At 13.2%, this passive income stock has the highest yield on the FTSE 250. And it trades at a 40% discount

Our writer takes a look at the highest-yielding FTSE 250 passive income stock. But how sustainable is this return? Could it be a value trap?

Posted by James Beard❯

Published 20 December

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

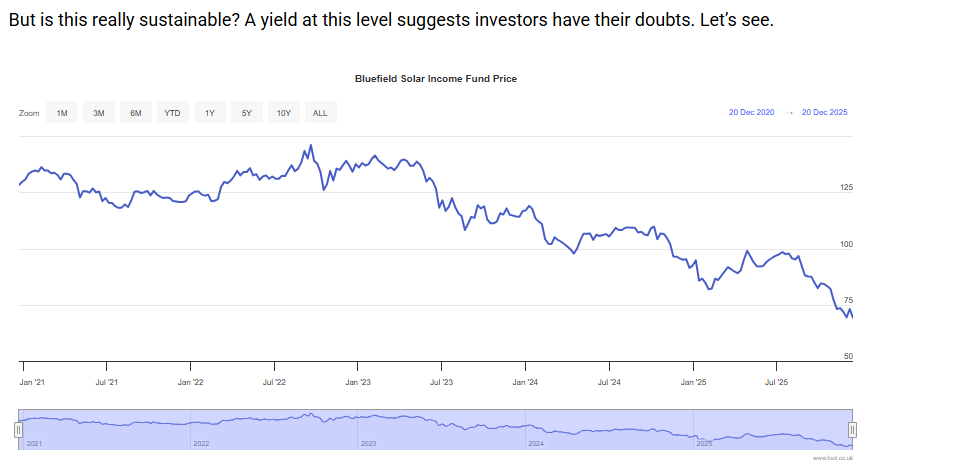

A £10,000 investment a year ago (17 December 2024) in Bluefield Solar Income Fund (LSE:BSIF) would have earned £955 in passive income over the past 12 months. But over this period, its share price has fallen by approximately a quarter.

If it can maintain its payout for another year, it means those buying £10,000 of shares today would earn £1,322 (38% more) over the next 12 months. This implies a yield of 13.2%, the highest on the FTSE 250.

Should you buy Bluefield Solar Income Fund

A cause for concern?

If I was a shareholder, I’d be concerned about the drop in Bluefield’s market cap. However, based on its latest internal valuation, the fall appears unjustified. It now means its shares trades at a 40% discount to the fund’s net asset value.

In other words, if the business ceased trading today and sold off its assets and cleared its liabilities, there would be around 26p a share – equivalent to three times its annual dividend – to give back to shareholders.

I appreciated that valuing non-quoted energy portfolios can be difficult, but this is an enormous discount. Can the fund’s accountants be so wrong?

And because of the management team’s frustration that investors don’t appear to value Bluefield’s 793MW of renewable energy assets as highly as they do, they have engaged advisors to explore the possibility of selling the group. If successful, it would probably mean the shares are de-listed from the London Stock Exchange.

An uncertain future

But there are no guarantees that a buyer will be found.

That’s due, in part, to the UK government’s decision to launch a consultation on how renewable energy projects should be subsidised in the future. Although there are no changes proposed to current contracts, it has caused uncertainty within the industry and makes investing in the sector riskier than might otherwise be the case.

Also, a higher interest rate environment means investors can earn a reasonable return elsewhere. This has resulted in many shares in the sector falling out of favour. And for the company, it makes it more expensive to borrow, which limits opportunities to expand.

If a sale doesn’t go through, the trust’s share price could continue to drift lower. But if it’s able to continue its recent policy of increasing its dividend each year, the yield will go higher still. Of course, there can never be any assurances given when it comes to payouts.

| Financial year (30 June) | Share price (pence) | Dividend per share (pence) | Dividend change (%) | Yield (%) |

|---|---|---|---|---|

| 2021 | 121.4 | 8.0 | +1.3 | 6.6 |

| 2022 | 131.0 | 8.2 | +2.5 | 6.3 |

| 2023 | 120.0 | 8.6 | +4.9 | 7.2 |

| 2024 | 105.6 | 8.8 | +2.3 | 8.3 |

| 2025 | 97.2 | 8.9 | +1.1 | 10.2 |

Source: London Stock Exchange Group/company reports

Final thoughts

But I reckon the Bluefield Solar Income Fund has plenty going for it. Most of its income (84% comes from PV assets) is secured by long-term agreements and, although there will be some variability depending on how often the sun shines, the UK weather is generally bright enough to help the fund earn revenue all-year round. And with the price it receives for a significant proportion of its output guaranteed, it should be able to predict its earnings with a reasonable degree of accuracy.

If a buyer does come forward, it’s hard to see how the directors can recommend selling the group for much less than its net asset value. I think it’s worth considering but not with the aim of a quick sale.

I enjoyed every paragraph. Thank you for this.