Read below and you may change your view.

Here’s the proof, from our friends at Hartford Funds.

Hartford looked at the years between 1960 and the end of 2024, which included everything: the inflation of the ’70s, economic crashes in 2001 and 2008 and, of course, the pandemic.

Here’s what they found: if you’d put $10,000 in the S&P 500 in 1960, you would have had $982,072 at the end of the period, based solely on price gains.

That’s not bad: a 9,721% increase.

It shows you why most folks only think about share prices when they invest. After all, with a gain like that, it’s tough to get excited about a dividend that dribbles a few cents your way every quarter.

But here’s the thing: when you reinvest your dividends, the magic of compounding kicks in. The difference is shocking: your $10,000 would have grown to $6,399,429, or more than $5.4 million more than you’d have booked on price gains alone!

That’s a 63,894% profit.

It’s a crystal clear example of how critical dividends are. And you can grab stronger profits if you buy stocks whose dividends aren’t just growing but accelerating.

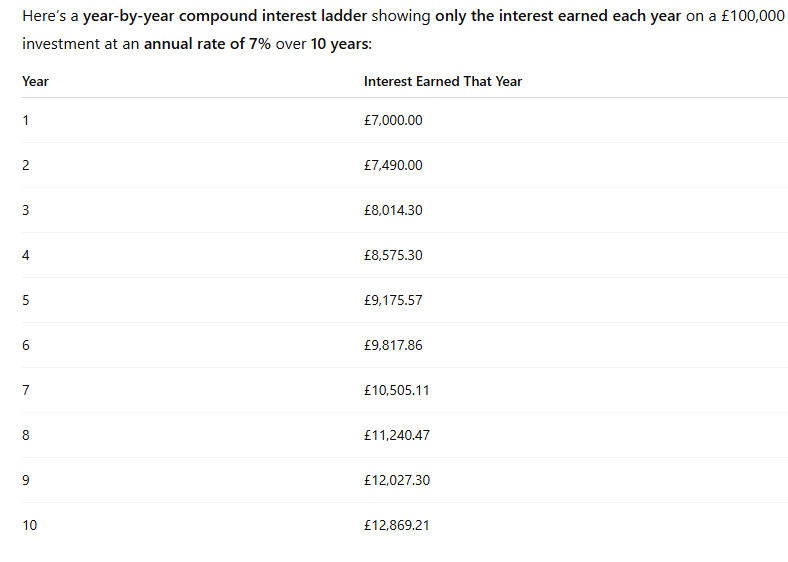

The good news is, if you are just starting out on your dividend re-investment journey, compound interest takes time to make a noticeable difference, so hopefully you will have more invested, when it does.

The current plan

On course to complete the plan before year ten, the target for 2026 may be increased to £10,500 but only if the dividends are repeatable, of course no dividend is ever 100% completely secure.

What a helpful and well-structured post. Thanks a lot!

I appreciate the real-life examples you added. They made it relatable.

Such a simple yet powerful message. Thanks for this.

I love how well-organized and detailed this post is.

I’ve gained a much better understanding thanks to this post.