These 5 Dividend Stocks Are Poised to Soar

- If you want a chance to score big dividends, and price gains, as interest rates stay “higher for longer”…

- And sail through the (inevitable) recession ahead…

- These 5 stocks—and the dividend strategy I’ll show you below—could be crucial.

Dear Reader,

You’re about to unlock a dead-simple, 3-step strategy that has uncovered, time and time again, dividend stocks whose payouts are set to surge higher.

And when they do, they take their share prices right along for the (very profitable!) ride.

Even better, this proven system works no matter what the economy (or the Fed!) are doing. Because the key indicators it’s based on help sustain a stock’s price in a market storm, too.

One group of investors has been following the recommendations this stealth strategy has uncovered since 2015.

And the gains they’ve posted have been very impressive indeed.

For example, my indicators flashed BUY on a stock that went on to soar double digits during the 2022 dumpster fire … while just about every other S&P 500 stock crashed!

This strategy has built solid long-term wealth again and again. Like when another recommendation delivered a steady 148% return through ALL market weather.

And right now we’re aiming straight at 5 overlooked dividend stocks poised to DOUBLE in 5 years or less, while their dividend payouts TRIPLE.

Read on and I’ll show you exactly how.

Enter the “Dividend Magnet”

My Dividend Magnet strategy consists of 3 “pillars.”

If a stock shows all three of these telltale signs, it’s time to BUY … then ride along as the company’s dividend grows, pulling its share price higher as it does.

And today I’m going to show you, step by step, exactly how the Dividend Magnet delivered that stout 148% return I mentioned a second ago.

Then we’ll discuss those 5 stocks my research indicates are set to soar far ahead of the market in the coming years.

Personally, I think triple-digit gains are squarely on the table with these 5 hidden gems.

But conservative sort that I am, I’m forecasting steady 15%+ annualized returns for the long haul.

That’s enough to double our investment every five years and triple our income stream, too. We’ll happily take that deal! Especially with the low volatility these 5 stocks offer.

Before we go further, though, I should take a moment to tell you a bit more about myself.

But my real passion is dividend investing. You may have seen me on CNBC, Yahoo Finance or NASDAQ, where I’ve been called on to share my methodology for collecting consistent, predictable and reliable retirement income.

My readers and I don’t go anywhere near profitless techs, penny stocks or other gambles you can’t tell your spouse about.

Safety is my No. 1 priority. Always has been. Always will be.

You see, I take a strategically contrarian approach to the markets.

And for the past several years, I’ve helped thousands of readers fund their retirement thanks to what I call “Hidden Yield stocks.”

Take a look at some of the big returns my premium members have booked:

TD Synnex (SNX): Up 83% in 3 Years

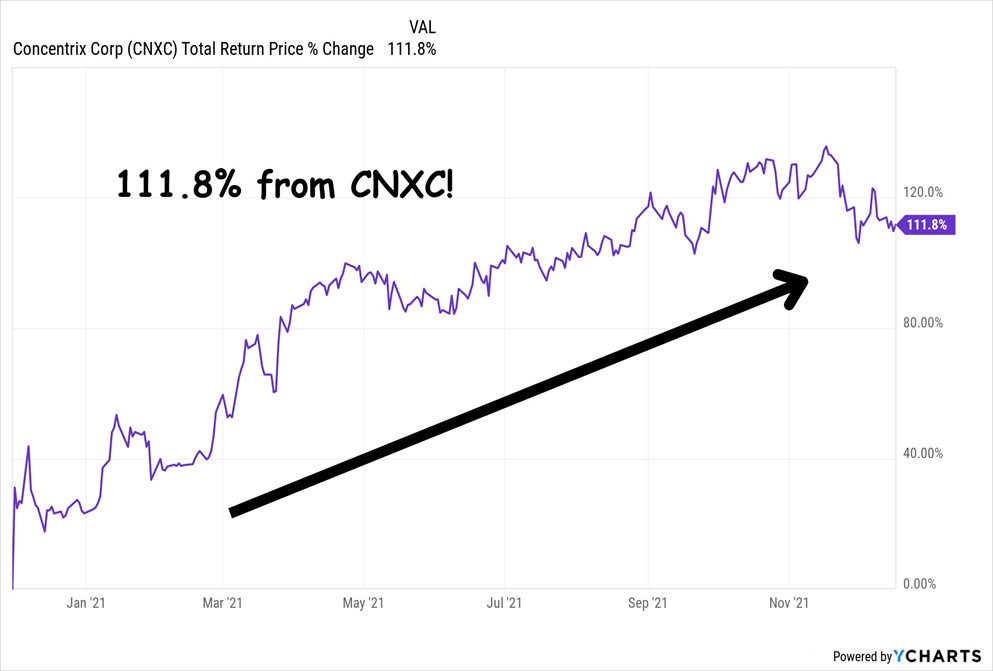

Concentrix (CNXC) Skyrocketed 111.8% in Just 1 Year!

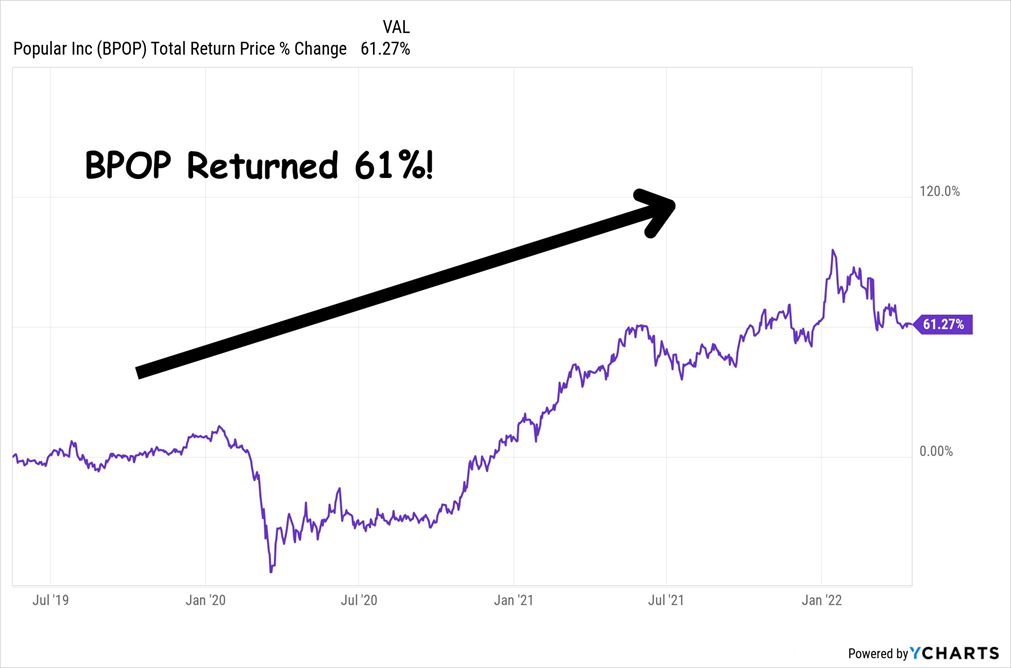

Popular (BPOP) “Popped” 61% in a Little Under 3 Years

Of course we both know investing in the stock market does come with some risk, so while we’d like every stock to go up, some recommendations do decline from time to time.

Now, as we move toward 2026, there are still plenty of oversold dividends on the board for us, despite the strong run the market’s been on. In fact, I expect our next round of picks to do even better than the ones I just showed you.

My Dividend Magnet system continues to be our North Star. I want you to join us.

Whatever your investing goal, this strategy — and the 5 dividend growers I’ll tell you about in a moment — MUST be at the heart of your investment plan.

As you might guess by this point, the humble dividend is the key to our Dividend Magnet approach—but not in the way most folks think.

How Dividends Drove a 63,894% Gain

Dividends really are the “Rodney Dangerfields” of the investing world—they get no respect!

But they should, because growing dividends are the key to thriving through any market.

And if you roll your dividends back into your portfolio, the power of compounding takes over and delivers the sort of growth that tech fanboys (and girls) can only dream of.

Here’s the proof, from our friends at Hartford Funds.

Hartford looked at the years between 1960 and the end of 2024, which included everything: the inflation of the ’70s, economic crashes in 2001 and 2008 and, of course, the pandemic.

Here’s what they found: if you’d put $10,000 in the S&P 500 in 1960, you would have had $982,072 at the end of the period, based solely on price gains.

That’s not bad: a 9,721% increase.

It shows you why most folks only think about share prices when they invest. After all, with a gain like that, it’s tough to get excited about a dividend that dribbles a few cents your way every quarter.

But here’s the thing: when you reinvest your dividends, the magic of compounding kicks in. The difference is shocking: your $10,000 would have grown to $6,399,429, or more than $5.4 million more than you’d have booked on price gains alone!

That’s a 63,894% profit.

It’s a crystal clear example of how critical dividends are. And you can grab stronger profits if you buy stocks whose dividends aren’t just growing but accelerating.

Which is exactly what we’re going to do in the first step of my 3-part Dividend Magnet strategy …

Step 1: Buy an “Accelerating Dividend”

(for Growth, Income and High Yields)

One thing we can say about today’s market is that, as employment growth slows (due in part to AI replacing expensive humans), interest rates are likely to move lower.

That setup reminds me a little bit of 2018, when rates were elevated but Jay Powell was edging toward rate cuts.

Lower rates, of course, are great for utility stocks—”bond proxies” that tend to rise as rates fall. So in November of that year, we picked up cell-tower landlord American Tower (AMT), a REIT whose “tenants” include AT&T (T) and Verizon (VZ).

We liked AMT because it’s a classic “tollbooth” play.

The company charges its clients for using its tower network, then hands that cash to investors as a steadily rising dividend. Buying AMT is a much better move than trying to pick winners among the big telcos.

You can see that in AMT’s performance as rates fell during our holding period: It crushed Verizon, America’s biggest telecom provider. (Verizon’s market leadership was no help to its shareholders in this period—they actually lost money, even with the company’s storied dividend included):

Even better, unlike pretty much any other stock, AMT had been raising its payout every quarter, to the tune of 65% during our holding period!

That rising payout acted like a “Dividend Magnet,” pulling up the share price in lockstep and delivering the 57% total return you see above. AMT also kept the hikes rolling through the pandemic, “magnetizing” the shares as it did!

That’s the “Dividend Magnet” in action—I’ve seen it work its magic on share prices time and time again. Like with our next stock, a chipmaker founded way back in 1930.

TXN’s “Accelerating” Dividend Powered

Us to a 148% Return

Texas Instruments (TXN) isn’t the stodgy calculator peddler it was 30 years ago. Today its analog chips power everything from appliances to industrial sensors.

Management is known for making shareholders’ interests a priority, and it doles out that cash to them on the regular. Those payouts, in turn, have powered the stock’s Dividend Magnet.

TXN’s dividend soared 120% over the 5 years we held it, helping us bag that 148% total return I mentioned earlier.

It was all thanks to the Dividend Magnet, which you can see pulling up TXN’s share price:

TXN’s Dividend Magnet Fires Up

130% dividend hikes. 120% price gains!

Add those payouts and gains together and you get that stellar 148% total return.

The two “dividends up, share price up” patterns I just showed you were no coincidence.

In fact, this predictable setup can not only tell us when to buy, but when to sell, too …

Consider utility American Electric Power (AEP), which I recommended in February 2024. My readers only held this one for a short time, for the best of reasons: It took off! By the time we sold in October, we were sitting on a sweet 27% total return.

But the reason why we bought AEP in the first place was its powerful Dividend Magnet. In the preceding decade, its payout had shot up 76%, and its share price had tracked it higher point for point.

Though by February 2024, a gap had opened up. That was our “in”!

AEP’s Payout Pulled Its Share Price Higher, Until a “Payout Gap” Gave Us Our Shot

We pounced. And by October, the share price had closed the gap. This was important because when a share price catches up to a dividend, and moves past it, it’s a key sell signal.

Share Price Catches the Payout, and We Take Profits

Once the 10-year gap between the price and dividend “reconnected,” we took our quick 27% gain off the table. And rolled it into the NEXT dividend grower!

This is hands-down the most exhilarating part of investing in Dividend Magnet plays like these: When investors (finally) catch wind of them, the stock can pop virtually overnight!

Do all of our calls work out like these? Of course not. I wouldn’t insult your intelligence and say they do. Investing in the stock market involves some risk, even with top-quality large-cap names like these, and you can lose money.

But I think you can see where I’m going here: we buy accelerating dividends, ride them higher and collect bigger payouts and price gains over time. This gives us a huge built-in advantage over investors who rely on traditional measures like earnings per share (EPS) growth, P/E ratios or whatever.

Now that we’ve seen how the Dividend Magnet can tell us to buy (and sell), let’s boost our payout-powered gains with a (wrongfully!) disrespected share-price driver: share buybacks.

Step 2: Toss in a Buyback “Afterburner”

Buybacks get a bad rap, but they shouldn’t, because when done right (i.e., when a stock is cheap), they can light a fire under share prices.

They work by cutting the number of shares outstanding, which boosts EPS and, in turn, share prices. They also boost our dividends because they reduce the number of shares on which a company has to pay out.

And when you combine a solid buyback program with an accelerating dividend, you get something very special indeed!

To see what I mean, let’s loop back to Texas Instruments. The company backstopped its Dividend Magnet with a steady buyback program during our holding period.

That took nearly 7% of its shares off the market:

TXN’s Buybacks Give Its Stock an Extra Kick

As you can see, the company’s Dividend Magnet is humming along beautifully, pulling the share price up as it goes.

Meantime, the buybacks kicked in an extra boost, pushing the shares ahead of TXN’s dividend growth!

Step 3: Use This Powerful Indicator for

Extra Dividend (and Share Price) Safety

Finally, we’re going to safeguard our gains and dividends by purchasing stocks with low beta ratings.

Beta what?

Don’t get too hung up on the jargon here.

Beta is a measure of volatility that you’ve probably seen on your favorite stock screener. A stock with a beta of 1 moves at roughly the same speed as the market (up or down). Betas below 1 are less volatile; those above 1 are more volatile.

For example, consider pharma giant AbbVie (ABBV), whose sturdy business results in a steady stock price.

ABBV has a 5-year beta of 0.52, which means it’s 48% less volatile than the S&P 500.

In other words, on days when the S&P 500 is down 3%, this stock should be down less than 2%.

That’s the theory.

In reality, it’s even better.

AbbVie is one of a tiny group of equities that actually gained through the 2022 mess, and by no small amount, either:

ABBV Soared in the 2022 Market Mayhem

Plus, this stock has a potent Dividend Magnet!

Check out how the share price (in purple below) has tracked the payout (in orange) over the last decade, during which we’ve seen rate hikes, rate cuts, a global pandemic, surging inflation and, yes, trade wars.

ABBV’s Dividend Magnet Drives Steady GAINS

Despite COVID, Inflation, Trade Wars and More

We’re not recommending ABBV today, because the share price has leapt ahead of dividend growth, as you can see on the right side of the chart above. This shows that ABBV is currently overvalued.

Taken together, this gives us a clear picture of how a rising dividend, buybacks and a low beta rating give this one downside protection, making it a true “recession-proof” dividend.

Leave a Reply