Financial performance and dividends

NAV total return was broadly flat over the six-month period (-0.2%). The positive contribution from macroeconomic updates, including revised UK inflation forecasts, a reduction in Finnish corporate tax, and FX tailwinds, combined with dividends and share buybacks, were offset by an increase in discount rates and weaker power price forecasts. Revenues remain well protected, with 85% fixed over the next two years, helping to mitigate much of the power price volatility. Development-stage asset valuations also saw a modest net decline, primarily due to headwinds in the floating offshore wind sector affecting Simply Blue. Further details on the NAV per share movements can be found in the interim report.

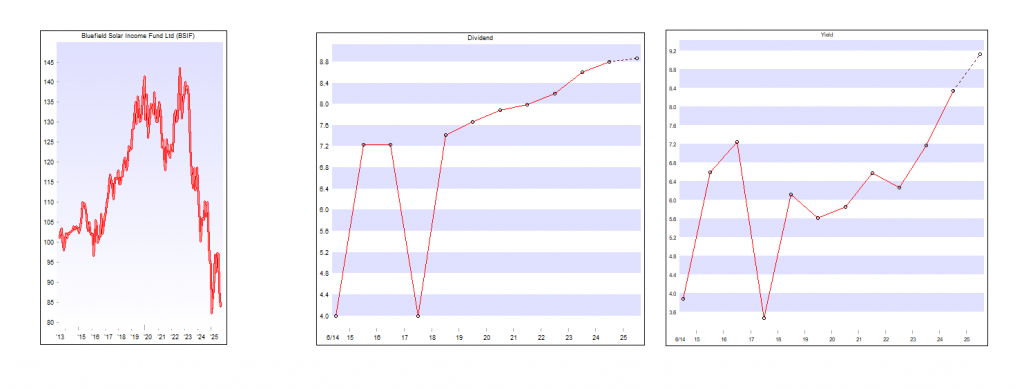

We continued to deliver against our progressive dividend policy, paying 3.08p per Ordinary Share over the first half, in line with the full-year 2025 target of 6.17p per share. This target, increased by 2.5% from FY 2024 in line with UK CPI, marks the fourth consecutive year of inflation-linked increases and is expected to be fully covered by operating cash flows. Total dividend payments amounted to £16.8 million during H1 2025.

ORIT continues to offer shareholders an attractive income profile. Based on the FY 2025 dividend target of 6.17p, and the share price of 73.4p as at 30 June 2025, the implied dividend yield is 8.4%. This supported a total shareholder return of 12.9% over the first half of this financial year, reflecting both income and share price appreciation. While the share price has since retraced to 66.0p as at 15 September, the implied yield has correspondingly increased to 9.3%, reinforcing the strength of ORIT’s income proposition in volatile markets.

Launch of ‘ORIT 2030’ – A strategic roadmap for growth

Existing capital allocation commitments remain in place for 2025

Core focus on NAV growth through investment into construction and developer assets

A clear plan to create further impact through adding new renewable capacity

Proposing a continuation vote every three years

Octopus Renewables Infrastructure Trust plc, the diversified renewables infrastructure company, today announces the launch of ORIT 2030, a defined five-year strategy designed to deliver substantial net-asset-value (“NAV”) growth, scale the company to £1 billion and generate attractive medium-to-long-term shareholder returns. The Board is also recommending that the Company’s continuation vote moves to every three years, from the current five-year cycle.

The three core goals of the 2025 Capital Allocation Update in March remain unchanged for this financial year.

2025 Capital Allocation Objectives and Update

1. An extended share buyback programme totalling £30 million

· £21.6 million shares repurchased to 15 September 2025

· Balance to be retained to make further purchases as required

2. A commitment to reduce debt to under 40% of Gross Asset Value (“GAV”)

· 47% at 15 September 2025; asset sales anticipated to bring this figure down

· On track to reduce debt to below 40% of GAV by year end

3. A pledge to sell at least £80 million of assets to pay down debt and make a small number of selective investments where they are deemed to be accretive

· Several sales processes advanced; on track to realise the £80m target by year end

· Selective investments made into developers Nordic Generation, BLC Energy, and conditional acquisition of Irishtown

Thereafter the Board and Octopus Energy Generation (the “Investment Manager”) will execute ORIT 2030, which is focused on the four strategic priorities set out below:

1. Grow: Invest for NAV growth

· Deploy capital into higher returning investments

o Increase target portfolio allocation to ~20% in construction assets

o Maintain 5% allocation to developer assets

· Accelerate NAV growth through a repeatable process of recycling, investment, improving operational performance and enhancing the value of assets

2. Scale: Build a larger, more investable company

· Target £1 billion net asset value by 2030, to create a more liquid and investable company

· Achieved through disciplined capital deployment and organic NAV growth, alongside potential value-accretive corporate M&A

· Share buybacks as a tool subject to market conditions and capital allocation priorities

3. Return: Deliver attractive risk-adjusted total returns

· Target medium-to-long-term total returns of 9-11% through a combination of capital growth and income

· Maintain existing progressive dividend policy, while preserving full cover

· Prudent balance sheet management, with leverage anchored at <40% GAV with the flexibility to move temporarily above this for value-accretive opportunities and strategic recycling

· Retain diversification across core technologies and geographies

4. Impact: Scale with purpose and resilience

· Aim to build approximately 100 MW of new renewable capacity per annum

· Sustain ORIT’s mandate, enabling new clean energy generation and supporting the energy transition

Continuation Vote

In addition to the above, the Board is recommending that the continuation vote moves to a cycle of every three years, from the current five. A resolution to this effect will be put to shareholders at the 2026 AGM and, if approved, the next continuation vote will take place at the Company’s 2028 AGM. The change is intended to give shareholders more frequent opportunities to assess the future of the Company, while reinforcing ORIT’s commitment to accountability and alignment with investor interests.

Phil Austin, Chair of Octopus Renewables Infrastructure Trust plc, commented: “ORIT 2030 marks the next phase in the Company’s development. This clear five-year strategy aims to scale ORIT significantly, drive NAV growth through investment into construction and development assets and – underpinned by resilient cash flows – maintain progressive fully-covered dividends.

“More than 90% of shareholders backed the Company at its continuation vote in June, indicating strong support for ORIT’s future, yet it has also been made clear from our active dialogue with investors that they want the Company to become larger, more investable and to stay true to its purpose. ORIT 2030 addresses this directly with a plan that balances yield, growth and impact, ensuring the Company delivers for shareholders, while supporting the energy transition.

“With disciplined capital management and the expertise of our Investment Manager, we believe we are well placed to execute ORIT 2030 and to pursue our ambition of building a £1 billion renewables vehicle by 2030.”

Your writing style makes complex ideas so easy to digest.