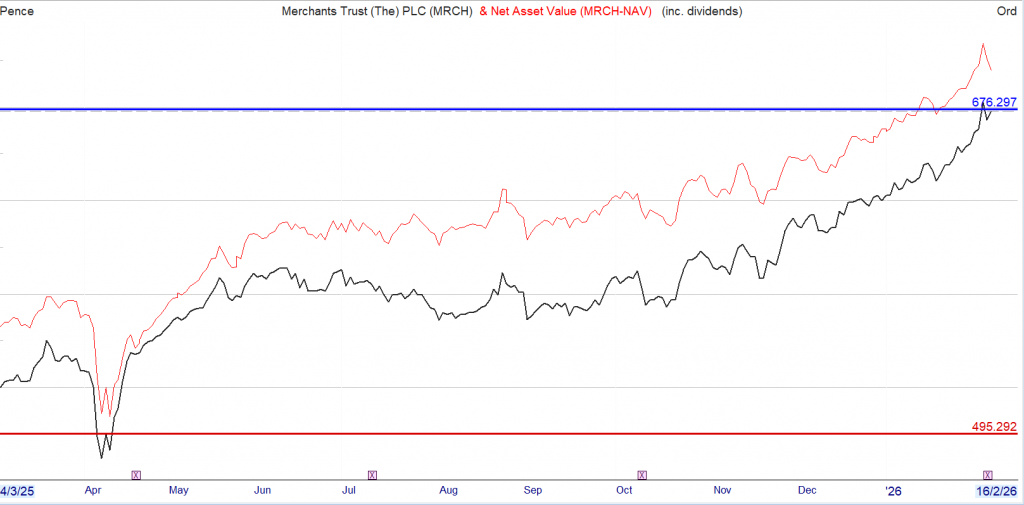

You decided to trade the breakout, the yield at 500p was around 6%. If the breakout failed you would still collect the dividend. Your analysis worked and you would currently be up 30% in less than a year. You would be watching the market to be ready to take part profits, maybe reducing the share holding back to your initial stake.

Performance and portfolio

Merchants delivered a NAV total return of 5.4% over the six-month period, compared with 7.5% for the FTSE All-Share Index. Absolute returns were positive, though relative performance lagged the benchmark and some peers. This was largely due to the narrowness of market leadership: as in the US, certain groups of companies drove the market higher.

Some of these leading stocks did not align with our Manager’s long-term value approach. Instead, greater emphasis has been placed on attractively valued domestic cyclicals, which have underperformed in the recent low-growth environment. While this positioning has weighed on short-term results, we remain convinced that it provides the best foundation for long-term returns. The Board has reviewed the Manager’s strategy in detail and continues to support this disciplined, value-focused approach.

Portfolio activity reflected evolving opportunities, with an unusually high number of new investments compared with a typical half-year. Selective purchases were made where valuations and income prospects were attractive, while holdings with more limited capital growth potential were reduced.

The share price return of 1.5% reflected a widening discount to NAV, in line with a broader trend across UK investment trusts as international investors reduced exposure to UK equities. The Board, together with advisers and the Manager, monitors this closely and retains the option of share buybacks if appropriate. Meanwhile, we remain active in shareholder engagement and marketing to improve awareness and demand.

Earnings and dividends

Total income from the portfolio was £28.8m, 2.5% higher than the £28.1m generated in the first half of last year. Earnings per share rose by 3.5% to 17.7p (2024: 17.1p). This strong income performance provides confidence both in the sustainability of the dividend and in rebuilding revenue reserves.

With the final dividend for the 2025 financial year now approved, Merchants has increased its dividend for 43 consecutive years – earning the Company “Dividend Hero” status from the AIC. The Board has declared a second interim dividend of 7.3p per share, payable on 20 November 2025 to shareholders on the register at 10 October 2025. This brings the total dividend for the first half of the current financial year to 14.6p, compared with 14.5p last year – a year-on-year increase of 0.7%.

One to consider for your Snowball, when Mr. Market gives you the opportunity.

Leave a Reply