You wanted a lower risk share for your Snowball

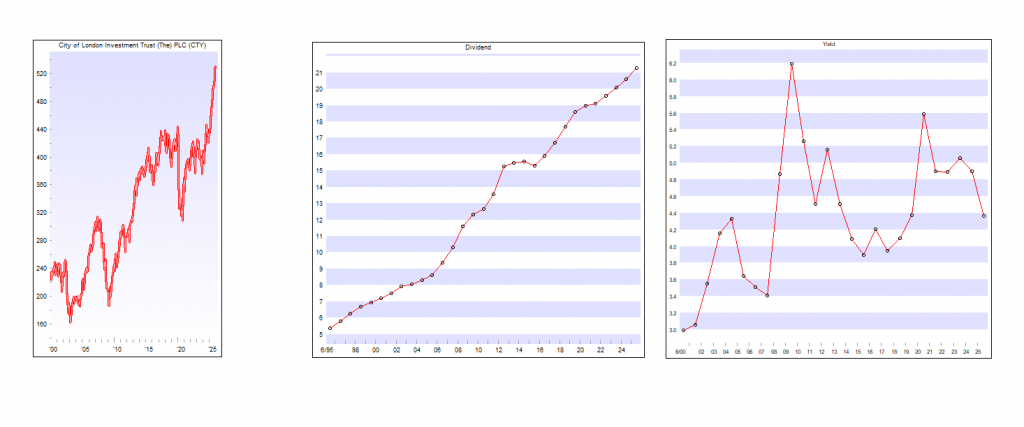

Having done your research you know that CTY have paid an increased dividend for over 50 years.

You wanted a ‘secure’ dividend just in case your research leads you to buy at the wrong time.

Current yield 4%, because it’s in lots of peoples most wanted shares list, it trades at a small premium.

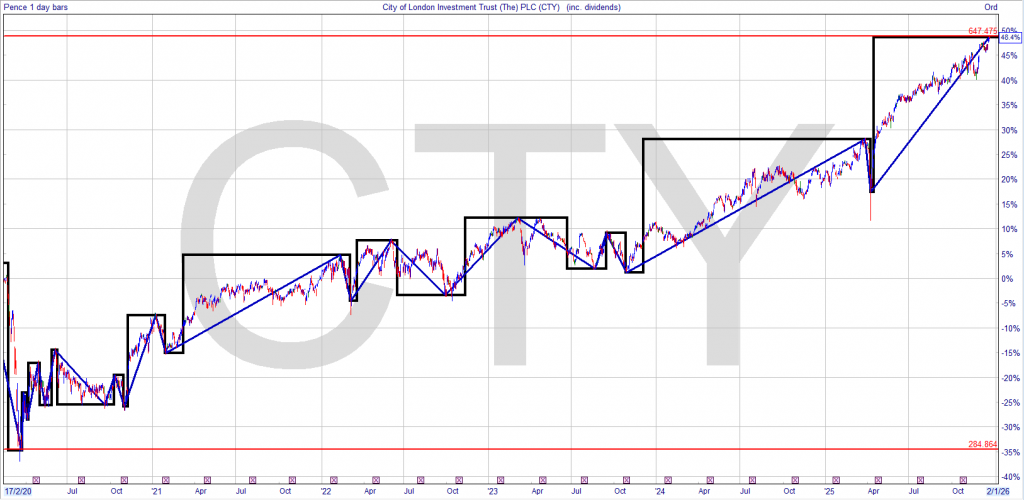

If you had bought under 300p after the covid crash the yield was 6.3%.

You decide as the price rose and the yield fell to re-invest the dividends elsewhere in your Snowball.

The current yield on your buying price is now 7% but the running yield is now 4%.

Without taking a very high risk, with your hard earned, you would have achieved the holy grail of investing, in that you can take out your capital and re-invest in a higher yielder and also receive income from a share that sits in your Snowball at zero, zilch, nothing cost.

You now have another share in your Snowball, providing income to re-invest and you would be on the way to

Everything crossed for another market crash ?

I appreciate the depth and clarity of this post.

This made me rethink some of my assumptions. Really valuable post.

Thanks for addressing this topic—it’s so important.