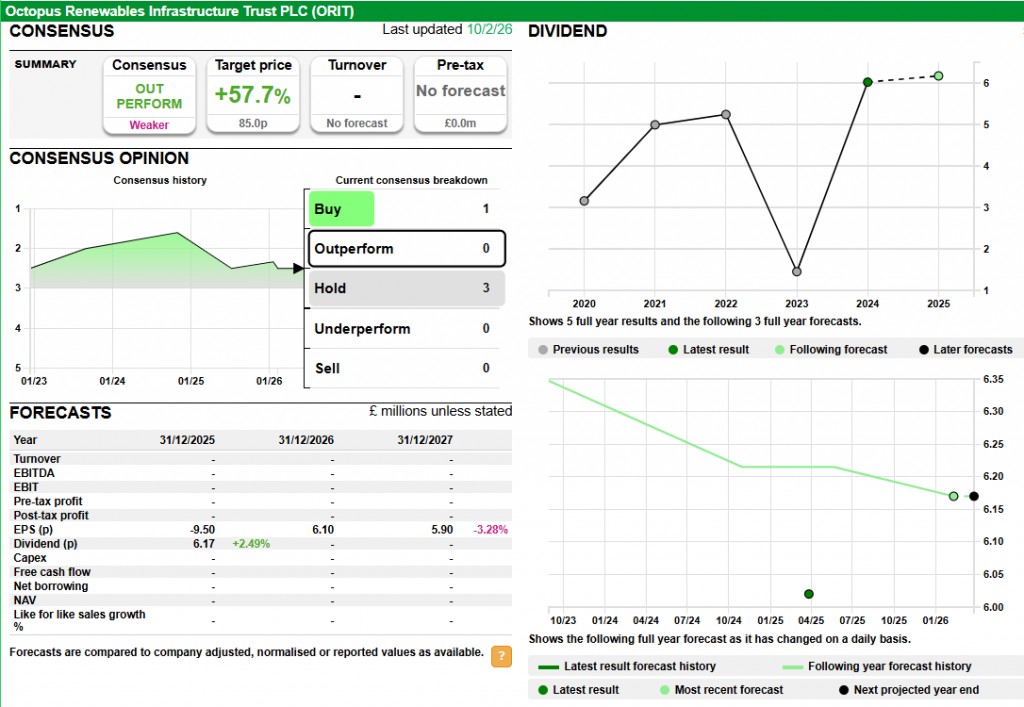

Octopus Renewables Infrastructure Trust now carries a 10.5% forward dividend yield. Could it rebound in value soon? I think so, with further Bank of England interest rate cuts on the horizon.

There’s a lot I like about the trust from a dividend perspective. Like other electricity producers, its operations are highly defensive and provide a steady flow of cash that can be returned to shareholders. I also like its wide, Europe-wide geographic footprint — this doesn’t eliminate the threat of weather-related disruptions, but it lessens the danger as localised calm conditions have a smaller impact on total power production.

An income stock I own

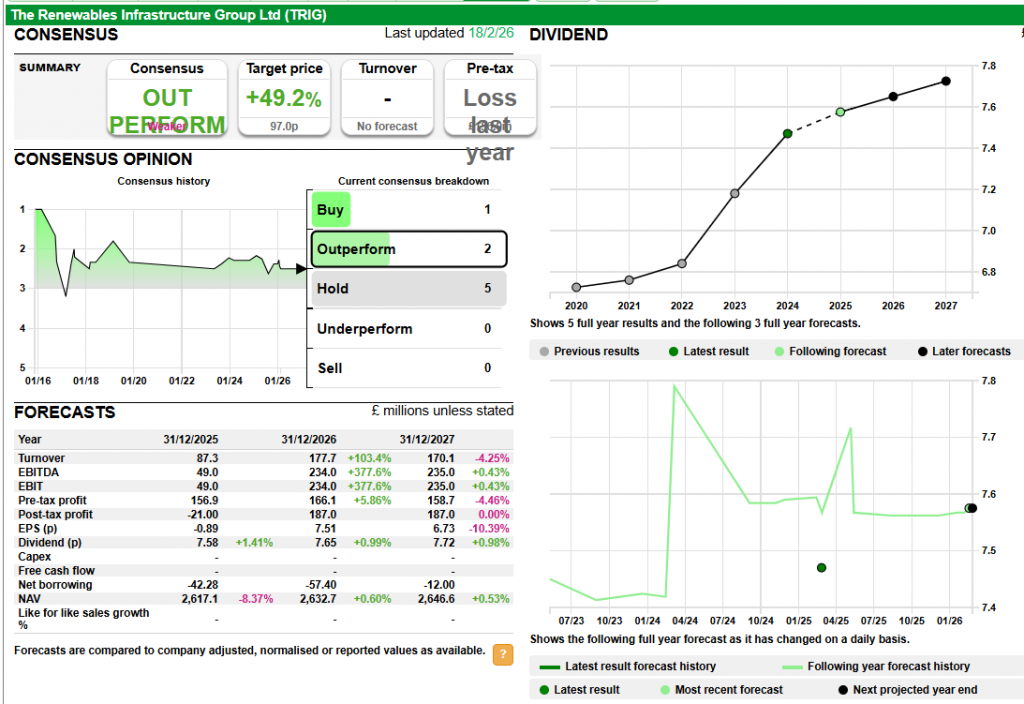

The Renewables Infrastructure Group is a renewable energy stock I’ve actually bought for my portfolio. And with a 10.7% forward yield, it’s one I think investors should seriously consider.

Why did I plump for this particular operator, you ask? With more than 80 assets on its books, it has an even wider footprint to protect against isolated operational problems. These are also spread across Europe, but that’s not all — its portfolio comprises onshore and offshore wind farms, solar projects, and battery storage assets, meaning it’s also well diversified by technology.

Lower electricity prices have been a problem of late. I’m confident, though, it will remain a robust passive income generator and that it’s share price will rebound following recent weakness.

Leave a Reply