By Keith Speights – Updated May 31, 2025

Key Points

- Relying on dividend income for life is possible for many, but it could require a large initial investment.

- Risks to consider include the possibility of dividend cuts or suspensions and inflation eroding the buying power of your income.

- Potential strategies to minimize these risks include diversification and investing in stocks and funds with solid track records of dividend increases.

As always, The Motley Fool cannot and does not provide personalized investing or financial advice. This information is for informational and educational purposes only and is not a substitute for professional financial advice. Always seek the guidance of a qualified financial advisor for any questions regarding your personal financial situation.

Imagine doing the things you love without worrying about money. That’s the dream for many Americans. Some achieve this goal in their 60s when they retire. Others can do it even earlier.

One of the top ways people fulfill this dream is by investing in dividend stocks. But can you rely on dividends for life after quitting your job?

Image source: Getty Images.

How could you live off dividends for life?

The concept of living off dividends for life is a simple one. First, you invest a sum of money in stocks that pay dividends. Second, you use the dividend income to cover your expenses after you quit working. Easy-peasy? Not necessarily.

First, you’ll need a substantial amount of money to invest. Exactly how much depends on the dividend yield the stocks you invest in pay. The dividend yield is the annual dividends per share paid by a company divided by its current share price.

Divide the amount of annual income you require by the dividend yield you expect to make to calculate how much money you’ll need to invest. For example, let’s say you want to make $100,000 per year. If you receive a dividend yield of 3%, you’ll need to invest around $3.33 million ($100,000 divided by 3%) to get that amount. That amount is attainable for some, but it could be a stretch for many people.

If you want to retire on dividend income but don’t have $3.33 million to invest, you have two options. First, you could try to get a higher dividend yield. A dividend yield of 5%, for example, would require only $2 million invested to make $100,000 per year. Second, you could try to live on less money. If you could make ends meet on $70,000, you’d need $2.33 million to invest with a 3% dividend yield.

Risks to consider

There are some risks to keep in mind, though. One biggie is that the dividend yield you receive in the future might not be as high as the yield you get at first.

Some companies cut their dividend payments over time. A few even suspend or eliminate their dividend programs. For example, going into 2020, The Walt Disney Company had paid a dividend for over 40 years. As a result of the COVID-19 pandemic, the company suspended its dividend program for three years.

It’s also possible that a company that has reliably paid dividends for a long time will be acquired, resulting in the elimination of its dividend. Walgreens Boots Alliance is a great case in point. The pharmacy giant had a streak of 47 consecutive years of dividend increases as of late 2023. However, Walgreens cut its dividend in January 2024. It’s now in the process of being acquired and taken private.

Inflation is arguably an even greater threat. It can erode the buying power of your dividend income even if none of the stocks you own reduce or suspend their dividends.

Potential strategies

The good news is that there are potential strategies you can follow to minimize these risks. Probably the most important one is to diversify your investments. If you only own five stocks, and one suspends its dividend, your income would be reduced by 20% assuming they are all paying the same amount. But if you own 25 stocks and it happens, your income would be only 4% lower.

Investing in dividend-focused exchange-traded funds (ETFs) is a great way to diversify. For example, the Schwab U.S. Dividend Equity ETF (SCHD+1.09%) owns 103 dividend stocks. Its top holdings include Coca-Cola, Verizon Communications, Altria Group, Cisco Systems, and Lockheed Martin.

The Schwab U.S. Dividend Equity ETF currently offers a dividend yield of around 4%. This ETF has also delivered an average annual return of roughly 12% since its inception in October 2011.

If you want diversification and an even higher yield, closed-end funds (CEFs) could be an alternative. One CEF that I own is the Cohen & Steers Infrastructure Fund . This fund owns 259 stocks. Its distribution yield is a lofty 7.2%. The CEF’s average annual total return since its inception in March 2004 is 9.5%.

There are two key things to note about closed-end funds, though. Many of them use leverage (borrowing), which increases their risk. The Cohen & Steers Infrastructure Fund’s leverage ratio is 28.5%. Their fees are also typically higher than ETFs.

How can you minimize inflation risk ? Look at the history of dividend increases for the companies and funds you’re considering. Just because a company or fund has increased its dividend consistently at an average rate higher than inflation doesn’t mean it will always do so. However, investing in stocks and funds with strong track records of dividend hikes could increase the odds that your annual dividend income at least keeps up with inflation.

Finally, re-evaluate your holdings regularly. The stocks and funds that are great picks today might not be such great picks a few years from now. Many Americans can quit their jobs and rely on dividends for life. But the sources of those dividends could need to change from time to time.

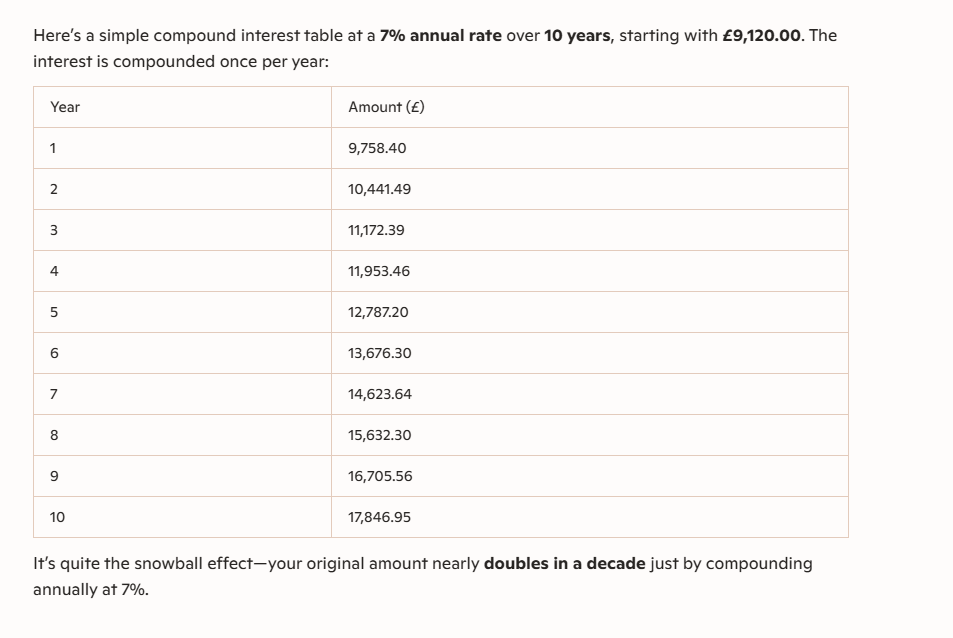

Most peoples Snowball will not be valued in millions, so concentrate your Snowball on the tail not the body.

The blog’s plan is to have a Snowball that pays a yield of around 18% on seed capital of 100k, with no funds added to the Snowball. The longer you have to re-invest your dividends the higher the yield should be.

Warren Buffett just collected another $204 million from Coca-Cola — a reminder that some of the most powerful returns on Wall Street come from patience, dividends, and owning the right business for decades.

Here’s how that payout breaks down, why Coca-Cola keeps funding Berkshire’s war chest, and what this kind of compounding looks like in real dollars.

Coca-Cola has been one of Warren Buffett’s signature bets since the late 1980s, and it’s still paying like clockwork.

Berkshire Hathaway owns 400 million shares, and Coca-Cola’s $0.51 quarterly dividend just delivered a $204 million payout. Sometimes the biggest wins aren’t dramatic. They’re automatic.

Coca-Cola dividends now bring Berkshire over $800 million a year, far beyond the original $1.3 billion cost. Coca-Cola may have its “secret” headlines, but Buffett only cares about one secret: the dividend arriving every quarter.

Why Coca-Cola Still Matters

Coca-Cola isn’t just a dividend machine, it’s still a modern profit engine.

With a market cap around $289 billion and gross margins above 61%, the company keeps doing what it does best: defend pricing power, stay everywhere, and find small ways to sell more. Mini cans. Convenience-store pushes. Product tweaks that look boring up close, but scale fast when you’re global.

That durability is why some Wall Street analysts still see upside, with price targets reaching $80. This implies that Coca-Cola is still being priced as a cash machine with staying power. And for Berkshire, that’s the whole point. No hype. No chasing trends. Just owning a durable cash machine, year after year, and letting dividends and compounding do the heavy lifting.

This is where most investors get caught. They chase the hot stock, the pop, the quick win, and end up trading emotions instead of building wealth.

Buffett plays a different game. He doesn’t need to react to every headline. He owns businesses that pay him, then lets time and dividends do the work.

The difference isn’t access to information. It’s behavior, and the traders who last tend to rely on rules, not emotion, like stop-loss and take-profit orders

Why This Dividend Story Matters

That $204 million payout is more than a headline number. It’s what long-term investing looks like when the business is durable and the cash flow is real.

While plenty of investors chase the next spike, Buffett’s Coca-Cola stake shows the quieter path: own a high-quality company, let the dividend stack up, and give compounding time to do its job. You don’t need to love soda to take the point, you just need to respect what consistent payouts can build over decades.

Leave a Reply