My real aim is to help investors safeguard their retirement from recessions with low-volatility—but highly lucrative—investments that consistently pay you, whatever direction the market goes.

This method lies very close to my heart and ethics.

You see, my first experience in the markets was brutal …

It was 2003, and I’d recently graduated from Cornell University and was designing computer systems for Fortune 500 companies. For the first time in my life, I was making money. So I decided to hire a broker to help grow my savings.

This guy had countless credentials and certifications, years of experience, and he talked a great game.

Without hesitation, I hired him.

The result?

Just one year later, this so-called expert had literally lost nearly ALL my money. Everything. Years of saving and investing, gone.

As you can imagine, I was furious. However, thanks to this experience, I came to a huge breakthrough. I realized that nobody is EVER going to care about MY money, MY future, MY retirement and MY family as much as I do.

And, I realized, if I wanted to retire rich, I needed to take control of my money.

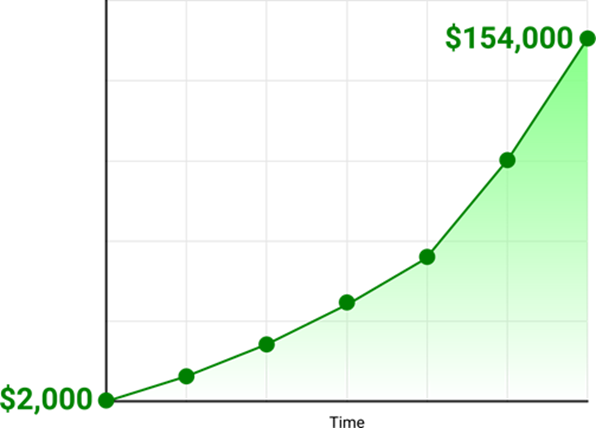

Anyway, with this realization, I decided to learn everything I could about investing. I was absolutely relentless. And after a few bumps in the road, it paid off, starting with a measly $2,000 that I turned into $154,000 in just 48 months!

Obviously, this sort of performance doesn’t go unnoticed …

Shortly afterward, I was invited to join a famous financial publication as an editor.

At first it was great. We helped our readers take home huge profits, exponentially grow their portfolios and finally create the financial freedom they’d been chasing their whole life.

However, as time passed, things started to change …

Instead of focusing on secure, safe stocks with huge upside, they started recommending all sorts of highly speculative, high-risk “investments” like obscure cryptocurrencies, volatile penny stocks and many other questionable opportunities.

Anyway, this didn’t sit well with me.

I believe financial analysts like me have an ethical and moral duty to help our readers safely grow their money—not recklessly gamble it away on some pie-in-the-sky idea.

Which is why I decided to set up my own research firm—Contrarian Outlook.

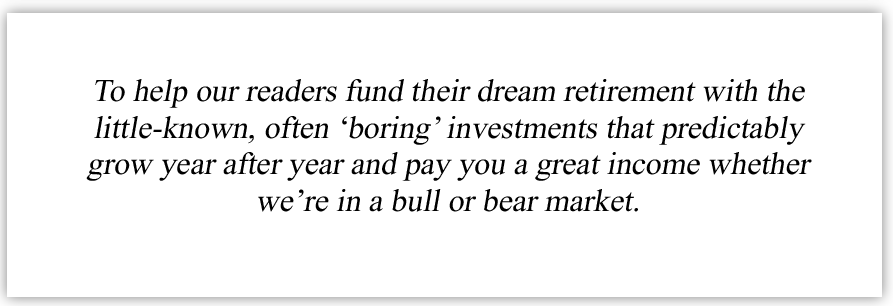

Since inception, the goal of Contrarian Outlook has been simple:

All without making any highly speculative bets you can’t tell your spouse about … without trying to time the markets … without the can’t-sleep-at-night worries … and without putting your retirement at risk!

Today I want to share five of my recession-resistant “Hidden Yield Stocks” with you.

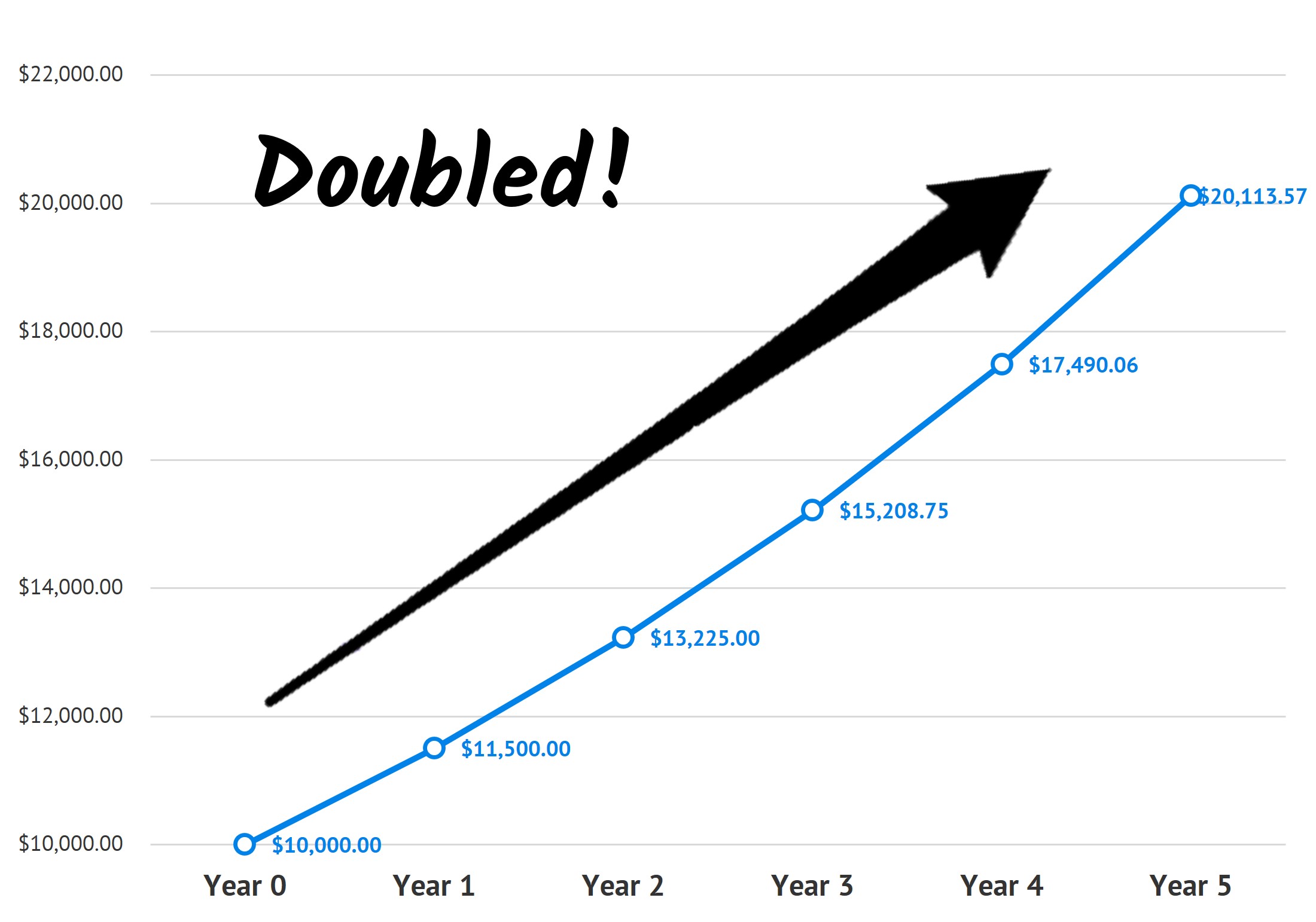

My research indicates each of these investments could deliver 15% total returns per year – even as we stumble towards a recession.

As you can see in the chart below, that’s enough to double your money every 5 years!

15% Average Annual Return on $10,000 Compounded Over 5 Years

Still skeptical?

Good. I would be, too.

Which is why I don’t expect you to just take my word for this.

Instead, I’m going to prove everything to you.

I’ll walk you through my investment approach. I’ll show you how to identify these “Hidden Yield Stocks.” And I’ll give you the cold-hard evidence that proves you can double—even triple—your portfolio without taking on any unnecessary high-risk bets.

Then I’ll give you 5 of my favorite recession-resistant “Hidden Yield Stocks” to buy now.

Here’s the Time-Tested Way to Make

15% Per Year From Stocks

There’s an untapped portion of the market few people know about …

It’s filled with stocks that seem “boring” to the uninformed investor…

Companies that rarely get coverage from the mainstream media …

Contrarian investments that are hiding their true potential …

However, if you look below the surface and read between the lines, these “Hidden Yield Stocks” offer intelligent investors the opportunity to deliver 15% total returns per year—no matter what the wider market does.

How?

Well, the answer lies in what I call “The Three Pillars.”

Pillar #1 – Consistent Dividend Hikes

Pillar #2 – Lagging Stock Price

Pillar #3 – Stock Buybacks

Together, these three pillars allow us to identify the stocks that are undervalued … overlooked … recession-resistant … and primed for major growth.

And by investing exclusively in these “Hidden Yield Stocks,” we can enjoy massive upside with very little downside … plus collect regular, reliable income through healthy dividend payouts!

As I said, today, I want to give you 5 of my favorite “Hidden Yield Stocks.”

But first, let me briefly explain each of the Three Pillars and show you how it helps to predict—with pinpoint accuracy—the direction a stock is going to take.

Pillar #1 – Consistent Dividend Hikes

Most investors approach dividend paying stocks backward.

Here’s how it usually works …

An investor will scan the markets looking for stocks paying a high dividend. After all, if a company is currently paying a high yield, it’s a great investment, right?

Dead wrong!

In fact, looking at the CURRENT yield is one of the slowest ways to grow your money.

You see, if you’re focused on current yields, you’re too late to the party. All the major gains have already been made. You’ll need to settle for earning a paltry 4%, 5%, maybe 6% per year … with minimal stock-price appreciation, too.

Sure, chasing high current yields will provide you with instant gratification, but it won’t give you the recession-resistant income … or the 15% year on year returns we want.

Instead, you need to focus on consistent dividend hikes.

In my opinion, selecting companies with a proven track of increasing their dividend payments is one of the safest, most reliable ways to get rich in the stock market. You see, every time a company raises its dividend, you start earning more from your original investment.

For example:

On a $1,000 initial investment, $30 in dividends equals a 3% return. Later, if the dividends go up to $40 a year, you are effectively earning 4% on your initial $1,000 investment.

As this trend continues, you could easily be earning 10%, 15%, even 20% per year just from rising dividends, as your initial investment never changes.

However, this ever-growing income from dividend hikes is just ONE part of the puzzle. To engineer real growth and quickly double an initial investment, we must combine Pillar #1 with the next two pillars of “Hidden Yield Stocks.”

Pillar #2 – Lagging Stock Price

After years of active investing, I’ve only ever found one surefire way to predict whether a stock will go up or down.

I call it the “Dividend Magnet,” and here’s how it works …

After you’ve identified stocks that are built on the foundations of Pillar #1 (consistently hiking their dividends), you want to narrow your search to companies whose share price LAGS behind the rate of dividend increase.

Why? Well, it’s simple really …

Share prices almost always increase as dividends increase.

This is because as a company hikes its dividend, mainstream investors tend to flock to the stock, chasing the new, higher yields. And this inevitably bids up the share price.

Let me give you a few examples where the dividend acts like a floor to keep bumping the share price higher:

UnitedHealth Group: Dividend Up 460% Share Price Gains 510%

Mastercard: Dividend Up 500%, Share Price Gains 532%

Cisco Systems: Dividend Up 111%, Share Price Gains 113%

As you can see in these examples, the stock price lags behind the dividend increases at some point in time …

However, as more investors notice the company’s soaring dividend and buy in, the price lag closes—sending the share price soaring.

So, by investing in the right companies whose share prices have fallen behind despite consistent dividend hikes, you can buy the stock, safe in the knowledge the Dividend Magnet will eventually pull the price up.

Now, investing with Pillar No. 1 and No. 2 alone would stand you in great stead.

However, there’s one final Pillar of a “Hidden Yield Stock” that can rapidly accelerate both the share price and dividend payouts …

Pillar #3 – Stock Buybacks

Uncovering companies that are buying back their stocks is one of the fastest ways to accelerate your gains.

You see, when a company buys back its stock, it is improving every single “per share” metric investors watch (earnings, free cash flow, book value, etc.).

After all, if a company reduces the number of its shares by 50%, its earnings per share will automatically DOUBLE without any actual increase in profits. And I probably don’t need to tell you what will happen next …

Investors quickly bid up the stock’s price to bring it back in line with the value it was trading at before. Indeed, my research shows that simply investing in stocks that are reducing their share counts can help you beat the broader market’s performance.

And it’s important to bear in mind that S&P 500 companies are sitting on huge piles of CASH (more than $1 trillion in all!). They’re rolling out fresh buybacks amid continued economic growth post-pandemic, and they’re getting a nice upside kick in return.

You can see this just by looking at the shares of Union Pacific (UNP), which took an impressive 31% of its stock off the market in 10 years, helping drive a 100% gain in the share price!

And that’s just one example. By targeting cash-rich companies that either continue to buy back shares now or have a long record of doing so (even if they’re holding off today), you can set yourself up for HUGE price gains.

In short …

Combine the Three Pillars … Buybacks,

Dividend Hikes and Price Lags, and Your

Yearly Returns Can Be Absolutely Astounding

For example, in April 2020, as the world was shutting down, I recommended food maker Mondelez International (MDLZ) because it looked cheap … was consistently growing its dividend payments … and management was aggressively buying back shares.

These three pillars told me the stock would skyrocket. And just take a look at what happened …

Over the next three years, Mondelez reduced its share count by 4.6% (orange line in the chart above) while raising its dividend a whopping 35% (blue line).

The market quickly responded, and the stock delivered a 39% price gain (purple line) by the time I recommended selling in April 2023.

Put it all together and that’s a 48% total return (green line) in just 3 years from a relatively boring (at the time!) company.

Of course not all of my recommendations work out exactly like this one … some better, some worse… and I’m no longer recommending MDLZ today.

But this example shows you that you don’t always need to take big risks or invest in things you don’t understand. All you need to do is sniff out these “Hidden Yield” stocks before the mainstream crowd catches on.

With These 3 Pillars, Uncovering Safe,

Secure Stocks Set to Return 15% Per Year

Is Like Shooting Fish in a Barrel

However, it still takes a lot of work …

You see, although these three pillars can help you beat the market, double your portfolio and enjoy true security in your retirement, you also need to analyze these “Hidden Yield Stocks” in excruciating detail before investing.

Not a prospect too many people look forward to …

Fortunately for you, I love this sort of in-depth financial research!

And, right now, I want to tell you about …

5 Hidden Yield Stocks to Buy Now

My research shows they will not only pay a healthy—and continually growing—dividend, but their stock prices are primed for major increases over the coming years.

Of course, no one has a crystal ball or can claim 100% certainty that any of their recommendations will play out exactly as they say, so let me explain why I’m so bullish on these stocks, even in these uncertain times …

But first, let me explain why I’m so bullish on these stocks, even in these uncertain times …

Hidden Yield Stock #1

201% Dividend Growth and Massive Upside

Our first stock is a biotech cash cow boasting 61% gross profit margins and a dividend that’s soared 201% over the past decade. The share price? It’s followed the payout higher, like a loyal puppy dog.

Pick No. 1’s Always-Rising Payout (and Hence, Price)

This firm generates so much cash that raising its dividend barely dents its cash flow. The company also buys back shares when they’re cheap. Over the past decade, management has taken 29% of its “float” off the market:

Pick No. 1’s Steady Share Buybacks

In recent years, this firm has been buying other firms specializing in treatments for rare diseases. There are more than 10,000 of these conditions identified today, but only 5% have approved medicines. As an established biotech, it has the R&D and manufacturing know-how to bring these drugs to market.

Since 2020, the drug maker has boosted rare-disease product sales from $2.2 billion to $4.2 billion. Yet the stock still hasn’t caught the media’s attention. Let’s jump in now, before it does.

Hidden Yield Stock #2

Death, Taxes and…

Death, taxes and the cyclical nature of natural gas are the only three rules of life. Natural gas has fallen due to trade war worries as I write this, but it always bounces back. The cure for low prices is, after all, low prices.

And that means Stock #2 is set to soar.

The reason for this is simply supply and demand. When natural gas prices are low, producers stop producing. Which means less supply.

Natural gas companies can cut (“shut in”) production quickly. They do it out of self-preservation—to save money so that they can live to see another “up cycle” in prices.

Of course they all cut at once! Which crimps supply. Which ensures rising prices that eventually test the ceiling, because it takes years to bring back higher supply. These firms cut quickly and ramp slowly.

When natural gas is low and due to rally, Stock #2 is my “go to” stock.

It’s sitting on nearly 4,000 drilling locations on proven reserves, literally decades of inventory!

This one is cheap now, and management is calling for a continued rise in demand (and by extension prices) as consumption of liquefied natural gas (LNG) doubles by 2050, driven by heightened demand from Europe.

The vast energy appetite of artificial intelligence is another growth driver here.

We could easily double our money because its stock price is due to climb. For months and even a few years, tickers can meander independently of their dividends. But eventually, they follow their payouts higher:

This Dividend Magnet Is Due

Let’s listen to this cash cow, which is imploring us to buy it—before Wall Street catches on.

Hidden Yield Stock #3

A “Dead Money” Play That’s Returned

Nearly 2,000%

This is my “go to” manufacturer and distributor for agricultural, construction and forestry equipment. In recent years, the company has expanded into financial services and solutions for its own equipment and technology as well as other ag projects.

And what a winner! Over the last 20 years, it has returned nearly 2,000% to its shareholders. This is one great company to buy and sock away for a long time.

But it’s best to buy on the dips when wheat is down. Troughs in wheat tend to mark lows in profits—and its price follows:

Buy When Wheat Bottoms (and Sell Tops)

Over the last 20 years, wheat and grain prices have rallied and reversed several times. But there’s been one consistency, which is the lynchpin for big returns—returning cash to shareholders.

Most of this manufacturer’s cash—about 63%—has been returned to shareholders through dividends and buybacks:

Divvie Up 170%, Share Count Down 19%

Fewer shares mean fewer dividends to pay, creating more cash for the firm to raise its divvie for those who hold on. This virtuous cycle is outstanding for shareholders.

Plus, management knows how to deal with corn and wheat prices: control costs, keep generating cash and be ready for that next boom.

Ag prices will take off again soon. It’s a matter of when, not if. They are scraping the basement floor right now. Stock #3, meanwhile, is reasonably priced for a blue chip at just 18-times earnings—depressed earnings.

This is “dead money” to Wall Street, which means now is the time to start grazing before the herd catches on.

Leave a Reply