The Bond God’s $4,000 Gold Call (and a “Dividend Twofer” to Profit)

Brett Owens, Chief Investment Strategist

Updated: September 23, 2025

When DoubleLine CIO Jeffrey Gundlach speaks, we yield hounds listen.

Right now, the “Bond God” has gold on the brain. We’re dialed in, because his latest utterances are pointing the way to a sweet 7.4%-paying “gold-dividend twofer” for us.

I’m talking about a play for price upside in the near term, followed by big monthly dividends (yes, 7.4%, and maybe more) when the “discount trigger” we’ll talk about in a sec kicks in.

The Bond God Calls ’Em Like He Sees ’Em

The Bond God is a dyed-in-the-wool contrarian who holds a special place in our hearts because, well, he’s often right. The 2008/2009 crisis? He called it. Trump’s 2016 win? He called that, too, as well as the 2022 panic.

So we were eager to hear what Gundlach had to say following the Fed’s decision to cut rates by a quarter-point last week. And, as usual, he didn’t disappoint.

“I think almost certainly gold will close above $4,000 by the end of this year,” he said. (That’s not new—he’s been saying it since March.) Gold trades around $3,675 an ounce as I write this, down a bit from pre-rate-cut levels.

And then there was this, er, nugget, about the Fed’s rate cut, with more likely to follow: “I think there’s a risk of over-easing.”

Bessent Takes on the 10-Year—And Gold Is Loving It

The Bond God no doubt sees what we see: Recent (and likely future) moves by the administration and the Fed are likely to keep inflation worries—and with them gold’s winning streak—alive.

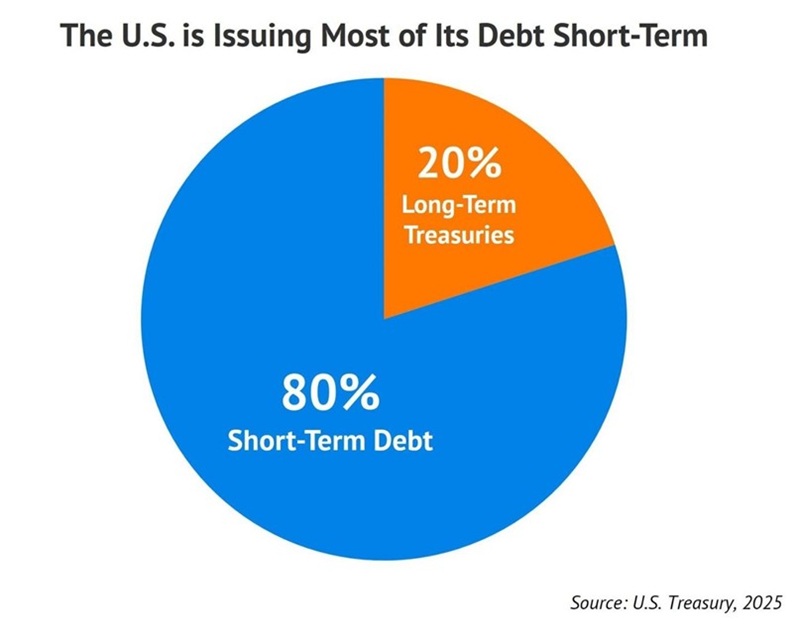

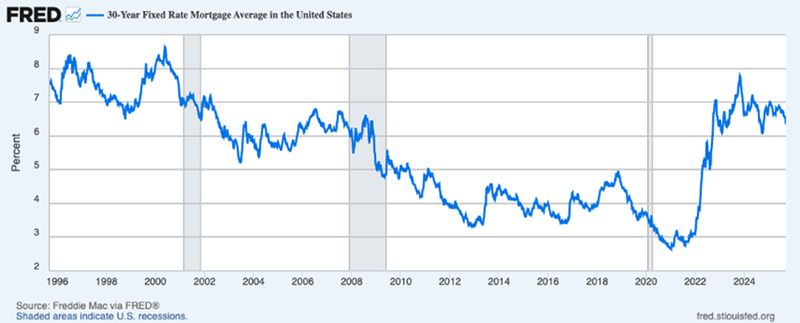

Let’s start with the administration, specifically Scott Bessent’s Treasury Department, which is doing something unusual: issuing 80% of the government’s debt on the short end of the yield curve.

By doing so, he’s decreasing supply of long-term Treasuries, boosting demand. That puts downward pressure on the 10-year Treasury yield, benchmark for consumer and business loans.

Uncle Sam wins, too, because the short end of the curve, set by the Fed, is usually lower than the long end. It also explains the pressure the administration is heaping on Powell: Lower short rates will save the government billions! Powell, for his part, is obliging, with two more quarter-point rate cuts expected by year-end.

Where does that leave us? With short-term rates falling and long-term rates capped—and potentially moving lower.

You don’t have to look far to see how falling Treasury rates ignite gold. It’s exactly what’s happened so far this year, with the gold-price benchmark SPDR Gold Shares (GLD), in purple, soaring as the yield on the 10-year (in orange) drops:

The Gold/10-Year Teeter Totter

This is likely what’s behind Gundlach’s thinking: As the Fed and Treasury bring rates lower—and keep inflation worries alive—gold will keep arcing higher.

Let’s, er, dig (sorry, couldn’t resist!) into those two gold plays I mentioned earlier, especially after the yellow metal pulled back a bit after last Wednesday’s rate cut.

“Gold-Dividend Twofer” Step 1: Put This 7.4% Dividend on Your Watch List

The 7.4%-paying GAMCO Global Gold, Natural Resources & Income Trust (GGN) is a smart way to tap gold for big (and monthly paid) dividends.

GGN holds mining stocks, including gold miners Alamos Gold (AGI), Kinross Gold (KGC) and UK-headquartered Endeavour Mining plc (EDVMF). It then sells covered-call options on its portfolio to generate that 7.4% income stream.

Using covered calls, GGN agrees to sell its stocks to a buyer at a future date and at a fixed price. In return, the buyer pays the fund a fee—or “premium,” which GGN keeps no matter how these trades play out.

It’s a great way to generate income, and it works particularly well with volatile stocks, like gold miners.

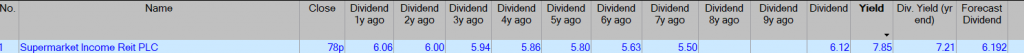

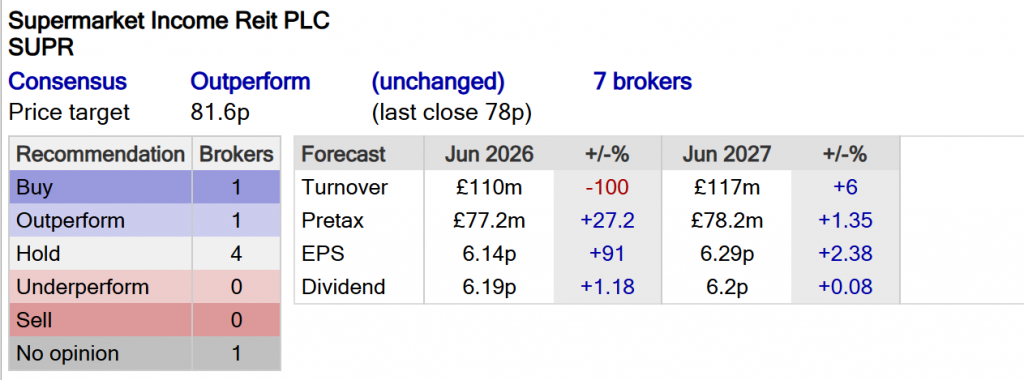

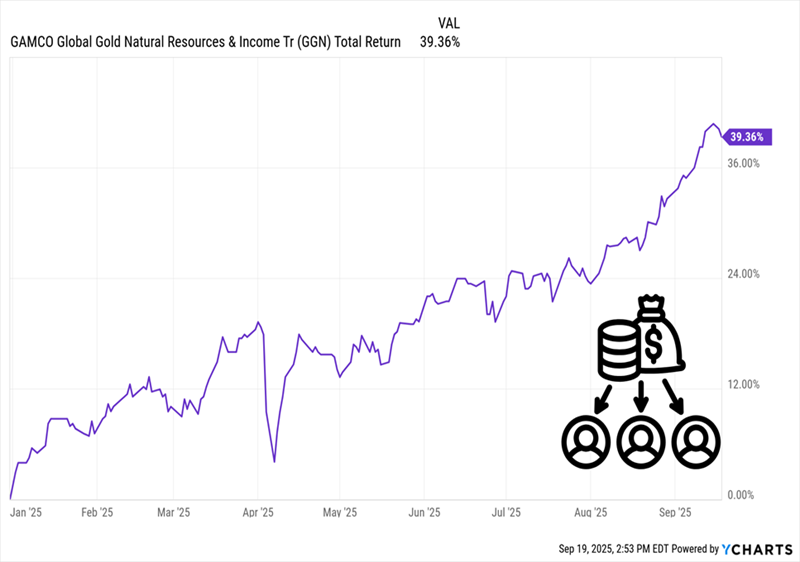

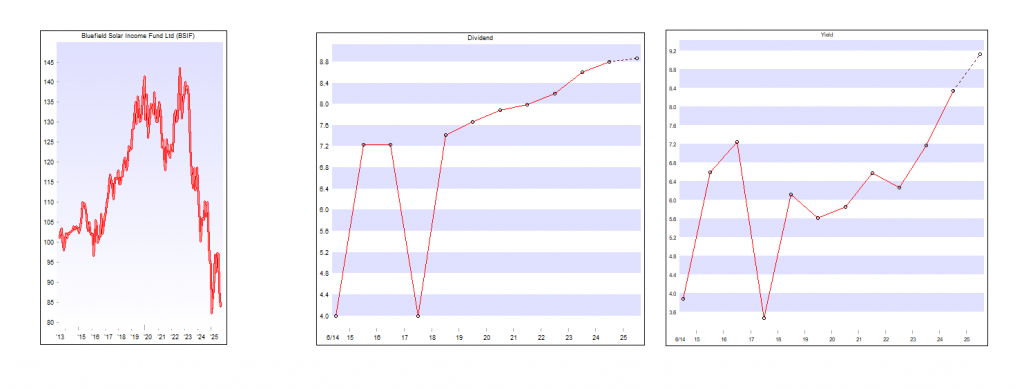

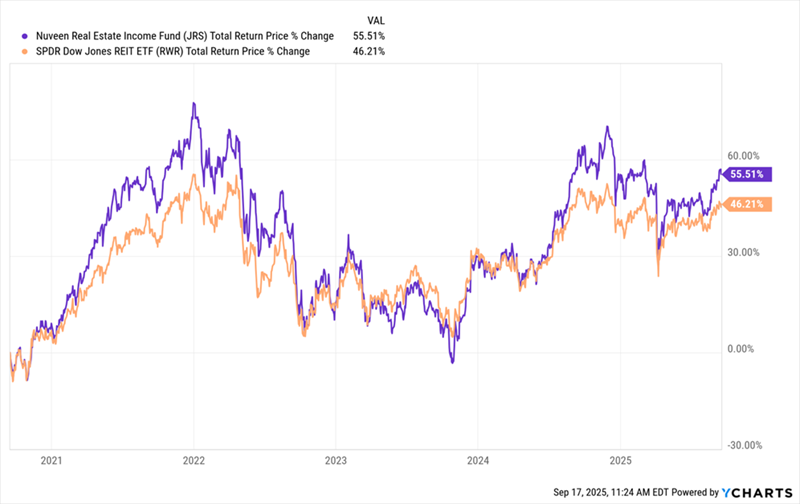

GGN cut its dividend mid-2020 and hasn’t raised it since. But recent portfolio gains could change that, as the fund’s total return NAV (or the return on its portfolio) has popped this year. That could prompt management to hand over a slice of these gains as a higher payout:

GGN’s Portfolio Soars. Payout Hike Next?

We know GGN well at my Dividend Swing Trader service. We hopped aboard this high-yielding gold fund back in May and, just over five months later, are sitting on a nice 23% total return as I write this.

We also like the fact that GGN goes beyond gold, as it also holds names like Freeport McMoRan (FCX), which focuses on copper, among its top-10 holdings. Energy stocks, like Chevron (CVX) and No. 1 holding Exxon Mobil (XOM), make an appearance, too. These additional resource stocks provide an added hedge against inflation.

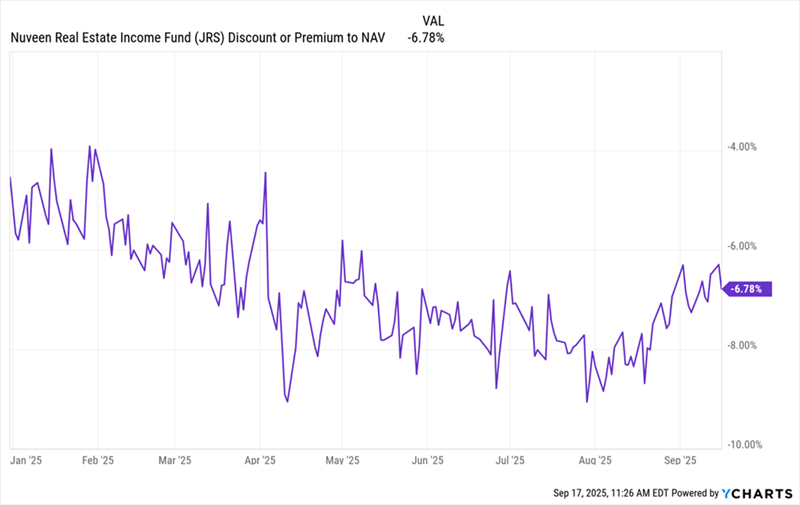

The fund now trades at a 1% premium to NAV, so we’re waiting for the next dip buy on this one. Same goes for another high-yielding gold fund we’ve traded for short-term gains in the past. It’s already soared even higher than GGN—a 56% gain, to be exact—in about the same timeframe.

You’ll want to make sure you own GGN and this other 56% gainer before gold’s next bounce. The timing isn’t quite right yet, but we’re getting close. I’ll tell you exactly when to make your move in Dividend Swing Trader.

Which brings me to …

“Gold-Dividend Twofer” Step 2: Look to NEM for Growth

Now let’s move from a CEF to Newmont Corp. (NEM), the world’s biggest gold miner. It’s benefiting from a sweet combo of cheap energy and high gold that I see continuing. As I write this, the WTI crude price is around $64. That’s up a bit since oil hit the skids in the April “tariff tantrum,” but it’s still historically low.

Energy is a major cost for any miner. And with the administration’s energy policy being, quite literally, “Drill, baby, drill,” lower oil looks set to stick around.

At the same time, the selling price of NEM’s main output, gold, is around that $3,700 level mentioned earlier, potentially heading to $4,000 if our man Gundlach’s latest call is right (and there’s every reason to believe it is, given his track record).

I think you’ll agree that this is a very good setup for a gold miner. No wonder Newmont’s revenue soared 21% year over year in Q2, and EPS came within a penny of doubling, to $1.43 from $0.72.

Yet shares trade at 14-times forward earnings, below the five-year average of 18. Management’s busy buying that deal, announcing $3 billion in buybacks at the end of July.

NEM yields 1.3% and pays a base plus variable dividend, so payouts rise when gold does well. But the dividend is just 21% of NEM’s last 12 months of free cash flow, so it’s safe.

The Takeaway: Start With NEM, Add GGN When Its Discount Returns

The bottom line? NEM is worth a look now, especially with its moderate P/E and buybacks. Then, when the time is right for GGN, we’ll pounce and add that fund (and its rich dividend stream), too.

The Independent

The Independent