I’ve bought 1698 shares in ORIT for 1k, this completes the current portfolio weighting with the share.

Investment Trust Dividends

I’ve bought 1698 shares in ORIT for 1k, this completes the current portfolio weighting with the share.

Octopus Renewables Infrastructure Trust plc

(“ORIT” or the “Company”)

Dividend Declaration

The Board of Octopus Renewables Infrastructure Trust plc is pleased to declare an interim dividend in respect of the period from 1 July 2025 to 30 September 2025 of 1.54 pence per Ordinary Share.

Payable on 28 November 2025 to shareholders on the register as at 14 November 2025 (the “Q3 2025 Dividend”). The ex-dividend date will be 13 November 2025.

The Q3 2025 declared payment is in line with the Company’s dividend target for the financial year from 1 January 2025 to 31 December 2025 of 6.17 pence per Ordinary Share*.

A portion of the Company’s dividend is designated as an interest distribution for UK tax purposes. The interest streaming percentage for the Q3 2025 Dividend is 59.3%.

Octopus Renewables Infrastructure Trust plc

(“ORIT” or the “Company”)

Q3 2025 Factsheet and Net Asset Value

Octopus Renewables Infrastructure Trust PLC, the diversified renewables infrastructure company, announces that its unaudited Net Asset Value (“NAV”) as at 30 September 2025, on a cum-income basis, was £523.4 million or 98.46 pence per Ordinary Share (30 June 2025: £540.4 million or 99.46 pence per Ordinary Share).

| Pence per Ordinary Share* | £m | ||

| Unaudited NAV as at 30 June 2025 | 99.46 | 540.4 | |

| Power prices and green certificates | (1.42) | (7.7) | |

| Macroeconomic assumptions | 0.65 | 3.5 | |

| Share buybacks | 0.64 | (8.2) | |

| Q2 2025 interim dividend | (1.52) | (8.3) | |

| Other movements | 0.66 | 3.6 | |

| Unaudited NAV as at 30 September 2025 | 98.46 | 523.4 | |

* Totals may not sum exactly due to rounding

Power prices and green certificates

Net movements in power prices and green certificates reduced NAV by £7.7 million over the quarter.

· The reduction reflects a recalibration of green certificate assumptions to adopt a more conservative external long-term forecast curve which is closely aligned with recent market trends. This led to a reduction in NAV of £12.9 million.

· Short-term and medium- to long-term power price forecasts increased slightly across ORIT’s core markets, partially offsetting the overall valuation reduction with a positive impact of £5.2 million.

ORIT’s portfolio continues to benefit from a high level of contracted revenue. As at 30 September 2025, 86% of the Company’s forecast revenue over the next 24 months was fixed or contracted, up from 85% at the end of June 2025. This strong degree of revenue visibility continues to provide robust protection against any short-term market volatility.

Macroeconomic assumptions

Macroeconomic updates had a positive impact on valuations during the quarter.

· Short-term UK inflation forecasts increased marginally, supporting inflation-linked revenue across the portfolio.

· Sterling weakened against the euro, generating a gross valuation gain of £7.3 million before currency hedging. After accounting for the Company’s FX hedges, the net impact of foreign exchange movements was a gain of £1.7 million.

Overall, the combined impact of these macroeconomic factors resulted in a net valuation increase of £3.5 million, equivalent to 0.65 pence per Ordinary Share.

Share buybacks

During Q3 2025, ORIT repurchased 11.8 million shares for approximately £8.2 million, at an average price of 69.4 pence per Ordinary Share. As at 30 September 2025, the Company had deployed £23.6 million of its £30 million buyback programme.

Following these repurchases, the total number of voting rights in the Company stood at 543,370,568. The reduction in shares in issue was accretive to NAV per share, resulting in an uplift of 0.64 pence in the quarter and 1.8 pence cumulatively since the programme began in June 2024.

The Company’s recently launched ‘ORIT 2030‘ strategy sets a renewed focus on long-term shareholder value creation, prioritising capital deployment into construction and development-stage projects which are expected to deliver higher returns and sustainable NAV growth. While buybacks remain an available tool, future capital allocation will be more strongly weighted towards investments that enhance scale, resilience, and dividend sustainability.

Other movements

An increase of £3.6 million or 0.66 pence per Ordinary Share was recorded from other valuation movements.

This increase reflects a £14.0 million uplift relating to the expected return on the assets, driven by the net present value of future cash flows being brought forward from 30 June 2025 to 30 September 2025. However, this gain was largely offset by lower-than-expected cash generation, principally due to low wind speeds, adjustments to future Capex and operational assumptions for some sites, and fund-level expenses, mainly related to the Company’s operating and transaction costs (including RCF interest).

Gearing

As at 30 September 2025, ORIT had total gearing (total debt drawn as a percentage of Gross Asset Value (“GAV”¹) of 47.8%, up slightly from 46.5% as at 30 June 2025. This temporary increase reflects the continued execution of the Company’s share buyback programme. ORIT remains on track to reduce total gearing to below 40% by the end of 2025, supported by scheduled debt amortisation of project-level term loans and active portfolio management through the ongoing asset recycling programme.

Notes

1 “Gross Asset Value” means the aggregate of (i) the fair value of the Company’s underlying investments (whether or not subsidiaries), valued on an unlevered basis, (ii) the relevant assets and liabilities of the Company (including cash) valued at fair value (other than third party borrowings) to the extent not included in (i) or (ii) above.

Factsheet

The Company’s Q3 2025 factsheet has been published today and is available to download at:

https://www.octopusrenewablesinfrastructure.com/all-reports-publications

Stephen Wright thinks Alphabet, Amazon, and Microsoft boosting AI spending makes a stock market crash this month less likely than it was a week ago.

Posted by Stephen Wright

Published 2 November, 8:02 am GMT

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of personal advice. Investments in a currency other than sterling are exposed to currency exchange risk.

You can never completely rule out a stock market crash. But I think the chances of a big decline in share prices just got significantly lower in the last seven days.

As I see it, one of the biggest threats to the overall stock market is the artificial intelligence (AI) trade running out of steam. And the last week has been a very positive one on this front.

The major cloud companies – Alphabet, Amazon, and Microsoft (NASDAQ:MSFT) – all reported earnings this week. And there was a common theme among them.

All three reported strong growth driven by high demand and all three announced plans to increase their spending. I think this is hugely positive for the stock market as a whole.

Microsoft is one of the best examples. The firm generated 40% revenue growth in its cloud computing business and increased its capital expenditure forecasts.

The market didn’t like this and the stock fell 3% after the earnings announcement. But I think this is a very positive sign for the stock market as a whole.

Right now, AI accounts for a lot of the S&P 500. And with the rest of the US economy finding it hard to generate any meaningful growth, investors are piling into artificial intelligence stocks.

One of the things that could derail this is one of the major cloud computing companies deciding to cut capital expenditures. That would be disastrous for Nvidia and the market as a whole.

Why might they do this? If it looks like the huge investments being made are going to generate weaker returns than expected, the likes of Microsoft might rethink their spending.

Alternatively, if investors get a sense that the investments are speculative rather than meeting existing demand, things could unravel quickly. But the latest results present no sign of this.

It’s clear AI stocks are in fashion at the moment (which is the understatement of the year). And that makes Microsoft’s stake in OpenAI an interesting development.

OpenAI has gone from being a non-profit organisation to a capped-profit one. And this is leading a lot of analysts to think the company might go public in the near future.

Microsoft stands to benefit from this. Its overall returns would be limited by the capped-profit model, but it could still realise a significant return on its initial investment.

The stock looks expensive at a price-to-earnings (P/E) ratio of almost 40. But its growth prospects mean it deserves serious consideration as a potential buy.

The stock market could crash for any number of reasons – a potential AI bubble is just one of them. Other risks include a potential recession and higher inflation in the US.

Those are still very much live and investors need to be ready for a downturn at any time. But the promise of higher capital expenditures seems to have fended off the AI risk, at least for the time being.

Most long-term investment plans involve reinvesting dividends for decades before they generate any passive income. Here’s one that doesn’t.

Posted by Stephen Wright

Published 2 November

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

The content of this article is provided for information purposes only and is not intended to be, nor does it constitute, any form of personal advice. Investments in a currency other than sterling are exposed to currency exchange risk.

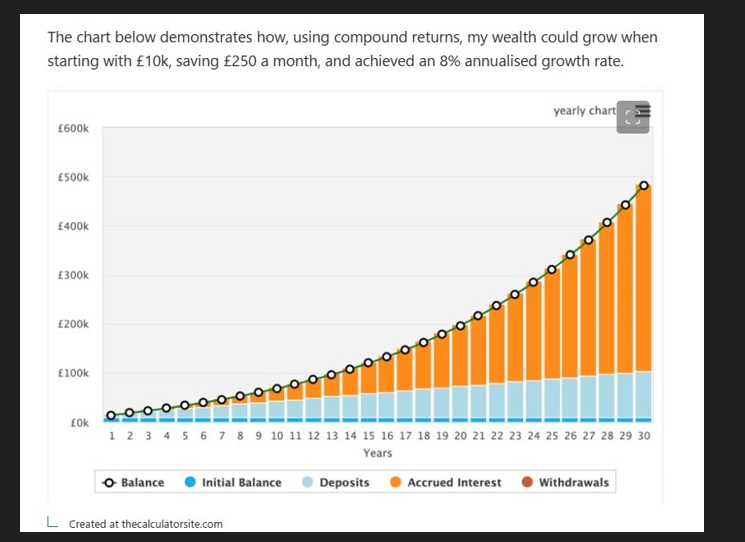

In general, investing plans either involve reinvesting dividends to aim for higher returns over time, or withdrawing them for passive income. But what if you do both?

More specifically, what happens if you invest £1,000 a month in dividend stocks, take out half the cash it returns each year, then reinvest the rest ? I think the answer is quite interesting

The question obviously depends on what kind of return you get on your investments. But (for reasons we’ll come back to later), let’s suppose a 6% annual return.

At that rate, a £1,000 monthly investment with half the return taken out and half reinvested turns into a portfolio worth £140,091 after 10 years. And it generates a total of £7,944 a year.

Importantly, you’ll have already taken out £20,091 over that time as passive income to do whatever you like with. And the numbers start to go up sharply from that point.

After 20 years, the total reaches £329,123, has already paid you £89,123, and makes £19,752 a year. By year 30, it’s at £584,194, earns £35,051 annually, and you’ve already had £224,194.

Most dividend investing strategies take one of two approaches. They either involve reinvesting to grow returns or taking out the cash generated as immediate income.

The problem with reinvesting is that it means you don’t actually get any income you can spend for years or even decades. And isn’t that the point of focusing on dividend stocks?

The downside to withdrawing the cash is that you miss out on the powerful force of compound interest over time. So your returns are likely to be much lower as a result.

With the hybrid strategy, you stand to benefit from both. You get half of your annual return as passive income you can spend straight away, while the rest grows over time.

The big question, then, is where to get a 6% annual return? I think there are a few potential candidates, but one that’s worth considering is Primary Health Properties (LSE:PHP).

The firm owns and leases a portfolio of GP surgeries. And as a real estate investment trust (REIT) it pays out 90% of its income to investors, instead of paying tax on it.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

The portfolio has very high occupancy rates and with the NHS as its main tenant, the risk of defaults is low. An ageing population also means I expect this to continue.

There’s a 7.5% dividend yield and the firm has a very good record of increasing its returns over time. So for investors targeting passive income, I think it’s definitely a stock to consider.

Primary Health Properties isn’t a risk-free investment (if there is such a thing). Its income depends on what governments decide to do about the NHS and public health.

I don’t see any threat on the horizon in this month’s Budget, but investors aiming for decades of passive income need to look further ahead than this. And this is something to note.

The best way to limit this risk is by building a diversified portfolio. Fortunately, there are plenty of other stocks worth considering right now that I think give investors a chance to do this.

LSE:FSFL

Last updated: 10:48 01 Nov 2025 GMT

Is the sun finally going to shine again for the UK solar sector? The UK’s 10-year government bond yield has slipped to 4.39%, its lowest level this year, and that is good news for funds such as Foresight Solar Fund Ltd (LSE:FSFL), whose share price tends to move in the opposite direction to gilt yields.

It comes down to simple maths. Renewable energy trusts are long-term, income-paying assets, not so different from bonds, so when government borrowing costs fall, their relatively generous dividends start to look more appealing.

Historically, the link between gilt yields and renewables valuations has been almost one-for-one, and investors appear to be betting on more of the same as markets look ahead to a possible rate cut from the Bank of England in December.

Foresight Solar has other reasons to feel cheerful. Operationally, this year has brought record sunshine across the UK, helping the company deliver strong generation figures.

Meanwhile, it has locked in favourable power prices through hedging, essentially fixing future revenues in advance, giving the fund a solid cushion of dividend cover for 2025.

At the current share price, Foresight Solar is yielding just over 10% on a 1.3 times covered dividend.

That means its cash generation comfortably exceeds what it needs to pay investors, even after accounting for debt repayments. The trust has never missed a payout since listing in 2013 and has gradually increased its dividend each year.

Support for renewables remains a rare point of stability in Westminster. Ed Miliband, the energy secretary, was one of the few to keep his role in Labour’s recent reshuffle, underlining the cross-party consensus around clean energy investment.

Foresight has also been selling some assets to pay down debt, which should strengthen its balance sheet further. For now, investors are being paid to wait while the market discount, the gap between the share price and the value of its underlying assets, narrows.

With gilt yields on the slide and a steady dividend stream, the outlook for Foresight Solar is starting to look brighter once again.

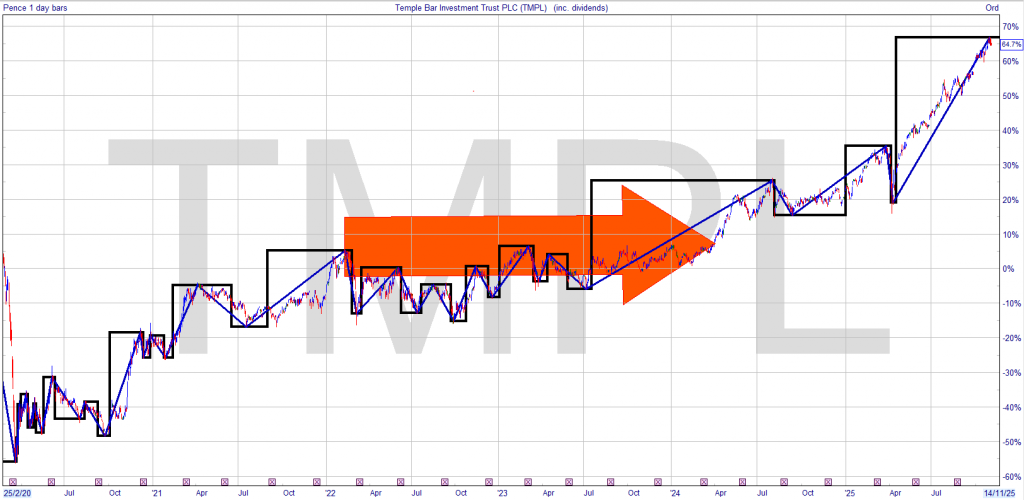

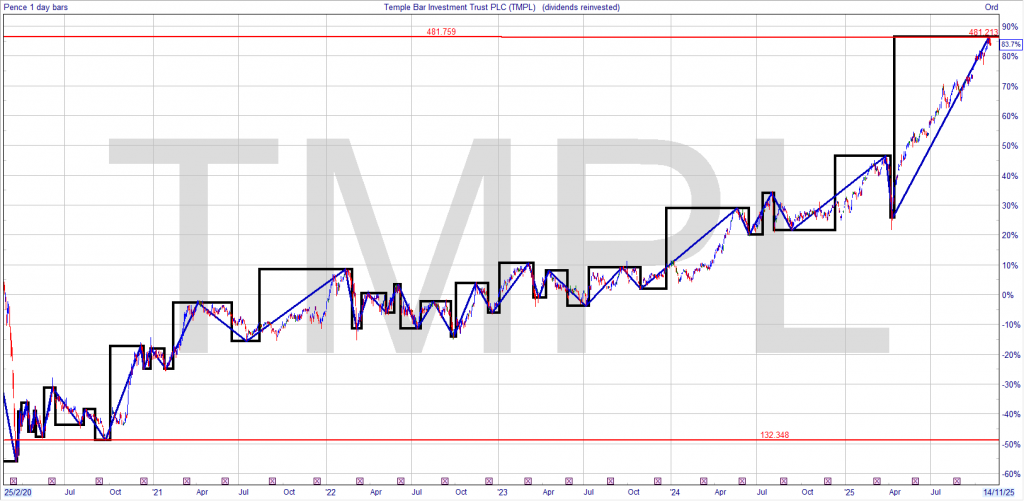

If you look closely at the TMPL graph, you will note that, even including dividends, you made, zero, zilch nothing for 2 years.

The same pattern can be seen with the control share. Mr. Market stays in business by persuading the great unwashed that the market will go up forever and then dumps on them. Maybe watch the share to get a feel for the market direction.

The blog whilst it’s a record of all trades it’s meant to be educational as well.

I understand it’s different strokes for different folks and life is life, but I intend to start a pair trading strategy with the current cash for re-investment. Because Mr. Market is at a new all time highs, the split will not be 50/50.

I will look to buy, GCP Infrastructure and TMPL Temple with a 80/20% split a blended yield of 8%. When Mr. Market falls, it’s not if but when, I could add to the TMPL position.

This ship sailed a while ago but everything crossed for a market crash, one strategy might be as you wait for a market crash is to re-invest the dividends from the pair trade into the growth share. Hopefully given time TMPL will produce a capital gain to accelerate the income in the Snowball.

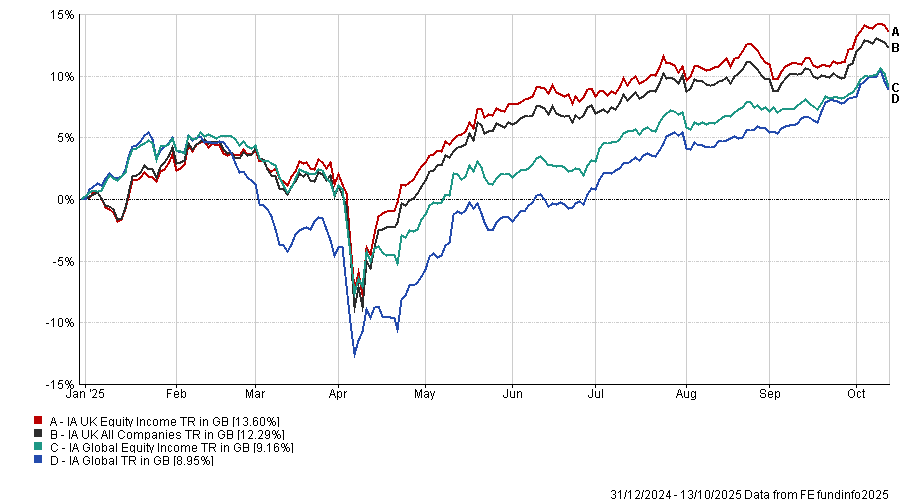

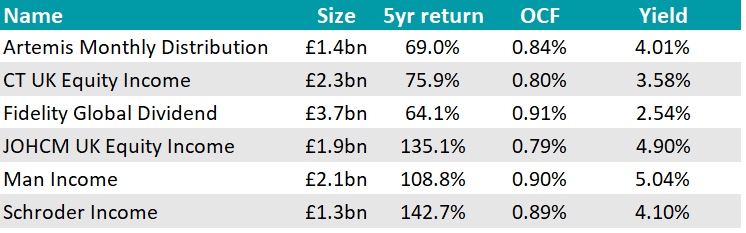

Equity income has had a positive year so far – here are five vehicles to get exposure.

By Matteo Anelli

Deputy editor, Trustnet

Income is back in fashion, as lowering interest rates and higher volatility around the world are pushing investors towards larger and more established companies that pay a dividend.

Fears of companies becoming overvalued and concentration in growth-focused areas of the market have also made investors more interested in other, not-so-crowded trades, with value investing and its key by-product, income generation, being an obvious place to look.

Equity income Investment Association (IA) sectors have pushed slightly ahead of their broader equity counterparts this year, so below, experts highlight their favourite income funds in the UK and globally.

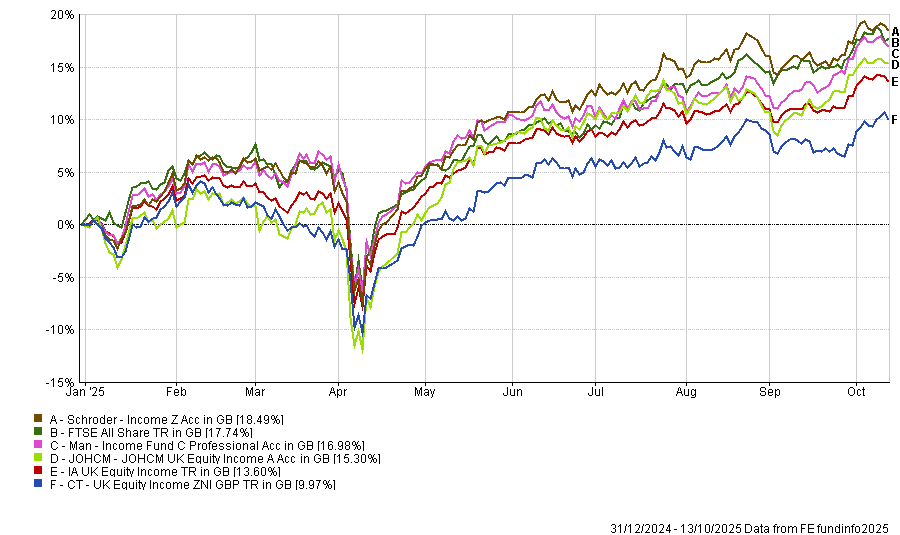

Performance of sectors over the year to date

Source: FE Analytics

UK equity income

We begin with the UK, where FundCalibre managing director Darius McDermott chose CT UK Equity Income.

“With interest rates no longer anchored at zero, we’re likely to see periods where value outperforms, just as it has done in previous rate-tightening cycles,” he said. “A key by-product of value investing is income generation and CT UK Equity Income is a great example of that”.

Managed by the “highly experienced” Jeremy Smith, the fund takes a contrarian, unconstrained approach, seeking out overlooked UK companies with resilient balance sheets and the capacity to deliver sustainable dividend growth.

It focuses on long-term capital preservation and real income generation, underpinned by bottom-up research.

“With the UK equity market still trading at a discount to global peers, CT UK Equity Income is well positioned to capitalise on the re-rating potential of high-quality, undervalued businesses,” McDermott continued.

“For income-seeking investors, it’s a compelling value option in today’s market.”

Other options exist however, with Dzmitry Lipski, head of funds research at interactive investor picking Man Income. Managed by Henry Dixon and co-manager Jack Barrat, it seeks superior capital returns to the FTSE All-Share along with a higher level of yield, which is currently 5.0% compared with about 3.5% for its benchmark.

“The fund has an excellent record of delivering on its objectives,” noted Lipski.

In addition to strong recent performance, over the mid and long-term the fund has outpaced peers and benchmark convincingly. Over both five and 10 years, for example, the fund has outperformed the benchmark and has almost doubled the average return of its equity income peer group over the decade.

Meanwhile, Dennehy Wealth discretionary investment manager Joe Richardson selected two further alternatives: Schroder Income and JOHCM UK Equity Income.

The former he described as “the grandaddy of UK value income funds”, highlighting its “solid, consistent” strategy with “a great record of growing payouts” year after year.

JOHCM UK Equity Income was praised for its strong yield, its value tilt and its “very strong” growth in payouts. He also appreciated its allocation to mid- and small-caps to give investor more breadth than the usual big-dividend names.

“Being UK income funds, both fit with the broader value story: the UK market in general looks incredibly cheap, not just versus history, but also compared to other regions,” said Richardson.

“However, if we get a widespread recession, dividends can be cut. That’s why we always stress the importance of a defensive layer, ideally with a few years of income set aside, so you don’t have to sell at the wrong time or rely on payouts that may be under pressure”.

Performance of funds against index and sector over the year to date

Source: FE Analytics

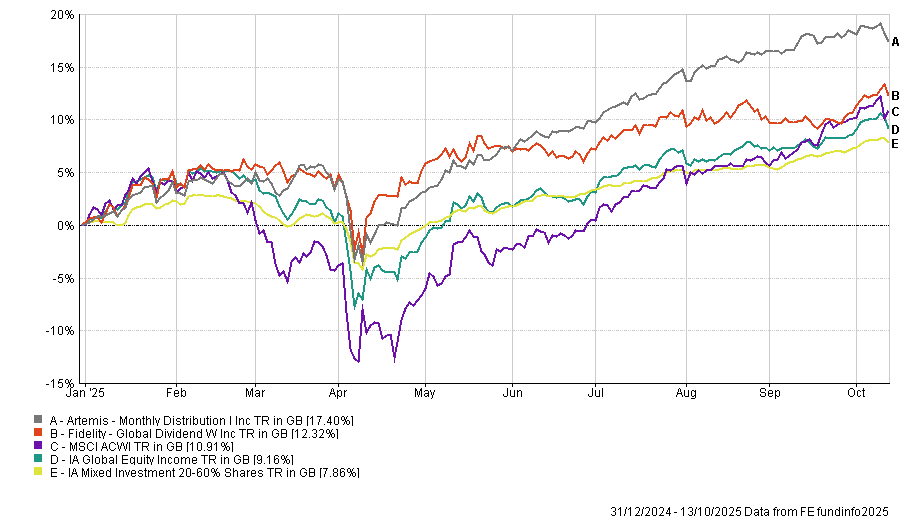

Global equity income

For global income seekers, Lipski opted for Fidelity Global Dividend. Since its inception in 2012, the fund has been led by Dan Roberts, who brings more than 20 years of experience to the table and is supported by the research team and resources at Fidelity.

It aims to achieve a mix of growth and income with low volatility versus the MSCI All Country World index. The yield aim is 25% more than the income produced by the companies included in the index.

“From an income perspective, the fund’s yield fell as low as 2.2% in the aftermath of the Covid pandemic, but has since been rising steadily to a level of 2.5% today,” said Lipski.

Finally, the head of fund research pointed out that not all income-paying funds are necessarily found in equity income sectors.

Artemis Monthly Distribution, for example, combines bonds and global equities, with the objective of providing a regular monthly income along with capital growth over a five-year period.

Performance of funds against index and sectors over the year to date

Source: FE Analytics

Managed by four experienced specialists, Jacob de Tusch-Lec and James Davidson are responsible for managing the equity sleeve of the portfolio with Jack Holmes and David Ennett in charge of the fixed-income allocations.

“The strategy has a strong track record, ranking in the top quartile of the IA Mixed Investment 20-60% Shares peer group since inception,” Lipski noted.

“Income has also been consistent over time, with a yield of at least 4% since inception to 2020, where it understandably dropped but has since re-established at pre-2020 levels, currently 4.0%.”

Source: FE Analytics

Disclosure – Non-Independent Marketing Communication

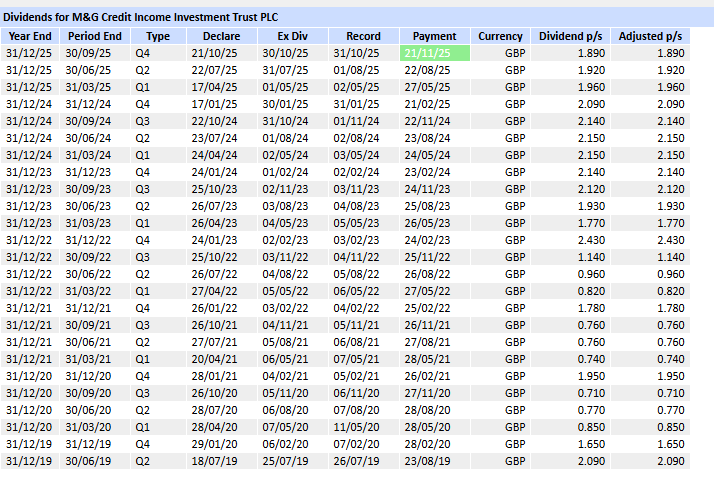

This is a non-independent marketing communication commissioned by M&G Credit Income (MGCI). The report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on the dealing ahead of the dissemination of investment research.

Overview Overview Analyst’s View Portfolio Gearing Performance Dividend Management Discount Charges

MGCI can be thought of as the best of M&G fixed income

M&G Credit Income (MGCI) offers an alternative to an investment in the conventional bond sectors, generating a yield similar to a high-yield bond fund from a portfolio of investment-grade quality and with minimal duration. While credit spreads look tight by historic standards and the UK and European economies look troubled, MGCI generates a high-dividend yield while taking low credit risk. The historic yield is 8.5%.

Manager Adam English can invest across all public and private bond sectors to achieve his objective of an attractive yield with low NAV volatility. It is the investment in private debt that is key: private debt typically allows much higher yields to be earned by lending to companies with a given credit quality. The extra yield is compensation for the illiquidity and the complexity of the deals, which require a high level of expertise to participate in.

Adam allocates across these sectors with a relative value approach, looking for where the yield is attractive relative to the risks involved. Currently, he is cautiously positioned given that spreads generally look narrow across many sectors. That said, he is still able to generate a portfolio yield of 7.5% from a defensively positioned, 70% investment-grade-quality portfolio. The dividend target is SONIA (the interbank lending rate) plus 4% of NAV annualised, calculated quarterly. As we discuss in the Dividend section, this means the portfolio yield is currently not quite covering the dividend. However, the trust continues to pay its dividend target of SONIA plus 4%, making a small contribution from capital, and Adam is waiting for volatility to throw up better opportunities to add yield.

Analyst’s View

We think MGCI looks extremely attractive as an alternative to a high-yield fund at this juncture, given the current state of the markets and the different sources of risk in its portfolio. There isn’t really any hiding place in public-debt markets. Government bonds look vulnerable to concerns about fiscal sustainability, while inflation continues to erode what might seem like reasonable nominal yields: volatility seems certain. These factors may have driven investors to the corporate bond market, where they have driven in spreads to very narrow levels where they offer little yield pick-up. To generate a high yield in public markets requires braving the sub-investment-grade space, where narrow spreads could easily come under pressure if the UK and European economies continue to weaken. MGCI has a portfolio of investment-grade-quality debt, which offers a yield equivalent to a high-yield fund, and a duration of less than one compared to 7.7 in the investment-grade market, meaning it should be much less exposed to volatility in the rates market. Investors should remember that there is no free lunch, and the extra yield comes from the illiquidity and complexity of the portfolio, but we think M&G is ideally placed to assess and manage those risks given its size and expertise across the fixed income and private assets space.

The portfolio yield being below the dividend target is something to watch but not to worry about in our view. Adam argues that low NAV volatility and a conservative approach are both key things investors expect from the fund, and he won’t compromise on that in the short term. His view is that volatility and opportunities are inevitable, and this should allow him to boost the portfolio yield above target in the fullness of time without having to accept prices he thinks aren’t attractive for the risks he has to take.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑