How to Collect Extra Income by February 27th

ACTION REQUIRED: The deadline to be on the list for the next payment is February 3rd.

That’s the date you need to focus on to be eligible for your first payment on February 5th.

Fellow Investor,

Starting on February 3rd you can fundamentally transform your income stream from a string of near misses to a steady, reliable flow of income right to your bank account.

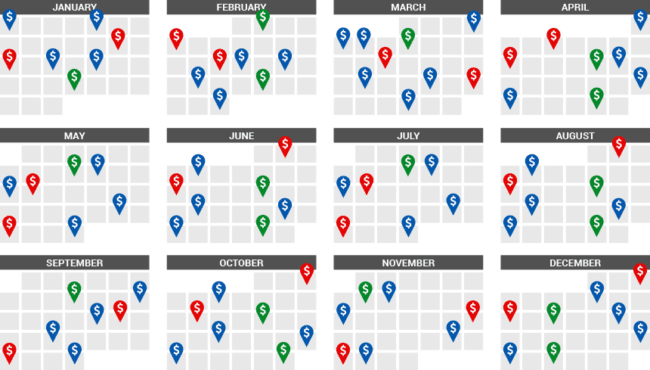

And it all starts with a simple to use, yet powerful calendar, like the one below, only with more details. Kind of like the one you might have on your desk, only this one tells you when you’ll get paid and how much you’ll receive each and every month.

No more guesswork, no more confusion, no more worrying if you did the right thing… just steady paychecks coming like clockwork.

With the monthly dividend paycheck calendar, you’ll stop worrying about the market’s ups and downs because they won’t matter anymore.

Your payday is already on the calendar.

In this urgent briefing, I’m going to share with you all of details on how the monthly dividend paycheck calendar works, how easy it is to use for investors of any level, and real life examples of the kinds of paychecks investors are getting right now.

Before I do that however, I’ll take just one minute to tell you who I am and why you should listen to what I have to say.

I’m Tim Plaehn, lead income analyst and editor of The Dividend Hunter.

I launched the Monthly Dividend Paycheck Calendar as part of my Dividend Hunter service over 10 years ago when we were in a near zero interest rate environment.

Many investors – particularly retirement focused investors – who had been told all their lives to put their money in 5% and 6% CDs and live off the interest were finding CDs at those rates no longer existed. Not even close. They were starving for yield and just as importantly, a plan.

In my previous career I’d been an F-16 fighter pilot and instructor in the United States Air Force. I’d also been a stock broker and certified financial planner. In all of those endeavors I was a meticulous planner.

So it seemed natural that I’d develop the Monthly Dividend Paycheck Calendar as part of my then newly launched Dividend Hunter. Now, 10 years later and tens of thousands of subscribers I’m still guiding our plan.

February 5th: the date that changes everything

In order to receive your first paycheck on February 5th, you must be a shareholder of record by February 3rd. That means you must own the stock by this date.

This date is critical and clearly marked on the monthly dividend paycheck calendar.

The way the calendar is structured you can expect between 11 and 29 paychecks per month. By starting with the Monthly Dividend Paycheck Calendar today, you will have the opportunity to earn a growing cash income stream in perpetuity.

That’s the way the calendar is set up: you’ll have a base of 11 paychecks every month and then in some months you’ll get a bonus paycheck and in others you’ll receive two bonus paychecks all the way up to 29 per month several times a year.

The peace of mind you’ll get from knowing that every month you’re going to get at least 11 paychecks is invaluable.

No more worrying about the market’s gyrations.

No more keeping tabs on how much you’re spending and how much you’re taking in, pinching every penny along the way.

No more worry at the end of the month that you might not be able to pay all of the bills.

The income derived from the monthly dividend paycheck calendar is like getting a bonus every month.

Whether you sock it away for the future, re-invest it, or treat yourself to something nice, it’s your call. After all, it’s your money. And in this letter, I’ll tell you how to get it.

How to collect extra income every month

To create the Monthly Dividend Paycheck Calendar I first had to find the very best dividend investments for individual investors.

Sure, some folks out there just chase down the highest yield, buy a bunch of shares, and expect money to just flow into their account. And for some, this works. At least for a while.

But the problem is that solely chasing down yield leaves you exposed. Sadly, there are many companies out there paying eye-popping yields that are just one bad management decision or one market pull-back away from bust. They cut their dividend and the results are calamitous for investors.

You see, the share price of stocks for companies that cut dividends always crashes. And hard.

For example, in August 2024 Intel Corp. announced a suspension to its dividend payments amid a cost-cutting program. The share price fell 38% in the seven days following the announcement and has only partially recovered though it still trades at a 26% loss from before the announcement.

Plus, any investors still holding onto shares of Intel are out of luck when it comes to dividends. Ouch!

Or take Walgreens, the big drug store chain. It seems there’s a store on practically every street corner in the U.S. and they should be printing money.

Instead, Walgreens cut its dividend earlier in 2024 with an announcement just after the beginning of the new year. Until then the dividend had been 48 cents per share.

Shareholders had enjoyed well over a decade of modest but consistent dividend increases from Walgreens.

That all changed with the announcement that the next quarterly dividend payment would be a mere 25 cents per share. That’s a 48% overnight haircut for income investors relying on those dividends to help pay bills and fund retirement.

And the share price has continued to tumble during the year, coming into it at over $26 a share and now trading for $11 the last time I checked… a 73% drop in price.

Do the mental math… 48% dividend cut and a 73% share price drop, an absolute catastrophe for investors.

Investors, many of them depending on that income for retirement money, watched helplessly as their income was cut by 48% and the principal by 73%.

They were counting on that money.

Imagine for a second how devastated they were. Could your portfolio stand that big of a hit? Could your lifestyle handle an 73% cut?

That’s why it’s important to me that we select the right dividend stocks for the monthly dividend paycheck calendar. And for me the right dividend stocks are those with a history and commitment to increasing their dividend payments.

It’s not enough that a company is paying dividends. Why? Because a company without a history of increasing dividends is 9 times more likely to cut their dividends than a company that has a solid track record of raising dividends.

And you saw from just the few examples above the devastation that just one dividend cut can cause for your portfolio. Imagine a string of them in your portfolio.

Now, I spend the better part of 60 hours a week sorting through the data, the SEC filings, the analyst reports, the company releases and annual reports, listening in on company conferences calls and dialing up management on the phone when I need to… all in an effort to find that core group of consistent dividend raising companies.

Even then most won’t make the cut. But the few that do make it get consideration for the monthly dividend paycheck calendar.

And then I look for a good spread of payment dates so all the paychecks aren’t lumped into a handful of months while the rest of the year has no cash coming in.

I don’t know about you but there’s something reassuring knowing that I’ll collect checks this month and next month and again the following month and so on.

I mean think about it: your bills come every month, right? The mortgage. The electricity bill. The gas bill. The cable bill. The phone bill. So why shouldn’t your dividend income be monthly, too?

Look, everyone’s household budget operates monthly. You get each bill throughout the month and like most of us, pick one day a month to pay all the bills, whether online or via check.

And that’s how your dividend income should be, steady throughout the month.

For example, if you start by February 3rd you’ll be in a position to collect your first check on February 5th and 10 more checks all totaling $4,395 by February 27th and you can continue collecting multiple paychecks every month indefinitely.

Collect an average of $3,184 in extra income every month

Now is a great month to get started with the Monthly Dividend Paycheck Calendar.

If you join by February 3rd you could collect your first payment in under a week. Then you’ll be on course for an average of $3,184 a month… but in some months the payouts can be much, much more.

The true value to starting with the calendar right now is earning $3,184 on average each month in 2025, 2026, and into 2027 and so on… then watching that number increase year after year. That is, of course, only if you start today with the Monthly Dividend Paycheck Calendar.

Add that up for 12 months and you are looking at over $38,218 in extra income for the year… money you didn’t have before… money you didn’t have to lift a finger for other than picking up a few shares.

Imagine that for a second, that’s enough to pay for a new car… in cash, or plan multiple vacations, finally pay off some bills, and more… and still know there are more checks to come.

All of this extra income can be yours only if you start using the Monthly Dividend Paycheck Calendar by February 3rd.

Like I said, as long as you own these stocks you’ll have a steady and reliable income stream. The way I’ve constructed the payout dates you’ll receive at least 11 checks each month. And in some months, when you follow along with the Monthly Dividend Paycheck Calendar you’ll get 29 payments or more!

Now is a great time to get started as you could be set to collect an extra $4,395 by February 27th just for following the Monthly Dividend Paycheck Calendar strategy. And, the best part is that this income does not stop after that.

Imagine that just when you’re starting to see holiday bills show up on your credit card… you’ve collected $4,395 in extra income… to put toward holiday bills, an extra vacation, or any expense you might have been putting off.

Think about it: that’s a quick $4,395 in extra cash that you didn’t have before deposited into your account in a matter of weeks.

Each and every month, if you join the Monthly Dividend Paycheck Calendar today, you will have the opportunity to collect a growing stream of dividend paychecks just like the ones I detailed above. This level of financial freedom is an opportunity that you should not pass up.

Well, we just talked about how much you can expect over the next several weeks when you get started today and start collecting checks as early as next week. You may bring in more or less depending on how much you choose to start with. It’s entirely up to you.

My calendar tells you what to buy and when, and when to expect your paycheck.

How much those paychecks are is entirely up to you.

That flexibility and the ability to tailor the calendar to your own particular needs is one of the advantages my Monthly Dividend Paycheck Calendar gives you.

You saw from the example above, just 500 shares in each of those stocks — nets you an extra $4,395 over the next few weeks that you didn’t have before. It’s kind of like finding free money. Of course you can start with as many or as few shares as you, even if just testing out the Monthly Dividend Paycheck Calendar

Then the cycle starts all over again so you’re getting paychecks every month with this system.

Remember, you’ll be set up to easily make an average of $3,184 for each month of 2026, 2027, and into 2028 and beyond. You can use this money to pay your bills, build up your retirement savings, or begin to live a life stress-free from worries about your income.

That’s how powerful this simple yet highly effective monthly dividend paycheck calendar can be. That’s how wealth creation begins. And it’s so easy for you to get started. Regular investors are using these stocks all the time to create their own income streams specific to their own needs.

Leave a Reply