One of the most troubled sectors continues to draw investors.

6th February 2026

by Dave Baxter from interactive investor

Our monthly list of bestselling investment trusts tells many a tale, from the enduring popularity of growth funds such as Scottish Mortgage Ord SMT

to the fact that bargain hunters have seized on the (briefly) wilting premium on 3i Group Ord III

But it also shows us that one particularly battered Association of Investment Companies (AIC) sector, Renewable Energy Infrastructure, continues to draw in buyers after a horrific run of performance.

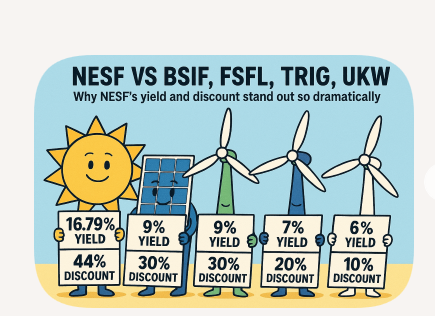

both sit in the top 10 list for January and seem to be a common addition to portfolios, what with their ultra-high dividend yields and wide share price discounts to net asset value (NAV).

But shareholders have been through the wars: rising interest rates (and bond yields) did huge damage to share prices across the sector in 2022.

All manner of problems, from a backlash against renewable energy to low wind speeds in the first half of 2025 and a broader crisis for the investment trust universe, have continued to hurt returns in the following years.

| Renewable trusts come with bumper yields | ||

| Trust | Discount (%) | Dividend yield (%) |

| Aquila European Renewables Ord AERI3.55% | -46.9 | 19 |

| NextEnergy Solar Ord NESF1.52% | -43.1 | 16.5 |

| Foresight Solar Ord FSFL1.82% | -39.8 | 13.3 |

| SDCL Efficiency Income Trust plc. SEIT1.42% | -43.5 | 12.7 |

| Gore Street Energy Storage Fund Ord GSF0.00% | -39.1 | 12.7 |

| Bluefield Solar Income Fund BSIF1.35% | -33.3 | 11.6 |

| Octopus Renewables Infrastructure Ord ORIT1.96% | -40.4 | 11 |

| Renewables Infrastructure Grp TRIG0.86% | -37.7 | 10.9 |

| Foresight Environmental Infra Ord FGEN0.28% | -30.5 | 10.9 |

| US Solar Fund Ord USF0.00% | -48.2 | 10.6 |

| Greencoat UK Wind UKW0.31% | -27.3 | 10.6 |

| Greencoat Renewables GRP1.61% | -30.2 | 9.8 |

| VH Global Energy Infrastructure Ord ENRG0.28% | -34.8 | 8.3 |

| Hydrogen Capital Growth HGEN0.00% | -43 | 0 |

| Ecofin US Renewables Infrastructure Ord RNEW3.26% | -48.8 | 0 |

| Aquila Energy Efficiency Trust Ord AEET0.80% | -45.6 | 0 |

| Gresham House Energy Storage Ord GRID0.00% | -36.8 | 0 |

Source: AIC, 04/02/2026.

The sector took another hit late last year, thanks to the government’s mooted decision to switch the inflation linkage on certain renewable subsidies from the RPI measure of inflation to the lower CPI level. That would limit the revenue that renewable assets (and the trusts that have stakes in them) can generate.

The government confirmed its decision to go ahead with this option last week, although the news did in fact prompt the sector to rally. It’s worth asking what triggered this – and what bargain hunters buying the likes of UKW shares now need to understand.

Lesser evils – and the funds feeling the most pain

The sector rallied because the switch from RPI to CPI from April, while unwelcome, seemingly represented the lesser of two evils. The government had also considered temporarily freezing the subsidy level to make way for “a gradual realignment with the CPI”.

As the table below shows, some of the renewable trusts have substantial exposure to certain subsidy schemes and would see their NAV fall on the back of either change.

But the first option (now chosen by the government) is less harmful, with modest hits to NAV. While the damage is lessened, it’s the solar funds that are expected to take the biggest hit.

| Estimated NAV impact of switching from RPI to CPI now vs a temporary freeze | |||

| Trust | Estimate of revenues from affected subsidies (%) | NAV change (%) from switching now | NAV change (%) from a temporary freeze |

| Bluefield Solar Income | 50 | -1.9 | -9.9 |

| Foresight Environmental Infrastructure | 20 | -0.3 | -1.7 |

| Foresight Solar | 49 | -2.2 | -10.9 |

| Greencoat UK Wind | 40 | -1.7 | -6.1 |

| NextEnergy Solar | 45 | -2.9 | -10.3 |

| The Renewables Infrastructure Group | 15 | -0.7 | -2.5 |

Source: JPMorgan.

Buy or avoid?

As mentioned, there’s plenty to draw a bargain hunter in, from wide discounts to high yields.

In theory, we now have plenty of catalysts for a recovery: interest rates have been on a downward trend, high dividend yields mean investors are “paid to wait”, while such payouts are in most cases fully covered by earnings, and corporate action could also drive improvements. That could range from asset sales to mergers and buyouts.

Note, for example, that names such as Harmony Energy Income and Downing Renewables saw bids at decent premiums to share prices in the last year. That could prompt a recovery from depressed valuations.

It’s worth pointing out that not all specialists are keen on the sector at all, with Charles Murphy, senior research analyst at Singer Capital Markets, arguing that the underlying assets could ultimately prove hard to value in future, undermining the investment case.

Meanwhile, investors are seemingly overwhelmed with factors that complicate the picture, from shifts in power prices to bond yield moves and a political environment that looks increasingly hostile to the subsector.

As Hawksmoor’s Dan Cartridge adds, Reform UK is leading in the polls. “They have extreme negative views on the renewables sector,” he says. “That’s an ongoing reason for caution, although the next general election is still quite a long way off.”

Such considerations might understandably put off a potential investor. There are much simpler ways to bag a good yield, be it via a “core” infrastructure trust such as HICL Infrastructure PLC Ord HICL

(on roughly 7%), via equity income or via a UK government bond, whose 10-year instrument offers 4.5%.

Which trusts are the analysts favouring?

With the caveat that some may simply avoid a headache by not investing in the sector at all, trust brokers and analysts did pick out a few names they viewed as appealing.

Murphy, who as mentioned is generally pretty bearish on the sector, nevertheless views Foresight Environmental Infra Ord FGEN

as an interesting fund thanks to the fact that it’s so heavily diversified.

At the mid-point of 2025, the fund had a 27% allocation to wind power, with 14% in anaerobic crop digestion (where organic materials such as grass are broken down by microorganisms to produce renewable energy), 12% in solar power, 10% in biomass and smaller allocations to areas such as low-carbon transport and energy storage. The trust can have an eclectic mix of assets, with these including a fish farm in Norway.

Hawksmoor’s Cartridge is also a fan of Foresight’s diversification, while pointing to other trusts which have a good spread of assets and “where overall cash-flow profiles are more defensive” – for example with strong solar power generation last year to offset the falls suffered in wind generation. Here, he points to Octopus Renewables Infrastructure Ord ORIT

and the Renewables Infrastructure Grp TRIG

To briefly linger on these names, ORIT unveiled something of a turnaround plan in September where it promised to continue and extend its share buyback programme, look to reduce its debt, sell down some assets and make selective new investments.

TRIG sought to roll into stablemate HICL last year, a plan that ultimately fell apart after it caused a stink among HICL investors. However, this drama may have alerted investors to the existence of TRIG as a possible takeover target.

The case for Greencoat UK Wind

Meanwhile, Greencoat UK Wind remains popular with the professionals, much as it does with ii customers.

Cartridge notes that it has “a unique funding model that has been successful over a long time”, while Peel Hunt’s Markuz Jaffe adds: “We like Greencoat UK Wind for the pure-play domestic strategy. It remains simple and is perhaps most exposed to the subsidy amendment but is linking [dividends] to inflation even if that’s now CPI rather than RPI.

“It has been a leader in trying to address the discount, via buybacks, changes to management fees and recycling capital to reduce gearing.”

The Peel Hunt team also has an eye on Bluefield Solar Income as a tactical opportunity, with a focus on how its sale process and strategic review is progressing. The trust is expected to give an update when it publishes its interim results in March. Jaffe notes that its peer, Foresight Solar, also looks interesting because of this.

“The portfolio is quite vanilla, it’s on a wide discount and its closest peer is going through a sale process, so there’s reason to expect a catalyst for a material rerating in the shares,” he says.

Not all rosy

An improving environment does not guarantee a recovery. Note, for example, that interest rates have already been falling over the last year, with no discernible rebound for most of the trusts in this sector. And investors may want to tread carefully.

Cartridge notes some caution on certain specialist names, for example. He points to ii customer favourite NextEnergy Solar, noting that the dividend yield at the NAV level is “higher than the discount rate, pointing to it being unsustainable” and Bluefield Solar.

When it comes to NESF, it does have one of the highest yields in its sector.

However, the board has been in the midst of a strategic review “exploring all options to close the current discount”. Options discussed include exploring “opportunities to enhance shareholder returns” and upping the level of capital recycling. The findings of the strategic review are due out this year.

As ever, specialist funds tend to carry greater volatility than generalist options and can reward and punish adventurous investors in equal measure.

The battery storage funds have taught us that: the two remaining names, Gore Street Energy Storage Fund Ord GSF

and Gresham House Energy Storage Ord GRID

suffered huge losses in earlier years but staged a fierce comeback in 2025. One factor here was the sale of rival fund Harmony Energy Income.

Leave a Reply