You do not need to take big risks to secure a healthy retirement.

If you had done your own research and bought when everyone else was selling, the worst that could have happened was that you earned enhanced dividends to re-invest at great prices. The next market crash is just around the next corner, it’s a given, although when the corner will be is the unknown. One trading strategy would be invest part of your dividend stream in a cash fund or a gilt, so u have funds when it happens. You may not buy at the bottom but if you are happy with the yield, it lessens the risk.

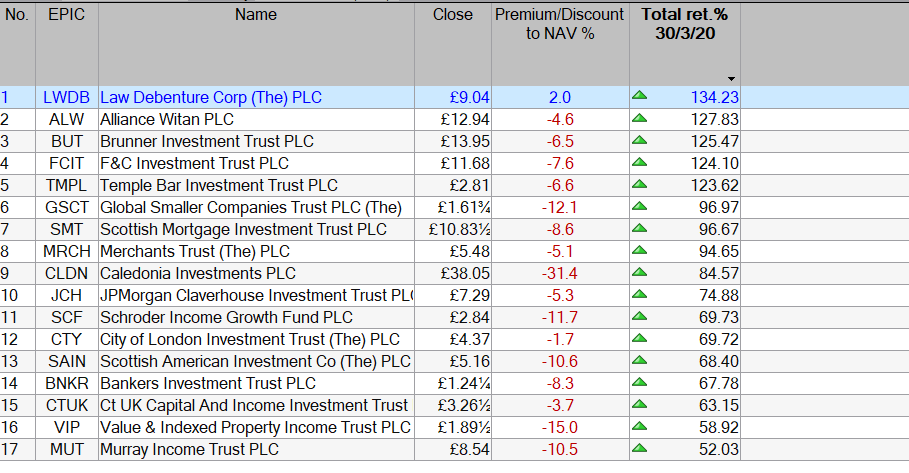

Note 8 funds have nearly achieved the holy grail of investing, where you can take out your stake, have an investment that pays you a dividend at zero, zilch, cost.

Remember compound interest takes time to build, you should make more money in you last few years of investing than in all the early years, that’s why life-styling is such a bad idea.

The worst aspect of a dividend investment plan is that you start to wish you life away as you await the next dividend to re-invest it, of course that aspect disappears when you start to spend your hard earned.

Stick to your task until it sticks to you.

The energy here is unmatched — you crushed it!

This article brought so much clarity to the topic.

Everything about this post screams excellence!

Every sentence bursts with enthusiasm — love it!

This article practically radiates enthusiasm — fantastic!

Every sentence bursts with enthusiasm — love it!

This is one of the most helpful articles I’ve seen recently.

This post was absolutely fantastic from start to finish.

Every line felt alive — incredible writing!

This is PURE GOLD — thank you for creating it!

Thank you for sharing something so thoughtful and well crafted.