Retirees: 2 Covered Call ETFs For Income And Peace Of Mind

Summary

- Covered call ETFs like GPIQ and GPIX offer retirees attractive income streams, especially when held in tax-advantaged accounts such as Roth IRAs.

- GPIQ provides Nasdaq-100 exposure with active management, a lower expense ratio (0.29%), and strong performance versus peers, making it ideal for income-focused investors.

- GPIX offers broader S&P 500 diversification, a similar cost structure, and outperforms many competitors, balancing sector concentration and yield for steady monthly payouts.

- Both funds prioritize ordinary income and capital gains distributions, with active management helping mitigate risks and NAV erosion, making them suitable for retirees seeking reliable income.

Introduction

As a military retiree, I’ve developed a soft spot for retirees of the traditional retirement age. Although I have a long way to go before reaching the age to be able to withdraw my dividends tax-free, this is an advantage traditional retirees have over us younger investors.

Moreover, with the plethora of covered call funds in recent years, this makes it easier for those of age to withdraw tax-free if you own a tax-advantaged account like a Roth IRA. If this is you, then you may want to consider this covered call duo for reasons I’ll discuss later.

Collecting A Nice Stream Of Income Has Never Been Easier

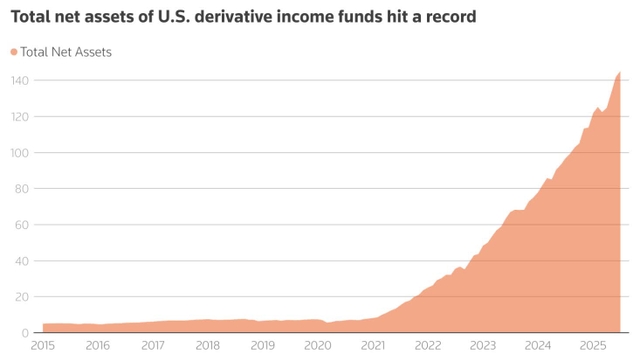

Below you can see the chart of the growing popularity of derivative income among investors. Until around 2021/2022, inflows remained flat but rose rapidly over the past 4 years or so, likely due to high inflation.

With inflation increasing since the pandemic and forcing the Fed to raise interest rates as a result, consumers have definitely felt the impact, increasing the need for more income.

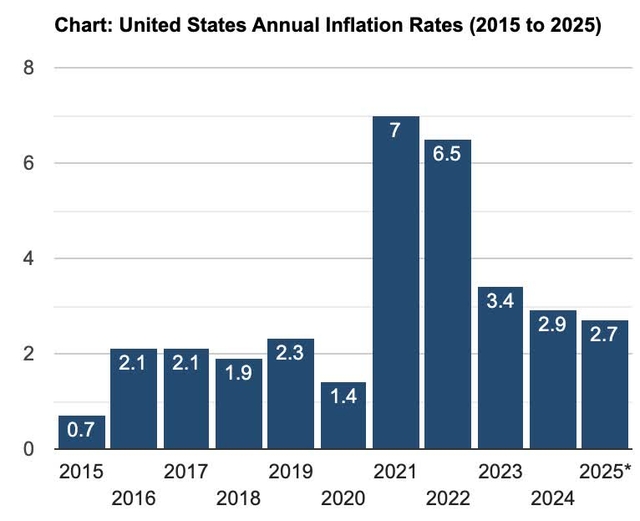

Below you can see inflation spiked in 2021, causing rates to rise. Since then, inflation has slowly come back down, currently sitting at 2.7%, closer to the Federal Reserve’s target of 2%.

With unemployment rising and risks growing of a recession, rate cuts appear imminent, although uncertainty remains due to tariffs. I do think we’ll see at least one rate cut this year, something I’ve echoed over the past year.

And while consumers are likely to feel relief from lower rates, the need for additional income won’t likely decrease as a result.

Moreover, if you’re a retiree currently living off income, then covered call ETFs may be worth considering. And for reasons I’ll lay out below, this duo may be suitable for your tax-advantaged accounts.

#1 Goldman Sachs Nasdaq-100 Premium Income ETF (GPIQ)

First on the list is the covered call ETF by asset manager Goldman Sachs (GS). For starters, I’ll say I haven’t been much of a fan of their BDC, Goldman Sachs BDC (GSBD), but their covered call ETFs seem solid so far.

For one, they’re actively managed instead of passively. And their main goal is to provide income with the potential to see capital appreciation, perfect if you’re a retiree. If you’re of age, it’s likely you focus more on income vs. capital appreciation, which is why covered call funds may be a good fit for your portfolio.

GPIQ looks to track the performance of the Nasdaq-100, so it’s obvious the fund is highly concentrated in the Technology (XLK) sector. They currently have 107 holdings and use an overwrite strategy to write calls on a varying percentage of the portfolio, usually between 25% and 75%.

Additionally, they use Flex Options, which allows management to change the options strike prices and dates, mitigating downside risks somewhat. This also allows them to participate in potential upside, not capping it like a lot of covered call ETFs do.

Something else I also like about GPIQ is that their expense ratio is more reasonable when compared to other premium income ETFs at just 0.29%. This means for every $10,000 invested, you’re paying an annual fee of roughly $30.

Some peers have expense ratios closer to 1%, or even above. For comparison, the NEOS NASDAQ-100(R) High Income ETF (QQQI) has an expense ratio of 0.68%, more than twice that of GPIQ.

JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) and Roundhill Innovation-100 ODTE Covered Call Strategy ETF (QDTE) were higher at 0.35% and 0.97%, respectively.

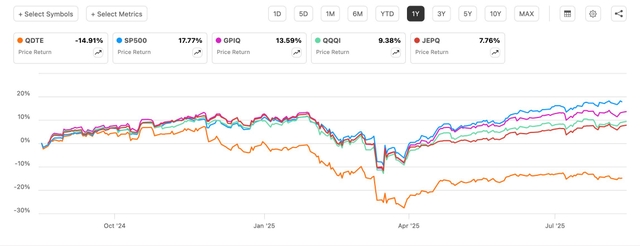

Below is how each fund performed over the past year in comparison to the S&P (SP500). GPIQ outperformed, up 13.59% in price returns.

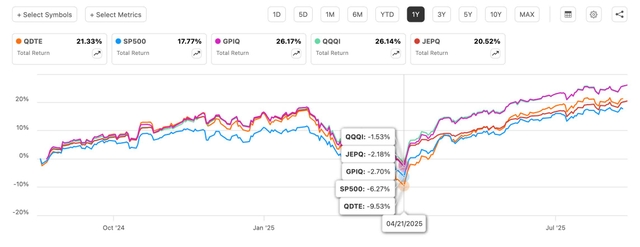

When adding in distributions, GPIQ also outperformed, although only slightly when compared to QQQI. While GPIQ managed to beat QQQI, the latter saw less of a dip during April’s Liberation Day, down 1.53% compared to 2.70% for GPIQ.

With a distribution yield of nearly 10%, GPIQ does have the lowest amongst the peer group. But their lower cost structure and better performance may be an attractive trade-off.

#2 Goldman Sachs S&P 500 Premium Income ETF (GPIX)

The other half of the duo is another fund by the asset manager, GPIX. Although both funds have a lot of the same holdings, like NVIDIA (NVDA), Microsoft (MSFT), Apple (AAPL), and Amazon (AMZN), GPIX has Berkshire Hathaway (BRK.A) (BRK.B) in its top 10 holdings.

And since they track the S&P, they have a significantly larger portfolio with 508 holdings currently. Both GPIQ and GPIX share the same active strategy, expense ratio, and inception date of October 24, 2023.

The difference is GPIX doesn’t have as high a concentration in the technology sector, with this making up 33.29% of its portfolio compared to 53% for GPIQ. The Financial (XLF) sector is GPIX’s second largest sector, while Communication Services (XLC) is GPIQ’s second largest.

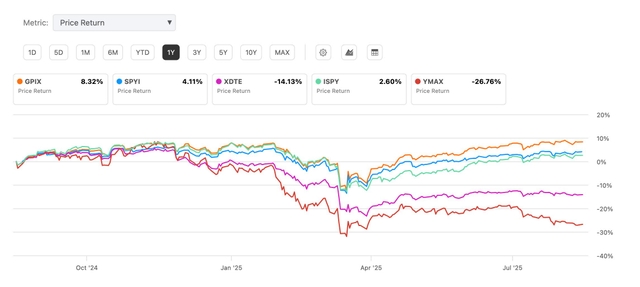

GPIX has outperformed its peer group, even the popular NEOS S&P 500(R) High Income ETF (SPYI), up 8.32% in the past year compared to the latter’s 4.11%.

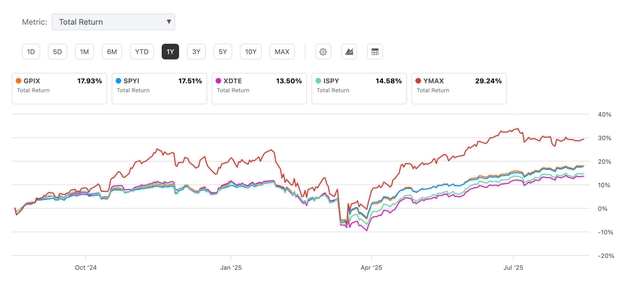

In total returns, GPIX managed to again edge out SPYI, but the YieldMax Universe Fund of Option Income ETFs (YMAX) bested the entire peer group in total returns. But this is due to their ridiculously high yields. YMAX’s current distribution yield sits above 67%, compared to 8.16% for GPIX and 11.83% for SPYI.

Why This Pair Is Attractive For Retirees

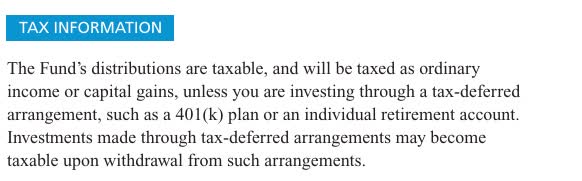

While many covered call ETFs’ distributions are considered return of capital, both GPIQ’s and GPIX’s distributions are mostly ordinary income or capital gains. Meaning, they’re better held inside a tax-sheltered account like a Roth IRA. Return of capital distributions are tax-deferred until sale, making them more appealing to younger investors with taxable accounts.

Hypothetical $100,000 Investment

Below is what you’d collect monthly if you invested $100,000 split between both funds using their average distributions through the first 9 months. Investors should also be aware that distributions can vary.

But both funds’ distributions have stayed relatively similar to previous months. At the current price of around $51/$52 a share for both at the time of writing, you’d collect $744 on a monthly basis. While this may not be enough to cover something like a mortgage, this could be used for medical expenses, car payments, or unexpected bills.

| Fund | Share Price | Share Count | Avg distribution | Monthly Payout |

| GPIQ | $51.49 | 971 | $0.4210 | $409 |

| GPIX | $51.57 | 969 | $0.3456 | $335 |

Furthermore, there are covered call funds, like many of YieldMax’s, with much higher yields, but the risk with these is continued NAV erosion, which leads to price decay over time.

So far, both GPIQ and GPIX have performed well as a result of NAV growth. And because they are both actively managed, management will rebalance its portfolio to mitigate underperformance.

Risks & Takeaway

Technology stocks have continued to perform well and carry the market overall. But both funds are subject to downside if the tech sector enters into a correction. Because the sector has performed well recently, it could underperform going forward if the market experiences a crash or correction.

For investors looking to buy, it may be prudent to wait for a potential pullback like the one we saw in April. If you just want steady income and don’t care much about price, then GPIQ and GPIX may be suitable investments due to their cost advantages and outperformance vs. peers.

Leave a Reply