How to invest £200 a month in UK shares to target a £42,050 second income

Let’s face it, all of us would probably benefit from a second income, especially a tax-free one. Dr James Fox explains the formula.

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more.

Investing £200 a month can be a powerful way to build wealth and target a substantial second income. This is especially true when we harness the power of compounding.

Compounding means investors earn returns not just on their original investments, but also on the returns those investments have already generated. Over time, this “interest on interest” effect can accelerate growth dramatically.

Slow and steady

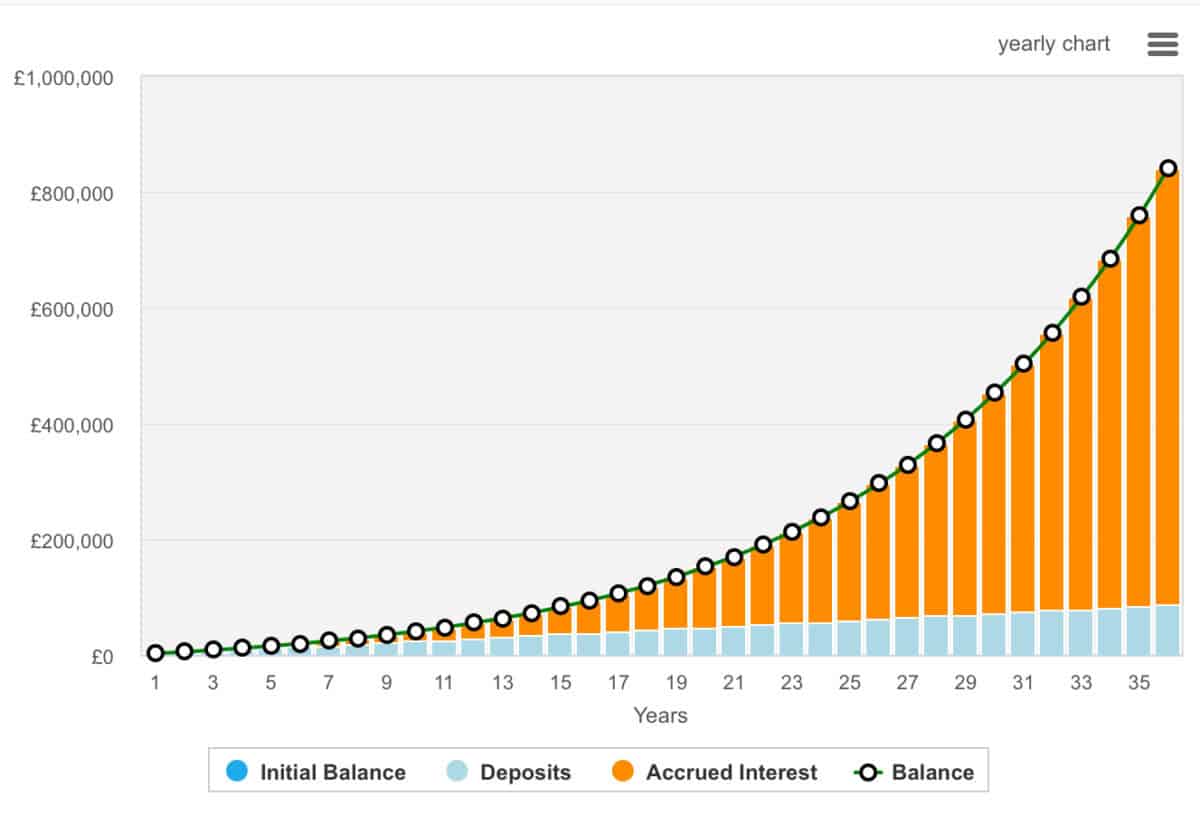

If anyone consistently invests £200 every month and achieves an average annual return of 10% over the long run, the portfolio could grow to over £841,000 in 36 years. Yes, it takes time, but the longer we leave it, the faster it will grow.

The maths behind this is rooted in the compound interest formula, where each year’s gains are added to your principal, so the base for future growth keeps getting larger.

After 36 years, an investor could look to allocate their portfolio towards companies with paying dividends or simply buy debt. With a 5% annualised yield, an investor would receive £42,050 annually. And that’s tax-free.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Don’t lose money

The above is great. However, none of this matters if investors make poor decisions and lose money. Protecting capital is just as important as seeking high returns. As Warren Buffett famously says, “Rule number one is never lose money. Rule number two is never forget rule number one”.

This is crucial because a large loss can be devastating. If a portfolio falls by 50%, it needs a 100% gain just to get back to where it started. That’s why it’s wise to focus on quality companies, ideally with strong balance sheets and sustainable dividends, and to diversify investments across sectors to reduce risk.

Investing wisely

Hi there! I could have sworn I’ve been to this blog before but after looking at some of the articles I realized it’s new to me.

Anyhow, I’m definitely delighted I discovered it and I’ll be bookmarking it and checking back

frequently! https://nzazurslot.Wordpress.com/