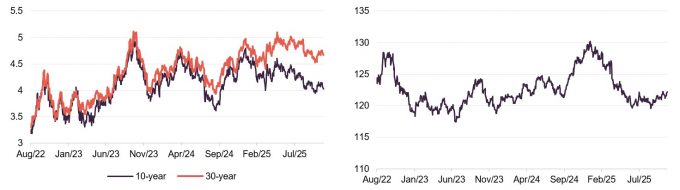

The US president has pushed for lower interest rates, but the Federal Reserve has resisted, citing worries about inflation from tariffs. Threats to dismiss Fed board members and its chair could hurt confidence in US bonds. US inflation has been rising anyway.

Debt investors are also worried about the long-term impact of the One Big Beautiful Bill (OBBB), which is expected to add trillions to the US deficit. If government borrowing costs also rise, this could cause further issues.

Figure 2: US long-term government bond yields

Figure 3: US dollar trade-weighted index

Source: Bloomberg

Source: Bloomberg

These concerns have likely weakened the US dollar, which has dropped sharply from its February peak on a trade-weighted basis. The decline could continue if investors move more money out of US assets.

Figure 4: Value versus growth in US market

Source: Bloomberg (based on MSCI US value and growth total retu

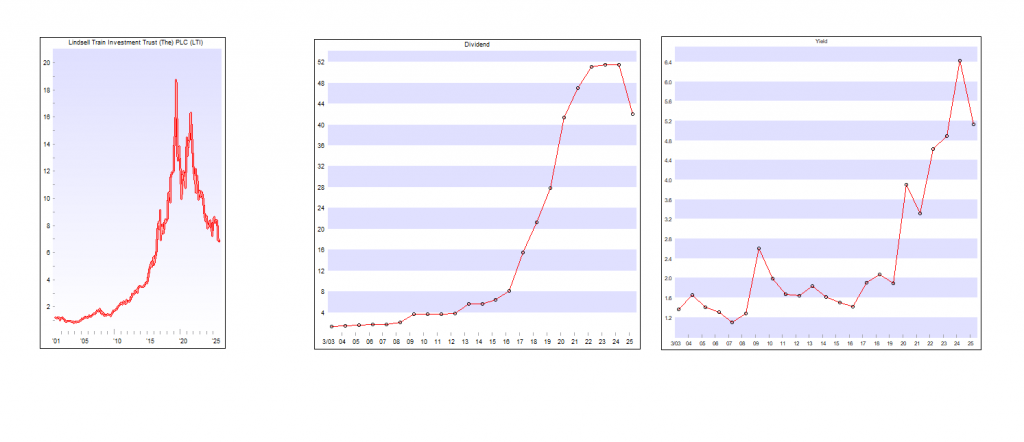

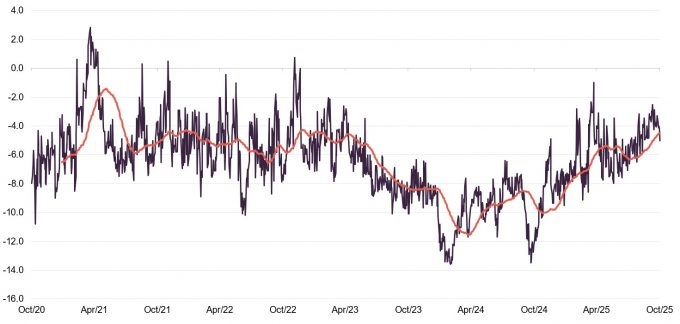

For BRAI, the key issue is how value stocks perform compared to growth stocks. As Figure 4 shows, value stocks have lagged behind growth stocks over the past 20 years, mainly due to the long period of low US interest rates after the 2008 financial crisis.

In late 2021, expectations of rising interest rates sparked a rally in value stocks, but this peaked at the end of 2022. Since then, growth stocks have outperformed again, driven largely by the success of AI. Another potential value rally was cut short by Liberation Day.

The managers note that unpredictable US policy changes make their job more challenging but also create unusual investor behaviour, leading to more mispriced stocks.

The portfolio

New portfolio in place from 22 April 2025

The portfolio was fully realigned to the new strategy by 22 April 2025, with no cost to ongoing shareholders due to the manager’s contribution to expenses and the NAV uplift from the tender offer. Previously, almost 10% of BRAI’s portfolio was in non-US stocks, but it is now entirely invested in US stocks.

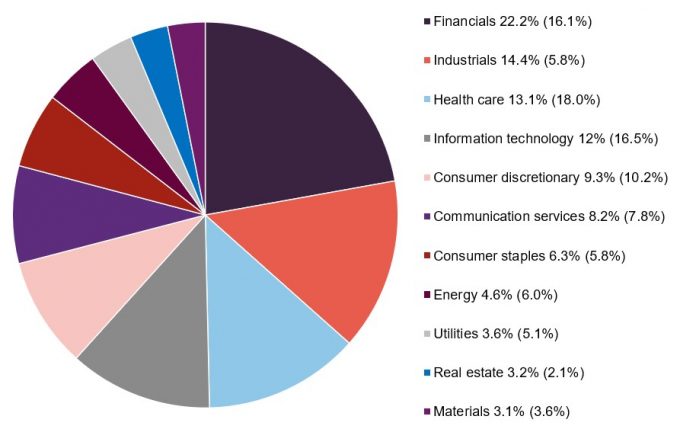

Marked shifts in sector and stock exposures

Figure 5 shows the portfolio breakdown by industry sector as at 30 September 2025, compared to the end of the last financial year (31 October 2024). There have been significant changes, with much higher exposure to financials and industrials, and lower exposure to healthcare and information technology. The net effect is that, on a sector basis, the portfolio now closely matches the benchmark, so most of the added value comes from choosing the right stocks.

Figure 5: BRAI asset allocation by sector as at 30 September 2025 (and as at 31 October 2024)

Source: BRAI

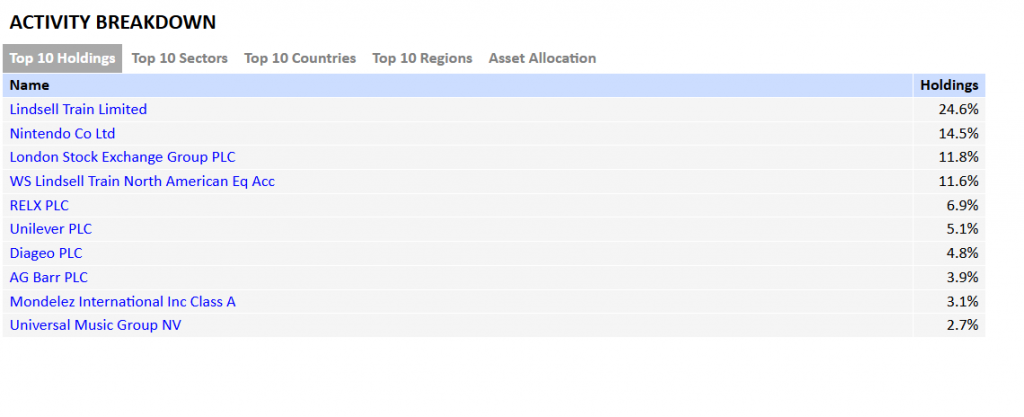

There is very little overlap between BRAI’s 10 largest holdings at the end of its last financial year (31 October 2024), before the new investment approach, and the top positions in the portfolio at the end of September 2025.

Figure 6: Top 10 holdings as at 30 September 2025

| % as at 30/09/25 | % as at 31/10/24 | Change | ||

|---|---|---|---|---|

| JPMorgan Chase | Financials | 3.2 | – | 3.2 |

| Berkshire Hathaway | Financials | 2.8 | – | 2.8 |

| Walmart | Consumer staples | 2.6 | – | 2.6 |

| Amazon | Consumer discretionary | 2.6 | 1.7 | 0.9 |

| Bank of America | Financials | 2.3 | – | 2.3 |

| Alphabet | Communication services | 1.9 | – | 1.9 |

| Morgan Stanley | Financials | 1.9 | – | 1.9 |

| Johnson & Johnson | Health Care | 1.8 | – | 1.8 |

| Charles Schwab | Financials | 1.7 | – | 1.7 |

| Pfizer | Health Care | 1.6 | – | 1.6 |

| Total | 22.3 |

Source: BRAI

Performance

Building a track record of outperformance

As mentioned earlier, we do not consider BRAI’s returns before the strategy change relevant here. Figure 7 shows BRAI’s share price and NAV performance compared to its benchmark and the S&P 500 Index.

The data indicate that BRAI has made a strong start, regularly outperforming its objective. The S&P 500’s gains have been driven by a few large AI-related companies, while BRAI’s benchmark is more diversified. Notably, BRAI has delivered solid returns over the past six months without heavily relying on the mega-cap AI trend.

It is still too soon to assess the volatility of these returns, but we will cover this in future reports.

Figure 7: Total return performance data for periods to end October 2025

| Calendar year | 1 month (%) | 3 months (%) | 6 months (%) | Since 22 April 2025 (%) |

|---|---|---|---|---|

| BRAI share price | 2.3 | 8.6 | 17.7 | 16.6 |

| BRAI NAV | 3.6 | 8.1 | 17.2 | 21.4 |

| Russell 1000 Value | 2.9 | 5.9 | 15.1 | 18.5 |

| S&P 500 | 4.9 | 9.0 | 25.6 | 32.3 |

Source: Bloomberg

Dividends

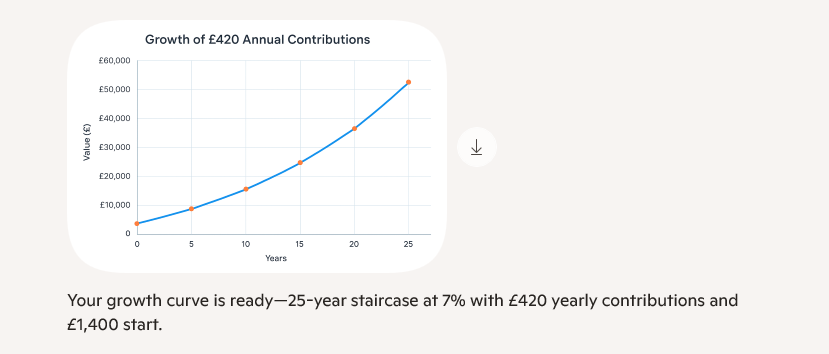

New enhanced dividend policy roughly 6% of NAV each year

From 17 April 2025, BRAI began paying a quarterly dividend equal to 1.5% of its NAV, or about 6% per year. The chart’s x-axis shows past ex-dividend dates, and future payments are planned for April, July, October, and January.

Figure 8 highlights BRAI’s dividend history over five years, with the final column showing the impact of the higher dividend policy.

To support these higher dividends and potential share buybacks, BRAI had £105.7m in distributable reserves at the end of April 2025. Paying dividends above net revenue is not new for BRAI, as its dividends have not been covered by earnings since FY 2017. This approach allows BRAI to invest flexibly across the US market, aiming to maximise total returns without needing to focus on high-yielding stocks.

Figure 8: BRAI five-year dividend history for financial years ending in October

Source: BRAI, Marten & Co

Premium/(discount)

Over the 12 months to 31 October 2025, BRAI’s shares traded at a discount to NAV ranging from 11.9% to 1.0%, averaging 6.3%. As of 26 November 2025, the discount stood at 5.4%.

The discount increased during 2023 as markets were led by the Magnificent Seven and value stocks lagged. BRAI’s rating started to recover in October, helped by the expected tender offer, and is now at a more reasonable level. The board hopes investors will support the new strategy and help the trust grow again.

Conditional tender offers

If BRAI does not outperform its benchmark by at least 0.5% a year after fees over three-year periods (the first ending 30 April 2028), it will offer shareholders a 100% tender at a 2% discount to NAV after costs. This tender offer will also be made if the company’s net assets fall below £125m at the end of any of these periods.

Figure 9: BRAI’s premium/(discount) over the five years ended 31 October 2025

Source: Bloomberg, Marten & Co

Structure

Capital structure

BRAI has 95,361,305 ordinary shares, with 38,949,167 held in treasury, leaving 56,412,138 shares with voting rights. Its financial year ends on 31 October, with AGMs usually in March. The board plans to announce the next annual accounts in January 2026. Shareholders approved the company’s continuation at this year’s AGM, with the next vote set for 2028 and every three years after that.

Fees and costs

From 17 April 2025, BRAI’s management fee is tiered: 0.35% on the first £350m of NAV and 0.30% on any amount above that. There is no performance fee.

The ongoing charges ratio for the year ended 31 October 2024 was 1.06%, based on the previous 0.70% management fee. With the reduced fee, this ratio should be significantly lower in this and future years. The board has estimated that over a full 12-month period under the new fee, the ongoing charges ratio is expected to decrease to around 0.70%–0.80%.

With the new enhanced dividend policy, the Trust joins the Watch List.