Investment Trust Dividends

My Favorite Fund for Retirement Income (Yields 8.3%)

by Michael Foster, Investment Strategist

I’m regularly struck by something American investors always seem to take for granted: The many choices we have available to gain financial independence.

And investors in closed-end funds (CEFs) make the most of these choices. These high-yielding funds kick out 8%+ dividends on average, and the portfolio of my CEF Insider service, which helps investors make the most of CEFs, pays even more, with its 18 holdings paying a rich average yield of 9.4%.

Plus, these funds offer stock-like upside, which makes them pretty much tailor-made for delivering financial freedom.

We’ll sketch out how two specific CEFs can help you find your way to an earlier, richer retirement in a bit. But first, back to that embarrassment of choices I mentioned a second ago.

What American Investors Take for Granted

Back in my 20s, when I was studying to get my PhD in Europe, I was told I had to pay into the national pension fund, and I would get that money back when I qualified for it. At that time, I qualified at 62, which seemed absurd – nearly 40 years for me (a severely underpaid academic!) to get back money I desperately needed today.

But as it turns out, I was lucky.

Europe’s mandatory retirement age is rising. Denmark, which currently has the oldest retirement age in Europe at 67, is raising that to 70. Germany, where a normal retirement age is currently 66, is discussing raising that to 73.

Whether you like the life of a worker or not, I’m almost certain that you like having the ability to choose that life without having to worry about governments changing the rules on you mid-game.

A Look at America

This lack of choice pushed me away from Europe in my 20s and led me back to America. Here’s what I found when I returned.

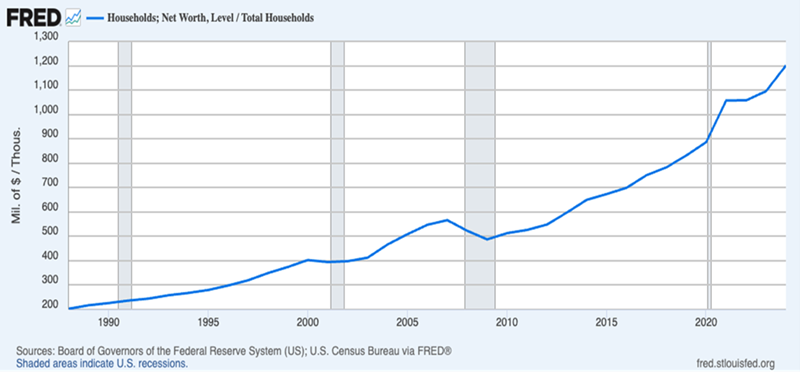

This chart shows that the average American household has gone from $200k in savings in the 1980s to $1.2 million now – and, no, that isn’t due to inflation. That $200k in savings would be $535k in 2025 dollars, so more than half of the jump to $1.2 million is due to actual value being created.

Of course, that wealth isn’t going everywhere. While all households have gotten richer on average, the top 0.1% of the population is attracting a greater proportion of overall wealth in the US, now near 14%.

The ethics of this aside, it’s clear that the households that have more wealth now have more choices – about when to retire, where to live, what lifestyle to adopt and so on.

In a way, it seems like Europeans have too little choice and Americans have so much that retirement investing can be tough for individual investors to navigate without either taking undue risks or locking themselves into weak returns.

CEFs: Your 8%+ Paying “Mini-Pension” (With Upside)

This is where CEFs come in, with their focus on assets from well-established companies. Plus their high yields almost act like a “mini-pension,” boosting your income without leaving you at the whim of the government.

This is the way I viewed CEFs in my late 20s, when I began using their high dividends to get the income I needed to make the choices I wanted. I still view them this way.

And in addition to their big dividends, these funds often chalk up strong returns, too, thanks in large part to their discounts to net asset value (NAV, or the value of their underlying portfolios). As these discounts – which only apply to CEFs, by the way – shrink, they put upward pressure on the fund’s price.

And the best part is that CEFs are easy to buy, trading on public markets just like stocks.

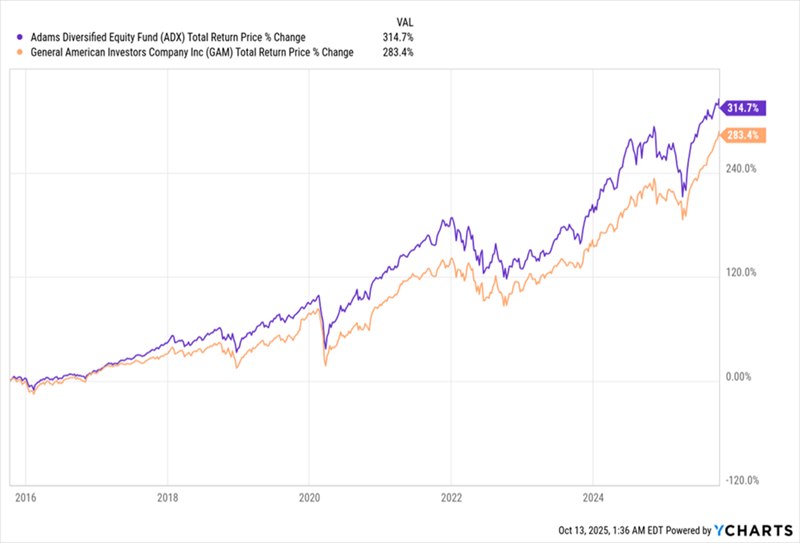

Consider the first CEF we’re looking at today, the Adams Diversified Equity Fund (ADX). It’s one of the oldest funds in the world, tracing its history back to the 19th century (and is a current CEF Insider holding, too).

This one is about as blue chip as it gets, with stocks like Microsoft (MSFT), Amazon (AMZN) and JPMorgan Chase & Co. (JPM) among its top holdings.

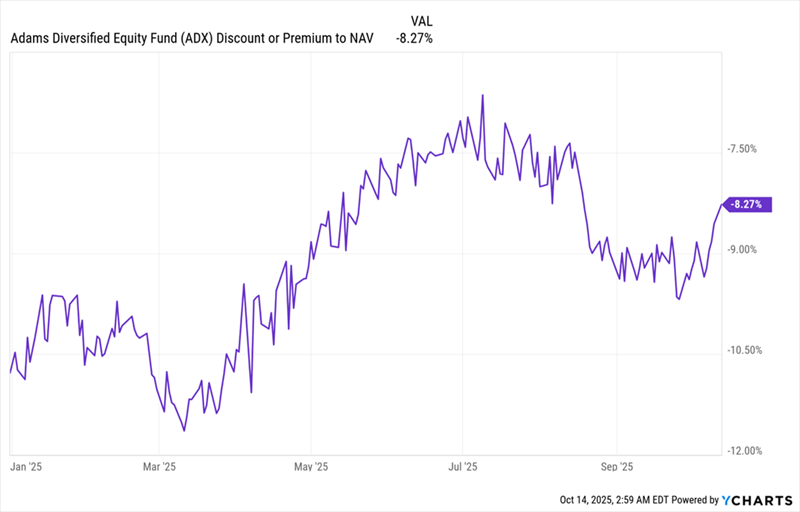

What’s more – and this is the key part – ADX trades at an 8.3% discount to NAV as I write this, and that discount is in the sweet spot, cheaper than it was a few months ago but carrying momentum as it steams toward par.

ADX Is a Rare Bargain in a Pricey Market

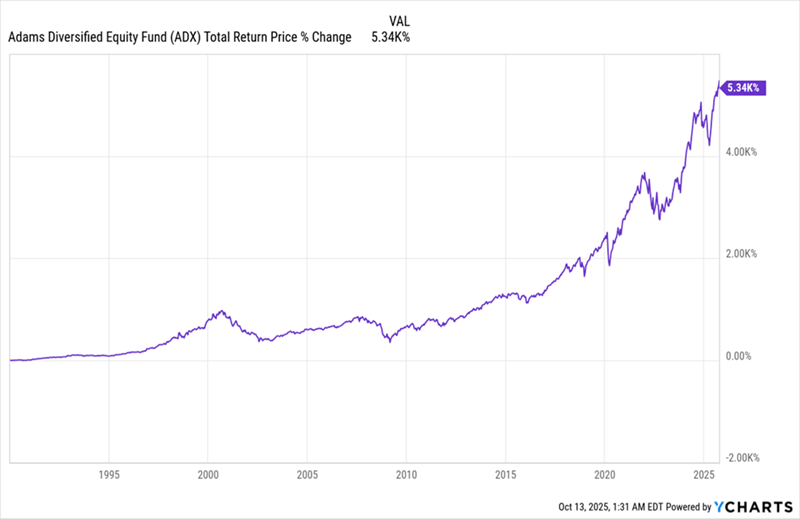

ADX has been paying dividends since before the Great Depression, and its 8.3% dividend yield is fully covered by the 13.3% total NAV return (or the return on its underlying portfolio) it’s enjoyed over the last decade. Moreover, ADX has delivered a 5,340% return to its shareholders, with dividends reinvested, since the late 1980s, when US household wealth just started to meaningfully tick higher.

ADX’s Long-Term Gains

That kind of performance – coming our way at a discount and with an 8.3% dividend – is exactly what we want from our “mini-pension,” and ADX delivers.

But, as I said, we do have choices here. And ADX isn’t the only US-stock-focused CEF that delivers a large income stream and has withstood the test of time.

Another is the General American Investors Company (GAM), which was launched in 1927 and yielded an impressive 9.4% to investors in 2024. GAM also holds large caps, with Alphabet (GOOGL), Berkshire Hathaway (BRK.A) and Apple (AAPL) among its top holdings.

And, like ADX, this fund’s market pricebased return has been strong over the last decade – though not quite as strong as ADX – with a 14.4% annualized return.

2 Strong Funds, But ADX Has an Edge

Moreover, GAM’s 9.3% discount sounds like a good deal, but that’s near its smallest-ever level, so we’re not rushing out to buy the fund today. But it is worth watching, and gets tempting when that discount drops to double digits.

But the larger point remains: With high-yielding CEFs like these, we can start generating a meaningful income stream we can choose to use however we like

Income at the end of October £9,915.00.

The 2025 fcast of £9,175.00 will be met even after the special dividend from VPC is deducted.

Current cash £1,035 > 1k to be added to the 5k in ORIT, maybe not today though.

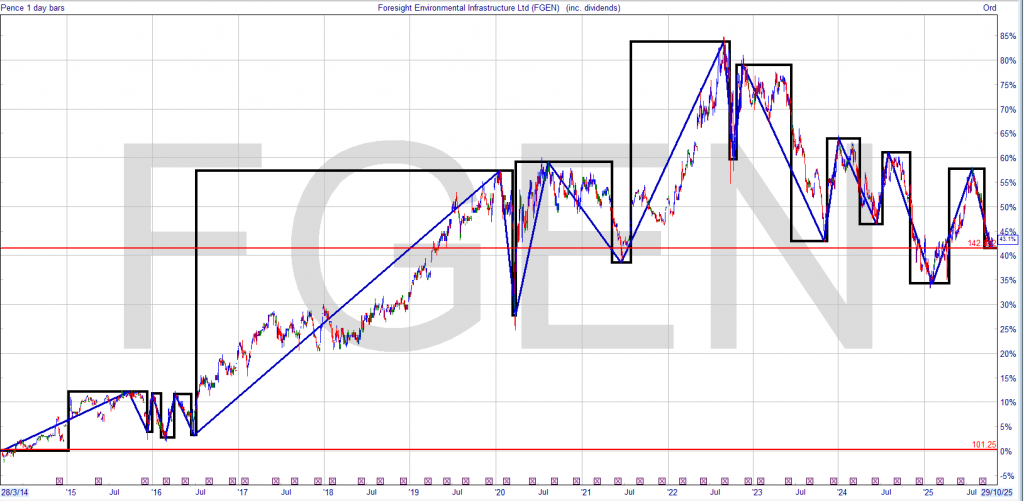

If you want to track the history of FGEN in the Snowball, type FGEN in the search box and the history of the share should be there.

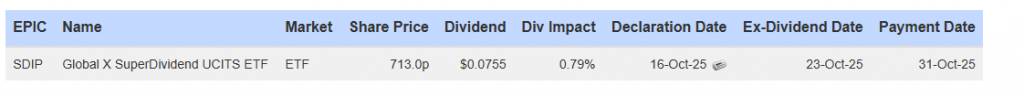

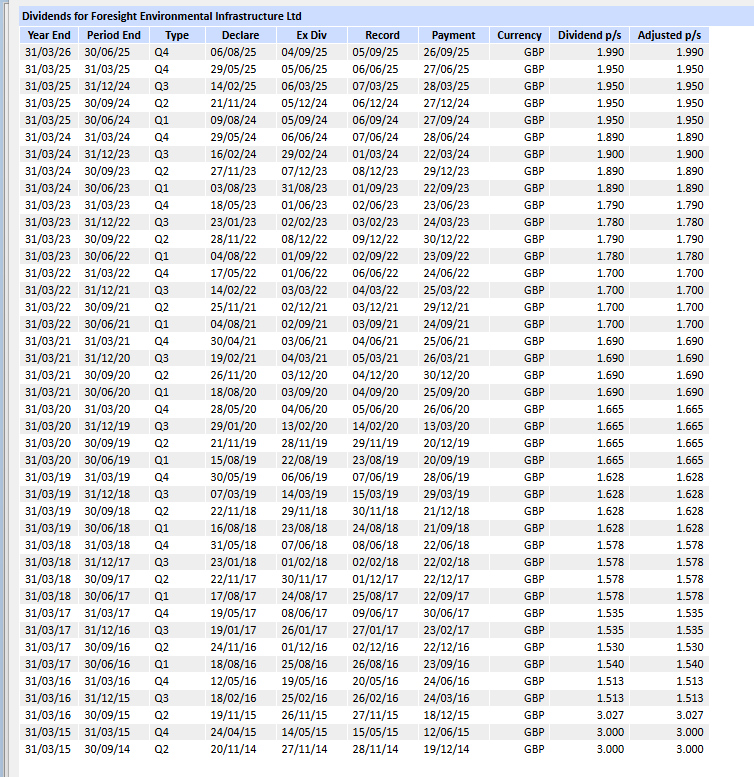

Dividend

The Company also announces a quarterly interim dividend of 1.99 pence per share for the quarter ended 30 June 2025, in line with the dividend target of 7.96 pence per share for the year to 31 March 2026, as set out in the 2025 Annual Report – which represents a yield of 9.7% on the closing share price on 5 August 2025.

Current price 69p dividend 7.96 a yield of 11.5%

Foresight Environmental Infrastructure Ltd (FGEN) may appeal to income-focused investors, but caution is warranted due to recent performance and valuation metrics.

Here’s a breakdown of the key factors to consider before buying:

📉 Performance & Valuation

🏗️ Portfolio & Strategy

⚠️ Risks & Considerations

🧭 Bottom Line

FGEN could be a value opportunity for long-term investors seeking high yield and discounted NAV, especially if you believe in the resilience of environmental infrastructure. However, negative earnings and weak recent performance suggest caution. If you’re building a narrative around institutional cycles, this might symbolize a fund in a trough—potentially poised for recovery, or emblematic of structural headwinds.

Foresight Environmental Infrastructure Ltd (FGEN) trades at a deeper discount and offers a higher yield than its peers, but its recent underperformance and negative earnings make it a riskier bet. Greencoat UK Wind (UKW) and The Renewables Infrastructure Group (TRIG) offer more stability and scale, though they too face headwinds.

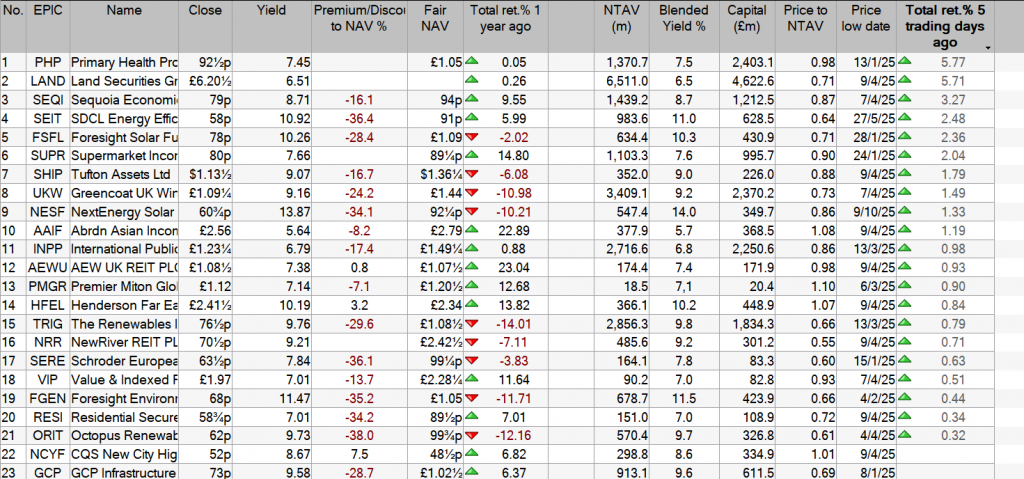

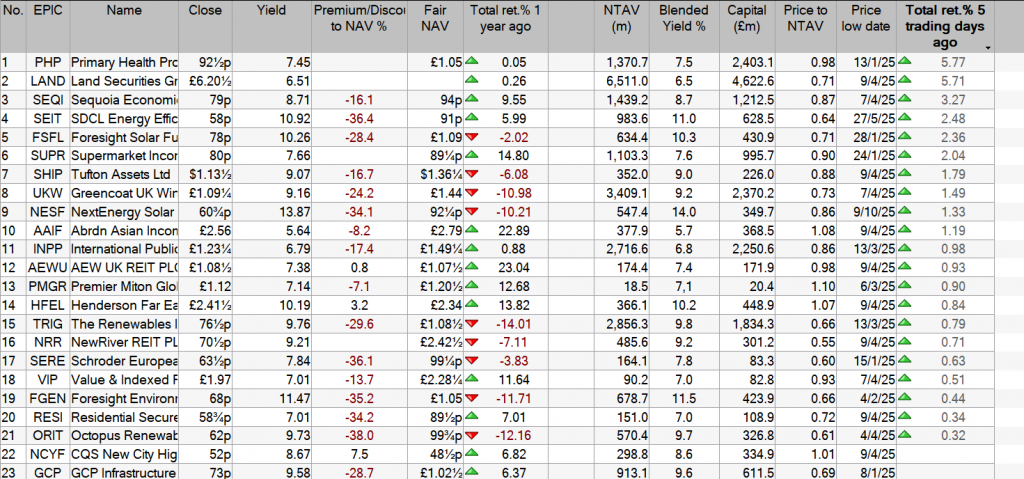

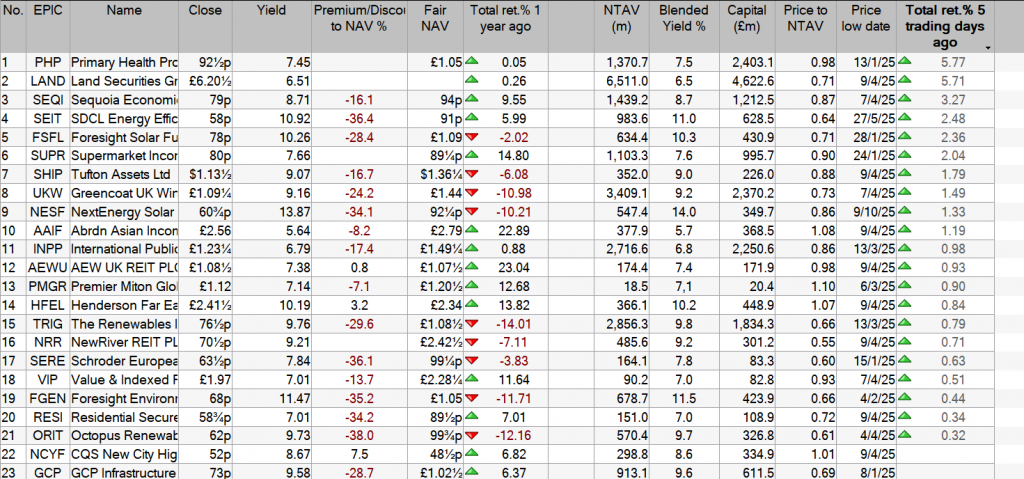

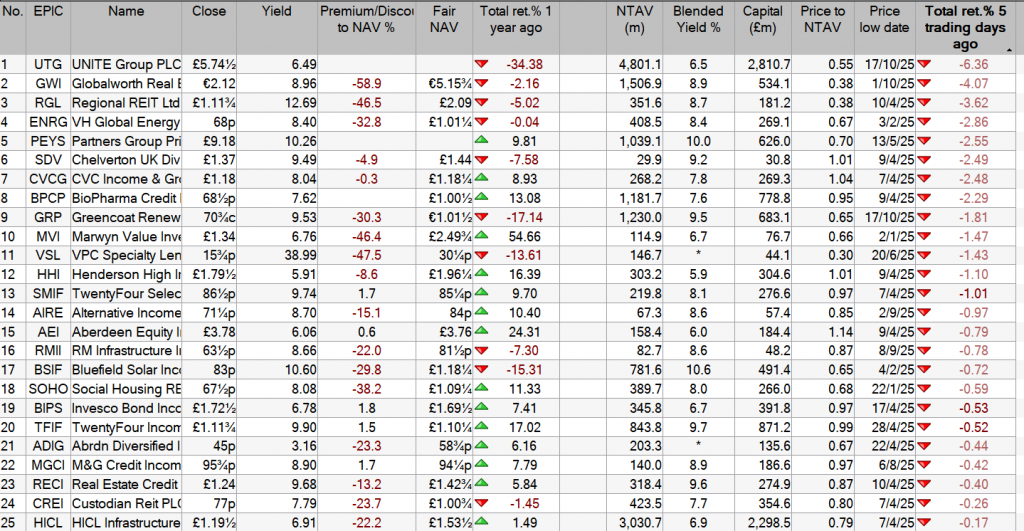

Here’s a comparative snapshot to help you sharpen your metaphorical lens:

🔍 Valuation & Yield Comparison

Sources:

🏗️ Portfolio Focus & Strategy

Co Pilot

Last month was a great one for investment companies exposed to gold, biotechnology, emerging markets and corporate actions aimed at restoring shareholder value. Infrastructure fund prospects look less than golden with high interest rates and declining power price forecasts, but one £422m renewables portfolio perhaps deserves a closer look with shares on a wide 35% discount.

The historic rally in gold, racing 11.5% to a new high in September, and up 57% this year, continues to propel listed mining funds with Golden Prospect Precious Metal (GPM) shares leaping 30.5% last month. That makes the New City managed closed-end fund the biggest riser in our table (see left column in our first table).

After a 143% surge this year, the Guernsey investment company is rapidly closing in on a £100m market valuation that could put it on the radar of more investors.

Stable mate CQS Natural Resources (CYN) and BlackRock World Mining (BRWM), which also have exposure to smaller gold miners, gained 28.4% and 21.9% respectively. CYN’s recent run up may have frustrated Saba Capital as the activist hedge fund exited at a much lower price in a tender offer. Geiger Counter (GCL), a £70m uranium mining fund run by the Golden Prospect team, also put on 20%.

| Investment company | Share price return (%) | Investment company | Underlying net asset value (NAV) return (%) |

|---|---|---|---|

| Golden Prospect Precious Metal | 30.5 | Golden Prospect Precious Metal | 31.1 |

| Petershill Partners | 29 | Geiger Counter | 21.1 |

| CQS Natural Resources Growth & Income | 28.4 | CQS Natural Resources Growth & Income | 20.8 |

| BlackRock World Mining Trust | 21.9 | International Biotechnology | 15 |

| Geiger Counter | 20 | BlackRock World Mining Trust | 14.8 |

| JPMorgan China Growth & Income | 13.8 | JPMorgan China Growth & Income | 14 |

| International Biotechnology | 13.6 | Biotech Growth | 13.6 |

| Biotech Growth | 13.2 | UIL | 11.6 |

| UIL | 13.1 | Polar Capital Technology | 10.1 |

| Schroders Capital Global Innovation | 13 | Pacific Horizon | 9.8 |

Source: Bloomberg, Marten & Co. Total returns exclude investment companies with market capitalisation below £15m.

Elsewhere, investment company corporate actions aimed at remedying poor shareholder returns resulted in a spectacular change in fortunes for Petershill Partners (PHLL).

Shares in the £2.5bn Goldman Sachs fund investing in alternative investment managers jumped 29% last month after unveiling plans to delist and return cash to shareholders. That more than halved the gap between the share price and underlying net asset value (NAV) with the discount falling from nearly 35% to under 16%. This puts it at the top of our list of “more expensive” London-listed funds (see right column of our third table below).

Emerging markets and biotech funds were also in favour with JPMorgan China Growth & Income (JCGI) and UIL (UTL), a sister fund and investor in Utilico Emerging Markets (UEM), both rising over 13%. At the end of the month UIL issued proposals for an annual £4m return of capital for the next three years until it delists that QuotedData’s James Carthew thought “ungenerous“.

| Investment company | Share price return (%) | Investment company | Underlying net asset value (NAV) return (%) |

|---|---|---|---|

| JPMorgan Emerging EMEA Securities | -20.5 | JPMorgan US Smaller Companies | -4.1 |

| NB Distressed Debt Investment Extended Life | -15.6 | NB Distressed Debt Investment Extended Life | -3.8 |

| Aquila European Renewables | -13.7 | STS Global Income & Growth Trust | -3.6 |

| Life Settlement Assets | -12.5 | Finsbury Growth & Income | -3.4 |

| Gore Street Energy Storage Fund | -10.7 | Scottish Oriental Smaller Companies | -3.3 |

| Octopus Renewables Infrastructure | -9.3 | Vietnam Holding | -3.3 |

| Foresight Environmental Infrastructure | -9 | VinaCapital Vietnam Opportunity Fund | -3.2 |

| Globalworth Real Estate Investments | -8.7 | Vietnam Enterprise | -2.9 |

| Oryx International Growth | -6.7 | Montanaro European Smaller Companies | -2 |

| Scottish Oriental Smaller Companies | -6.7 | Dunedin Income Growth | -1.7 |

Source: Bloomberg, Marten & Co. Total returns exclude investment companies with market capitalisation below £15m.

The Russian court of appeal upholding $439m in damages to VTB Bank against eight JP Morgan entities, including the JPMorgan Emerging Europe, Middle East & Africa Securities (JEMA) investment trust, dented the speculative bubble around the £83m fund’s shares which retreated 20.5% last month. As a result the erratic share price premium tumbled from 332% over NAV in August to a slightly less enormous 231% (see last table below).

Infrastructure investment companies suffered another poor month as yields on 30-year UK government bonds, or gilts, maintained their highs of around 5.5%, diminishing the value of the funds’ long-term cash flows.

Aquila European Renewables (AERS), down 13.7%, was the biggest faller in the peer group a month after writing down its valuation following the withdrawal of a potential bidder for some of its assets.

Gore Street Energy (GSF), the international battery fund under pressure from RM Funds, slid 10.7% before this month’s disclosure that activist investor Saba has also taken a 5% stake.

Octopus Renewables Infrastructure (ORIT) declined 9.3% despite announcing a five-year recovery plan on 23 September.

| Investment company | £m raised | Investment company | £m returned |

| Fidelity European | 446.3 | Scottish Mortgage | 103 |

| City of London | 12.8 | Monks | 54.3 |

| TwentyFour Select Monthly Income | 10.9 | Worldwide Healthcare | 42.8 |

| Invesco Global Equity Income | 7.8 | Alliance Witan | 31 |

| Invesco Bond Income Plus | 7.5 | Finsbury Growth & Income | 29.2 |

Source: Bloomberg, Marten & Co. Excludes investment companies with market capitalisation below £15m. Figures based on the approximate value of shares at 30/9/25.

Data last month showed a spike in withdrawals from open-ended funds after jittery investors withdrew £1.8bn in August. These high outflows read across to investment companies whose average share price discounts, excluding highly-rated private equity giant 3i Group (III), widened to 14% from 13.1% in September, according to broker Winterflood.

That trend saw more share buybacks across the market as investment companies sought to draw a line in the sand under their share prices. Scottish Mortgage Trust (SMT), the £12.6bn Baillie Gifford flagship, bought back an estimated further £103m of its shares in response to the lack of investor demand.

By contrast, Fidelity European (FEV) issued around £446m shares in nearing completion of its merger with Henderson European which swells its assets to over £2.1bn and leaves it trading close to NAV on a narrrow 1% discount.

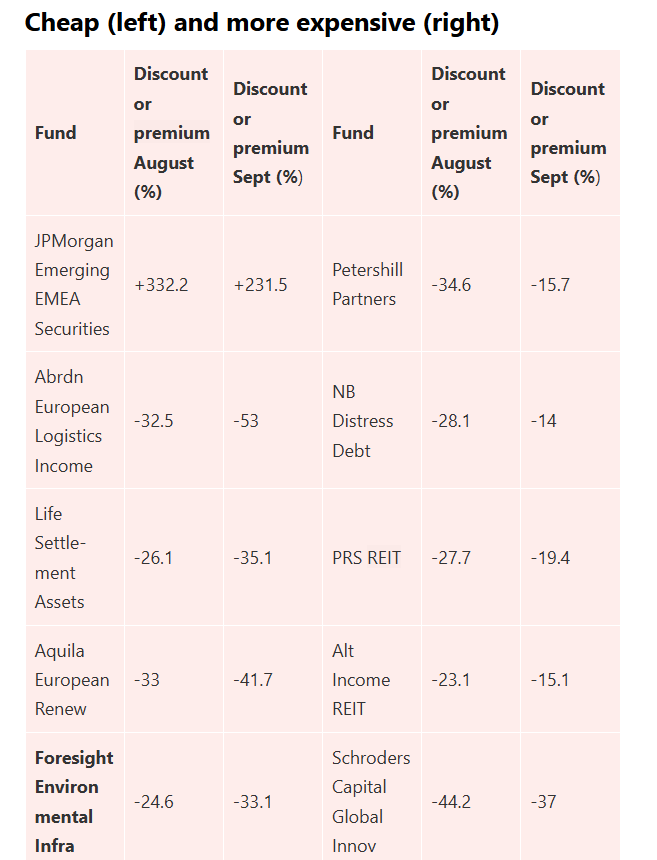

Source: Bloomberg, Marten & Co. Negative numbers show the discount or gap between share prices when they stand below their net asset value. Positive numbers show the reverse, the premium, or how much share prices stand above NAV. August data at 29/8/25 and September data at 30/9/25. Investment companies on the left have seen their discounts widen or premiums fall making their shares cheaper. Those on the right have seen their discounts fall or premiums rise to make them more expensive.

The continued derating of listed renewables funds last month has left eight of the sector’s 18 investment companies on double-digit dividend yields. That creates a fertile ground for bargain-hunting income investors.

One of those eight, Foresight Environmental Infrastructure (FGEN), catches our eye at the bottom of our last table after its share price discount widened from nearly 25% to 33% in September. The valuation gap has widened slightly since then with the shares trailing nearly 35% below net asset value where they offer an 11.6% yield against this year’s 7.96p dividend target.

Remarkably, the shares have slipped further since a continuation vote on 18 September when 94% of shareholder votes on a 59% turnout were cast in favour of the 11-year-old company’s continuation. Just over 6% voted to wind down the fund, slightly less than the 7.3% who did so last year.

At 69p, FGEN has fallen nearly 20% since the end of July and the shares have more than halved from their peak three years ago at 133p, having launched at 100p in 2014. Anyone thinking of buying now needs to consider two things: whether there will be further falls in the price, eroding the benefit of the 1.99p quarterly dividend; and whether the payout could even be cut in response to sector-wide pressures such as falling power price forecasts, low wind speeds and irradiation and grid constraints.

On the latter point, the company says its dividend in the last financial year of 7.7p per share was 1.3 times covered by earnings and it has consistently raised the dividend every year since launch. It operates a highly diversified portfolio, generating revenues from anaerobic digestion, bioenergy and hydro as well as wind and solar power. It expects 57% of next year’s revenues will be fixed on government subsidy or long-term contract, providing good visibility.

Moreover, following a strategic review in June, it is focused on core renewable energy assets with secure, long-term, inflation-linked revenues. As a result, it forecasts the future payouts will remain “healthily covered”.

In terms of the share price, FGEN holds a continuation vote if its shares trade below an average 10% discount over one year. That makes a further vote in 2026 very likely as things stand, providing a backstop that, if the derating continues, the company could be wound up and the value of its assets released. Meanwhile, the company is buying back its cheap shares having extended a £20m programme by £10m in March.

| Company Name | Place change | |

| 1 | Royal London Short Term Money Mkt Y Acc (B8XYYQ8) | Unchanged |

| 2 | L&G Global Technology Index I Acc (B0CNH16) | Up 1 |

| 3 | Artemis Global Income I Acc (B5ZX1M7) | Down 1 |

| 4 | Vanguard LifeStrategy 80% Equity A Acc (B4PQW15) | Unchanged |

| 5 | HSBC FTSE All-World Index C Acc (BMJJJF9) | Up 2 |

| 6 | City of London Ord CTY0.00% | New (12th last week) |

| 7 | Vanguard FTSE Global All Cp Idx £ Acc (BD3RZ58) | Down 1 |

| 8 | Scottish Mortgage Ord SMT2.07% | Down 3 |

| 9 | Temple Bar Ord TMPL0.28% | New |

| 10 | Fidelity Index World P Acc (BJS8SJ3) | Unchanged |

UK income trusts City of London Ord

CTY and Temple Bar Ord TMPL0 have entered the top 10 table as FTSE 100 shares continue to surge.

Temple Bar, whose shares have beaten all other UK income funds and trusts so far in 2025, looks to target underpriced shares, while City of London is known, among other things, for a long record of increasing its dividends. Both recently traded on share price dividend yields north of 4%, though the sheer popularity of the trusts means shares in both also trade on premiums to the value of their underlying portfolios.

Royal London Short Term Money Mkt Y Acc (B8XYYQ8) tops the table, as it has done every week since early July.

Interest rates were held at 4% at the Bank of England’s last meeting in September, with the fund’s yield closely linked to the base rate. Money market funds may be held inside SIPPs, ISAs or general trading accounts.

Global tracker funds of different stripes remained popular, with the HSBC FTSE All-World Index C Acc (BMJJJF9), Vanguard FTSE Global All Cp Idx £ Acc (BD3RZ58) and Fidelity Index World P Acc (BJS8SJ3) funds all in the top 10. These offer cheap exposure to a portfolio of global shares: the HSBC fund has a yearly charge of 0.13%, while the Vanguard fund has a cost of 0.23% and Fidelity Index World charges 0.12 per cent.

Global trackers tend to have substantial exposure to the US equity market, but a more UK-focused global fund remains popular. Vanguard LifeStrategy 80% Equity A Acc (B4PQW15), which has a fifth of its portfolio in bonds, has roughly half of its equity exposure in the US, with around a quarter in the UK.

Investors also continued to focus on tech and growth stocks, via the L&G Global Technology Index I Acc (B0CNH16) and Scottish Mortgage Ord

SMT The latter focuses on future trends, from e-commerce to artificial intelligence, with top holdings including SpaceX, MercadoLibre and Amazon.

Exiting the table this week is Vanguard LifeStrategy 100% Equity A Acc (B41XG30).

Brett Owens, Chief Investment Strategist

Updated: October 2025

The manic market just dumped business development companies (BDCs), again. These three dividend stocks paying up to 11.7% are poised to bounce back when sanity returns.

BDCs, which lend money to small businesses, are on the “outs” with the Wall Street suits after multiple soft jobs reports. The spreadsheet jockeys fret about an unemployment-induced economic slowdown and miss the real story: small businesses are making more money than ever thanks to AI.

Here is what’s actually happening in the Main Street economy:

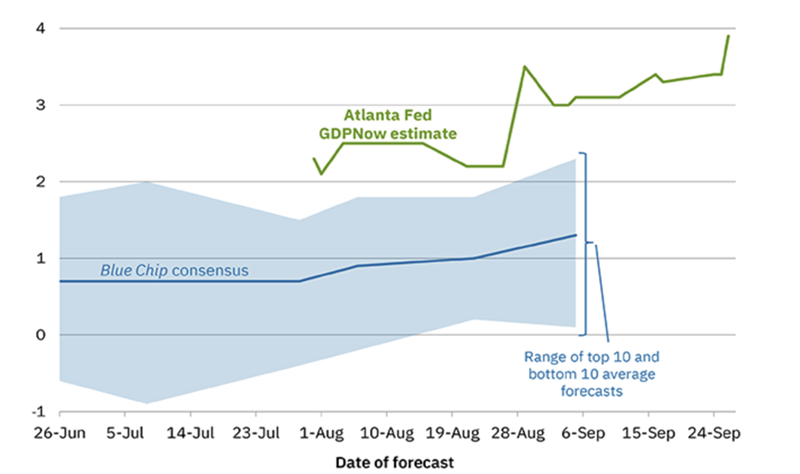

Small business profits are popping. While the unemployment numbers scream slowdown, the actual economy is booming. Check out the Atlanta Fed’s most recent GDPNow estimate—it’s up almost 4%!

Atlanta Fed Says Economy is Cookin’

We’ve been on this beat for months here at Contrarian Outlook. Automation is not slowing the economy. It is making it leaner and wildly profitable. While payrolls cool, output keeps rising. That’s no recession—it’s an efficiency boom!

This is music to BDCs’ ears. These lenders profit when Main Street’s cash flow swells.

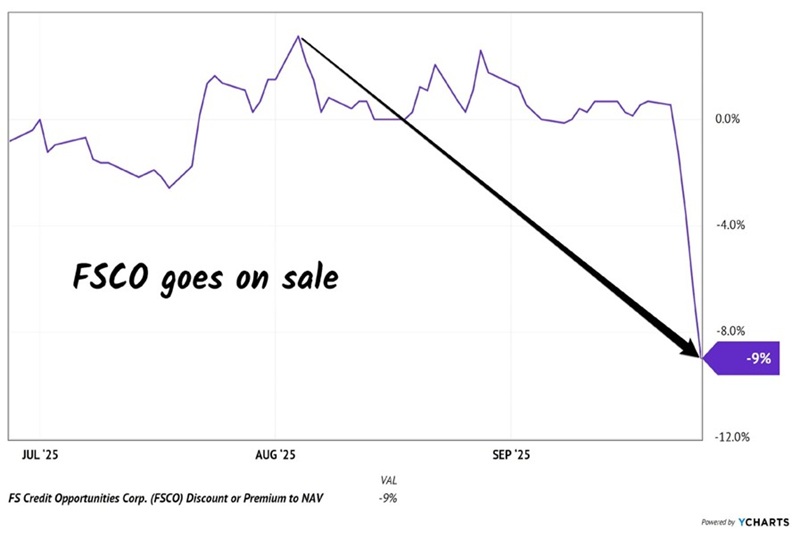

So, we thank knee-jerk sellers for giving us a deal on FS Credit Opportunities (FSCO), which yields 11.7% today. FSCO has been around for 10+ years but only traded publicly as a closed-end fund for the last two. CEF investors loathe newness, so FSCO fetched a discount to net asset value (NAV) until recently.

Portfolio manager Andrew Beckman and his team are skilled at “layering” credit—structuring loans with different levels of protection—so that FSCO is positioned to get paid back first even if credit conditions worsen. It’s an ideal fund to own if you were worried about the economy. This cash cow keeps collecting through slowdowns.

FSCO extends high-quality loans that are not subject to the daily whims of the public markets. These are private credit vehicles held by sophisticated investors who don’t care about recent job reports—they want their yield!

As do we income investors.

The vanilla dividend chasers finally found their way to FSCO this summer, sending it to a record 3% premium to NAV. But these weak hands fled when FSCO paid its monthly dividend (uh, the price drops because you just got paid, people!) and weak employment numbers weighed on the BDC sector.

The result? FSCO slipped from a 3% premium to a nifty 9% discount last week. Investors panicked but the strength of FSCO’s loans didn’t change:

FSCO Shares Went on Sale

FSCO continues to post strong credit metrics and cover its payout comfortably. Its high loan yields led Beckman and his management team to raise the monthly dividend multiple times this year:

FSCO Pays Monthly, Raises Often

FSCO looks good here, and it’s not alone. Ares Capital (ARCC), the largest BDC in America with $22 billion in assets, is killing it.

Ares is the big bully on the block—it sees the best deals before anyone else. And it shows. Non-accruals—loans that aren’t paying—remain a mere 2% of the portfolio, a hefty 20% below the industry average of 2.5%. No wonder ARCC’s net investment income (NII) has consistently covered its quarterly dividend, now $0.48 per share, with a small surplus each quarter!

And this bully loves economic turbulence. It thrived in 2020, growing book value through the Covid panic while smaller rivals stopped lending. And we have evidence that the punier BDCs are retrenching again, leaning into existing borrowers rather than pursuing new loans.

When the smaller fish throttle back, the bully turns up the volume. ARCC yields 9.5%, a payout supported by current income. That’s a rare combo of yield and quality in this market. We’ll keep collecting the digital checks.

Last but not least, Main Street Capital (MAIN), is the steadiest grower in BDCLand. Not only has it paid monthly since 2008—hasn’t missed a beat—but it also adds quarterly “specials,” rewarding shareholders when portfolio income exceeds expectations.

MAIN invests in small, privately held businesses—between $25 million and $500 million in annual revenue—and takes both debt and equity stakes. This dual role lets it profit as a lender and as a partial owner when its companies thrive.

In the main, MAIN’s portfolio remains broad and balanced—about 190 companies across diverse industries, with no single position over 4%. That diversity keeps MAIN steady through economic cycles.

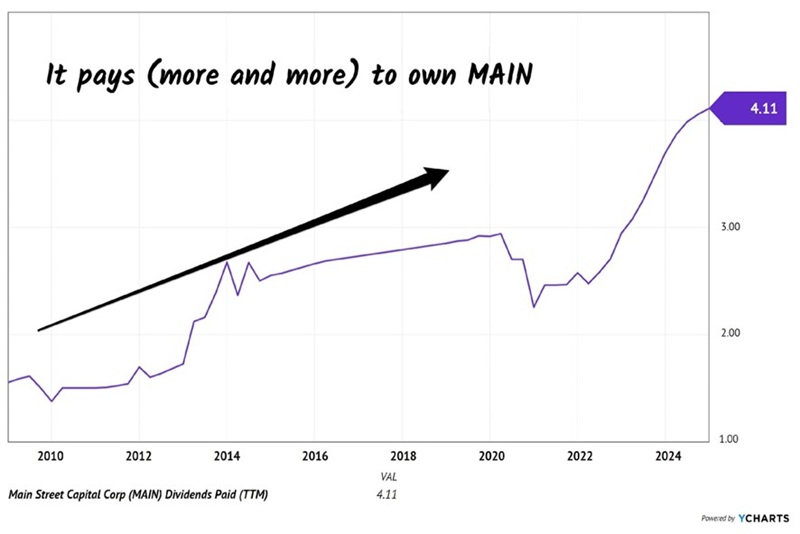

Since 2009, total annual dividends have jumped from $1.50 to more than $4 per share, a 170%+ climb that few serious dividend payers can match. The current yield sits around 6.8% today:

MAIN Regularly Raises Its Monthly Dividend

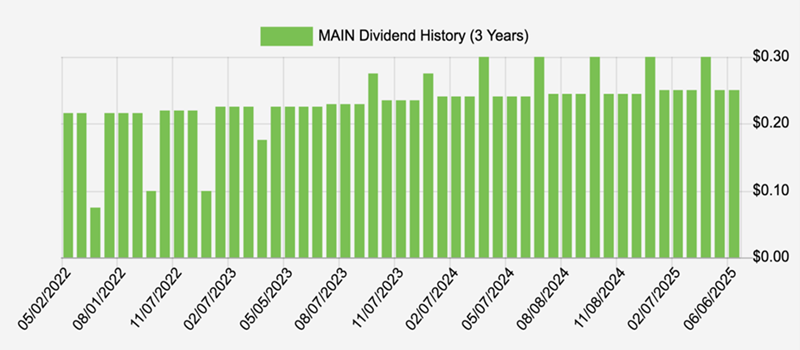

MAIN currently pays a generous 6.8%, with the majority delivered through dependable monthly payments. Check out this pretty payout picture:

MAIN pays monthly while ARCC “only” dishes its dividend quarterly.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑