I’ve sold the Snowball shares in NRR for a profit of £69.00,including the earned dividend but not received until January.

I’ll re-invest the funds in a longer term holding.

Investment Trust Dividends

I’ve sold the Snowball shares in NRR for a profit of £69.00,including the earned dividend but not received until January.

I’ll re-invest the funds in a longer term holding.

Andrew Didham, Chairman of GCP Infra, commented:

This year marks the Company’s 15th anniversary since IPO and I would like to take this opportunity to thank shareholders for their ongoing support. During this time, the Company has delivered a total NAV return of 185.2% and has achieved the objectives set out at IPO of generating income, preserving capital and diversifying across a range of asset classes.

The Company continues to pay a stable and sustained dividend, underpinned by an operational and diverse portfolio of UK infrastructure assets, paying a dividend of 7.0 pence per share in line with the target for the 2025 financial year. I am pleased to confirm that the same target1 is reaffirmed for the forthcoming financial year.

The objectives of the capital allocation plan have progressed, albeit slower than hoped or anticipated. The Company has generated total disposal and cash proceeds of c.£80 million from the realisation of various renewables assets, and portfolio equity exposure has been materially reduced. Leverage has been reduced from £104 million at the time of the announcement of the plan to £20 million at 30 September 2025 and furthermore, £35.6 million has been returned to shareholders through the buyback programme. The Investment Adviser is actively progressing transactions that, if completed, would materially complete the objectives set out in this plan.

Following publication of this annual report, and completion of the capital allocation plan, the Company intends to engage with shareholders early in 2026 to propose a future strategy for the recycling and use of capital.

1.The dividend target set out above is a target only and not a profit forecast or estimate and there can be no assurance that it will be met.

GCP current dividend yield 9.9%.

If you have a dividend re-investment plan, it’s your duty to check the fcast for next year and if the fcast dividend is paid.

(Image credit: Cristina Gaidau / Getty Images)

Dividends went out of style in the pandemic. It’s great to see them back, says Rupert Hargreaves

“The true investor… will do better if he forgets about the stock market and pays attention to his dividend returns.” – Benjamin Graham

Dividend income has always been one of the key contributors to equity-market returns, especially in periods of volatility or bear markets. In the 1970s and 2000s, both periods of significant market volatility for the S&P 500, virtually all of the index’s returns came from income, according to data compiled by Bloomberg and Guinness Global Investors. In the 1970s, the index recorded growth of 76.9%, with 17.2 points coming from price appreciation and 59.7 from dividend income. In the 2000s, the index fell by 24.1%, but dividends added 15 points for a total return of -9.1%.

The longer one stays invested, the more critical dividends become. Guinness Global’s data, going back to 1940, reveal that, over rolling one-year periods, the total contribution from dividend income to total return was just 27%, but that number grew to 57% over a rolling 20-year period. They also reveal that $100 invested at the end of 1940, with dividends reinvested, would have been worth approximately $525,000 at the end of 2019, versus $30,000 with dividends paid out. In this period, dividends and dividend reinvestments accounted for 94% of the index’s total return.

Stay ahead of the curve with MoneyWeek magazine and enjoy the latest financial news and expert analysis, plus 58% off after your trial.

The same trend has been observed in the UK. Between 1 January 2000 and 31 December 2019, the FTSE 100 delivered an average annual return of just 0.4%. However, if you include dividends, the index has actually returned 122% over the same period (or 4% a year), according to Schroders’ calculations.

Still, there’s a reason the figures presented only go up until 2019. Since the pandemic, this relationship has broken down. The latest data from S&P Global show that, since 1926, dividends have contributed about 31% of the total return for the S&P 500, while capital appreciation has contributed 69%. That’s mostly down to the performance of the past five years.

Since the end of 2021, dividend stocks, as defined by the S&P 500 Dividend Aristocrats index – S&P 500 constituents that have followed a policy of increasing dividends every year for at least 25 consecutive years – have produced a total return of just 9% a year compared with 15.6% for the broader S&P 500 index. This decade, dividends have added just 12% to the S&P 500’s total return, the lowest contribution on record, says Hartford Funds.

As Ian Lance, co-manager at the Redwheel and Temple Bar Investment Trust, notes, equity returns have been “driven by a positive re-rating of equities, particularly in the US and particularly in technology stocks”. Dividend stocks were also hit disproportionately hard in the pandemic years. During 2020, $220 billion of dividends were either cut or paused, according to Janus Henderson.

Research by Goldman Sachs found that more than 80% of US dividend exchange-traded funds (ETFs) underperformed the S&P 500 during the 2020 equity drawdown period, and half of them did not bounce back as strongly as the index in the subsequent recovery.

Dividend stocks also “tend not to perform well when interest rates rise”, as Alan Ray, investment trust research analyst at Kepler Partners, notes. “Investors drawn to conservatively managed dividend-paying companies when interest rates were close to zero now find they can buy ‘risk-free’ UK gilts with yields of 4% or 5%, or even just keep cash in a savings account,” says Ray.

Despite the headwinds for dividend stocks over the past five years, history shows they can be a safe haven in periods of volatility and uncertainty. What’s more, many income stocks are now trading at relatively undemanding valuations compared with their growth peers, suggesting there’s a bigger margin of safety with these equities in the event of a market downturn.

There’s no official definition of what makes a good income stock, but there’s one thing most of the research on the topic agrees on, and that’s a correlation between yield and quality, or rather the lack of it. While a dividend stock with a high yield might seem attractive as an income play, more often than not the yield is a reflection of traders’ doubt about the sustainability of the payout.

As Martin Connaghan, co-manager of Murray International Trust, notes, “there is no point in being drawn in by a high dividend yield… because that yield is most likely unsustainable and hence false. Stocks that have, on the face of it, very high yields can be vicious value traps if dividends are subsequently cut.”

In fact, research shows that, rather than chasing high yields, investors should instead look to companies offering yields around the 2% to 4% mark. Yield itself should not be used as a gauge of quality. The best way of evaluating the sustainability and quality of a dividend payout is to analyse the quality of cash flows. In business, cash is king. Cash flow gives a good indication of management’s approach to capital allocation.

As Imran Sattar, portfolio manager of the Edinburgh Investment Trust, notes, “For stocks with higher yields it is important to understand the sustainability of that dividend, how much the dividend is covered by earnings and free cash flow, or ongoing capital generation in the case of a bank… and also to think about whether there is anything on the horizon that could change the cash-flow dynamics such as an increased need for investment.”

This view is echoed by Connaghan, who says, “The ability to sustain and grow dividends is essential. Companies with a high cash-conversion ratio, dividend cover and free cash-flow yield should be in a much stronger position to do this.”

Free cash flow is generally defined as the cash flow generated by operations, excluding the costs of running the business and capital expenditures. In a traditional capital allocation framework, if a firm has free cash to spend, it should first reinvest it back into its operations if it can achieve an attractive and sustainable return on investment. If this opportunity is not available, the company should use the money to reduce debt, and if it has no debt, return the money to investors.

Cash flow figures give us a real, unabridged version of what management is doing with a company’s funds. Investors often turn to earnings before interest, tax, depreciation and amortisation (Ebitda) as a proxy for cash flow, as that’s the metric companies usually like to present. However, this ignores essential business costs, such as the replacement of capital equipment, interest on debt and taxes.

Similarly, a simple dividend cover calculation, which generally takes earnings per share divided by the dividend per share, also provides a misleading picture. Earnings per share do not account for all capital expenditure, particularly on long-term assets, which can be extremely costly for capital-intensive companies. When a company pays a dividend, the money leaves the business. That means the capital must be truly surplus to requirements to prevent problems emerging at a later date.

History is littered with companies that have paid out too much during the good times and have struggled with weak balance sheets and a lack of shareholder support in the bad.

The best dividend stocks are those in companies that strike a balance between operational costs, including capital expenditures, and prudent balance-sheet management, along with sensible dividend policies. And they avoid the damaging concept of a “progressive dividend policy”. Progressive policies envisage the dividend rising steadily year after year. They are designed to provide security for investors. In fact, they do the opposite.

Companies always have and always will go through cycles, and making a commitment to increase a dividend year after year, no matter what, forces management into wrong decisions. It’s difficult to cut a dividend when such a policy is in place, which often puts firms in difficult positions, having to pay out more than they can afford.

Some of the most sensible dividend policies are based on small regular payouts, with annual special dividends based on profit throughout the year. This gives more flexibility, allowing management to announce additional distributions as needed without putting undue stress on the balance sheet. Managers can also choose to alternate between dividends and share buybacks, the latter being easier to turn on and off depending on the business environment.

FTSE 100 insurance giant Admiral is an excellent example. Car insurance can be a volatile and unpredictable business. It moves between a hard market when insurance prices are rising and profits are plentiful and a soft market where competition intensifies, prices fall and insurers have to stomach big losses. Managing a business through this cycle requires financial flexibility and a strong balance sheet, so Admiral cannot afford to commit itself to an unsustainable dividend policy. Instead, it commits to distribute 65% of its post-tax profits annually as a regular dividend, supplementing these distributions with special payouts.

For example, for the first half of the year, Admiral declared a regular dividend of 85.9p per share and a special dividend of 29.1p per share, for a total distribution of 115p, or 88% of post-tax profit. This was a pretty hefty interim distribution for the group. In 2021, a bumper year following the pandemic, which forced a change in driving habits and a substantial reduction in accidents, the company’s annual dividend payout reached just under 280p per share. However, in the following years, as drivers returned to the road and started crashing into each other, the company reduced its distribution in line with falling profits. For the 2023 financial year, it paid out just 103p across both its interim and final dividends.

Another example is CME Group. It pays a regular quarterly dividend, equivalent to a yield of about 2% per year. It supplements this with a special distribution at the end of the year based on annual trading performance. Last year, for example, the company paid out four regular dividends of $1.15 per share and one final special dividend for the year of $5.25.

The perils of a regular dividend policy became all too clear in the mining sector back in 2016. That year, commodity prices slumped as China’s previously meteoric growth started to splutter to a halt, leaving mining giants such as BHP, Rio Tinto, Glencore and Anglo American in a difficult position. Not only had these companies made a commitment to hefty, regular, progressive dividends based on past profitability, they had also spent and borrowed heavily to fund growth.

As commodity prices and revenue plunged, something had to give. BHP cut its interim dividend by 75%, the first cut since 1988, and abandoned its progressive dividend policy. Rio also slashed its dividend in half and Glencore was forced into a messy restructuring involving a $2.5 billion cash call, as well as a dividend cut.

In another example, BT had to cut its dividend in 2020 when management realised the company needed to spend more on its fibre build-out to keep up with the competition. This was a big blow for income investors as prior to the cut BT was often touted as one of the UK market’s top income plays.

Sensible capital allocation is a good indicator of dividend quality, as is the overall quality of the business. Quality can be defined in many different ways. Warren Buffett summed it up quite well in his letter to shareholders of Berkshire Hathaway in 1996: “Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business whose earnings are virtually certain to be materially higher five, 10 and 20 years from now.”

To put it another way, a quality company is one that has a strong competitive advantage and a long runway for growth. A strong competitive advantage also typically translates into higher-than-average profit margins, providing the company with ample cash to invest in marketing, growth and debt repayment, and to return funds to shareholders.

James Harries, co-manager at STS Global Income & Growth Trust, says the best income stocks are “predictable, resilient, high-quality businesses” you can “say something sensible about on a five-,seven- and 10-year view”. That often means sticking with the companies that he describes as “steady as she goes” – they often “grow slower, but [grow] more persistently”.

A great example of the strategy, and a recent addition to the portfolio, is Nike. “It’s the highest quality global sports brand,” notes Harries, and though the company is going through some turbulence, “I’m pretty confident that we’re buying a really high-quality asset at a very attractive valuation”. Nike is one of the best-known and valuable consumer brands in the world, boasts a gross profit margin of more than 40%, and has billions of dollars in net cash on the balance sheet. It’s also rewarding shareholders, with $591 million in dividends in the first half of 2026 and $18 billion returned via share buybacks since June 2022.

The utilities sector can also be a good place to hunt for income. “Often a utility company operates in a regulated sector that is supported by a long-term concession contract, which will stipulate the return that can be generated over the life of the concession,” notes Jacqueline Broers, co-portfolio manager at Utilico Emerging Markets. As a result, cash flows can be more “resilient” and “predictable” than those of other sectors. “All of which translates into a more sustainable long-term dividend payout.”

Broers highlights the example of IndiGrid Infrastructure Trust, which owns 41 power projects comprising 17 operational transmission projects, three greenfield transmission projects, 19 solar generation projects, and battery energy storage (BESS) projects located across 20 states and two union territories in India. The average remaining contract life on the company’s transmission assets is just under 26 years, with contracted revenues underpinning the company’s dividend yield of about 10%.

The other advantage utilities tend to have is the prohibitive replacement cost of their assets. Take UK-based National Grid, which owns the majority of the UK’s high-voltage transmission network, comprising thousands of miles of cables and transmission stations. Building these assets from the ground up would be virtually impossible today, not to mention the vast cost. That gives the company a robust competitive advantage.

Utilities aren’t the only companies that can have such an edge. Connaghan points to the likes of Grupo ASUR, a Mexican-listed airport operator with 16 assets across Central and Latin America. “Its key asset is Cancun airport and the company has seen its passenger numbers increase by a compound annual growth rate of 6% over the last 35 years,” he says. “Such was the financial strength of this business in the earlier part of this year that in April, they announced two 15-peso special dividends in addition to a regular dividend of 50 pesos. This put the stock on a 14% dividend yield.”

The fund manager also highlights the likes of Enbridge, a Canadian pipeline business which transports and stores natural gas and oil through its network, which spans North America. The company has grown its dividend for 30 years in a row. “This type of business is far less exposed to the underlying shifts in the commodity prices themselves, as 98% of its Ebitda comes from assets backed by either regulated returns or take or pay agreements,” he notes.

The structure of an investment trust lends itself to income investing. Not only do they give investors access to a well-diversified portfolio of income stocks, but they can also pay dividends out of both capital and income, unlike ETFs and other open-ended investments. That means trusts are more likely to be able to sustain their dividends in periods of market volatility. Trusts with a global mandate also have far more flexibility in where they can invest so they can pick the best income, quality and growth plays in the world.

JP Morgan Global Growth and Income (LSE: JGGI), Murray International (LSE: MYI), Scottish American (LSE: SAIN) and STS Global Income & Growth (LSE: STS) all have a global mandate. Ecofin Global Utilities and Infrastructure (LSE: EGL) has a global mandate within its utility sector. Others, such as Law Debenture (LSE: LWDB) and Temple Bar (LSE: TMPL), have a UK focus, but with some international holdings.

Brett Owens, Chief Investment Strategist

Updated: December 3, 2025

Let’s get our 2026 dividend shopping finished ahead of time, shall we?

Come January, we’ll have plenty of company from vanilla investors, rushing to “figure out the new year.” Trends. Predictions. Buy this!

But there’s no reason to wait. We already know some of the key dimensions of 2026. Interest rates, for one, are on their way down. Fed Chair Jay Powell has delivered two rate cuts to end the year, with more to follow.

Whether or not Powell personally delivers them doesn’t matter to us. Powell is on his way out. But the Fed show will go on, with a ringmaster ready to roll.

Kevin Hassett isn’t some mystery bureaucrat drifting into the big chair. He’s been broadcasting his playbook for two decades. Hassett spent the 2000s arguing that the Fed moves too slowly, waits for too much data and leaves too much growth on the table. He quipped that the Fed should “cut early and cut often” because market confidence is a policy tool, too.

Now, he gets to run the show. And he’s being appointed by an administration that wants mortgage rates lower yesterday, housing market activity and growth charts that point up. Hassett knows the assignment—cut early and often!

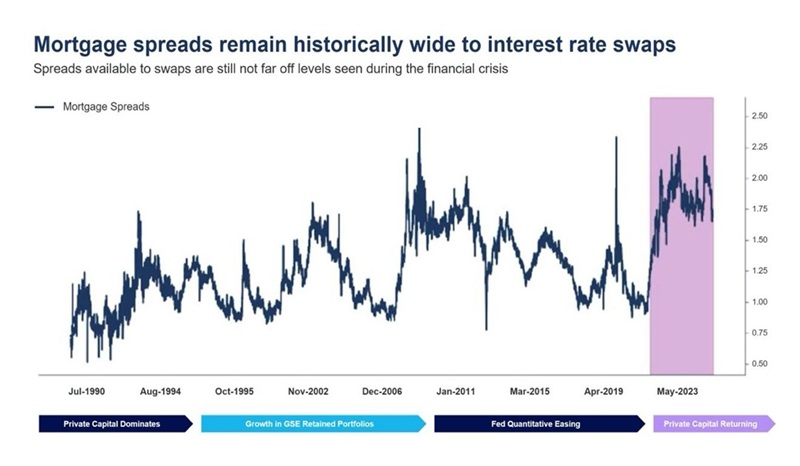

When this happens, mortgage REITs Annaly Capital (NLY) and Dynex Capital (DX) are going to run. These stocks yield 12.3% and 14.7% respectively, but these dividends are merely a generous appetizer for the main course of price appreciation. Annaly and Dynex both boast portfolios that are perfectly positioned for the dawn of the Hassett era. They own government-backed mortgages that rise in value as long-term rates fall. Few companies benefit more from falling rates than these two.

Annaly and Dynex are sneaky bargains with mortgage spreads—the difference between the 10-year Treasury yield and mortgage rates—just coming down from manic levels. Over the last 20 years, the Great Financial Crisis, 2023 bond meltdown and 2024 mortgage-rate spike delivered the greatest “spreads” in which it was a great time to be an mREIT buyer:

Mortgage Spreads Ease from Manic Levels

The spread is the engine of profit for Dynex and Annaly, and the engine rarely runs this hot. Both firms loaded up on cheap “agency” mortgage-backed securities when spreads were peaking. These are government-guaranteed bonds backed by Fannie Mae and Freddie Mac. No subprime surprises or commercial property problems here.

Spreads have been easing with mortgage rates coming down all year. The administration wants them lower. With each tick down, Annaly and Dynex portfolios gain in value.

Now 2026 won’t just be about cheaper money. It will be the first commercial year of “Applied AI”—where AI moves past the hype stage and starts showing up in margins, product cycles and cash flows.

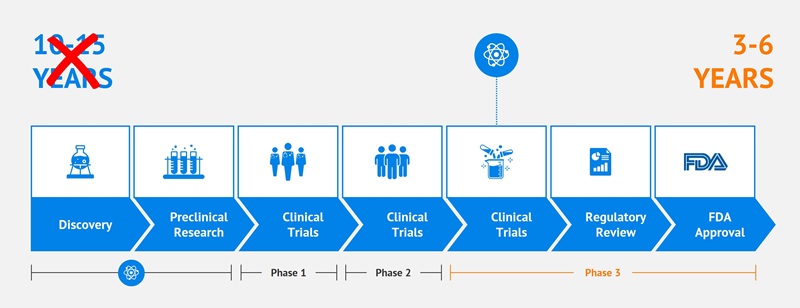

Historically, it has taken 10 to 15 years to develop a new drug. Every month matters because patents last only 20 years. The faster a company gets a drug to market, the more “gravy” months and years it enjoys with monopoly pricing power.

When patents expire, the generic versions hit the market. And the profit party is over for the original blockbuster.

AI, however, is extending the sales calendar starting in 2026.

Drug discovery cycles are already compressing. From 10 to 15 years, they will soon approach six years or less. Industry experts, in fact, are saying three to six years will be the new normal. Whoa! That can be a decade or more monopoly pricing!

No, AI isn’t replacing scientists—it’s multiplying them. These models run overnight, on weekends, forever. They eliminate dead ends and push more viable drug candidates into trials.

In the years ahead, pharma will have more shots on goal, resulting in more drug candidates and approved medications. And by getting these drugs to market faster, these companies will have more time to monetize the winners.

Profits are about to pop. BlackRock Health Sciences Term Trust (BMEZ) yields an elite 8.6%, owning some of the most innovative drug development companies on the planet. BMEZ is a neat way to buy them at a discount to their net asset value, with an enhanced dividend.

Pharma’s pick-and-shovel provider is also well positioned. A current of new pharma money will flow upstream into the company supplying the labs.

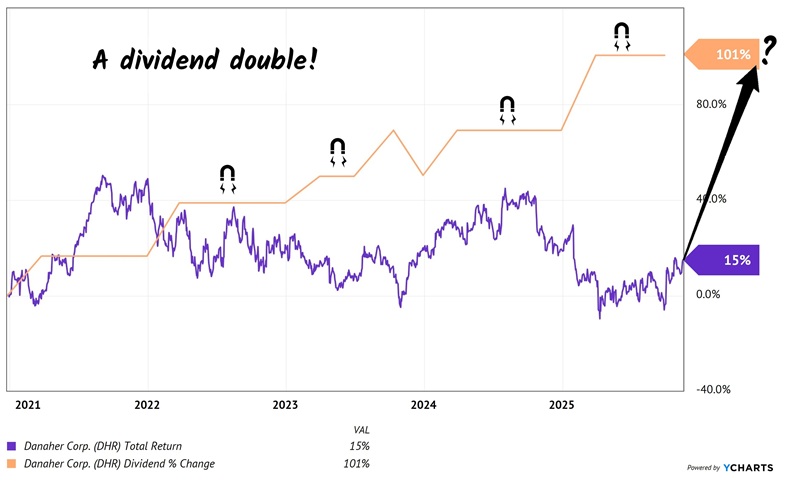

That’s Danaher (DHR), the quiet go-to company in life sciences and diagnostics. Danaher doesn’t sell drugs. It sells the tools, the instruments, the purification systems, the diagnostics, and, critically, the consumables that pharma needs to move discoveries from idea to lab to clinic to market.

No consumables, no experiments. No experiments, no drugs.

And because Danaher doesn’t sell drugs itself, it avoids the political circus entirely.

Consumables are the big catalyst here—they are the “razor blades” that labs burn through every day, and AI-driven R&D means more experiments, not fewer. That’s the first place we’re seeing gains at Danaher.

And its dividend? A phat double in a mere five years! When a payout pops 100% and a stock price rises only 15% over the same time period, saying the stock is “due” for a rally is an understatement.

Danaher’s Dividend Magnet is Due

Danaher’s management treats shareholders to regular raises, and these generous hikes add up.

Of course AI itself is a tremendous power hog. Every time ChatGPT generates a response, it pulls from enormous racks of servers running in data centers. Those servers draw electricity on the scale of small cities.

The servers are fed by the “boring” utility stocks owned by Reaves Utility Income Fund (UTG). Our closed-end fund yields 6.2%

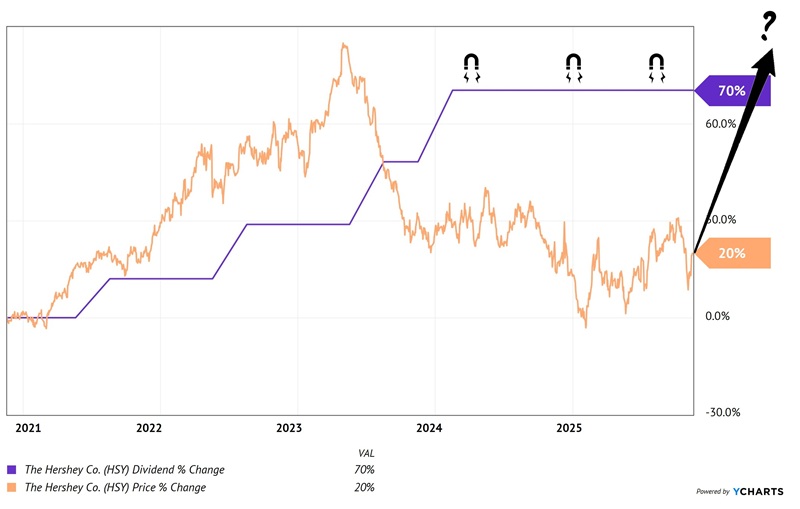

Finally, on a completely different topic from interest rates and Applied AI, let’s talk about chocolate. Hershey Foods (HSY) deserves our attention. This is an American icon that pulled back when cocoa prices exploded, input costs spiked and margins compressed.

But Hershey didn’t lose its competitive moat just because cocoa had a tantrum. The brands are as dominant as ever—Reese’s, Hershey Bars, Kit Kat, Kisses, Twizzlers—the whole candy aisle lives under this roof.

Even as cocoa kept rising, Hershey’s cash flow rebounded. Management quietly rolled out a two-year efficiency plan, pushing automation deeper into the production lines and tightening costs. They raised prices across the portfolio. And consumers, as they almost always do, kept buying their comfort food.

What we’re really buying here is the return of the dividend magnet. Hershey raised its payout 70% during a five-year period where the stock meandered. That is the kind of “magnet gap” we love to pounce on!

Hershey’s Dividend Magnet is Due

With input costs easing, restructuring savings flowing, and a beaten-down share price that’s starting to rally, Hershey is primed for a rebound.

Megatrend stocks like these are the secret to retiring on as little as $500K. The “suits” that say we need $2 million or more are talking their own book. Their “safe” strategies are failing while we income investors secure our own dividend-powered retirements with megatrend stocks like these

By Brad Thomas, Wide Moat Research

It finally happened yesterday morning.

Alexandria Real Estate Equities (ARE), a life-science-specific real estate investment trust (“REIT”), cut its dividend.

By a lot.

As PR Newswire put it, the company:

… announced that its board of directors declared a quarterly cash dividend of $0.72 per common share for the fourth quarter of 2025, representing a 45% reduction from the dividend declared for the third quarter…

This kind of action can be due to poor, complicated, or even occasionally corrupt management.

But it can also be circumstantial.

During the COVID-19 crisis, for instance, many REITs saw their properties shut down for months or more. The companies (understandably) had to cut the dividend.

I think the recent cut from Alexandria would fall into this latter category. As I’ve shared on numerous occasions, I have a high opinion of management. But the company has been dealing with dynamics in its property sector that were wholly unpredictable.

And so, today, we’ll consider if – with this bad news out of the way – shares have finally reached a turning point.

Alexandria Real Estate was founded three decades ago during the biotechnology revolution of the 1990s. Medical advancements were all the rage back then, making them must-have investments.

But Alexandria decided to capitalize on the craze in a particularly unique way – by building specialized facilities for biotech and pharmaceutical companies to operate in.

I last covered the company on November 3, writing how this:

… was something nobody had done before. But Alexandria did it so well, it was able to go public just three years later. And for a long time, it was an incredible stock to hold.

Between 1997 and late 2021, it returned more than 2,800%, or about 15% annualized. Big-name companies like Merck, Eli Lilly, AstraZeneca, Johnson & Johnson, and Novartis trust it to provide the unique working spaces they require to advance their research, including labs and attached offices.

Altogether, Alexandria boasts 700 tenants and a 39.1 million square-foot portfolio, with another 4.2 million square feet under current construction. These mission-critical facilities are located in medical research hotspots such as:

But then, COVID-19 came along…

At first glance, you might think that would bode well for a company like Alexandria. It spurred even more demand for life-science exploration. While tenants and investors alike were running away from other REITs, the collective determination to end the pandemic made the life-science situation outright manic.

Markets always respond to demand. And the demand for life sciences buildings at the time could be summed up in one word – more!

But, as always happens, this sector got over its skis. The industry overbuilt. And as the urgency of the pandemic receded, we were left with one heck of a supply glut.

As I wrote last month:

… nearly half the lab space completed between 2022 and 2024 remains empty today.

Even the most responsible life-science landlords have suffered as a result of that kind of foolishness. And it shows in [Alexandria’s] stock price. From its peak, the stock is down 74%.

So, no, this life-science landlord isn’t operating in its ideal economic environment right now. That’s why I flat-out predicted:

With earnings slowing down, ARE will evaluate its dividend in 2026 to remain aligned with per-share FFO and maintain capital for core operations. Here at Wide Moat Research, we estimate a 35% dividend cut would preserve the REIT’s $315 million in annual cash flow.

We now know that management decided to be even more conservative, slashing their payout by 45%. And the stock is down by about 13.7% since yesterday’s open.

But does that make Alexandria an even more attractive value proposition? We need more details to sort through this bargain bin.

In the past, we’ve argued here at Wide Moat Research that Alexandria enjoyed “moat like” attributes such as:

However, ongoing challenges have narrowed that moat rating.

Over the past 20 years, ARE has featured an average occupancy of 93.5%. But that figure fell to 90.6% in the third quarter of 2025 and will likely decline to around 88.5% by the fourth quarter of 2026… even after accounting for over 2% of properties that may be sold.

We also have to consider slower development leasing, with a 39% reduction in annual construction spending. Then there’s higher capital expenditure (capex) needs, with $2.9 billion of expected non-core asset sales in 2026.

Likewise, ARE’s elevated vacancy will drive higher leasing costs, since new leases are more expensive than renewals. And this will further eat into its adjusted funds from operations, or AFFO (see my recent article on AFFO here).

On its recent investor day, Alexandria noted that revenue and non-revenue-enhancing capex will go up quite a bit. For the past five years, it has averaged 17% for revenue/non-revenue-enhancing capex.

For 2026, that will shoot up to 27% to 32%. Around 55% of this is associated with upcoming vacancies at sizable assets. For instance, Alphabet’s (GOOG) life-science company, Verily, will be vacating its space in San Francisco, and another large property is going dark in Cambridge next year.

ARE has therefore announced 2026 FFO guidance of $6.25 to $6.55, which represents a 29% reduction at the midpoint.

That’s why it had to slash its dividend so severely. By doing so, it conserves $410 million of capital.

Alexandria has some other tools in its arsenal to regain shareholder value. This includes lowering construction spending, buying back shares on the cheap, and continuing to reduce general and administrative (G&A) costs – where it plans to save compared with 2024.

Then again, there are catalysts it can’t control, such as the recovery in capital formation for early-stage life science companies.

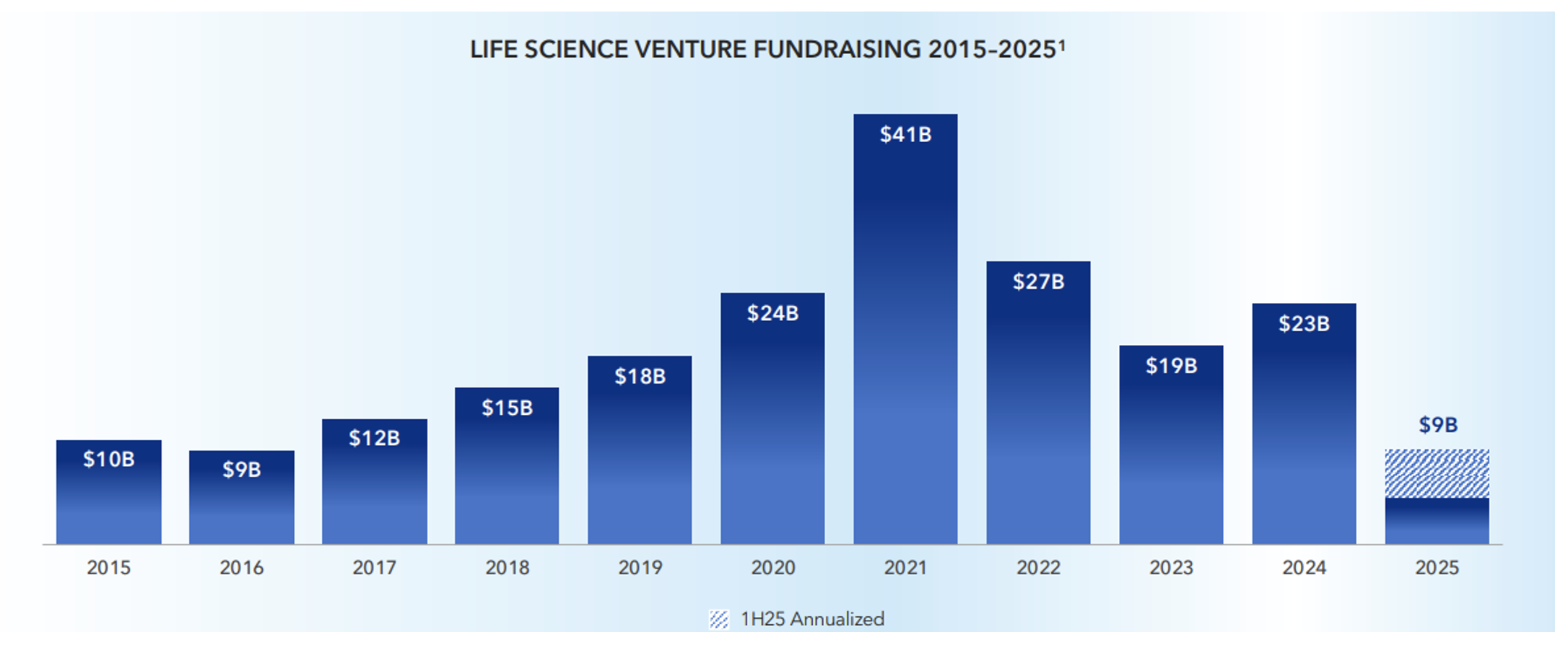

As viewed below, life science venture capital (“VC”) fundraising is at its lowest level since 2016.

Source: ARE Investor Day Presentation

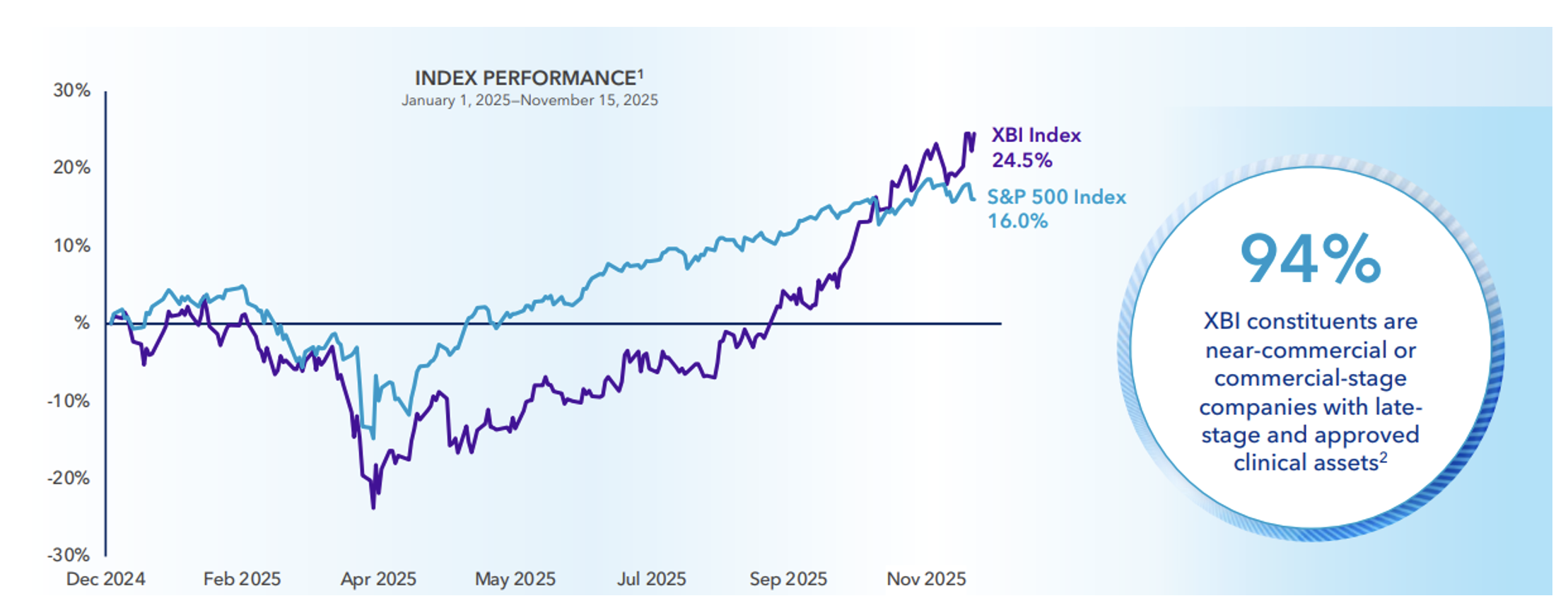

On the plus side, there is an increase in biotech interest, complete with renewed IPO activity. And that kind of growth demands more lab space.

Source: ARE Investor Day Presentation

So is ARE’s stock price in bargain territory?

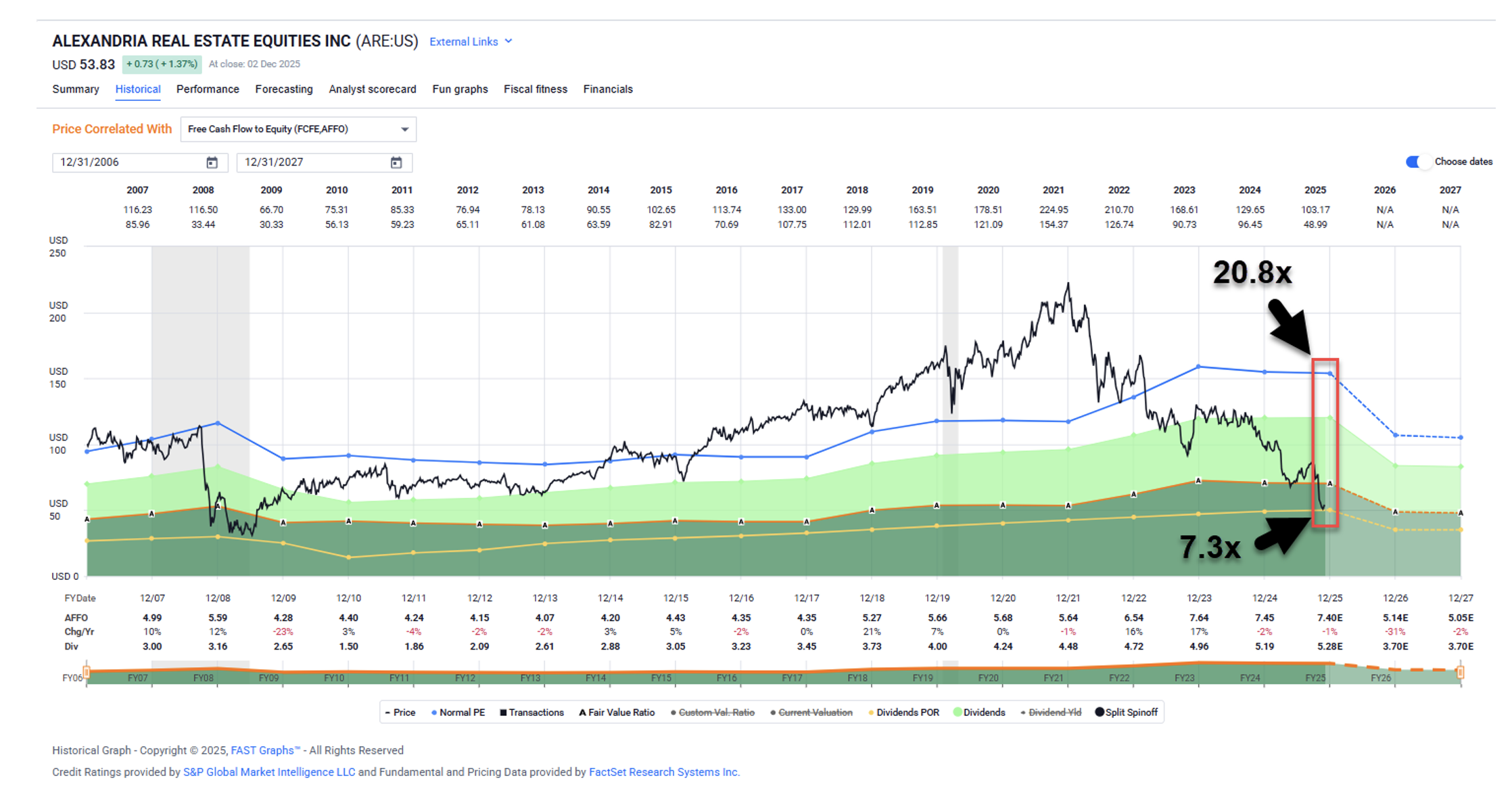

As shown below, ARE is trading at a multiple of 7.3 times compared with its normal P/AFFO of 20.8 times. The REIT hasn’t traded this low since the Global Financial Crisis.

Source: FAST Graphs

We have to also consider that how interest rates are coming down (though perhaps not this month). That supports VC interest and, in turn, serves as a catalyst for development leasing and improved profit margins at ARE.

From a value investor’s lens, one could argue that ARE is a clear bargain since it’s trading at a 50% discount to its intrinsic value. Still, its fundamentals have certainly become weaker, as evidenced by the latest dividend cut news. And there is a chance that ARE could be removed from the S&P 500 as a result.

Passive income text with pin graph chart on business table© Provided by The Motley Fool

How I’d turn £100 a month into a lifetime of passive income

Story by Charlie Keough

Building streams of passive income is a goal for many and making extra funds outside of my main source of income will provide me with an extra layer of financial security.

I don’t need an abundance of money to start doing this. With just £100 a month, here’s what I’d do

I’d put my money to work in the stock market. Some savings accounts may offer relatively attractive returns at the moment. However, with my money sitting in the bank, I’m missing out on the growth opportunities that the market provides.

More specifically, I think the FTSE 100 is a strong entry point. Many of its constituents are household names whose products are used every day. And as Warren Buffett says, it’s best to invest in companies we understand.

On top of that, the Footsie provides some of the best passive income opportunities. After all, its average dividend yield is around 4%. For comparison, the S&P 500’s is under half of that.

Within the index, I’d look for companies that have a track record of providing stable growth. While past performance is no indication of future returns, this will offer me greater confidence that the companies I invest in will be able to withstand any economic downturn, such as what we are seeing right now.

I must also do my due diligence. For example, I’d be looking at the financial health of companies, more specifically their balance sheets. A firm with high levels of debt may be at risk should it come under financial pressure. What’s more, with interest rates amplified, and predictions the UK base rate won’t decrease to 2%-3% until the tail end of next year, debt will be more expensive to finance.

I’d also look for businesses that have a history of returning value to shareholders, such as Dividend Aristocrats. These are companies that have paid and increased payouts to shareholders for a prolonged period.

£100 a month is equivalent to £25 a week. And by cutting back my spending, for example, by a coffee every day, I could more than easily afford this.

With an average annual return of 8%, £100 a month after 30 years would equate to a portfolio worth around £125,000. At a 4% dividend rate, I’d be earning just over £9,500 a year in passive income by year 30.

Of course, I’m aware these returns aren’t guaranteed. The stock market is volatile and historical performance may not repeat itself. Nevertheless, nearly 10 grand a year in passive income is not to be sniffed at, even with the impact of inflation. And this additional money could pave the way to a more comfortable retirement.

The post How I’d turn £100 a month into a lifetime of passive income appeared first on The Motley Fool UK.

Predicting the Future of Entertainment© Getty

A billionaire has offered an insight into his financial success – explaining how the process of “getting rich” begins with a simple daily task.

Back in 2011, the star shared a post entitled, How To Get Rich, in which detailed his path from living with five roommates and sleeping on a floor to appearing on Forbes’ World’s Richest People list. “It doesn’t suck to be rich,” Cuban exclaimed. “The question everyone wants answered, is how to get there.”

Whilst there is no “template” to guarantee success for everyone, there are also “no shortcuts” either, he added. The initial advice is simple, however. “Save your money. Save as much money as you possibly can,” Cuban said. Of course, this is easier said than done, but he goes on to elaborate: “Instead of coffee, drink water. Instead of going to McDonald’s, eat mac and cheese.”

Cuban, who also offers financial tips on his TikTok account, continued: “If you use a credit card, you don’t want to be rich. The first step to getting rich, requires discipline. If you really want to be rich, you need to find the discipline, can you?”

Cuban went on to emphasise that the greatest rate of return you will earn is on your own personal spending. “Being a smart shopper is the first step to getting rich,” he said. “You have to give things up and that doesn’t work for everyone, particularly if you have a family.

“That is reality. But whatever you can save, save it. As much as you possibly can. Then put it in 6 month CDs in the bank. The first step to getting rich is having cash available. You arent saving for retirement. You are saving for the moment you need cash.”

Once you’ve began to notice progress this way, Cuban said the second part of your plan should involve becoming an expert in your chosen field – whether that be your passion, a specific industry or a skill set. “Find the one you love the best and GET A JOB in the business that supports it,” the billionaire advised. “It may not be the perfect job, but there is no perfect path to getting rich.”

From £4 a Month The Donkey Sanctuary

“It could be as a clerk, a salesperson, whatever you can find,” Cuban added. “You have to start learning the business somewhere. Instead of paying to go to school somewhere, you are getting paid to learn. It may not be the perfect job, but there is no perfect path to getting rich.

“Before or after work and on weekends, every single day, read everything there is to read about the business. Go to trade shows, read the trade magazines, spend a lot of time talking to the people you do business with about their business and the people they buy from.”

Cuban warned, however, that the path is not a short-term project. “We aren’t talking days,” he clarified. “We aren’t talking months. We are talking years. Lots of years and maybe decades. I didn’t say this was a get rich quick scheme. This is a get rich path.”

Remember the Snowball never adds more cash to the seed capital, if you can you will increase your retirement Snowball but I guess a billion is a bridge too far.

| Esther Clarke maps.app.goo.gl/vdiniHaTRQaRR7uL9x iwsu@lu.qa 104.237.242.246 | I just recently got engaged and performed the hunt for the perfect diamond engagement supplant Houston, TX. The option right here is unbelievable! I discovered a magnificent ring that exceeded my requirements engagement rings houston |

Muhammad Cheema explains how an investor could target £5,555 in monthly passive income over time by making use of a Stocks and Shares ISA.

Posted by Muhammad Cheema

Published 9 December

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

As we approach closer to 2026, investors may be looking for new ways to make passive income.

I believe buying shares is one great way to achieve this. This is because investors only need to research the companies they’re invested in, not manage them.

One tax-efficient way to buy shares for this purpose is to use a Stocks and Shares ISA. You can invest up to £20,000 a year into one, and the dividends received are be tax-free.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

By investing consistently over time, it’s possible that investors could make a sizeable additional income.

So, how much would you need to aim for £5,555 a month? And what shares may help achieve this?

To achieve a passive income of £5,555 a month, investors need to consider high-yielding dividend stocks.

If we target an average portfolio yield of 5%, £1,333,200 would be needed to generate this second income straight away. It’s important to bear in mind that dividends aren’t necessarily guaranteed.

However, I doubt many reading this have that amount of spare cash to use right now. Even if you do, only £20,000 can be invested in an ISA annually to get the benefit of tax-free dividends.

However, it can still be achieved over time. For example, if investors set aside a more reasonable £20,000 initially, and then invest £1,666 a month, they could hit £1,341,746 in 24 years. That’s more than enough to generate £5,555 a month.

Crucially, the £1,666 monthly investment means it’s just under the ISA limit. Moreover, this is computed under some pretty conservative assumptions, notably that annual share price and dividend growth are only 2%. Investors would also need to reinvest their 5% dividends.

A juicy 6.7% yield

As mentioned above, an average yield of 5% could help to generate an investor’s passive income machine. That’s why Pfizer (NYSE:PFE) is a good share to consider, with a handsome 6.7% dividend yield.

Since the start of 2025, the pharmaceutical giant has seen its shares fall by 3.2%. Considering the S&P 500 has gained 16.7% over the same period, this has been disappointing.

However, savvy investors will understand that the cost to obtain the future stream of Pfizer’s dividend is now 3.2% cheaper than it was at the start of the year. Furthermore, its yield is far superior to the S&P 500’s 1.1%.

It also has a strong track record of raising its dividend year on year. It’s now increased every year since 2010.

There are some risks with respect to the company. The biggest is that it has several patents coming to an end over the next few years.

For example, Eliquis, its top-selling medicine, is set to lose its patent exclusivity in Europe in 2026 and in the US in 2028.

However, I still believe the firm’s long-term prospects remain strong. This is because it has plenty of exciting candidates in its pipeline, such as its PF-4044 medicine, which management believes could be used to treat various types of cancer.

While the company may have struggled with growth over the last few years, I believe it has solid foundations to bounce back and resume growth. That’s why I believe investors should consider its share

Will the stock market crash next year? Nobody knows for sure, including our writer. Here’s what he’s doing now to prep for whenever a crash comes.

Posted by Christopher Ruane

Published 9 December

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

At the start of 2025, I saw various reasons to be concerned about where the stock market might go. 2025 is not over yet, but so far we have avoided a stock market crash

April did see a ‘correction’, commonly defined as a sudden fall of 10% or more, whereas a crash requires 20% or greater.

The FTSE 100’s 11% fall in the first week of April now feels like a distant memory. Indeed, since then, the flagship UK share index has risen 26%.

But is the British economy 26% stronger than in April – or at all?

I do not think the economy is in notably better shape than it was earlier in the year.

In itself though, that might not be relevant in terms of where the UK stock market goes from here.

After all, the FTSE100 remains less aggressively valued relative to earnings than its US counterpart and some other overseas stock market indexes.

Broadly speaking, investor sentiment has held up so far this year despite wobbles along the way. That could continue.

What if it does not, though?

Sooner or later there will be a stock market crash — but nobody knows when.

Could it happen in 2026 ? Absolutely. Geopolitical risks remain high and the global economic outlook is not that strong.

However, that was true a year ago – and since then, stock markets on both sides of the pond have moved upwards. Key indexes including the FTSE 100 have repeatedly set new all-time highs along the way.

Rather than trying to time the market, which it is impossible to do with absolute confidence, I am instead making hay while the sun shines – but also preparing for a storm!

By ‘making hay’, I mean that this year I have bought shares I think potentially offer great value.

Some, such as JD Sports and Diageo, have seen their prices tumble this year even while the broader FTSE 100 index has moved upwards strongly. I have bought both.

But I am also preparing for that storm even though I do not know when it will happen.

Specifically, I have been looking for great companies I would love to invest in, but that currently sell for more than I want to pay.

That way, if a market crash brings prices tumbling down, I should be ready.

For example, Games Workshop (LSE: GAW) is the sort of quality company I would be happy to own – if only I could buy it at what I saw as an attractive price.

The Games Workshop share price has been riding high, having risen 92% over the past five years.

Selling fantasy games and associated paraphernalia is big business – and offers attractive profit margins. Games Workshop benefits from its own intellectual property including franchises like Warhammer.

It also has a well-heeled, loyal customer base and proven business model. So even in a tough economy, it may keep doing well.

The company’s concentrated manufacturing base brings risks, especially if anything happens to take its main factory complex offline.

But at the right price I would gladly add some of its shares to my portfolio.

Compiling a list of brilliant shares to buy.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑