0R

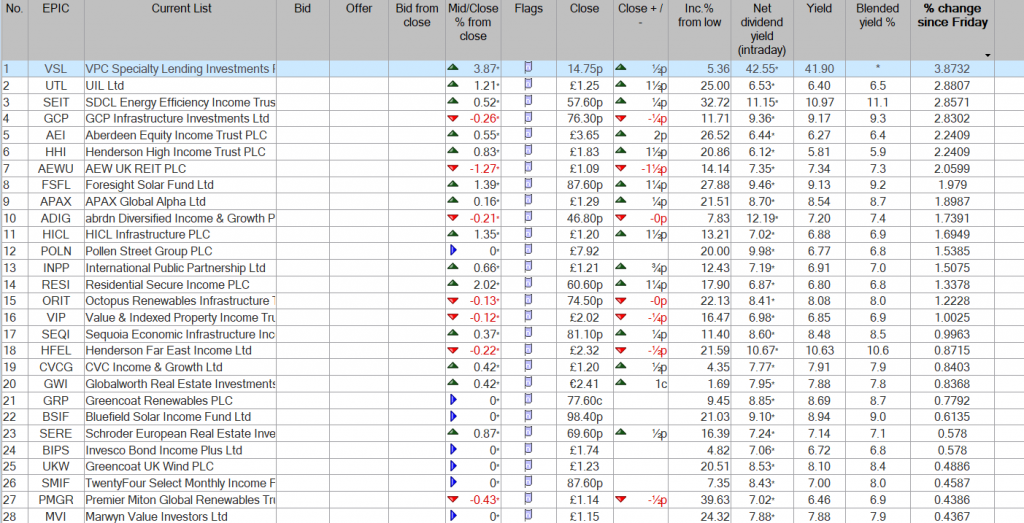

Investment Trust Dividends

0R

If we double the value of the control share VWRP 272K. The gamble with your future is, it could be a lot less or more.

Using the 4% rule it could provide a ‘pension’ of £10,880.00

The Snowball should produce an income of £18,000.00, which you should be able to pencil in with some certainty because with a dividend re-investment plan you fail by the month not the year.

Better, much better if you have longer before you intend to spend your hard earned income.

When you start to spend your dividends, most of the dividends in your Snowball should increase near to the inflation rate.

The comparison share is VWRP, where the 4% rule will be used to provide a pension.

Current value of VWRP £136,278.00, not too shabby.

Current pension you could withdraw £5,451.12.

Current Snowball pension £9,120.00

Do you wish to invest in the dog or the tail or maybe both ?

The SIPP’s an excellent tool for investors who want to take hold of their retirement planning. Dr James Fox explains why his daughter has one.

Published 27 June

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

As a parent, I want to give my daughter every possible advantage for her future. That’s why I decided to open a Junior Self-Invested Personal Pension (SIPP) for her now. That’s despite her retirement being five decades away.

The reason’s simple. The earlier you start investing, the more powerful the effect of compound interest becomes. And the more likely she is to achieve true financial security in later life.

A Junior SIPP allows me to contribute up to £2,880 a year. And with government tax relief, it becomes £3,600 — a 20% boost before the money’s even invested. By starting with her current balance of £3,500 and contributing £3,600 a year, or £300 a month, she’ll benefit from both these tax advantages and the long-term growth potential of the stock market.

Let’s look at the numbers. Assuming an average annual return of 10% — a figure that reflects long-term stock market averages and is achievable with a diversified investment approach —her pension pot could reach over £8m in 50 years (she’d be 51). This projection includes modest annual increases in contributions. I’ve added this due to the likelihood that she’ll be able to pay in more once she starts working herself.

The power of compounding means that the money invested in her early years works hardest, growing exponentially over decades. For example, after 10 years, her pot could already exceed £80,000, and by year 25, it could be over half a million. By year 50, with continued contributions and growth, the total could surpass £8m, providing her with a level of financial independence that few can imagine.

However, starting a SIPP for my daughter is about more than just numbers. It’s about giving her a head start, teaching her the value of long-term investing, and ensuring she has choices and security in the future. In a world where retirement provision is increasingly an individual responsibility, I believe this is one of the best gifts I can give her.

Scottish Mortgage Investment Trust (LSE:SMT) is a core holding in my daughter’s SIPP. It’s an investment trust with a long-term focus on high-growth, innovative companies across technology, healthcare, and other transformative sectors.

Despite recent volatility, the trust’s strategy of backing world-changing businesses has delivered outsized returns over time. Its managers have a proven track record of identifying winners, and the trust’s diversified approach helps spread risk across dozens of companies. Currently, the portfolio’s top holdings include SpaceX, MercardoLibre and Amazon.

One risk to highlight is Scottish Mortgage’s use of gearing (borrowings to invest). This amplifies both gains and losses, making the trust more volatile than traditional funds. This, combined with its concentration in fast-growing but sometimes unproven businesses, means short-term swings are inevitable.

However, for patient investors with a long-time horizon, Scottish Mortgage is certainly worthy of consideration. It’s diversified while broadly focusing on technology-driven investments, and I believe it will continue to drive strong growth in her SIPP.

How long would it take an owner of Legal & General shares to get their money back in passive income?

Our writer looks at the passive income potential of Legal & General, one of the highest-yielding shares on the FTSE 100 (INDEXFTSE:UKX).

Posted by James Beard

Published 11 July

LGEN

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

Read More

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

Passive income — earning money from doing very little — is a great way of saving. And buying dividend shares is one of the most popular ways of building a nest egg for later in life, or to help set aside cash for a rainy day.

But it can sometimes be bewildering deciding which stocks to buy. Personally, I like to invest in the largest listed companies. Their strong reputations and global reach means they can be highly profitable. As a result, they tend to pay the biggest dividends. And generally speaking, their earnings are more reliable, making their payouts more predictable.

An example

One of the best passive income shares around at the moment is Legal & General (LSE:LGEN), the pensions, life insurance and asset management group.

For 2024, it declared a dividend of 21.36p. Based on its current (11 July) share price of 252p, it means the stock’s yielding 8.5%. This makes it the second-highest-yielding share on the FTSE 100, where the average is 3.5%. It also comfortably beats anything that could be earned on a high-interest savings account.

And if it was able to maintain its payout at this level, anyone buying one of the group’s shares today would get their money back in just under 12 years.

But if the income was reinvested buying more of the company’s shares, the payback period would fall further.

Caution!

However, for two reasons, this type of analysis is a little simplistic. Firstly, dividends are never guaranteed. Should Legal & General’s earnings come under pressure then one of the first things likely to be cut will be payments to shareholders.

However, the group has a better record than most when it comes to maintaining its dividend. It was last cut during the 2008-2009 financial crisis and it kept it unchanged during one year of the pandemic. The company’s pledged to increase its payout by 2% per annum from 2025-2027.

The second reason why these numbers must be be treated with caution is that the group’s share price could fall. Of course, it could also go up.

But there’s little point receiving generous dividends if the underlying value of the shares is being constantly eroded. Unfortunately, nobody can see into the future. However, over the past five years, Legal & General’s been a steady performer. Its shares are now changing hands for 14% more than they were in July 2020.

Strong prospects

Personally, I think the company’s well placed to benefit from an ageing population and the likelihood of the state retirement age continuing to rise.

But its investments are sensitive to wider macroeconomic conditions. And a sustained downturn in global equities or the bond markets will impact its earnings. It also faces intense competition from some household names as well as some challenger brands.

However, it has a strong pipeline of potential new business. It’s also been around since 1836. Over the past 179 years, it’s come through plenty of difficult times, including financial crises and wars.

In addition, it has a strong balance sheet holding more than twice the level of reserves needed to comply with regulatory requirements. But it’s the group’s generous dividend — supplemented by a share buyback programme — that sets itself apart from most of its peers. Overall, I think it’s one of the best FTSE 100 stocks to consider.

The journey to date.

The portfolio was started on the 09/09/22 with seed capital of 100k, no further capital will be added

Included are dealing costs for buys £10.00 and sales £5.00.

Because of the costs buys are normally above 1k but any profit taking may be lower as it’s the markets money not the Snowball’s.

Remember even if you book a profit, a profit is not a profit until the share is sold and the money sits in your account.

At the end of 2022 the Snowball earned dividends of £1,609.01

2023 £9,422.59

2024 £10,796.00

2025 £6,893.20 to date

But it takes time to build.

The current plan.

2025 target income of £9,120.

Current cash to re-invest £576.46

Current shares xd £327.00

GL

Shares in this FTSE 250 stock generate a much higher dividend yield than the index average and can produce potentially life-changing passive income over time.

Posted by Simon Watkins

Published 10 July

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

FTSE 250 global investment manager aberdeen (LSE: ABDN) is up 53% from its 9 April 12-month traded low of £1.23.

Much of this jump has come from a turnaround in results as it continues with its reorganisation plan. This was instigated after the firm was demoted from the FTSE 100 in August 2023. It broadly aims to reduce middle management levels, cut costs, and improve the customer experience.

A risk to the stock is that this plan falters at some stage. Another is that a renewed surge in the cost of living prompts customers to cancel their policies.

However, 2024 saw an IFRS profit of £251m, compared to a £6m loss the previous year. Its 30 April Q1 trading update saw a reiteration of 2026 targets of a £300m+ operating profit and around £300m of net capital generation.

A further bump in its share price followed June’s upgrading of the stock to Overweight from Neutral by investment bank JP Morgan. The new rating indicates that the bank expects the stock to outperform its sector.

A stock’s yield moves in the opposite direction to its price, if the annual dividend stays the same. As a result, such a price rise has reduced the firm’s dividend yield from well over 10% when I first purchased it.

Nevertheless, it is still delivering an annual payout of 7.8%. By comparison, the current average yield of the FTSE 250 is 3.4% and the FTSE 100 is 3.5%.

Consensus analysts’ forecasts are that aberdeen will keep its dividend at 14.6p until the end of 2027 at minimum. It has been at this level every year since 2020.

Given the same average share price as now, this would continue the 7.8% dividend yield offered by the stock.

At that price, £11,000 — the average UK savings amount – would purchase any interested investor 5,851 shares in aberdeen.

Those shares would make £858 in dividends this year. Over 10 years on the same basis this would rise to £8,580 and over 30 years to £25,740.

That said, if the dividends were reinvested back into the stock – ‘dividend compounding’ – much more would be made.

More specifically, given the same 7.8% average yield, the dividends would be £12,936 after 10 years, not £8,580. And after 30 years they would be £102,332 rather than £25,740.

Including the original £11,000 stake, the total value of the aberdeen holding would be £113,332 by then. And this would be paying an annual dividend income of £8,840 at that point.

I have periodically been adding to my holding in aberdeen since I bought it after its demotion from the top-tier index. Aside from its huge dividend income potential, I thought it was enormously undervalued back then.

Both elements behind my investment decision were proven correct then, and I think both still stand now.

The yield forecast is for 7.8% until 2027 at minimum. And a discounted cash flow valuation shows the stock is 47% undervalued at its present price of £1.88. Therefore, its ‘fair value’ is £3.55.

Consequently, I will buy more shares very soon.

Updated: SPDR S&P US Energy Select Sector and iShares S&P 500 Energy Sector were among the worst-performing ETFs in Q2 2025.

Bella Albrecht 7 Jul 2025Share

Exchange-traded funds, or ETFs, are often low-cost instruments for investors to track popular indexes or leverage experienced manager choices in an attempt to beat the market. The best ones serve as building blocks for a portfolio, and unlike open-end mutual funds, all ETFs are traded throughout the day on an exchange.

In the second quarter of 2025, the worst performers included SPDR S&P US Energy Select Sector UCITS ETF SXLE and iShares S&P 500 Energy Sector UCITS ETF USD Acc IUES. Data in this article is sourced from Morningstar Direct.

To read about the best-performing ETFs, check out our other story.

To find the quarter’s worst-performing ETFs, we screened those in Morningstar’s equity, allocation, or fixed-income categories that are available in the UK. We excluded exchange-traded notes, known as ETNs, and ETFs with less than $25 million (£18.3 million) in total assets. We also excluded funds that fall into Morningstar’s “trading” categories, as these funds are designed for active traders and are not suitable for long-term investors.

Among the worst-performing ETFs, five were from the equity healthcare category, where funds fell 4.44% in the second quarter.

The worst-performing ETF in the second quarter was the £490 million SPDR S&P US Energy Select Sector UCITS ETF, which lost 14.03%. The passively managed State Street ETF fell further than the average 3.87% loss on funds in the equity energy category in the second quarter. Over the past 12 months, SPDR S&P US Energy Select Sector fell 11.87%, placing it in the 80th percentile within its category and underperforming the 0.19% return on the average fund.

The SPDR S&P US Energy Select Sector UCITS ETF, launched in July 2015, has a Morningstar Medalist Rating of Bronze.

With a 14.02% loss, the £513 million iShares S&P 500 Energy Sector UCITS ETF USD (Acc) was the second-worst performing ETF on our list for the second quarter. The passively managed iShares ETF fell further than the average 3.87% loss on funds in the equity energy category. Over the past year, iShares S&P 500 Energy Sector lost 11.97%, placing it in the 83rd percentile within its category and underperforming the 0.19% return on the average fund.

The Bronze-rated iShares S&P 500 Energy Sector UCITS ETF USD (Acc) was launched in November 2015.

The third-worst performing ETF in the second quarter was the £53 million Invesco Energy S&P US Select Sector UCITS ETF, which fell 14.01%. The Invesco ETF, which is passively managed, fell further than the average 3.87% loss on funds in the equity energy category. Over the past 12 months, the ETF fell 12.04% to place in the 85th percentile within its category, underperforming the category’s average return of 0.19%.

The Invesco Energy S&P US Select Sector UCITS ETF has a Morningstar Medalist Rating of Bronze. It was launched in December 2009.

The £54 million Xtrackers MSCI USA Energy UCITS ETF was the fourth-worst performing ETF in the second quarter, with a loss of 13.67%. The passively managed Xtrackers ETF performed worse than the average 3.87% loss on funds in the equity energy category. Over the past year, the ETF dropped 10.40% to land in the 77th percentile within its category, underperforming the category’s average one-year return of 0.19%.

The Bronze-rated Xtrackers MSCI USA Energy UCITS ETF was launched in September 2017.

Fifth-worst was the £251 million Invesco Health Care S&P US Select Sector UCITS ETF, which lost 12.66% in the second quarter. The passively managed Invesco ETF fell further than the average 4.44% decline on funds in the equity healthcare category. Over the past 12 months, Invesco Health Care S&P US Select Sector fell 13.54%, finishing in the 56th percentile within its category. It dropped further than the category’s average loss of 9.50%.

The Invesco Health Care S&P US Select Sector UCITS ETF has a Morningstar Medalist Rating of Bronze. It was launched in December 2009.

The sixth-worst performing ETF in the second quarter was the £1.7 billion iShares S&P 500 Health Care Sector UCITS ETF USD (Acc), which lost 12.66%. The passively managed iShares ETF fell further than the average 4.44% loss on funds in the equity healthcare category. Over the past year, iShares S&P 500 Health Care Sector fell 13.54%, placing it in the 56th percentile within its category and falling further than the 9.50% loss on the average fund.

The iShares S&P 500 Health Care Sector UCITS ETF USD (Acc) has a Morningstar Medalist Rating of Bronze. It was launched in November 2015.

With a 12.64% loss, the £242 million SPDR S&P US Health Care Select Sector UCITS ETF was the seventh-worst performing ETF on our list for the second quarter. The passively managed State Street ETF fell further than the average 4.44% loss on funds in the equity healthcare category. Over the past 12 months, the SPDR S&P US Health Care Select Sector UCITS ETF lost 13.52%, placing it in the 55th percentile within its category and putting it down further than the 9.50% loss on the average fund.

The SPDR S&P US Health Care Select Sector UCITS ETF, launched in July 2015, has a Morningstar Medalist Rating of Bronze.

The eighth-worst performing ETF in the second quarter was the £474 million Xtrackers MSCI USA Health Care UCITS ETF, which fell 12.07%. The Xtrackers ETF, which is passively managed, fell further than the average 4.44% loss on funds in the equity healthcare category. Over the past year, the ETF fell 13.04% to place in the 51st percentile within its category, dropping further than the average one-year loss of 9.50%.

The Xtrackers MSCI USA Health Care UCITS ETF, launched in September 2017, has a Morningstar Medalist Rating of Bronze.

The £76 million Invesco S&P World Health Care ESG UCITS ETF was the ninth-worst performing ETF in the second quarter, with a decline of 11.58%. The passively managed Invesco ETF performed worse than the average 4.44% loss on funds in the equity healthcare category. Over the past 12 months, the ETF dropped 15.19% to land in the 73rd percentile, falling further than the category’s average loss of 9.50%.

The Invesco S&P World Health Care ESG UCITS ETF has a Morningstar Medalist Rating of Bronze. It was launched in April 2023.

Tenth-worst was the £258 million SPDR MSCI World Energy UCITS ETF, which lost 10.48% in the second quarter. The passively managed State Street ETF fell further than the average 3.87% loss on funds in the equity energy category for the quarter. Over the past year, SPDR MSCI World Energy fell 8.34%, finishing the 12-month period in the 66th percentile within the equity energy category. It underperformed the category’s average one-year return of 0.19%.

The Gold-rated SPDR MSCI World Energy UCITS ETF was launched in April 2016.

Exchange-traded funds are investments that trade throughout the day on stock exchanges, much like individual stocks. They differ from traditional mutual funds—known as open-end funds—which can only be bought or sold at a single price each day. Historically, ETFs have tracked indexes, but in recent years, more ETFs have been actively managed. ETFs cover a range of asset classes, including stocks, bonds, commodities, and most recently cryptocurrency.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑