My Top Pick For October Yields 14%: AGNC Investment

Oct. 04, 2025 AGNC Investment Corp. (AGNC) StockAGNC

Rida Morwa

Summary

- Whispers of rate cuts pushed AGNC to market-beating returns; the cuts have arrived and will benefit earnings.

- The benefit is cumulative over time, not instantaneous for AGNC.

- Collect monthly income and enjoy as your capital climbs in value.

- Looking for a portfolio of ideas like this one ?

Co-authored by Treading Softly

There’s a well-known Wall Street adage that says, “Buy the rumour, sell the news.”

Many investors were expecting interest rate-sensitive investments to immediately spike once interest rates were cut, if they were cut, and as such, a lot of interest rate-sensitive investments were climbing on the expectation of rate cuts to occur.

The Federal Reserve cut its target rate by 25 bps, with one dissenter who wanted to cut rates by 50 bps. Another rate cut is widely expected in October. While there is plenty of time for economic reports to change expectations, it is clear that the Federal Reserve is increasingly concerned about the labor market and believes that the risks of unemployment rising are higher than the risk of inflation.

Interestingly, after the rate cut decision, both the general market (SPX) as well as REITs (VNQ), which generally benefit from interest rate cuts, sold off. This isn’t expected to be a long-term trend, but for the market itself, it meant that there was more information given in the update from the rate cut that concerned investors than the excitement over the rate cut itself. It also followed the very well-known adage: once the rate cut was news, people were selling, trying to lock in any gains they benefited from by buying the rumor ahead of time.

Today, I want to look at an investment that we have covered previously that benefits tremendously from rate cuts. These kinds of benefits, though, don’t happen overnight. They happen over time, and we can expect those benefits to accumulate even more so as additional rate cuts occur, if they do.

Let’s dive in!

I’m Still Buying Rate-Sensitive Opportunities

Interest-rate-sensitive stocks benefit from a dovish Fed, and there are few stocks that are more interest-rate-sensitive than agency mREITs like AGNC Investment Corp. (NASDAQ:AGNC), yielding 14.4%.

AGNC primarily invests in “agency MBS”, which are mortgage-backed securities that are guaranteed by the agencies Fannie Mae or Freddie Mac. If a borrower defaults, the agency buys the mortgage back at par value. Agency MBS typically trade with a very high correlation and at a relatively tight spread over US Treasuries, because they are considered very low risk from a credit perspective.

However, since mortgages can be prepaid whenever a borrower wants, and often are prepaid through refinancing, selling the house, or making extra payments, agency MBS does diverge from US Treasuries. If you buy a 30-year Treasury Bond, you know you won’t be paid back until maturity in 30 years. If you buy a 30-year agency MBS, you can expect to get most of your money back in 5-7 years. The life expectancy of agency MBS can be projected, but it cannot be known because it is very dependent upon interest rate movements.

AGNC takes advantage of the difference by borrowing short-term using a form of lending known as repos. Repos are very low risk for the lenders because they have the right to the underlying collateral, in this case, agency MBS. Also, the contracts are typically less than 90 days, creating a very low duration risk for the lender. As a result, the lending rate on repos is typically very close to the Federal Reserve’s target rate.

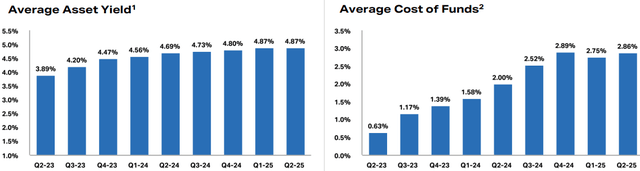

The risk is that AGNC’s assets are MBS that can be expected to remain outstanding for several years. The risk to AGNC is that its cost of borrowing can exceed the yield it receives. AGNC’s cash flow will be directly impacted by its average asset yield minus its cost of funds: Source

The Federal Reserve’s target rate was above AGNC’s average asset yield for a couple of years. Today, it is 4-4.25%, providing a comfortable cushion.

Yet if we look at AGNC’s cost of funds, we can see that it is 2.86%, which is much lower than the Fed rate. This is caused by AGNC’s hedging portfolio, specifically its interest-rate swaps. Contracts where AGNC agrees to pay a fixed interest rate and receives a floating interest rate. AGNC aggressively bought up swaps when interest rates were super low. Those swaps have been maturing, and we can see AGNC’s cost of funds drift upward.

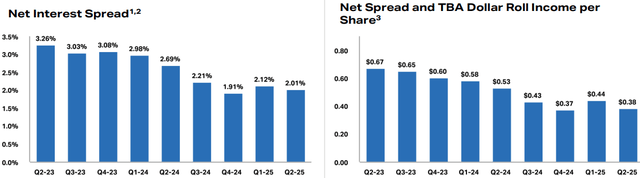

This directly caused AGNC’s spread income per share to decrease over the past two years. In this chart, we can see AGNC’s net interest spread (Average asset yield – cost of funds) and how it translated into AGNC’s per/share earnings: Source

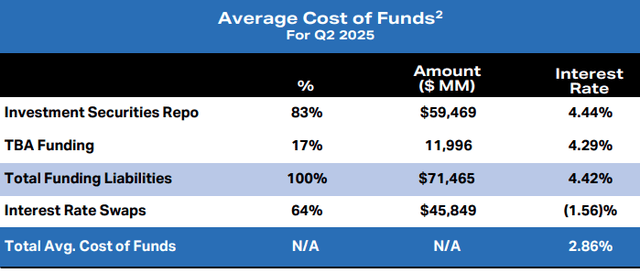

What does the recent Fed cut mean? Let’s look at how “cost of funds” is calculated: Source

We can see that AGNC’s repo costs were 4.44%. That number can be expected to come down very close to exactly as much as the Fed’s target rate. So a 25 bps cut will result in that number coming down about 25 bps.

TBA (To Be Announced) are futures, where AGNC simultaneously buys and sells future contracts maturing in different months, with the “interest rate” being the implied financing costs of the transaction. That rate is impacted by numerous factors, including the expectation of future rate cuts.

Then, the benefit of interest rate swaps is subtracted to arrive at the average cost of funds. Note that AGNC had $45.8 billion in swaps hedging $59.4 billion in borrowings.

The Fed’s 25 bps rate cut will immediately benefit the $13.6 billion in unhedged repo borrowings. 0.25% of $13.6 billion is $34 million in lower interest.

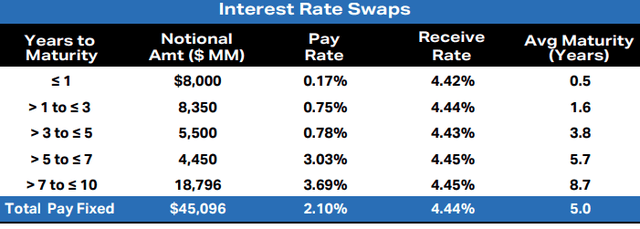

With the swapped portion, it is more complicated. AGNC has $8 billion in swaps where they are currently paying 0.17%, and those swaps are going to mature over Q3 and Q4: Source

If they don’t replace those swaps, they will be paying about 4.19% on the underlying repo after the Fed’s rate cut. That is better than 4.44%, but still a lot higher than the 0.17% they were paying. 4% interest on $8 billion is $320 million/year.

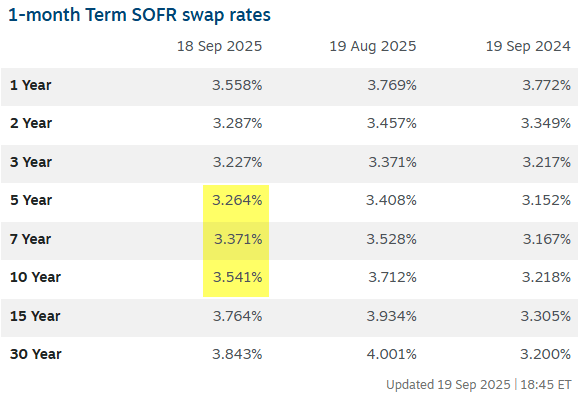

However, swap rates are also impacted by the expectation of Fed rate cuts. In the 5-10 year range, which is the sweet spot for agency mREITs, rates are currently 3.264%-3.541%. Source

Note, they were actually lower in 2024 when the market expected the Fed to be more aggressive with its rate-cutting cycle. AGNC will have the option of replacing its existing swap with a new one. If AGNC replaces the swaps, then they get a lower rate immediately than they are currently paying on their repo contracts. However, if the Fed does cut rates below 3.25-3.5%, then in the future they might be “overpaying”.

On the other hand, AGNC can just allow the swaps to expire and allow their interest expense to be unhedged. This would result in an increase to 4.19% today, but if the Fed cuts in October, it will be 25 bps lower. And their expense would be reduced directly with each cut.

This is a decision that AGNC will need to make as its swaps expire. It is important to note that through the end of 2025, the swaps expiring are going to have a larger financial impact than repo rates coming down. As calculated above, repo rates coming down will be a benefit of roughly $34 million per 25 bps in rate cuts. If we assume three rate cuts by year’s end, which is the consensus expectation, that would be roughly $100 million in savings.

On the other hand, the $8 billion in swaps that are paying only 0.17% now will be rolling off. If we assume 75 bps in repo cost reduction, they would still be paying 3.69% vs the current 0.17%, an increase of 352 bps. 3.52% of $8 billion is $281.6 million, or a $0.07/quarter headwind to earnings if AGNC goes completely unhedged. If AGNC chooses to enter into new swaps for some or all of the debt rolling off, the impact could be smaller.

So is the Fed rate cut good for AGNC’s cash flow? Yes. It does ultimately lead to AGNC paying less interest expense. However, we need to be aware that we aren’t going to see a huge spike in earnings from AGNC yet because they have these swaps maturing that have inflated earnings the past few years. That’s an approximately $0.07/quarter headwind, where each 25 bps fed rate cut is a $0.007/quarter tailwind.

AGNC has other tailwinds. For example, it can raise common equity at a premium to book value and issue preferred equity, and buy more new MBS. On a hedged basis, AGNC can easily deploy newly raised capital and generate a return on equity that is higher than its current dividend. At a high level, this works by increasing AGNC’s average asset yield, and higher revenues will also help offset the increase in interest expense as the swaps mature.

The bottom line is that declining rates are beneficial to AGNC, but we expect earnings in the near term will be relatively flat. We anticipate the tailwinds being generated by a lower Fed rate will primarily offset the maturity of the extremely favorable interest rate swaps, resulting in relatively flat earnings through the end of 2025. However, as we go into 2026 the pace of interest rate swap maturities is much slower, the swaps are already at a higher rate, and the Fed will have time to cut rates even more. As a result, the interest rate swaps that have restrained earnings growth in 2025 will be a much less relevant factor in 2026.

AGNC peers have been raising dividends, while AGNC has kept its dividends the same. This is largely because AGNC was already paying out a higher dividend relative to book value. The very attractive swaps it snagged in 2021 are a big reason why some peers had to cut dividends in 2022/2023, and AGNC didn’t. The swaps managed to last long enough to make it to an environment where AGNC can support its dividend without them.

To the extent that AGNC can continue issuing equity over book value and grow in 2026, dividend raises could be on the table within the next few years.

Conclusion

For AGNC, the benefit of declining rates or interest rate cuts is not an instantaneous proposition. Likewise, if you were to take a 3-mile run today, you would not instantly wake up with a perfectly sculpted body tomorrow. No, the benefit is cumulative over time. The more you run, the more the benefit. The longer you run, the greater the benefit. Likewise, for AGNC, as rates remain lower than before and continue to decline, the benefits will accumulate over time.

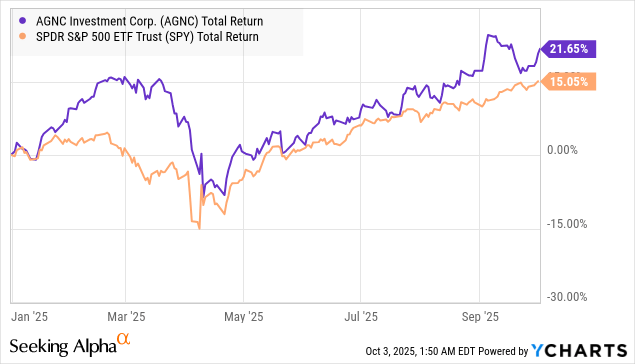

For traders who buy the rumor and sell the news, AGNC is going to move quickly into the category of no longer meeting any of their interests. This year, AGNC has strongly outperformed the market on the expectation of interest rate cuts, not that they’re here, we’re seeing traders exit their positions, bringing current returns closer to that of the overall market – traders locking in short-term gains:

For income investors who position their portfolio to benefit regardless of what interest rates are doing, AGNC continues to be a highly attractive opportunity to collect double-digit yields paid out monthly from ultra-safe investments in agency MBS. AGNC itself does add risk by adding in leverage to the scenario and so it does not carry the same ultra-low risk rating that Agency MBS would on its own. However, it is well-positioned to continue to benefit from additional interest rate cuts, as well as benefit from the newer, lower rate that we’ve just seen.

When it comes to retirement, collecting wonderful income that pours in from the market to your coffers is a great idea. Rarely does anything in life come for free, and with every time you put money to work, there’s going to be some risk that is tied to it. Even leaving money in a bank account has risk. Risk that the bank may collapse, risk that the government won’t honor its FDIC insurance, and the loss of value over time due to the eroding effects of inflation. Hiding your money under a mattress also comes with a risk of theft. If that cash is stolen, you can kiss it goodbye, and inflation still negatively impacts it there. By putting your money to work in the market, you can help balance that risk with reward by having your money earn more and be able to achieve the retirement that you’re dreaming of. Don’t let your finances be what stops you from having the retirement that you’ve always dreamed of. That’s where the unique Income Method within High Dividend Opportunities can massively benefit you by helping you unlock the potential of your nest egg.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Hey There. I discovered your weblog using msn. That is a

really smartly written article. I’ll be sure to bookmark

it and come back to learn extra of your helpful info.

Thank you for the post. I’ll definitely comeback. https://Auplayamo.wordpress.com/

Hey very nice web site!! Man .. Beautiful .. Amazing .. I will

bookmark your blog and take the feeds additionally? I’m satisfied to search out a lot

of helpful info here within the post, we want develop extra

strategies on this regard, thank you for sharing.

. . . . . https://20betcasinouk.Wordpress.com/