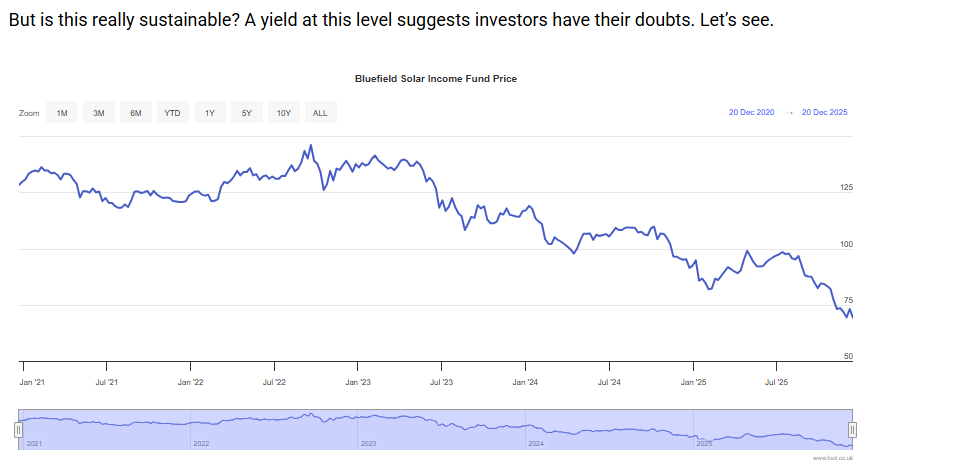

But we launched this newsletter and our Monthly Dividend Paycheck Calendar income system because there are regular hardworking people looking for a steady income stream. Looking for something they can rely on. And we couldn’t have started too soon for some folks.

You see, contrary to what they try to tell us – the mainstream financial news, the government, the politicians – nothing’s changed for those of us looking for stable and steady income.

You and I both know it. Otherwise, you wouldn’t be a dividend investor.

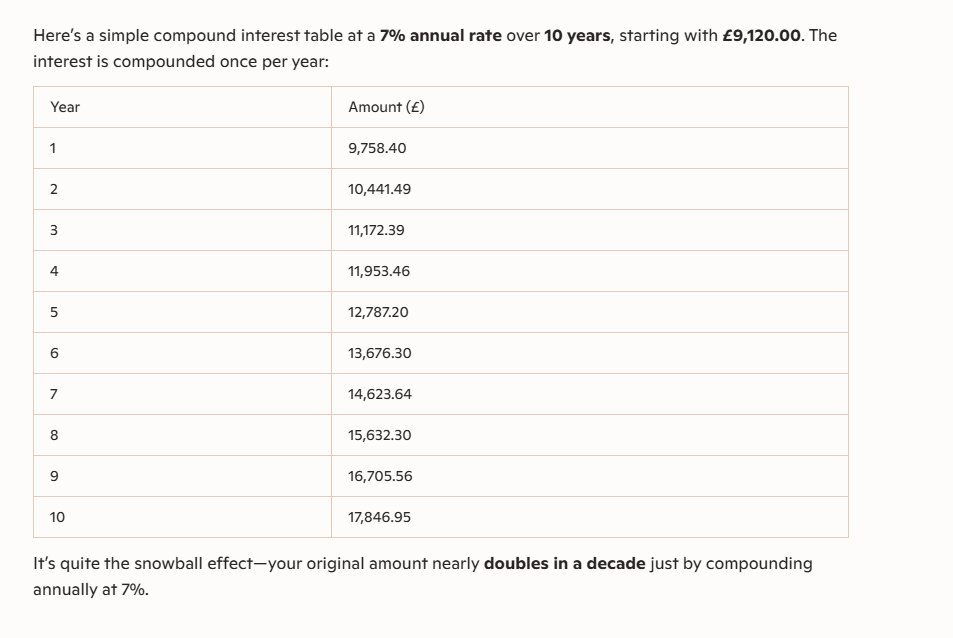

Think about this for a moment: up until the financial crisis the conventional wisdom for retirement money was to put the bulk of your money in bond funds and CDs and live off the interest. Made sense when CDs were paying 5, 6, even 7%. Nice way to fund your retirement.

But that’s not the world we live in today even with recent Fed rate hikes.

What if the Fed Reverses Course to Raise Rates?

This is the second most common question I get from dividend investors through email and at speaking engagements.

I’ll share with you my response to that in two parts.

First, the Fed isn’t going to raise rates. Jobs numbers are lousy right now.

In fact, they just did the opposite recently and cut rates by a quarter point.

And second, today you’d be lucky to get much more than a 4% yield on a CD without having to tie up a tidy sum for a long time.

4%? Are they kidding us or just plain being greedy and rude?

Take your pick but either way that’s not even enough to cover inflation as we’ve experienced these past years, let alone let you “live off the interest” like so many of us were promised when we were younger.

And remember, that’s not going to change any time soon.

It’s only the last couple of years that we’ve seen the Fed finally raise rates for the first time since before the Great Recession and even then only modestly.

And you know what happened? The world didn’t end. Dividend stocks didn’t tank. And just recently the Fed decided to hold rates where they are… after dropping them 100 basis points in just the last half year.

Rates aren’t going back up any time soon. Period.

But let’s pretend they raise rates at every meeting for the next year and it’s not going to make one bit of difference for people like you and me. At least not for those of us who want passive income like we used to expect from CDs and bonds.

So the Fed raised rates a few times. Big deal. Are they looking for a pat on the back? Then they turned right around and lowered them… and then maybe they will raise them back up a bit. It’s just their way of trying to keep our economy from falling apart. But in the meantime they keep jerking savers around with yo-yo rates that at the end of the day don’t come near anything to provide income, let alone keep up with real inflation.

Post-COVID was the first series of serious rate raises in over two decades.

Why? Because just before COVID they couldn’t get inflation to go above 2% – to them inflation that’s too low is considered a bad thing, to those of us who shop for our own groceries it’s a completely different matter.

After COVID the economy was awash in extra dollars printed as stimulus checks and inflation was cranking like we hadn’t seen since the Carter years.

And since then they’ve paused then raised then paused and then raised a little and played the “wait and see” game. And then maybe they’ll raise them another 0.25% or maybe their drop rates by 0.25%. Who knows?

Let me spell it out: that quarter of a percent is 0.0025. And what has your bank raised CDs to? Back to the 5, 6, 7% we enjoyed a little before the 2008 crash? The kind of return you could actually live off of.

No, the banks raised them to still below 4%. And only begrudgingly. Can you live on 4% interest in a world where the cost of everything continues to go up?

And this will go on for years… maybe a decade or more.

Despite all the cheerleading, the Fed is too scared to do anything other than incremental rate tweaks of 0.0025… and with “wait and see” pauses between each rate change.

Frankly, it’s hard to imagine a day when we ever get back to those decent yields on CDs that we could live off the interest.

And worse, if you follow the news then you know that all of the talk is about cutting rates, not raising them.

We just have to face it: you’re never going to be able to go back to when you could park your money into CDs maturing in successive months (in banking terms this is called laddering) and take the cash out without so much as lifting a finger. I know that’s not what some people want to hear.

Growing up and even deep into our careers we were told to save our money, put it in CDs, and live off the interest. That’s what they told us… but that’s not an option now and it’s not coming back.

Sorry, but it’s the truth and I’m not the kind of guy to sugarcoat the truth. And the sooner we face up to the truth the sooner we can take action and do something about it… the sooner we can take control of our financial well-being.

And this is why the Monthly Dividend Paycheck Calendar is more important than ever.