5 Best Dividend Stocks To Hold In Uncertain Times

Nov. 07, 2025 VIG, VICI, HST, THG, KALU

Steven Cress, Quant Team

SA Quant Strategist

Summary

- As investors look to year-end and into 2026, the appeal of dividends lies not only in income but also in stability through uncertainty.

- When evaluating dividend stocks, I strive to look beyond headline yields and look for quality, as defined by dividend safety and supportive Factor Grades.

- This basket of five stocks has an average dividend yield of 3.96%, well above the 1.15% for the S&P 500 and 1.65% for the Vanguard Dividend Appreciation Index ETF (VIG).

- All five stocks have Strong Buy Quant Ratings, emphasizing diversification, durability, and quality for investors seeking steady income through market cycles.

- I am Steven Cress, Head of Quantitative Strategies at Seeking Alpha. I manage the quant ratings and factor grades on stocks and ETFs in Seeking Alpha Premium. I also lead Alpha Picks, which selects the two most attractive stocks to buy each month, and also determines when to sell them.

Just released is an update about my Top 10 Quant Stocks of 2025 Up 45%. It’s a great opportunity to recap some of my annual top stock picks as we approach the coming new year and Top 10 Stocks for 2026. In the meantime, now is a good time for investors to explore or revisit the best dividend stocks, as economic and market uncertainty is on the rise. The U.S. government shutdown just earned the distinction of being the longest on record, while Wednesday’s ADP report showed modest employment growth.

Meanwhile, the Fed’s interest rate path is increasingly questionable as Fed Funds Futures now give roughly a 63% probability of a 25 bps cut in December, down from 86% a month ago. Fanning the flames of uncertainty, Trump’s tariff powers are also about to be tested in the Supreme Court. In a go-anywhere type of macro backdrop, the right mix of dividend stocks can provide a good balance of low volatility and yield to support a retirement portfolio or a long-term income and growth strategy.

5 Best Dividend Stocks: Diversification, Quality, Yield

SA Quant has explored its universe of top dividend stocks and selected five options for investors based on their exceptional Quant factor and dividend grades. When evaluating dividend stocks, I strive to look beyond headline yields and look for quality, as defined by dividend safety and supportive Factor Grades in key areas like valuation, growth, and profitability.

This basket of five stocks has an average dividend yield of 3.90%, well above the 1.15% for the S&P 500 and 1.64% for the Vanguard Dividend Appreciation Index ETF (VIG).

1. VICI Properties Inc. (VICI)

- Market Capitalization: $32.25B.

- Quant Rating: Strong Buy.

- Quant Sector Ranking (as of 11/06/2025): 12 out of 174.

- Quant Industry Ranking (as of 11/06/2025): 2 out of 11.

- Sector: Real Estate.

- Industry: Other Specialized REITs.

- FWD Yield: 5.97%.

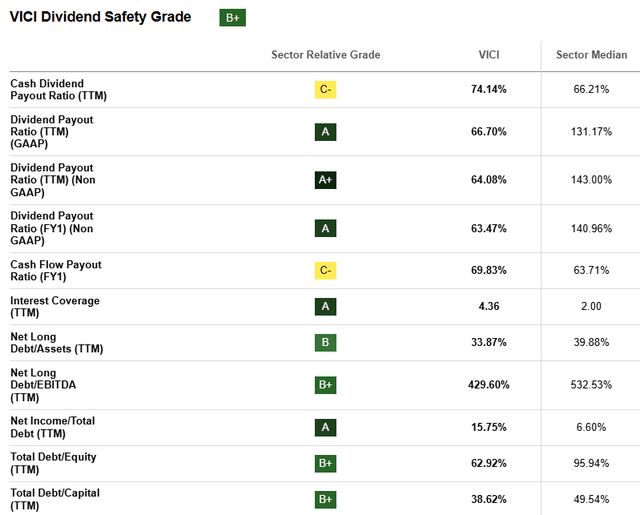

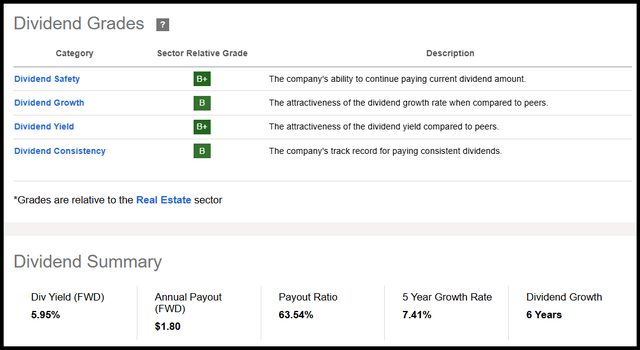

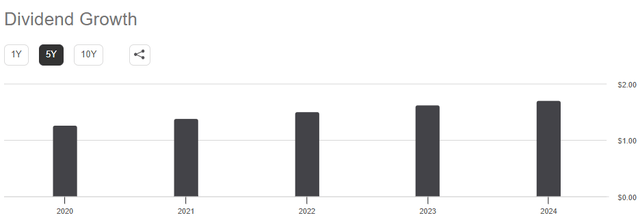

One of my 3 High-Yielding Dividend Stocks For 2025 featured in January, VICI Properties is a real estate investment trust that owns some of the most iconic entertainment and hotel properties in the U.S., including Caesars Palace and MGM Grand. Its portfolio is built on long-term triple-net leases, meaning tenants are responsible for taxes, insurance, and maintenance. This gives VICI predictable, inflation-linked income. VICI’s dividend safety is supported by its outstanding dividend payout ratio of 63.54% and a strong dividend scorecard.

In last week’s Q3 earnings call, CEO Edward Pitoniak opened by emphasizing “Q3 2025 earnings growth rate,” highlighting AFFO per share growth of 5.3% vs. Q3 2024 and underlining the company’s resilience: “The VICI team continues to demonstrate its resourcefulness and resilience in growing relationships that grow our revenues and profits without… significantly growing our capital base.” VICI’s earnings growth supports its multi-year dividend growth history.

VICI also comes at an attractive valuation. The stock trades at a deep discount with a forward P/FFO ratio of 10.90, which is 17.42% below the sector median.

Some investors may be concerned about declines in Las Vegas tourism, but VICI remains resilient as its earnings growth tells a story of strength. With a dividend yield near 6% and recurring cash flows, the company fits neatly into a “steady income through uncertainty” framework. For similar reasons, we include another REIT in our mix of five best dividend stocks for economic uncertainty.

2. Host Hotels & Resorts, Inc. (HST)

- Market Capitalization: $11.29B.

- Quant Rating: Strong Buy.

- Quant Sector Ranking (as of 11/06/2025): 8 out of 174.

- Quant Industry Ranking (as of 11/06/2025): 1 out of 14.

- Sector: Real Estate.

- Industry: Hotels and Resorts.

- FWD Yield: 5.88%.

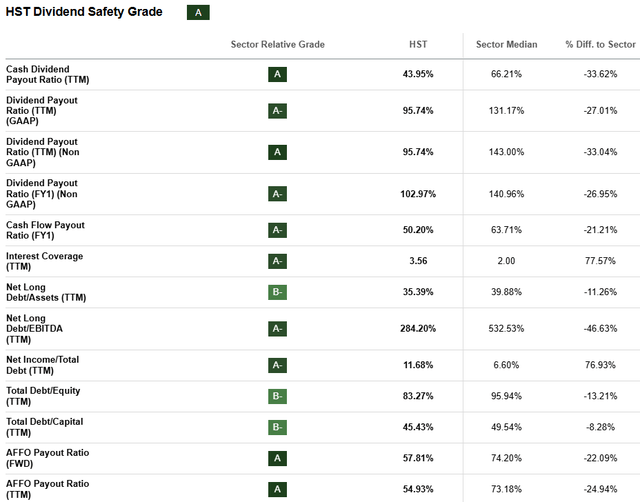

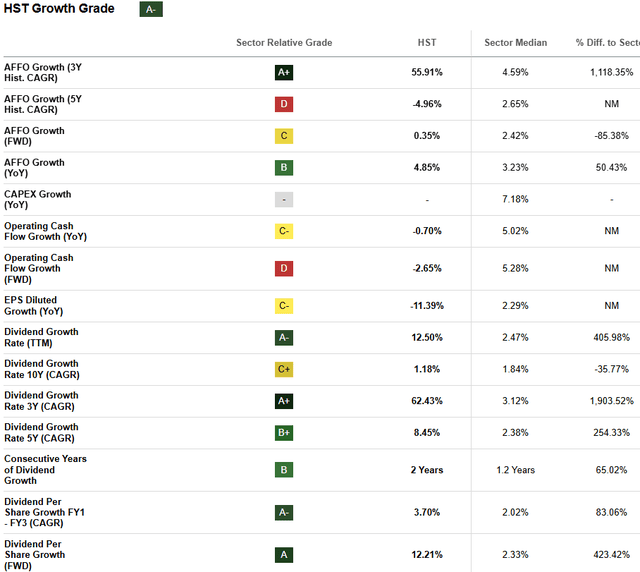

Among the 3 Quality REITs Yielding 5%+ I shared in July, Host Hotels & Resorts is one of the largest lodging REITs in the U.S., owning a premier portfolio of luxury and upper-scale hotels in key markets. While hospitality is more cyclical, HST has strengthened its balance sheet and focused on premium properties that maintain pricing power. At 5.88%, its yield provides strong income potential, and the company benefits if leisure and business travel remain resilient despite moderate economic growth. Although HST has paid a consistent dividend for a mere two years, HST’s ‘A’ dividend safety grade is supported by a lot of green, including its 43.95% cash dividend ratio and forward AFFO payout ratio of 57.81%, which are 33.62% and 22.09% below the sector median, respectively.

If inflation remains sticky, HST’s growth trends can be a counterbalance. The REIT’s AFFO growth is likely to remain attractive, judging by its three-year CAGR of 55.91%, which crushes the sector median of 4.59%. During the recent earnings call, the consensus FFO estimate is $0.33, and the consensus revenue estimate is $1.31B.

HST suits investors seeking higher income with a calculated level of risk in a diversified dividend mix. As I’ve mentioned before about HST, by owning rather than operating the hotels, HST can focus on driving property value growth while reducing its exposure to daily operational risks and complexity. The company can continue its strong results, driven by higher rates and a strong recovery in select markets like Maui.

Moving from REITs to healthcare, biotech stocks with momentum can provide a solid diversification tool in a dividend stock portfolio.

3. Gilead Sciences, Inc. (GILD)

- Market Capitalization: $152.24B.

- Quant Rating: Strong Buy.

- Quant Sector Ranking (as of 11/06/2025): 30 out of 974.

- Quant Industry Ranking (as of 11/06/2025): 19 out of 472.

- Sector: Healthcare.

- Industry: Biotechnology.

- FWD Yield: 2.57%.

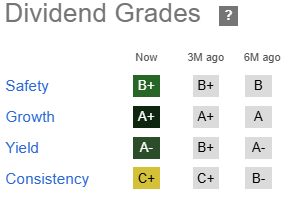

Gilead Sciences is a leading biotechnology firm best known for its antiviral treatments for HIV and hepatitis. Unlike cyclical industries, Gilead’s earnings stem from essential, recurring demand, providing a layer of defense against economic slowdowns or trade-related disruptions. Its solid dividend yield of 2.57% is supported well by free cash flow, and the company maintains one of the more conservative payout ratios among large-cap biopharma names. GILD has continued its strong momentum, returning more than 25% from approximately $97 to $122 per share, since I selected it for Stay In May: Top 5 Dividend Stocks. The company’s yield is supported by strong profitability and dividend safety.

GILD’s A+ profitability grade comes as no surprise as the company’s EBITDA margin of 48% is roughly five times higher than the sector median of 9.44%. With close to $9.7B in cash from operations, GILD offers investors a strong indication that the company’s in a strong position to maintain paying and possibly grow its dividend. In the earnings call last week, Gilead raised its 2025 revenue growth outlook 5%. CEO Daniel O’Day stated that “our third quarter earnings underscore the growing momentum you’re seeing from Gilead today, which is driven by our strong portfolio and the impressive execution of our teams.” He highlighted commercial outperformance across HIV therapies and Livdelzi, with Biktarvy growing 6% year-over-year, Descovy up 20%, and Livdelzi posting 35% sequential growth.

With a steady pipeline and prudent capital allocation, Gilead fits a “slow-growth, sticky inflation” environment by offering income stability that’s less sensitive to interest rate uncertainty.

GILD complements cyclical sectors by adding healthcare’s defensive balance. Meanwhile, a high-quality insurer that performs well across economic cycles can add an element of stability and dividend safety in an uncertain environment.

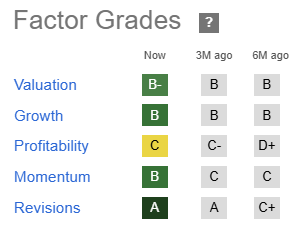

4. The Hanover Insurance Group (THG)

- Market Capitalization: $6.26B.

- Quant Rating: Strong Buy.

- Quant Sector Ranking (as of 11/05/2025): 10 out of 684.

- Quant Industry Ranking (as of 11/05/2025): 3 out of 53.

- Sector: Financials.

- Industry: Property & Casualty Insurance.

- FWD Yield: 2.05%.

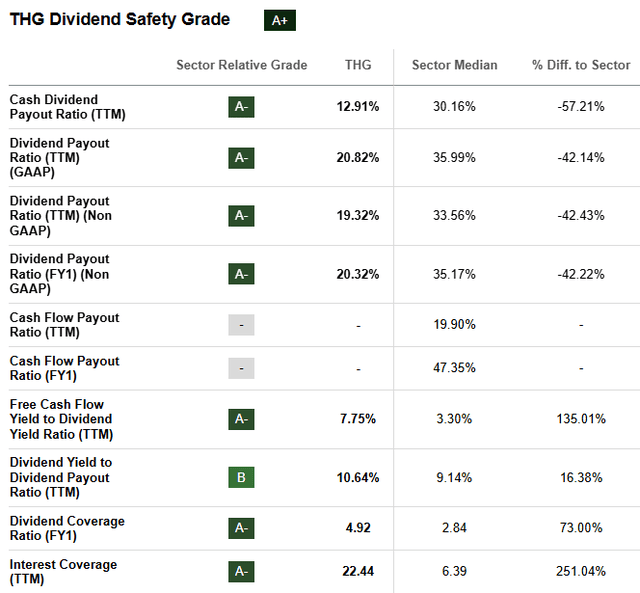

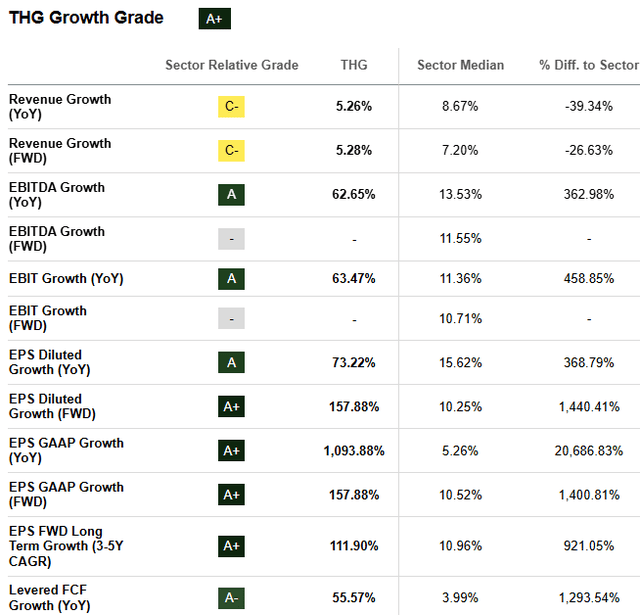

The Hanover Insurance Group is a property insurer providing coverage for business, homes, and specialty lines across the U.S. Its disciplined underwriting and diversified portfolio make it a high-quality insurer that performs well across economic cycles. In an environment of moderate growth and persistent inflation, insurers like THG can have pricing power to maintain margins, offering a built-in inflation buffer. While its yield of 2.05% is lower than some high-yielding REITs in the mix, the payout is well supported by strong EBITDA growth.

At its earnings call last week, Hanover signaled growth acceleration into 2026 with a record Q3 ROE and AI-driven specialty expansion. CEO John “Jack” C. Roche described the third quarter as delivering “exceptional results” due to “robust net investment income, a very strong ex-CAT performance and a quiet catastrophe quarter.” He pointed out Personal Lines’ improved profitability and Core Commercial’s flexibility to adapt amid shifting market dynamics. In Specialty, Roche described new AI-powered underwriting tools in E&S as streamlining submission processing, improving efficiency, and creating scalability: “This scalable approach we’re taking ensures that innovation developed in one segment can be adapted and deployed across our enterprise.”

The company’s focus on commercial and specialty segments adds another layer of defense against an uncertain economic environment with stable pricing power. THG’s long record of dividend growth reflects a management philosophy emphasizing shareholder return and prudent risk management rather than aggressive expansion.

For investors prioritizing quality, reliability, and modest growth over higher yields, THG provides an appealing anchor amid an uncertain economic climate.

5. Kaiser Aluminum Corporation (KALU)

- Market Capitalization: $1.49B.

- Quant Rating: Strong Buy.

- Quant Sector Ranking (as of 11/06/2025): 30 out of 277.

- Quant Industry Ranking (as of 11/06/2025): 4 out of 5.

- Sector: Materials.

- Industry: Aluminum.

- FWD Yield: 3.33%.

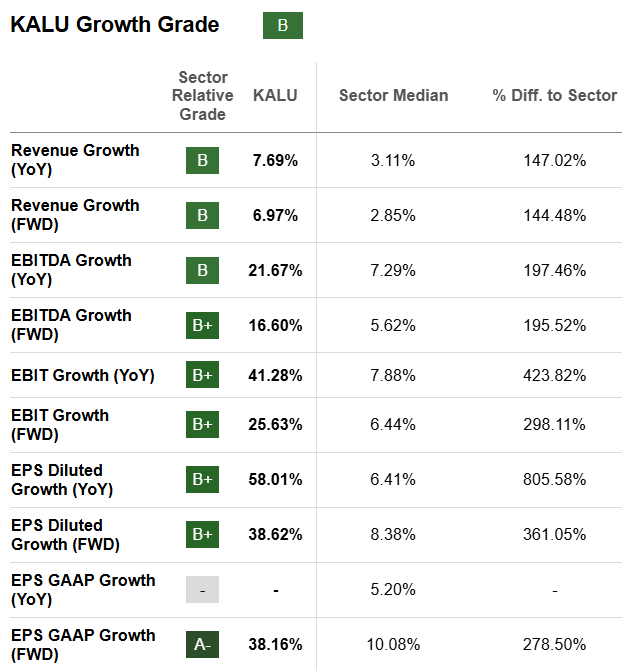

Kaiser Aluminum is a leading producer of specialty-fabricated aluminum products serving aerospace, automotive, packaging, and industrial markets. The company operates across the value chain, from rolling mills to finished components, giving it flexibility and pricing leverage. With a dividend yield of 3.33%, KALU offers a solid income stream supported by steady cash flow and prudent balance sheet management. Also supported by solid growth, Kaiser’s consistent dividend payments and disciplined capital spending make it one of the more stable industrial names in the cyclical materials sector

Adding to its growth story at its Q3 earnings call, Kaiser’s CEO Keith Harvey noted “another strong quarter, marking our fourth consecutive period of performance ahead of our expectations.” He highlighted $20 million in start-up costs tied to strategic investments for aerospace and packaging, while a favorable metal pricing environment continued to support results. The CEO then added, “As a result, we’re once again raising our full-year EBITDA outlook.”

In an environment of sticky inflation and tariff uncertainty, aluminum producers stand to benefit from domestic reshoring trends and supply chain diversification, both of which support demand for U.S.-made materials. For investors seeking a blend of moderate yield and real asset exposure, KALU adds an industrial dimension to the other pieces of our best dividend stocks mix in real estate, healthcare, and insurance.

Conclusion: 5 Best Dividend Stocks to Diversify Amid Uncertainty

As investors look to the end of the year and into 2026, the appeal of dividends lies not just in income but also in stability through uncertainty. The five stocks on our list, VICI Properties, Host Hotels & Resorts, Gilead Sciences, The Hanover Group, and Kaiser Aluminum, reflect different paths to achieving that goal. VICI and HST offer high yields and real estate that can maintain strength in sticky inflation, while GILD brings consistency from healthcare’s defensive stability. THG adds the insurance piece, providing dependable cash flow well suited to a slow-to-moderate growth economic environment. Kaiser Aluminum adds industrial strength to the group, offering inflation-sensitive exposure to U.S. manufacturing while maintaining decent yields. Together, these names illustrate how investors can balance yield and quality, providing stability amid the uncertainties of a market that may be headed for slower growth, sticky inflation, and tariff uncertainty. Common threads across all five are diversification and durability, which are qualities investors seek through cycles, not just in booms.

Leave a Reply