Current income for this calendar year £9,904.00

Current announced dividends £1,610.00

Fcast for this year £11,828.00

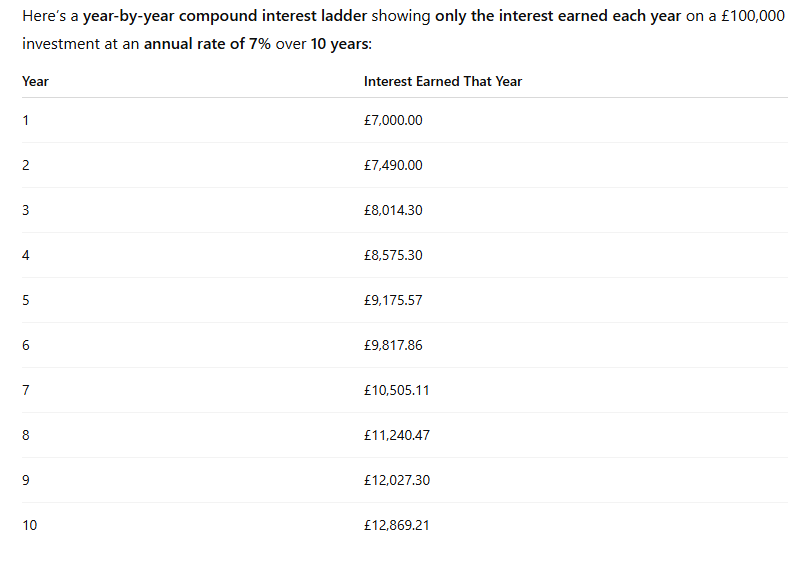

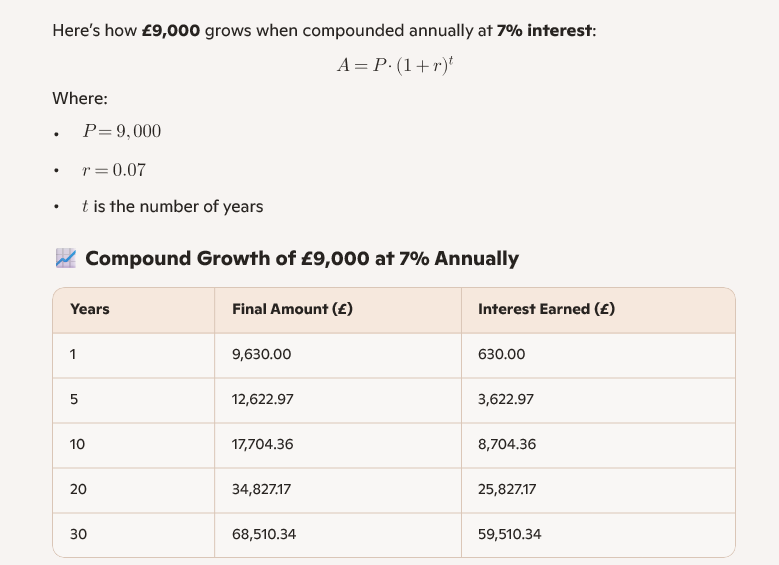

But that will soon be history, the fcast for 2026 is £9,817.00 and the target £10,500.00

Investment Trust Dividends

Current income for this calendar year £9,904.00

Current announced dividends £1,610.00

Fcast for this year £11,828.00

But that will soon be history, the fcast for 2026 is £9,817.00 and the target £10,500.00

DIY investors on picked out these investment trusts as their favourites during October:

| Header Cell – Column 0 | Investment Trust (Interactive Investor) | Investment Trust (Fidelity Personal Investing) |

|---|---|---|

| 1 | Scottish Mortgage | F&C Investment Trust |

| 2 | Polar Capital Technology | Temple Bar Investment Trust |

| 3 | Greencoat UK Wind | Schroder Oriental Income Fund |

| 4 | City of London | Schroder Japan Trust |

| 5 | Temple Bar Investment Trust | TwentyFour Income Fund |

| 6 | Golden Prospect Precious Metals | International Public Partnerships |

| 7 | Henderson Far East Income | M&G Credit Income Investment Trust |

| 8 | Fidelity China Special Situations | CQS New City High Yield Fund |

| 9 | NextEnergy Solar | GCP Infrastructure Investments |

| 10 | JPMorgan Global Growth & Income | JP Morgan European Growth & Income |

Source: Interactive Investor, Fidelity International

There is less overlap on the investment trusts that investors favoured on each platform, though Temple Bar appeared on both lists.

Investors do seem to have used investment trusts in part to diversify away from the US and towards Asia during October, with investment trusts focusing on investing in China, Japan and other Asian markets featuring on both lists.

Brett Owens, Chief Investment Strategist

Updated: November 4, 2025

Some of our favorite bond funds (yielding 8%+) just took a header. And it’s setting up the best buying opportunity we’ve seen in nearly three years.

We can thank panicked mainstream investors for our shot here.

CEF Investors Are Ultra-Conservative (and Easily Spooked)

This opportunity is coming to us in closed-end funds, which we love for a lot of reasons—not the least of which is the fact that they’re a small corner of the market.

As of the end of 2024, there were just 382 CEFs out there, with $249 billion in assets among them. Compare that to roughly $11 trillion in ETFs, as of the end of June. The CEF market’s small size keeps institutional players out, leaving these funds mostly in the hands of everyday investors.

And weak hands they are!

There’s a very predictable pattern of these investors (typically on the conservative side) getting spooked out of their holdings at any hint of bad news. It’s a pattern we can easily play—and we’ve got another shot now.

The trigger? The recent collapse of auto-parts supplier First Brands and subprime car-loan lender Tricolor. Both sparked worries of cracks in private credit markets.

JPMorgan Chase & Co. (JPM) CEO Jamie Dimon—never one to pass up a chance to play the Prince of Darkness—piled on, commenting that, “When you see one cockroach, there are probably more.”

History Repeats

Weak-handed investors worry that smaller banks’ credit issues are resurfacing—echoes of March 2023, when Silicon Valley Bank collapsed. That turned out to be a buying opportunity.

And we have its sequel in front of us now—with a few key differences (all of which work in our favor).

Back then, aggregate bank reserves had plunged near $3 trillion, a danger zone for liquidity. The Fed was raising rates and beginning “quantitative tightening”—letting government bonds “roll off” its balance sheet.

Today bank reserves are healthy at $3.3 trillion. The Fed is cutting rates and, following last week’s Federal Open Market Committee meeting, said it would end quantitative tightening on December 1. Plus, as we discussed in last Tuesday’s article, Uncle Sam is buying Treasuries, putting downward pressure on long-term rates.

In other words, liquidity is plentiful. This money will keep flowing into bank balance sheets, cushioning credit markets and, by extension, high-yield bonds.

And yet, “first-level” investors are selling off high-yield bond CEFs, just as they did in March 2023.

Take the Western Asset High Income Fund II (HIX), which holds about 62% of its portfolio in US-based high-yield corporate bonds.

Over the last few weeks, the fund has seen its market-price-based return (in purple below) slip as worried investors sold. Meanwhile its NAV return—or the return of its underlying portfolio, in orange—has sailed along:

HIX’s Price Drops, But Its Portfolio Is Fine …

The result is that the fund, which had been trading around par for most of the year (save for the April “tariff tantrum,” another episode the first-level crowd overreacted to), trades at around a 2.7% discount to NAV as I write this. Not bad!

… Giving HIX a (Likely) Temporary Discount

This is a pattern we’ve seen across many of the bond funds in the portfolio of our Contrarian Income Report service. And it’s why I’m urging investors to buy them now.

And consider this example: The RiverNorth/DoubleLine Strategic Opportunity Fund (OPP), which holds 52% of its portfolio in investment-grade debt and is managed in part by our man the “Bond God” Jeffrey Gundlach.

OPP yields 14%, but its weighting toward investment-grade debt (where bargains are harder to find), and its relatively small size (around $213 million in assets, as of October 28) are two reasons why we don’t recommend it in Contrarian Income Report.

Nonetheless, the fund does offer low volatility, with a five-year beta-rating of 0.64, meaning it’s 36% less volatile than the S&P 500.

No matter. Investors dumped it anyway. Check out the dip in OPP’s market-price-based return (in purple below) over the last few weeks, while its portfolio (in orange) has—you guessed it—motored along.

Investor Panic Is Easy to Spot Here

The result: an 8.5% discount, as of this writing, that’s well below the fund’s five-year average of 6.2%.

In a way, this is easy to understand: OPP’s focus on investment-grade debt means it’s likely held by more-conservative investors. In other words, the folks most likely to sell on the first negative headline.

Something similar happened to OPP back in March and April of 2023. Back then, its discount bottomed out at 16%. That, too was a buying opportunity:

Last “Panic” Brought Big Gains to OPP Buyers

A 39% gain in two-and-a-half years! That’s a huge move for a bond fund, especially one weighted to investment-grade credit. And every pullback since has been a buying opportunity.

That’s the beauty of CEFs: When a big discount appears, we look deeper.

If it’s the result of the mainstream crowd selling in a panic, while NAV is chugging along, that’s almost always a great time to buy. This is the kind of window this private-credit “crisis” is giving us now.

Sorry boys and girls not naval gazing.

IF GCP stays in business in it’s current form and the dividend remains the same, the picture would be

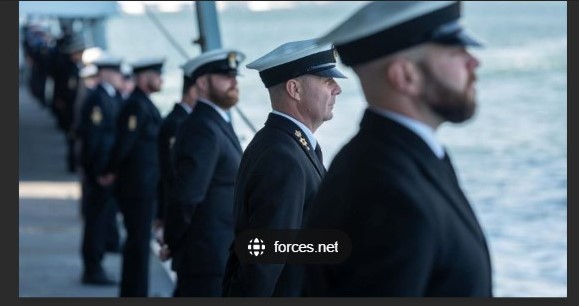

You would be earning, for ease of comparison ten percent on your seed capital and let’s say 7% on the dividends re-invested, income of £900 plus £600 a yield of 16% after ten years. Anyone lucky enough to have longer to invest the amount of income growth accelerates.

You would have earned income as you re-invested but for this comparison we will use it as a contingency.

Whilst you have little control of what the final value might be but with some care and intention you should be able to achieve the income figure.

I have bought for the Snowball 12243 shares in GCP Infrastructure for 9k, part of the pair trade with TMPL.

I’ve bought 11395 shares in FSFL for 8.5k.

Yielding 10.75% and trading at a discount to NAV of 31%.

I’ve sold SMIF for a profit of £855.00, mostly from earned dividends.

The plan was to switch the position into TFIF but not yet.

To address concerns around overcompensation and ensure a fairer inflation adjustment mechanism for the RO, the UK government, the Scottish Government, and the Northern Ireland Executive are considering two options for transitioning from the Retail Price Index (RPI) to the Consumer Price Index (CPI). Both options aim to deliver a more proportionate approach to inflation indexation, reduce costs to consumers, and align with broader government and

regulatory policy.

Option 1: Immediate Switch to CPI Indexation

This option would involve a simple switch in the the price index used to adjust the RO buy-out price from the RPI to the CPI. Subject to legislative schedules, the UK government, the Scottish Government, and the Northern Ireland Executive would look to implement ahead of

Changes to inflation indexation in the Renewables Obligation scheme

the next annual adjustment scheduled in March 2026 which would see the RO buy-out price increased in line with CPI. This approach would ensure generators continue to receive a stable and predictable return that maintains its value, whilst making savings in the energy system.

Option 2: Temporary Freeze and Gradual Realignment with CPI

This alternative would involve freezing the RO buy-out price at the 2025/26 level (£67.06 per ROC), taking effect from April 2026 (subject to legislative schedules). The government would construct a ‘shadow’ price schedule for the RO buy-out price from 2002, annually adjusted using CPI instead of RPI. No further inflation-linked increases would be applied until the cumulative effect of CPI-based inflation on that shadow price matches the current RPI-adjusted

buy-out price. At this point of realignment, annual indexation would resume using CPI.

This option goes further than Option 1 and would not only prevent further overcompensation in future but gradually realign scheme costs after presumed historical overinflation caused by RPI’s tendency to overstate inflation. It could stabilise scheme costs in the short term and transition to a more sustainable inflation measure over time. This would bring with it greater

long-term savings for consumers, as scheme costs would be held steady until CPI and RPI inflation realign. We estimate that in scheme compliance year 2026/27 this could save consumers around £300m, rising to an estimated saving of around £820m in 2031/32.

The UK government, the Scottish Government, and the Northern Ireland Executive are seeking views on which of these proposals presents the best alternative to the current methodology of RPI-indexation of the RO scheme.

We are particularly mindful that any change needs to be balanced against the broader impacts on renewables investment in the UK, which is essential to protect consumers against volatile fossil fuel prices. This is particularly pertinent in a period where the sector is focused on delivering the UK government’s Clean Power 2030 mission.

Dividends can be more reliable than share prices as they’re driven by

the companies performance itself and not by the whim of investors.

Thursday 6 November

abrdn Property Income Trust Ltd ex-dividend date

Artemis UK Future Leaders PLC ex-dividend date

BlackRock Smaller Cos Trust PLC ex-dividend date

Chenavari Toro Income Fund Ltd ex-dividend date

Custodian Property Income REIT PLC ex-dividend date

CVC Income & Growth GBP Ltd ex-dividend date

Dunedin Income Growth Investment Trust PLC ex-dividend date

JPMorgan India Growth & Income PLC ex-dividend date

Picton Property Income Ltd ex-dividend date

Taylor Maritime Investment Ltd ex-dividend date

Tritax Big Box REIT PLC ex-dividend date

As a pair trade I’ve bought 2k of Temple Bar IT TMPL for the Snowball. The position will be treated as a quasi tracker and may have to be held for several years to print a profit. IF TMPL continues to go up, I’ll most probably sell the position unless I had bought some more shares and then I would just take out the profit and re-invest into a higher yielder. That’s the plan anyway.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑