“Bull Or Bear,

I Don’t Care”

These 5 “recession-resistant” dividends are set

to deliver 15%+ total returns for years to come

no matter what the market does next.

Hi, I’m Brett Owens.

I’m the Chief Investment Strategist at Contrarian Outlook.

Today I’m going to reveal a simple strategy that could triple many investors’ dividend income in just a few years—without making any high-risk, highly speculative investments you can’t tell your spouse about.

I call it the “Recession-Resistant Retirement Plan.”

Now you might believe that to double or triple your dividend income, you would need to find the next Amazon, Facebook or Google and get in at ground zero.

However, this just isn’t true.

In fact, as you’re about to see, investors who endlessly chase these unicorns tend to lose a lot of money—and lose it fast.

The truth is, these breakthrough companies are one in a million, and trying to fund your retirement with them is the fast track to the poor house.

The same goes with the latest cryptocurrencies (which, although they’ve soared recently, have a long history of cratering overnight), penny stocks, profitless tech startups and every other overhyped stock you hear the so-called gurus telling you to “buy, buy, buy!”

Personally, I don’t see why you would want to gamble on your future.

Especially when there are safe, secure stocks that are nicely positioned to return 15% per year on an annualized basis in the long run, no matter what direction the market goes.

It’s stocks like these that I specialize in finding.

And today I’m going to share my exact process with you. Then I’m going to give you …

5 Recession-Resistant Stocks Set to

Deliver 12% to 20% Returns Per Year

In Both Bull and Bear Markets

But first, let’s get one thing straight.

Do you agree, if you were looking for the perfect retirement portfolio it would:

- Pay real, spendable income – not just paper gains.

- Be built on safe, secure stocks that are much less volatile than the typical stock.

- Continue paying—even if the market crashes.

- Be cash-flow rich, free from major debt and profitable.

- Pay a generous—and ever-growing—dividend.

- Keep growing revenues year after year after year.

- Be safe from new competitors.

And most important of all …

Do you agree that your recession-resistant retirement portfolio would be built on the undervalued, overlooked and often-ignored stocks other investors miss? The stocks you can buy for pennies on the dollar and watch soar over time?

As I said, I specialize in uncovering these contrarian stocks …

- The plays an intelligent, income-focused investor could use to double or triple their wealth every few years.

- The investments that are designed to protect against wild market swings so you can enjoy a stress-free, secure retirement.

- The stocks that can be held for years without the “can’t-sleep-at-night” worries.

So, if you’re retired or you’re looking to retire soon, this may be the most important investment advice you ever read.

Bold claim, I know.

But please bear with me for just a couple minutes …

Because I’m going to show you, step-by-step, how to find the stocks best positioned to deliver double-digit annualized returns—through boom, bust, inflation, deflation, you name it

Better yet, I’m going to show you how to do this without making any highly speculative, high-risk bets. Everything you’ll discover is focused on buying reliable stocks with rock-solid fundamentals, strong cash flow and terrific long-term prospects.

So while other investors lose their shirts chasing the latest unicorn …

You could be quietly doubling—even tripling—your retirement income by investing in what I call the “Hidden Yields.”

In just a moment, I’ll tell you how to build a recession-resistant retirement plan with these Hidden Yield stocks, and I’ll tell you about 5 specific names to buy now.

But first, let me tell you a little bit more about myself …

Today I’m writing to you from sunny Sacramento, where the tech industry is still growing, thanks to massive investments in AI. But tech execs are also growing more worried about the trade war, and what it might mean for the vast amounts of revenue they pull in from outside the US.

You may have seen me on CNBC, Yahoo Finance or NASDAQ, where I’ve been called on to share my methodology for collecting consistent, predictable and reliable retirement income without making any wild, speculative bets that keep you up at night.

You see, I take a strategically contrarian approach to the markets.

And for the past several years, I’ve helped thousands of readers fund their retirement thanks to what I call “Hidden Yield stocks.”

For example:

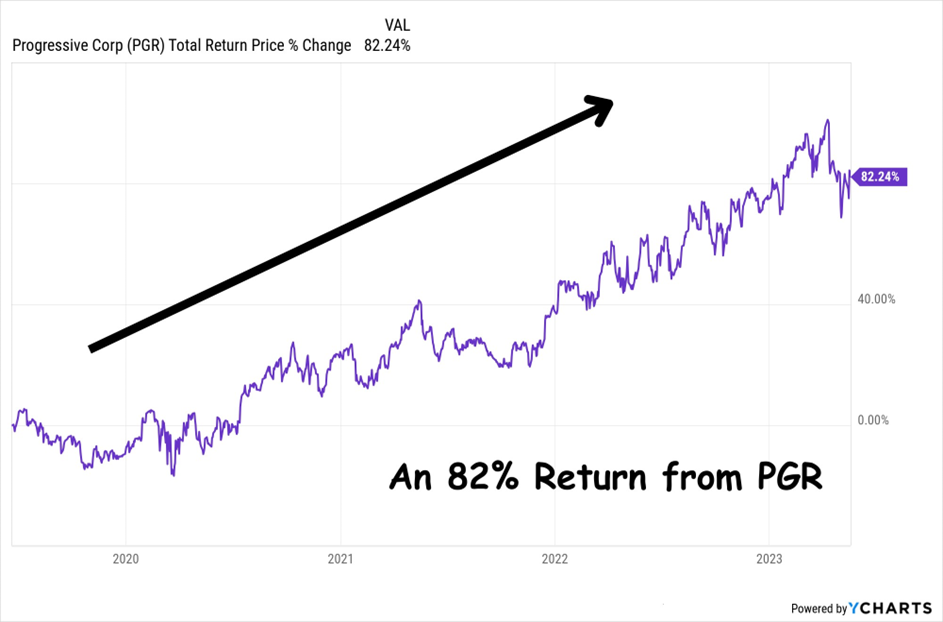

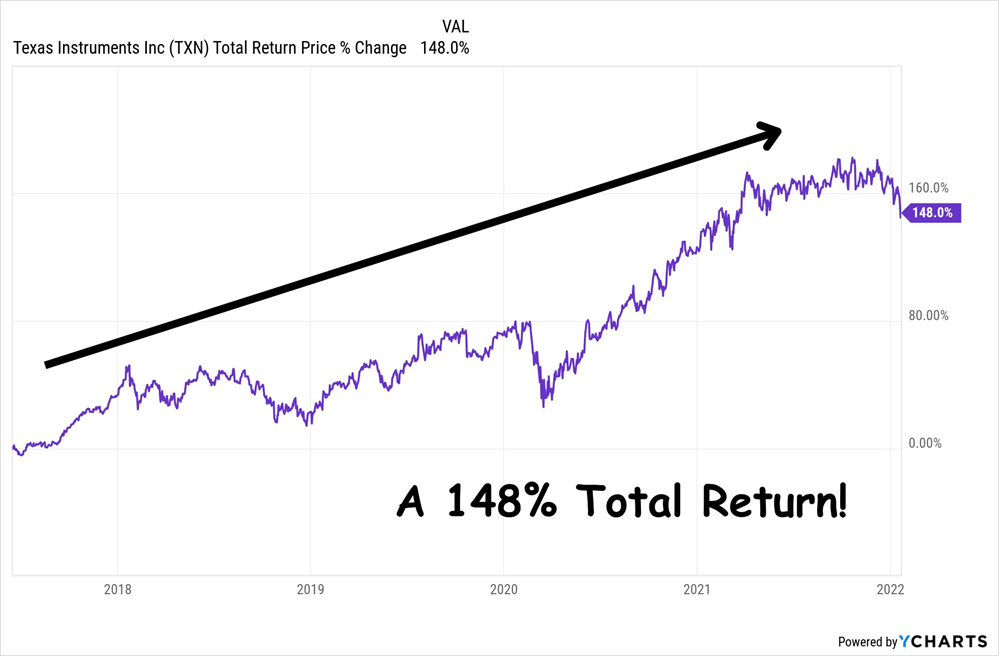

82% on Progressive Corp. in Just Under 3 years

22% on Microsoft in just 3 months

83% on Synnex Corp. in 24 Months

148% on Texas Instruments in just over 4 years

Now, I know these aren’t the huge 500% … 1,000% … or 5,000% overnight gains you hear other gurus CLAIMING they can get you.

But—as you’ll see in just a moment—outrageous claims like these are nothing more than overhyped promises designed to separate YOU from your money.

And to be clear, not all recommendations play out as well as the four examples above. Investing in the stock market is inherently risky, and some recommendations have lost money.

So we level-headed contrarians don’t chase unicorns.

We don’t listen to smiling swindlers.

We don’t put our family’s futures in jeopardy.

Instead, my readers and I focus on …

Doubling Our Money Every 5 Years with

15% Total Returns Per Year on Little-Known

“Hidden Yield Stocks”

However, this is just one small part of what I do.

whoah this weblog is great i really like studying your posts.

Keep up the good work! You understand, many people

are searching around for this information, you could

aid them greatly. https://hellspinincanada.wordpress.com/