Stock Picker’s Market

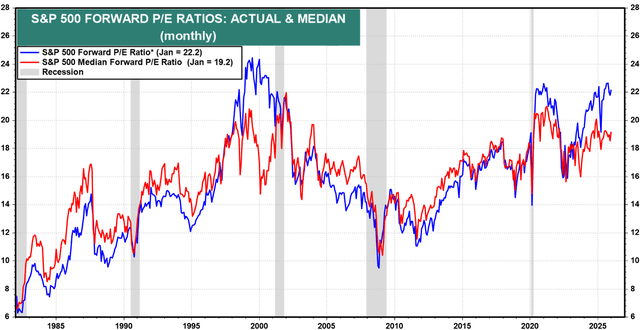

The stock market, on average, is expensive. However, we have seen a diversion that hasn’t occurred since the late 1990s, where the average P/E (price/earnings) ratio of the S&P 500 is materially higher than the median P/E ratio: Source

The median is the company that is in the middle, where 50% of companies in the S&P 500 are trading at higher valuations, and 50% are trading at lower valuations. We discussed the concept of valuation in-depth last month with our members because we believe this is the most important concept in the market today.

Microsoft (MSFT) reported objectively strong results, but the share price declined anyway. We’ve noticed that analysts are asking more questions about the profitability of AI spending rather than just blindly cheering it on. Here is a question that we think exemplifies this concern during the earnings call:

“Keith Weiss Morgan Stanley, Research Division

I’m looking at Microsoft print where earnings is growing 24% year-on-year, which is a spectacular result. Great execution on your part, top line growing well, margins expanding. But I’m looking at after-hours trading and the stock is still down. And I think one of the core issues that is weighing on investors is CapEx is growing faster than we expected and maybe Azure is growing a little bit slower than we expected. And I think that fundamentally comes down to a concern on the ROI on this CapEx spend over time. So I was hoping you guys could help us fill in some of the blanks a little bit in terms of how should we think about capacity expansion and what that can yield in terms of Azure growth going forward. More to the point, how should we think about the ROI on this investment as it comes to fruition?”

In essence, Wall Street is starting to say, “Show me the money!” There isn’t much doubt about the potential for AI and that there will be tons of money to be made, but there are concerns about whether the money will show up in time to justify the trading prices for these stocks. Wall Street is no longer enraptured by the AI arms race; they are starting to ask for tangible results. If they don’t find them, they’ll move on to invest in sectors where tangible results are being realized right now. In a nutshell, that’s exactly what the dot-com bust was all about. It wasn’t that the Internet didn’t have tons of potential; it was about whether that potential was translating into high enough earnings, soon enough, to justify the valuations today. In 2001, the answer was they weren’t.

There are many companies that are trading at low valuations. The strength of the S&P 500 is increasingly relying on a handful of stocks to maintain very high valuations.

What This Means for Income Investors

Let’s put the points we made together:

- The market is favoring investments that are perceived as safer.

- The public markets are valuing credit risk lower than private markets.

- Economic fundamentals are soft, and consumers are struggling.

- Some stocks are trading at premium valuations, while others are trading at low valuations.

Putting these together, what does that point to?

Hold Safety

We want to own assets that are perceived as “safe”. Fortunately, we were buying a lot of those in recent years, like mREITs that invest in agency MBS, municipal bond funds, preferred equities, and bonds. We’ve been pounding the table until our hands were bruised about the virtues of fixed-income investments. We continue to believe that these are good investments, even if the prices are higher than they were. These investments are just starting to come back into favor and have some significant upside left to go.

For investors who don’t have a healthy allocation to these investments, there is still time to add them.

Credit Risk Arbitrage Opportunities

For the credit risk portion of our portfolio, there is more opportunity, but also more risk. These investments are trading at lower valuations in the public markets than they can get in the private markets. As a result, the chances of seeing drastic moves like ARI’s decision to sell substantially all of its assets are higher. We could see more of these publicly traded vehicles being taken private or large asset sales from publicly traded companies to private companies to take advantage of the valuation differences. The public companies will be exploring ways to unlock that value, which could create significant upside for public shareholders.

On the risk side, with investor enthusiasm low, prices are likely to remain under pressure. This will be accelerated to the extent that management teams reduce dividends in response to lower interest rates on floating-rate investments or as a strategy to retain capital to make new investments. We expect dividends for BDCs to generally drift downward toward 2021 levels, and CLO equity funds have become a wildcard with a big unknown on whether other funds will follow OXLC’s example and position themselves to have a profile of growing NAV and paying lower dividends or if they will continue to pay out substantially all their cash flow at the expense of NAV.

We believe that long-term credit risk is trading at attractive valuations in the public markets. We believe that the institutions are right, and the risk of defaults is relatively low. But sentiment is negative, and it could become more negative as the year goes on.

Be Aware of the Consumer

When making an investment, we should be aware of whether our dividends are dependent upon a strong consumer. Dividends that stem from areas of relatively inelastic demand should be favored over dividends from sectors that are very elastic.

The Wendy’s Company (WEN) is trading at a 7% yield, but it’s a company that is quite dependent upon consumers being willing to pay for convenience. We expect another dividend cut to be very likely, so we will avoid it.

No doubt, we will see many consumer-centric businesses with yields that tip into our territory. We will exercise caution when choosing whether or not to take advantage of those “deals” because we recognize that the consumer is weak. We would rather own the landlord who rents properties to WEN because WEN is good for the rent even after they cut the dividend. O’s 5% yield > WEN’s 7%.

Be Aware of Valuations

When the market has been generally bullish for an extended period, there is often a tendency for investors to start dismissing the concept of valuation as irrelevant. It is true that buying something cheap doesn’t mean that you’ll make a lot of money right away. It doesn’t mean that the price won’t go lower for an extended period of time. However, in the long run, only two prices matter when calculating your total return: the price you pay and the price you sell at.

Prices bounce all over the place. Valuations go high, they dip low, and they will go to both extremes much further than any amount of staring at numbers can justify. We remember in 2021 when some preferred shares were trading at such high premiums to par that they had a negative yield-to-call, and people were buying preferred equity where the inevitable return was a guaranteed loss. There have been cases of bonds trading at negative yields to maturity.

If that kind of inaccurate pricing can occur in fixed income, where the amount of the interest/dividends is known to the penny, and you can calculate with a pencil and paper the best possible return that you can have by the call date or maturity date, and investors are still buying tickers that are guaranteed to have negative returns—how far off can the market be when the future returns are at best educated guesses that are open to debate? It can be off by a lot, and it can be off for a long time

Eventually, the chickens come home to roost, and the market comes around to recognize the earnings that it previously undervalued, or the earnings fail to materialize, and the price comes down to a level reflecting that. The thing is that there is always a future, so while the market will cross that “fair value” line, it will usually keep going until the extreme is in the opposite direction.

When a stock in your portfolio is up or down a lot, make sure you take the time to understand how much of that price difference is due to an actual change in earnings and how much is due to a change in valuation. You want to buy at a low valuation and consider selling when investments are trading at a high valuation.

Conclusion

It is a stock-pickers’ market where there are some investments that are simply too expensive to be reasonable investments, some investments that are more expensive but still have a good long-term return profile, and some investments that are absolute bargains.

This is true for dividend investors as much as it is for everyone else. In our portfolio, we have a base with the relative safety of assets like agency MBS, fixed income, and bonds. For several years, this portion of our portfolio actually saw the lowest valuations. That is changing, although there are still opportunities that are attractive long-term.

To that base, we add investments in holdings and sectors that carry more risk but are trading at low valuations. Today, credit risk is a good place to look for investments that are trading at low valuations and paying very high yields.

We will focus on sectors that aren’t dependent on a strong economy. Sectors supported by tangible assets and inelastic consumer demand. Real estate, utilities, infrastructure, and more.

Leave a Reply