One High-Yield Stock (5.77%) And One Dividend Growth Pick (10.35% CAGR) For Our Dividend Portfolio

Nov. 13, 2025 ET MSFT, VICI, BRK.A, BRK.B, ARCC, GOOG, GOOGL, BLK

Frederik Mueller

Summary

- I added Microsoft (MSFT) and VICI Properties (VICI) to the Dividend Income Accelerator Portfolio, boosting sector diversification and dividend growth potential.

- MSFT is overweighted due to its strong competitive edge, robust profitability metrics, and high dividend growth potential, justifying its premium valuation.

- VICI offers an attractive forward dividend yield and consistent dividend growth, making it suitable for both income and dividend growth investors.

- Portfolio adjustments improved risk-reward balance, increased exposure to Information Technology and Real Estate, and maintained a strong blend of yield and growth.

The acquisition of additional shares of Microsoft (NASDAQ:MSFT) and VICI Properties (NYSE:VICI) helps improve our dividend portfolio’s balance of income and dividend growth potential while increasing the proportion of our portfolio that is allocated to the Information Technology and the Real Estate Sector.

While VICI Properties pays investors currently a Dividend Yield [FWD] of 5.77%, Microsoft has strong dividend growth potential, underlined by its 10-Year Dividend Growth Rate [CAGR] of 10.35%.

Through our latest portfolio additions, we have increased the proportion that is allocated to Microsoft from 1.14% to 2.58% and to VICI Properties from 0.83% to 2.38%.

The proportion that is allocated to the Information Technology Sector has been increased from 5.76% to 7.25% and the proportion allocated to the Real Estate Sector has been raised from 8.10% to 9.53%.

After our latest additions, the Weighted Average Dividend Yield [TTM] and 5-Year Weighted Average Dividend Growth Rate [CAGR] stand at 4.14% and 7.46%, respectively.

Why I added additional shares of Microsoft to The Dividend Income Accelerator Portfolio

As I explained in greater detail in my previous article on Seeking Alpha, I suggest overweighting both Alphabet and Microsoft in a diversified dividend portfolio that focuses on dividend growth.

With a proportion of 3.34% on the overall portfolio, Alphabet is already among the three largest positions of The Dividend Income Accelerator Portfolio.

Through the acquisition of additional shares of Microsoft to our dividend portfolio, we have increased the company’s proportion from 1.14% to 2.58%.

Microsoft strongly aligns with the investment approach of our dividend portfolio due to the company’s competitive edge over competitors, its strong dividend growth potential, and its attractive risk-reward profile.

Microsoft in terms of Valuation

Microsoft currently has a P/E [FWD] Ratio of 32.41. This means that Microsoft’s current P/E [FWD] Ratio is 4.41% above the Sector Median and 1.76% above the company’s 5-Year Average, indicating a fair Valuation.

However, from my point of view, Microsoft deserves a Premium Valuation, given the company’s significant competitive advantages, the company’s broad product portfolio, and its high growth rates (EBIT Growth Rate [YoY] of 17.45%).

Microsoft in terms of Profitability

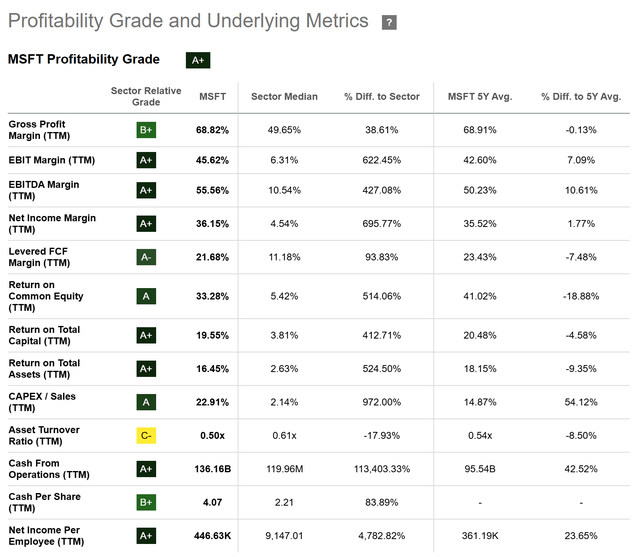

Microsoft’s A+ rating in terms of Profitability Grade is underlined by the company’s Return on Equity [TTM] of 33.28%, which is significantly above the Sector Median of 5.42%, its Return on Total Capital of 19.55%, which is well above the Sector Median of 3.81%, and its Gross Profit Margin [TTM] of 68.82%, which stands significantly above the Sector Median of 49.65%.

Microsoft’s strong dividend growth potential

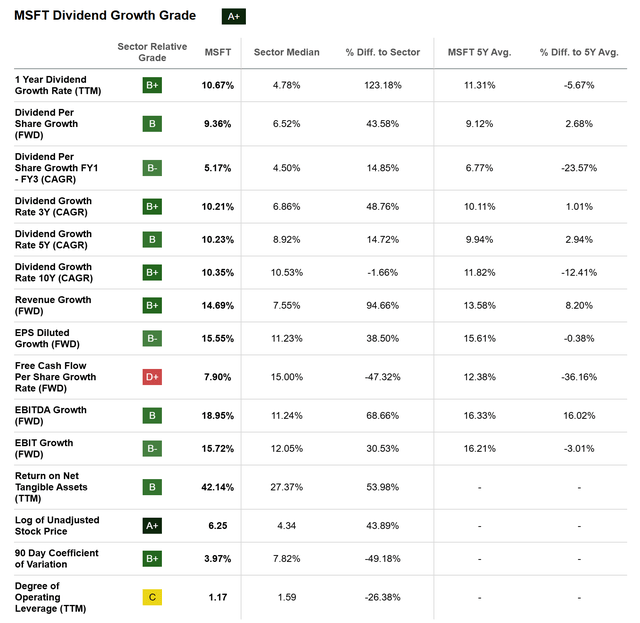

Microsoft currently has a Dividend Payout Ratio [FY1] [Non GAAP] of 22.56%, which serves as an indicator of the company’s strong dividend growth potential. This is also underlined by Microsoft’s 10-Year Dividend Growth Rate [CAGR] of 10.35%.

Additionally, it can be mentioned Microsoft’s EPS Diluted Growth Rate [FWD] of 15.55%, which is another indicator of Microsoft’s potential to raise the dividend in the future.

Furthermore, it can be highlighted Microsoft’s EBIT Growth Rate [FWD] of 15.72%, which further strengthens my belief that Microsoft can strongly contribute to our dividend portfolio’s future dividend growth potential.

Why I added additional shares of VICI Properties to The Dividend Income Accelerator Portfolio

Through the acquisition of additional shares of VICI Properties for The Dividend Income Accelerator Portfolio, we have increased the company’s proportion on the overall portfolio from 0.83% to 2.38%.

With a current Dividend Yield [FWD] of 5.77% and the company’s 5-Year Dividend Growth Rate [CAGR] of 7.41%, VICI Properties not only offers investors attractive dividend income potential, but also significant potential to increase this dividend income year over year.

VICI Properties’ Dividend Income Potential

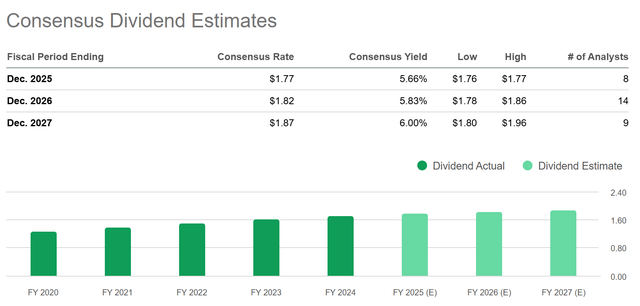

Below you can find Consensus Dividend Estimates for VICI Properties. For 2025, the Consensus Yield stands at 5.66%, for 2026 at 5.83%, and for 2027, at 6.00%, underlining my theory that VICI Properties can be an adequate investment choice for both investors looking for dividend income and for dividend growth.

The largest positions of The Dividend Income Accelerator Portfolio after adding Microsoft and VICI Properties

Berkshire Hathaway

After adding additional shares of Microsoft and VICI Properties to our dividend portfolio, the portfolio proportion that is allocated to Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) has decreased from previously 4.98% to now 4.96%. Despite the fact that Berkshire Hathaway does not pay dividends to its shareholders, the company collects large amounts of dividends and strongly aligns with the investment approach of our investment portfolio due to its focus on companies with significant competitive advantages that are financially healthy.

Alphabet

Alphabet’s (NASDAQ:GOOG) (NASDAQ:GOOGL) proportion of the overall portfolio has increased to 3.34%. This means that Alphabet is presently the second-largest position of our dividend portfolio. Like Microsoft, Alphabet will significantly contribute to our portfolio’s dividend growth potential.

Ares Capital

Through the acquisition of additional shares of Microsoft and VICI Properties, the proportion of our investment portfolio that is allocated to Ares Capital (NASDAQ:ARCC) has decreased from 3.26% to 3.22%. This means that Ares Capital remains the third-largest position of our dividend portfolio.

BlackRock

After adding shares of Microsoft and VICI Properties to our dividend portfolio, the portfolio’s proportion that is allocated to BlackRock (NYSE:BLK) has decreased from 3.09% to 2.89%, implying that BlackRock is presently the fourth largest position of our overall portfolio.

Microsoft

After adding additional shares of Microsoft to our dividend portfolio, we have increased the company’s proportion compared to the overall portfolio from 1.14% to 2.58%. By overweighting Microsoft within our portfolio, we optimize the portfolio’s risk-reward profile and strengthen its dividend growth potential.

Conclusion

By adding additional shares of Microsoft and VICI Properties to our dividend portfolio, we have not only optimized our portfolio’s risk-reward profile, but also kept our portfolio balance of income and dividend growth while, simultaneously, increasing the proportion allocated to the Information Technology and the Real Estate Sector.

The portfolio proportion allocated to the Information Technology Sector has increased from 5.76% to 7.25% and the proportion allocated to the Real Estate Sector has increased from 8.10% to 9.53%. This demonstrates that we have increased our portfolio’s level of sector diversification, thereby reducing our portfolio’s risk level and improving our portfolio’s risk-reward profile.

Our portfolio’s Weighted Average Dividend Yield [TTM] now stands at 4.14% while its 5-Year Weighted Average Dividend Growth Rate [CAGR] is at 7.46%, indicating that our portfolio continues to balance income, dividend growth, and capital appreciation, allowing investors to invest with a reduced risk-level while generating substantial dividend income.

Leave a Reply