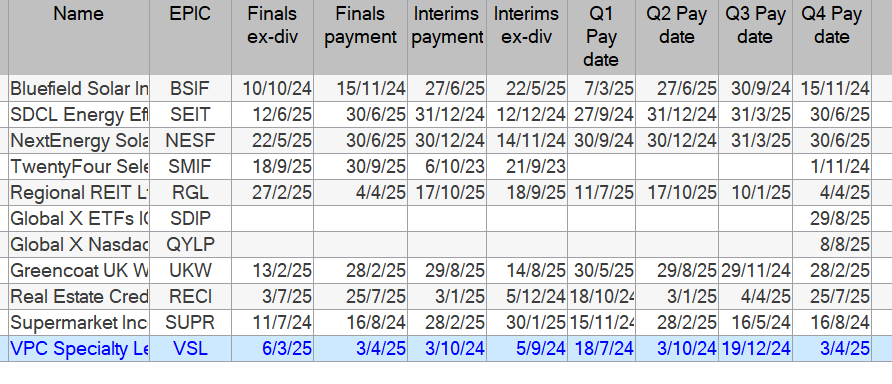

EPIC Name Market Share Price Dividend Div Impact Declaration Date Ex-Dividend Date Payment Date

SDIP Global X SuperDividend UCITS ETF ETF 730.0p $0.076 0.77% 18-Sep-25S Dividend Announcement 25-Sep-25 03-Oct-25

Investment Trust Dividends

EPIC Name Market Share Price Dividend Div Impact Declaration Date Ex-Dividend Date Payment Date

SDIP Global X SuperDividend UCITS ETF ETF 730.0p $0.076 0.77% 18-Sep-25S Dividend Announcement 25-Sep-25 03-Oct-25

All dates and dividends subject to change.

SDIP,QYLP and SMIF pay monthly dividends.

VPC having returned cash are in the final stages of their winding up

This is the blogs Snowball, your Snowball should differ subject to how many years you have to retirement and therefore your risk tolerance.

By Keith Speights

Key Points

This dividend stock continues to make Buffett smile.

Warren Buffett loves dividends. Don’t be fooled by the fact that he has never wanted Berkshire Hathaway (BRK.A 0.42%) (BRK.B 0.38%) to pay a dividend. The legendary investor frequently talks about the dividends Berkshire receives from its investments. And nearly every stock in the conglomerate’s portfolio pays a dividend.

Some of those stocks generate a lot more income than others. Buffett is raking a yield of nearly 63% from one Dividend King. And, no, that’s not a typo.

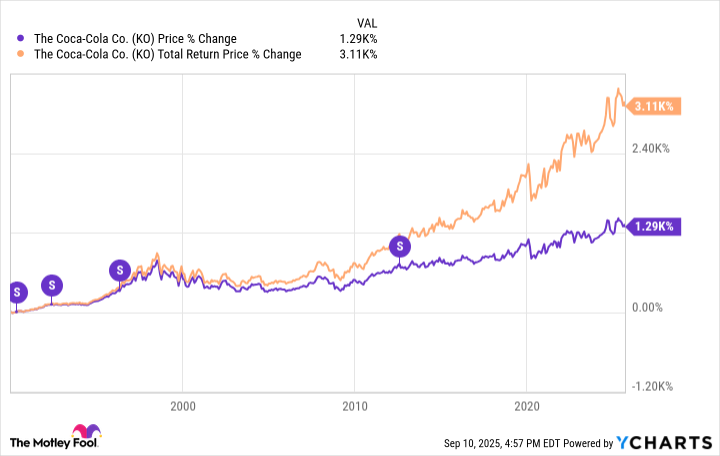

Image source: The Motley Fool.

That Dividend King I’m referring to is The Coca-Cola Company. You might wonder how Buffett is enjoying a yield of nearly 63% when Coca-Cola’s forward dividend yield currently stands at only 3%. That’s a good question with a simple answer.

Buffett first initiated a position in Coca-Cola in 1988. He added to Berkshire’s stake over the next few years, eventually spending around $1.3 billion to acquire a significant stake in the giant beverage and food company.

Although Buffett hasn’t always adhered to his favorite holding period of forever, he’s on the right track to do so with Coke. The stock is his longest-held position. Berkshire still owns 400 million shares, making Coca-Cola the conglomerate’s fourth-largest holding.

Those 400 million shares generate annual dividends of $816 million for Berkshire. Dividing that total by the $1.3 billion Buffett initially spent to buy the stock gives an effective dividend yield of roughly 62.7%.

The secret behind Buffett’s monster dividend yield, therefore, boils down to a buy-and-hold strategy. It’s also helped that Coca-Cola has increased its dividend every year since the legendary investor first bought the stock.

Coca-Cola hasn’t only generated nice dividends for Buffett through the years, though. It has also provided jaw-dropping returns.

Since early 1988, Coca-Cola’s share price has skyrocketed almost 1,300%. This includes four stock splits along the way. Importantly, though, that gain doesn’t include dividends. With dividends reinvested, Coca-Cola’s total return during the period is over 3,100%.

Coca-Cola has also given Buffett something else: refreshment. The multibillionaire said at Berkshire’s annual shareholder meeting in May as he picked up a can of Coke, “At 94 years of age, I’ve been able to drink whatever I like to drink.” (Buffett turned 95 on Aug. 30, 2025, by the way.)

Buffett has mentioned in the past that he typically drinks five cans of Coca-Cola each day. He said in a 2023 interview, “I think happiness makes an enormous amount of difference in terms of longevity. And I’m happier when I’m drinking Coke or eating hot fudge sundaes or hot dogs.”

While Coca-Cola is unquestionably one of Buffett’s favorite stocks, he hasn’t bought additional shares in a long time. Is Coca-Cola stock a buy now? I think the answer depends on your investing style.

If you’re a growth-oriented investor, Coca-Cola probably won’t appeal to you very much. The stock has lagged well behind the S&P 500 (^GSPC -0.10%) in recent years. Wall Street analysts also project that Coke’s earnings will grow more slowly than the S&P 500’s earnings in 2025 and 2026.Collapse

Dividend Yield

3.01%

What if you’re a value investor as Buffett has been throughout his career? Coca-Cola might not be at the top of your list, either. The stock’s forward price-to-earnings ratio is 21. While that’s not a terribly lofty valuation, it likely isn’t cheap enough to attract much interest from value investors.

On the other hand, if you’re an income investor, Coca-Cola looks like a great stock to buy right now. We’ve already mentioned the company’s status as a Dividend King and its solid dividend yield. I think income investors can count on this stock to keep the dividends flowing and growing for years to come — just as it has for Buffett over the last four decades.

Dividing that total by the $1.3 billion Buffett initially spent to buy the stock gives an effective dividend yield of roughly 62.7%.

Remember with compound interest, you will make more money in the last few years than in most of the earlier years, so even if you have a modest amount to start your Snowball, the sooner you start the sooner you will finish. GL

UK coloured flags waving above large crowd on a stadium sport match.

Every investor has their own priorities when deciding which UK stocks to buy. Some look for rapid growth, some for high income. The latest ‘Dividend Dashboard’ from fund platform AJ Bell highlights something else to consider.

It has high praise for companies with long records of increasing dividends every year, arguing this can help drive the share price higher over time. It counted 17 FTSE 100 members with an unbroken dividend streak lasting a decade or more. Happily, two of the best are on my watchlist.

The first is London Stock Exchange Group (LSE: LSEG). Over the last decade it’s delivered a total return of 408.8%, turning £10,000 into £50,880. Dividends have risen at an average compound growth rate of 15.5% a year in that time, which is remarkable. Yet the trailing yield is just 1.51%, which is misleading

The group’s share price is actually down 18% over the last 12 months. It’s even down 5% over five years. My view is that it simply ran too far ahead of itself, trading on a price-to-earnings ratio of around 32 at one stage, more than double the FTSE 100 average. Investors were pricing in a lot of growth that didn’t quite come through.

First-half results, released on 31 July, looked good to me. Adjusted earnings per share rose 20.1% to 208.9p. The interim dividend was lifted 14.6% to 47p. Management also launched a £1bn share buyback.

The shares still look a little pricey, trading at a P/E of 23.5. There are also questions over how artificial intelligence (AI) might affect demand for its data products, by reducing headcounts at City terminals. Yet the world increasingly runs on data and I still like the long-term outlook, which is why I bought the stock last week. After reading the AJ Bell report, I’ll consider buying more.

The stock looks cheaper than LSEG with a P/E of 14.25 and has a higher trailing yield of 3.68%. It would be higher still if the share price hadn’t done so well.

Q2 results on 16 July showed assets under management rose 8.2% to $122.57bn. Fee-earning assets climbed 11% year-on-year to $82.19bn, while fundraising hit $3.4bn.

There are risks. Private equity groups like Intermediate Capital Group rely on selling successful assets for profits, and the pool of buyers has shrunk lately. Smaller companies have also been hit by higher interest rates, which push up the cost of capital while inflation eats into potential future returns.

That said, the group’s long-term record is compelling. I’ve got some cash to invest in case the market dips in September and October, and I will seriously consider buying this stock if it does. I’ve waited long enough.

The AJ Bell research underlines an important lesson. A progressive dividend policy can be more valuable than a high but unreliable yield, over the longer run.

Current cash to re-invest £1,495.00

Current xd cash £1,120.00

Brett Owens, Chief Investment Strategist

Updated: September 17, 2025

Most Wall Street “suits” are allergic to dividend cuts. These spreadsheet jockeys sooooo lack imagination. They prefer linear trends—up and to the right.

Dividend growers model nicely. Payout “resets” (cuts!) do not. So, there is often a knee-jerk reaction from analysts to sell every divvie slash they see.

Same goes for most individual income investors. These vanilla beans sold BlackRock Health Sciences Term Trust (BMEZ) late last week when BlackRock sliced the dividends for three of its popular funds.

The weaker hands sold. Big payouts remain. As contrarians, we’re intrigued.

Dividend cuts, ironically, often mark the start of opportunity. Here’s what the knee-jerk sellers miss:

In other words, the “bad news” is already priced in. This nifty 9.2% monthly dividend can now be had for 89 cents on the dollar.

Why the deal? Because this is a CEF. Unlike ETFs or mutual funds, CEFs raise a fixed pool of capital at launch. After that, shares just trade back and forth on the exchange.

That creates inefficiencies—often big ones. When investors sell (like last week), they often dump CEF shares without looking at the underlying assets. Discounts widen, even if the portfolio is perfectly fine.

That’s when dividend deal hunters like us step in!

CEF discounts open the door. Politics blow it off the hinge. Wall Street is worried about President Trump letting RFK Jr. “go wild on health” from his perch at HHS. The first-level fear is that pressure on drug prices is bearish for healthcare.

But remember Trump 1.0: big pharma lagged, while biotech and medical device makers soared. BMEZ’s portfolio today is a blend of biotech and medical device makers with big potential. These aren’t cartel-like insurers or big pharma names whose product prices the government may cap.

BMEZ holds the kinds of firms that benefited the most in Trump 1.0: healthcare innovators that thrive when regulation lightens.

Top holding Alnylam (ALNY) is a pioneer in “RNA interference”—a cutting-edge class of medicine that essentially turns off disease-causing genes. Alnylam’s therapeutics are being explored for treating genetic, heart and neurological diseases.

Bad genes? Alnylam fixes them.

The company’s research benefits from less regulation. The stock soared under Trump 1.0, racking up 300%+ gains. And the sequel is shaping up to be even bigger with ALNY already up 90%:

BMEZ Top Holding Loves the Trump Life

Number two BMEZ holding, Veeva Systems (VEEV), gained a fantastic 570% under Trump 1.0. The life sciences software and data provider benefits from a looser healthcare mergers and acquisitions environment because Veeva’s existing customers install Veeva’s platforms on newly-acquired corporate laptops.

VEEV shares lost 4% in Biden’s four years as sector M&A slowed, but they are already up 29% as the healthcare deals begin to flow.

ALNY and VEEV are increasingly hot tickers, and deservedly so. But they are hidden beneath the cloak of BMEZ! The discount to NAV means we’re paying less than 90 cents on the dollar for this duo.

Dexcom (DXCM), is the fund’s number three holding. It makes continuous glucose monitors that are quickly replacing old-school finger sticks for diabetes management. Its stock climbed 354% under Trump 1.0.

Let’s put the dividend reset in perspective. We are moving from a variable monthly overpayment to a consistent 11 cents per month. BlackRock is like a carpenter. Management measured twice so that they can cut just once and leave the payout at these levels for the foreseeable future:

BlackRock Measures Twice, Cuts Once

So we have a 9.2% divvie supported by the current administration’s policies. With an 11% discount to boot! The vanilla sellers may regret dumping this well-supported monthly dividend.

If this monthly dividend discussion sparked an “ah ha!” moment for you, well, welcome! Wall Street has been feeding you the equivalent of “junk food” financial advice your entire life.

The 4% withdrawal rule? C’mon man! BMEZ yields 9.2% which is enough to live on dividends without tapping our principal.

Plus, it trades at an 11% discount—which means upside is likely! What a cherry deal.

None of the vanilla maxims generate passive income. It’s time to clean up the financial diet. Trim down the “buy and hope” desperation and beef up the dividends.

Real Estate Credit Investments Limited (the “Company”)

Ordinary Dividend for RECI LN (Ordinary shares)

Real Estate Credit Investments Limited announces today that it has declared a first interim dividend of 3.0 pence per Ordinary Share for the year ending 31 March 2026. The dividend is to be paid on 17 October 2025 to Ordinary Shareholders on the register at the close of business on 26 September 2025. The ex-dividend date is 25 September 2025.

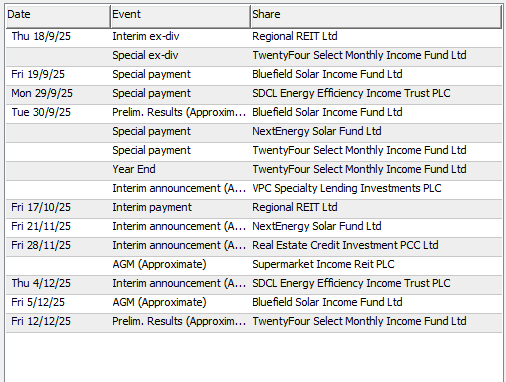

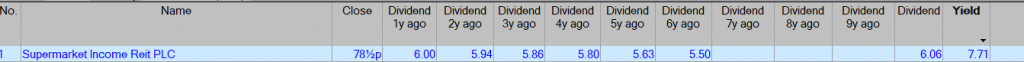

If you buy SUPR today the fcast dividend is 6.18p per share.

The current price to buy is 78.9p a buying yield of 7.75%.

The yield should gently increase, although there are never any guarantees.

So in around ten years time, if the Trust still trades, you should have received all your capital back.

You would have achieved the holy grail of investing in that you would be receiving income from a share that sits in your account at a zero, zilch cost.

If you re-invest the earned dividends into another high yielding trust you will also be earning income a blended yield of around 15% plus on your seed capital.

If you are lucky enough to have another ten years to invest, you can do it all over again but with a much shorter time scale.

If you do buy, remember the rules of the Snowball.

A home for your hard earned as you wait for markets to fall, which they will but the timing is the unknown.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑