Row of family homes

Often, investors tell me they think buying a property is safer than buying shares. It feel that way, but in reality it’s possible to buy well, or badly, in both cases.

This is no accident. Successive governments have sought a more regulated, professional housing market, discouraging non-professional investors. It’s no surprise that many landlords are selling up.

The thing is, residential property as an asset class continues to thrive. It offers stability, income and long-term growth underpinned by limited housing supply, with demand driven by demographics. Unlike offices or retail investments, we all need a roof over our heads.

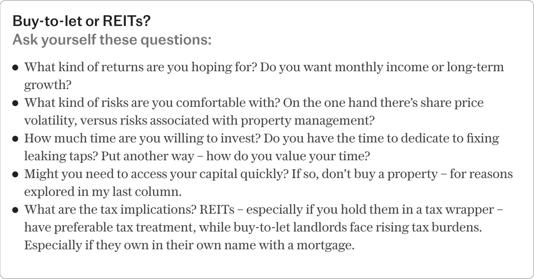

So, if you’ve lost faith in buy-to-let, but still want to get a cut of these profits, could property shares, such asTrusts) or shares in housebuilders, offer a practical alternative?

Bricks or shares?

The decision between direct property investment and property shares boils down to control versus convenience.

You benefit from the rental income and growth. It’s not without risks, but if like most road users you think you’re a better than average driver, then you’ll feel safer. If only because owning a physical property can be reassuring.

There are some downsides, of course. There’s the costs I’ve already mentioned which means it’s expensive to get started. You are liable, and compliant tenant management is increasingly costly, time consuming and complex. Plus market risks – for example, changing tax rules and policies – can erode profitability overnight.

At the other end of the control spectrum are property shares, which offer exposure to the housing market without the headaches of direct ownership. REITs, for example, allow you to invest in professionally managed property portfolios, including through your Isa or Sipp.

Liquidity means that shares can be bought or sold quickly and there’s no management hassle or liability for you. Plus, professional managers handle tenants, maintenance and strategy.

However, there are trade-offs. Share prices are volatile and are influenced by market sentiment, not just property values.

You are not in control of anything except when and whether you buy or sell. Instead, you’re betting on fund managers. Incidentally, those fund managers are not cheap, and management fees can erode returns.

REITs also face a “liquidity mismatch”. Shares are easily traded, but underlying property assets take time to sell, which can cause trouble if lots of shareholders decide to sell at once.

The choice often boils down to this: do you want to drive the car or be chauffeured?

Want to make money from buy-to-let? Don’t own property

Buy-to-let allows you to take the wheel. You can potentially earn higher returns through active management, but it also demands time and effort.

Property shares are the muted version. A hands-off option offering lower potential returns, without the headaches or responsibility.

Your decision should align with your financial goals and circumstances. You don’t need to choose one or the other, but you might prioritise differently for your next investment.

A wealth planner I know advises all of her clients to use their Sipp and Isa allowances first, perhaps including property shares, and only then to consider other options like direct property.

Navigating risks

In simple terms, risk is the likelihood of losing your money. It can be measured by how much property values and returns vary over time.

In the world of real estate, risk is often explained badly, so many investors overlook the difference between return on investment and return of investment.

For example, as buy-to-let returns have been squeezed, many investors have been seduced into buying “off-plan” or new builds from glossy brochures.

Maintenance costs can be lower for new-build properties (though not necessarily – it really depends on the build quality). However, if you’re buying brand new then, much like a new car, you’re paying the developer’s premium.

If you’re not convinced, find a development that was new 10 years ago on your preferred property platform. Look at the prices paid then, and what has been paid since. Once you factor in stamp duty, legals and agent fees – the original buyer has frequently lost money.

So where does this leave us? Buy-to-let increasingly feels like a strategy that once worked, but doesn’t any more – and property shares could be the modern alternative you’re seeking. But you’ll need to proceed with caution.

As with any investment, do your research, seek professional advice, and, above all, make sure your choices suit your circumstances.

Anna Clare Harper is a property investor, founder, writer and host of a leading property podcast – find out more at annaclareharper.com.