If you had been lucky or had a diversified Snowball

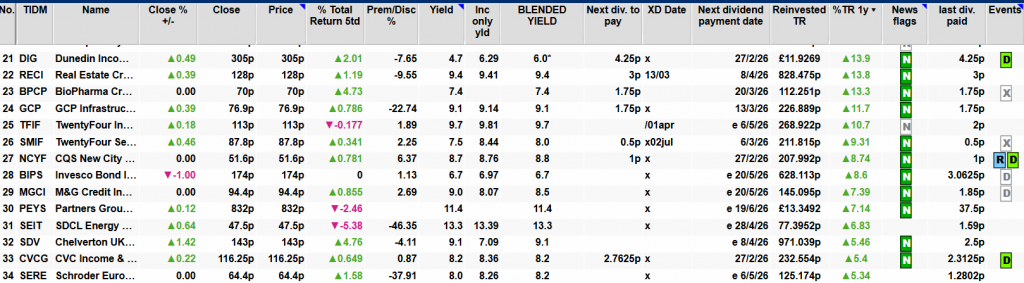

Investment Trust Dividends

If you had been lucky or had a diversified Snowball

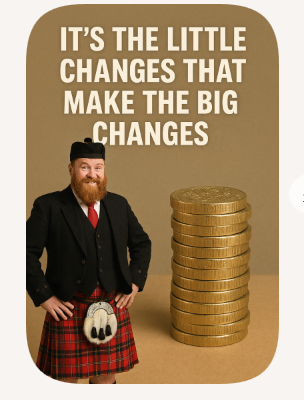

My share programme has changed their format, so until I get used to the new format, let’s look back at yearly performance, where if your Snowball is both

And you have been unlucky, these are the TR returns for one year.

19th February 2026

CT GLOBAL MANAGED PORTFOLIO TRUST PLC

All data as at 31 January 2026

This data will be available on the Company’s website,

CT Global Managed Portfolio Trust PLC

Income Portfolio

| Top Ten Equity Holdings | % |

| JPMorgan European Growth & Income | 6.6 |

| Murray International Trust | 6.1 |

| JPMorgan Global Growth & Income | 6.1 |

| NB Private Equity Partners | 5.4 |

| JPMorgan Global Emerging Markets Income Trust | 4.7 |

| Schroder Oriental Income Fund | 4.4 |

| STS Global Income & Growth Trust | 4.3 |

| The Law Debenture Corporation | 4.2 |

| 3i Infrastructure | 4.1 |

| TwentyFour Income Fund | 3.8 |

| Total | 49.7 |

Note: All percentages are based on Net Assets

| Net Gearing | 6.6% |

Research for your Snowball.

Posted on 4th October 2015 | By Phil Oakley

Updated: August 2024

If you are watching or listening to the news at the end of the day you will usually be told what happened to the stock market that day. More precisely, you will be told whether it went up or down in price.

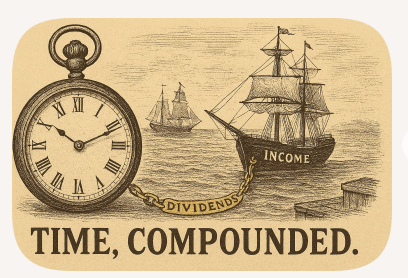

Yet investing in shares is not just about changes in prices. When you own a share of a company you are often paid a dividend as well. Dividends can be very important. They can form a major part of any long-term savings plan and also a source of income to live on.

In this chapter, we are going to look at why dividends are important and how you can use them to build up your savings pot or as a source of income. Then we will look at some of the tools that ShareScope has to help you find some dividend paying shares that can help you meet your goals.

Dividends are your share of a company’s after-tax profits paid to you during a year.

They make up part of the investment return from owning a share. However, unlike a share price that goes up but then goes down again, a dividend once it has been paid cannot be taken away from you.

What’s good about dividends is that they represent a real, tangible return on the shares that you own.

The same cannot be said for a rising share price. Share prices tend to move up and down a lot and there’s no guarantee that you will sell for a profit.

Return = Change in share price + dividends received

Investing in shares that pay chunky dividends and holding them for a long time can be a great way to build up your portfolio’s value.

That’s because the dividend from shares and the reinvestment of them is where the real money can be made from the stock market over the long haul.

Why is this?

I’ve never been able to find the source, but Albert Einstein was rumoured to have said that “the most powerful force in the world is compound interest”.

When it comes to investing – and dividend investing in particular – I’m inclined to agree with him.

Compound interest is essentially earning interest on the interest that you’ve already been paid. This is what tends to happen if you leave money in a savings account for a number of years.

Let’s say that you put £100 into a savings account that pays interest of 10% per year at the end of the year.

You have a choice of what to do with the interest that you receive. You can either spend all or some of it or you can reinvest it.

In the first year, you will receive £10 of interest on your £100 of savings. If you spend the interest every year, this is what happens to your interest income and savings over five years.

| Year | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| Starting Amount | £100 | £100 | £100 | £100 | £100 |

| Interest at 10% | £10 | £10 | £10 | £10 | £10 |

| Spent | -£10 | -£10 | -£10 | -£10 | -£10 |

| Ending Amount | £100 | £100 | £100 | £100 | £100 |

You receive £10 every year to spend and at the end of five years the value of your savings is still £100.

You’ve had £50 of interest income and preserved your savings pot. So your initial £100 has given you £150 of value.

But what would happen if you didn’t spend the interest and reinvested it back into the savings account at 10%? If you compound the interest you receive.

| Year | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| Starting Amount | £100 | £110 | £121 | £133.10 | £146.41 |

| Interest at 10% | £10 | £11 | £12.10 | £13.31 | £14.64 |

| Spent | £0 | £0 | £0 | £0 | £0 |

| Ending Amount | £110 | £121 | £133.10 | £146.41 | £161.05 |

Well, after five years, the value of your £100 would have grown to £161.05 and your annual interest income would have grown to £14.64.

The longer you reinvest your income the bigger the potential annual income and the value of your savings pot. This is the power of compound interest at work.

The one big caveat here is that the interest rate has stayed the same for five years.

This might be the case with a fixed term savings account or a bond, but is rarely the case for other investments. I’ll say a bit more on the effect of changing interest rates a little later on.

You can use this strategy of compounding to very good effect with dividend paying shares.

Instead of spending the dividend you receive, you use it to buy more shares in the company which paid you, which in turn gives you more dividends in the years ahead.

Repeat this process for long enough – the longer the better – and it is possible to turn a small initial sum of money into a large one. This can be the case even if dividends per share or the share price do not change.

Let me show you how this can work.

Let’s say that you buy 1000 shares in a company called Bob’s Book Stores plc at 100p per share (so an investment of £1,000) when it is paying an annual dividend per share of 4p.

Over the next thirty years the company doesn’t grow its profits but maintains them.

Dividends stay at 4p per share and the share price stays at 100p.

If you had kept your 1000 shares you would have received an annual dividend income of £40 (1000 x 4p) or £1200 over thirty years.

With your 1000 shares still worth £1000, your investment value would be £2200 (£1,000 + £1,200).

But if you had reinvested the dividends and bought extra shares (To keep things simple, I’ve ignored the impact of broking commissions and buying whole shares here) each year you’d have ended up with a much better result.

At the end of thirty years you would own 3243 shares worth £3243 and have an annual dividend income of £125. This equates to a yield on initial cost of 12.5% (£125/£1000).

An investment of £1,000 in Bob’s Book Stores over 30 years:

| Left alone | With dividends reinvested | |

|---|---|---|

| Value of shares | £1,000 | £3,243 |

| Income Received | £1,200 | £0 |

| Investment value | £2,200 | £3,243 |

| Annual income in year 30 | £40 | £125 |

| Yield on cost | 4.00% | 12.50% |

That said, if you pick the right investments you’ll find that dividends don’t stay the same for thirty years – they can often increase substantially.

This makes dividend reinvestment and the power of compound interest even more attractive – if you can find the right share at the right price. More on this in a short while.

It’s worth adding that companies which have an explicit policy of paying and growing dividends (known as a progressive dividend policy) usually aim to increase their payouts by at least the rate of inflation every year.

Theory is all well and good, but what about what happens in the real world?

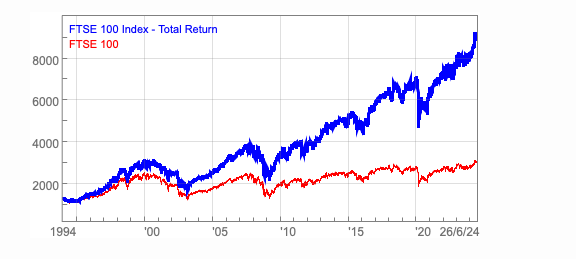

The chart below compares the value of the FTSE 100 (the lower or red line) with the value of the FTSE 100 Total Return index (the higher or blue line), which includes the effect of reinvested dividends since 1994.

You can now see that the total return index is worth a lot more than the FTSE 100 index.

This is important as it should make you look at investment results in a different way. Investing in shares is not just about the changes in share prices, it’s about the total returns which includes the dividends you receive.

However, the point I want to get across is that dividends matter and can make up a large chunk of the returns that you get from owning shares over the long run.

Buy the right share at the right time and the right price and you can see spectacular results. Take British American Tobacco (LSE:BATS) for example.

Let’s say you bought 1,000 shares of this company on the first trading day of 2000 for 332.5p (an investment of £3325 excluding stamp duty and dealing costs) when it was paying an annual dividend of 22.2p (or a dividend yield of 6.7%). The shares were very cheap as many investors ignored them and put their money into glamorous internet shares.

Just over fifteen years later though in January 2015, BAT shares are priced at 3522p and are paying an annual dividend of 144.9p. Most people would be quite happy. The shares have soared as has the annual dividend per share.

Even if they had spent their annual dividend income, their investment would have increased in value more than ten-fold to £35,220. The dividend income as a percentage of the original price paid (144.9p/332.5p) – or the yield on cost – would be an impressive 43.6%.

But say you’d reinvested your dividend income every year and bought more shares with it. Your investment would have soared in value to £69,335 with an annual dividend income of £2753.64 – or a yield on cost of 82.9%.

An investment of 1,000 shares in BAT since January 2000

| Left alone | With dividends reinvested | |

|---|---|---|

| Value of shares | £35,220 | £69,335 |

| Income Received | £1,112.60 | N/A |

| Investment value Jan 2015 | £36,332.60 | £69,335 |

| Annual income Jan 2015 | £1,449 | £2,753.64 |

| Yield on cost | 43.60% | 82.90% |

Of course, hindsight is a wonderful thing but this example does highlight three very important rules of a successful dividend re-investment strategy:

This is a very powerful investing strategy, especially for shares with high dividend yields that are capable of growing their dividends year after year.

What’s particularly good about it is that you focus your attention on the performance of the company and its ability to keep paying a growing dividend rather than what’s happening to the share price. The bigger the amount of your investment return that comes from dividends and their reinvestment, the less you tend to worry about share prices.

In fact, with this investment strategy you can actually welcome falling share prices. As long as the underlying business is sound, a falling share price allows your dividend to buy more new shares which means more dividends to potentially boost your long term returns.

With this mindset, you worry less and concentrate on what’s important rather than the short-term whims of the stock market. To me this is proper investing and more people would be better off – financially and emotionally – if they put their money to work this way.

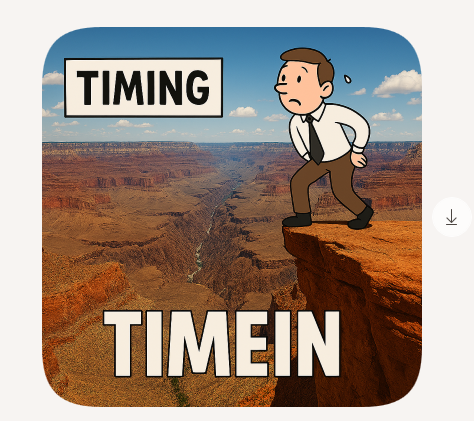

That said, evidence suggests that very few investors follow this strategy as the average time that people hold shares is becoming increasingly shorter which means that there is insufficient time for it to pay off.

This strategy is based on holding on to a share for a long period of time. This is known as a buy and hold strategy. However, this must not be confused with a buy and forget strategy.

Whilst you do hear stories of people who had left shares invested and forgotten about them for 30 years, and then to find out they had become millionaires, it is probably wiser to keep an eye on your investment from time to time.

I’m not talking about obsessing about share prices every day. Instead you should read the company’s half year and full year results statements to see that all is well and that your dividend is still safe and growing.

The other thing to keep an eye on from time to time is the dividend yield on your shares. This is important because it represents the rate of interest you are getting on your reinvested dividends.

Back in 2000, the dividend yield on BAT shares was 6.7%. This was the income return you would get by reinvesting the dividend. In January 2015, the dividend yield – and reinvestment rate – had fallen to 4.1%. The rate of dividend growth has also slowed down a lot. When this happens, the incremental value from reinvesting diminishes.

What you need to be constantly asking yourself is whether you can reinvest at a higher rate elsewhere? You can search for shares with high dividend yields and dividend growth potential with ShareScope. I’ll be showing you how to do this shortly.

Reinvesting your dividends is fairly straightforward. With funds (not exchange traded funds or ETFs) you can buy what are known as accumulation units that do this for you. Alternatively you can set up an automatic dividend reinvestment plan for individual shares with your broker (often restricted to shares that are in the FTSE 350 index) who will reinvest dividends for you for a small fee.

If you don’t want to reinvest back into the same share (for example if the price has gone up a lot and the dividend yield is too low), you can always just let your dividends increase your cash account over a year and then reinvest the money later on when you find a good dividend paying share at a reasonable price.

The temptation when you find shares that look interesting based on their numbers is to rush in and buy them.

This can often be a mistake.

Take your time and do your homework.

This should be seen as the bare minimum amount of research that you should do.

Following a disciplined approach means that you can learn a great deal about a company.

I also like to read the front half of the company’s annual report which gives a flavour of the company and its short- and longer-term objectives.

You won’t know everything – no outside investor ever does – but you should have enough information to know what you are buying and why.

The real skill in investing often rests with having the patience to wait and pay the right price.

People regularly rely on the dividend income from shares as a source of income to live on – especially in retirement and they are not buying an annuity.

If you are looking for dividend income to supplement your pension, then you can look for shares that might help you to do that in ShareScope.

Using dividends to find outstanding companies

Outstanding companies don’t necessarily have to pay a dividend or have paid one for a long period of time.

However, companies that have a long track record of increasing their dividend per share every year are often those with the characteristics of great companies.

An ability to keep increasing a dividend payout in recessions, pandemics and in the face of competition is one that generally serves investors well – again with the proviso that they buy the shares at a fair price.

When it comes to the UK stock market, only 10 companies have been able to increase their dividend per share for 20 years or more.

In the S&P 500 over in the US, that number increases to 14.

Posted on | By Phil Oakley

Updated: August 2024

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Q4 2025 Dividend Declaration

As previously indicated, the Company will pay a dividend of 2.50 pence per share (“pps”) for the period 1 October 2025 to 31 December 2025, (2024 Q4: 2.20 pence per share) amounting to 10pps for 2025. The entire dividend will be paid as a REIT property income distribution (“PID”).

Shareholders have the option to invest their dividend in a Dividend Reinvestment Plan (“DRIP”), and more details can be found on the Company’s website https://www.regionalreit.com/investors/investors-dividend/dividend-reinvestment-plan.

The key dates relating to this dividend are:

| Ex-dividend date | 26 February 2026 |

| Record date | 27 February 2026 |

| Last day for DRIP election | 20 March 2026 |

| Payment date | 10 April 2026 |

The level of future payment of dividends will be determined by the Board having regard to, among other factors, the financial position and performance of the Group at the relevant time, UK REIT requirements, the interest of shareholders and the long-term future of the Company.

REGIONAL REIT Limited

(“Regional REIT”, the “Group” or the “Company”)

Q4 2025 Dividend, Year End 2025 Valuation and Trading Update

Delivering in 2025, prudent approach in 2026

Regional REIT Limited (LSE: RGL), today announces its portfolio valuation as at 31 December 2025, Q4 2025 dividend, and an update for both EPC ratings and rent collections.

In 2025, the Company completed £51.6m of disposals – ahead of target and at a 1.3% premium to book value – and reduced LTV to 40.4% by year‑end (39.9% including post‑period disposals). The gross annualised rent roll of £50.4m tracked broadly as expected, while the dividend for the year was fully covered at 10 pence per share. December also saw the successful refinancing of £72.4m of debt which was due to expire in August 2026 and a new management contract being put in place bringing significant fee savings and also introducing much greater shareholder alignment for the Manager.

The portfolio valuation decreased by 2.9% in H2 2025, bringing the full‑year decline to 5.0%, largely reflecting previous changes in income following the tenant breaks previously announced.

Looking ahead to 2026, the Company’s strategy is to retain cash where possible to facilitate essential, accretive capital expenditure to accelerate the repositioning of the portfolio to benefit from occupiers’ demand for quality space. In addition, the successful sales programme from 2025 will be continued. This will reduce debt and LTV but also temporarily lower earnings. Given this, the impact of the lease breaks from 2025 and the fact that debt costs will increase from the refinance at August 2026, going forward the Company plans to distribute a minimum 90% of the profit from the property rental business and is targeting* a dividend of 8 pence per share dividend for 2026. The Board remains confident that this approach of improving the quality of the portfolio is firmly in shareholders’ long‑term interests and aligns with the Company’s strategy and medium‑term outlook

The target dividend has been cut from 10p to 8p.

That equates to a yield of 7.5%, so it continues to be a hold for the SNOWBALL

Ken Hall looks at a discounted UK REIT yielding around 9% and breaks down the key risk he believes investors shouldn’t ignore.

Posted by Ken Hall

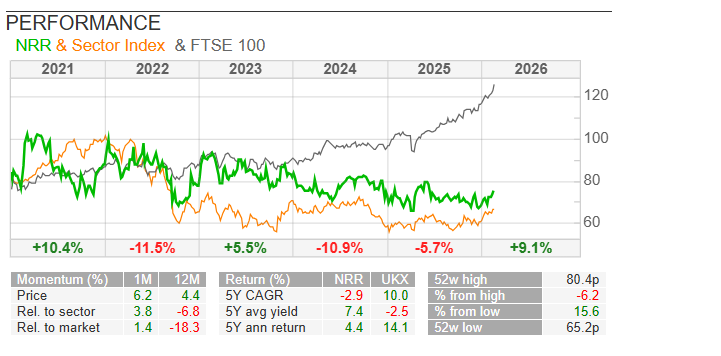

Published 18 FebruaryNRR

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

When a real estate investment trust (REIT) offers more than double the the market average yield, it usually comes with strings attached. A near-9% dividend yield looks generous and reassuring. It even looks like easy money.

But yields often rise for the wrong reasons. So before focusing on income, investors should aim to find out what’s driving it.

Over the past year, the NewRiver REIT (LSE: NRR) share price has struggled to build sustained momentum. While there have been short bursts of recovery, the stock has climbed just 2.7% in the last 12 months as concerns linger around UK retail property and borrowing costs

The business appears to have stabilised. Occupancy has improved and management has been recycling weaker assets. For the year ending 31 March 2025, adjusted earnings per share were 6.3p.

Yet retail property remains a tricky area. Even though the REIT focuses on convenience-led locations, which tend to be more resilient than fashion-heavy shopping centres, tenants still face cost pressures. If retailers struggle, rental growth can stall.

The company trades on a price-to-earnings (P/E) ratio of 11.3 as I write late on 17 February, which looks modest compared to the wider market. More strikingly, the shares change hands at a price-to-book (P/B) ratio just 0.6. In simple terms, the market values the company at a discount to the stated value of its property portfolio.

For income investors, the headline attraction is the near 9% dividend yield. That comfortably exceeds the FTSE 100 average, which sits closer to 3.5%.

That’s great from an income perspective, but it isn’t the whole story.

REITs come with tax advantages and are required to distribute at least 90% of their taxable income as dividends for shareholders. But high yields often signal perceived risk. Property companies typically carry debt, and higher interest rates increase financing costs. If borrowing remains expensive for longer, profit growth could stay under pressure.

There’s also the question of dividend cover. While earnings currently support the payout, there’s limited room for error if conditions worsen.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

The catch is not necessarily that the dividend is unsafe. Rather, it’s that the business operates in a sector still rebuilding confidence.

If interest rates fall and consumer spending remains steady, retail-focused REITs could see valuations improve. A move closer to book value alone could lift the share price meaningfully. In that scenario, today’s yield may prove attractive in hindsight.

But if the economy weakens or retailers retrench, property values could come under renewed strain. In that case, the high yield may simply reflect the stock’s high risk profile.

For now, this REIT offers a compelling income stream backed by improving fundamentals, which could support further share price gains.

However, the clear trade-off between a generous dividend yield in exchange for exposure to a tough sector is one that needs closer evaluation from investors.

For now, the numbers justify investor consideration, but not complacency. That’s the real catch behind this 9% yield.

Pair trading for your Snowball is where you pair a high risk trade with a lower risk trade.

The SNOWBALL invests to have a blended yield of 7%, as this doubles your income in ten years if the dividends are re-invested at 7%.

The SNOWBALL currently invests in Investment Trusts as currently many trade at a discount to NAV. If these discount close the SNOWBALL would look to re-invest in ETF’s.

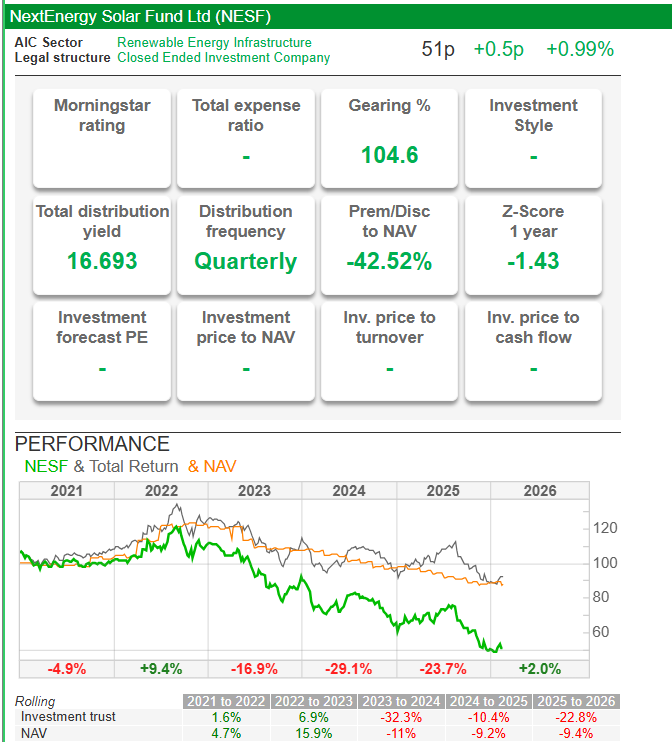

If you wanted to build up a fund to re-invest to buy a coveted share the next time the market crashes you could buy a money market account, although if the expected interest rates happen, the income will fall, or lock in a yield of around 3.5% with a short term gilt and pair trade it with a higher yield Investment Trust such as NESF.

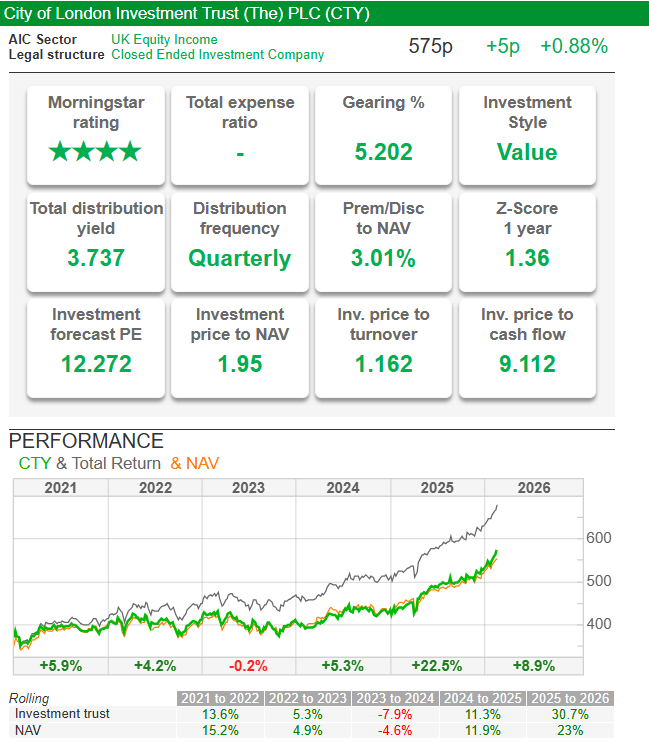

Or if you wanted an equity share CTY.

Faith Glasgow explains the benefits of investing in funds with contrasting styles or approaches, and asks a range of experts to name their top fund pairings for several major regions.

18th February 2026

by Faith Glasgow from interactive investor

Should you hold several funds covering the same market? Certainly, articles about diversification often warn of the dangers of stock overlap between funds, resulting in unwitting over-exposure to particular companies.

However, all markets comprise a range of businesses in terms of size, sector, and other characteristics such as growth, value, or a dividend focus – so there’s a interesting case for combining funds that adopt complementary styles or focuses to cover the same region.

Obvious pairings include growth-focused holdings with those seeking out undervalued businesses, and pairs concentrating on different market capitalisations.

Not only can such combinations provide broader (but still selective) coverage of that market, but they may respond differently to wider macroeconomic issues such as interest rate trends, inflation or US tariff imposition – giving you a more robust portfolio overall.

To give you some ideas for attractive pairings, we’ve asked some experts for their recommendations across several major regions.

Global fund managers have a huge universe of stocks from which to select, making a best-ideas philosophy – where the manager does a lot of filtering and deep research – an attractive starting point. On that basis, Sheridan Admans, founder of Infundly, a UK-based investment consultancy, suggests pairing the WS Blue Whale Growth I Sterling Acc and WS Havelock Global Select A GBX Acc funds.

Although both funds take a similarly high-conviction approach, they come at it from very different starting points in regard to portfolio construction, risk exposure and sources of return.

Blue Whale Growth uses bottom-up selection processes to identify just 25 to 35 large-cap stocks from developed markets, particularly North America. It focuses on businesses with real potential to grow and become more profitable in the long term, and attractive valuations bearing that potential in mind.

“This structure gives Blue Whale strong upside participation when global growth leadership is concentrated in high-quality franchises with durable earnings and pricing power,” Admans explains – although the portfolio can be relatively volatile.

In contrast, Havelock Global Select’s 30 to 40 holdings are selected on the basis of value and quality, “where valuation, balance-sheet strength, asset backing or behavioural mispricing create attractive long-term return potential”.

There’s a bias towards mid- and smaller-cap businesses and away from the crowded mega-cap growth space, and a more even spread across the US, UK and Europe, reducing reliance on any single regional growth engine and helping to lower volatility.

The two strategies form a complementary global equity pairing, says Admans. “One is designed to capture sustained growth in dominant franchises through a concentrated large-cap portfolio; the other seeks out a concentrated set of value and quality-led ideas, exploiting mispricing and structural inefficiencies.”

Stephen Yiu, manager of Blue Whale Growth, was recently interviewed by interactive investor. You can watch the videos via the links below.

At Nedgroup, multi-manager portfolio manager Madhusree Agarwal offers a markedly different approach to US investment.

Nedgroup makes strategic use of index tracking funds to deliver returns for investors, and for US coverage that includes pairing the S&P 500at market‑cap exposure with a S&P 500 Equal Weight ETF. As Agarwal observes: “On paper, they hold the same companies. In practice, they deliver very different outcomes.”

There are plenty of index fund and ETF options to gain exposure to the S&P 500 index, however the most-popular options among interactive investor customers are the accumulating and distribution versions of

Vanguard S&P 500 ETF USD Acc VUAA

and

Vanguard S&P 500 UCITS ETF GBP VUSA

Two equal weight ETF options are Invesco S&P 500 Equal Weight ETF Acc GBP SPEX

and

Xtrackers S&P 500 EW ETF 1C GBP XDWE

Agarwal explains that the market‑cap weighted S&P 500 “remains the most efficient way to capture long‑term US equity growth, but it naturally becomes concentrated in the biggest winners, particularly during periods when mega‑cap growth stocks dominate markets”.

As a result, investors can end up with far more concentrated exposure to a small number of names than is desirable. By pairing a standard S&P 500 ETF with an equal-weight approach counterpart, she adds, risk is spread more evenly and rebalancing takes place regularly.

In addition, Agarwal suggests complementing this large‑cap pairing with S&P 600 small‑capexposure. That further broadens the source of returns for investors, providing greater sensitivity to domestic US growth and higher use of debt to leverage returns. Options include

iShares S&P SmallCap 600 ETF USD Dist GBP ISP6

Invesco S&P SmallCap 600 ETF USML

“Importantly, the S&P 600 includes profitability screens, which improves quality relative to many broader small‑cap indices,” she notes. Rather than betting on a single style being ‘right’, “the aim is to build US equity exposure that can adapt as market leadership changes, delivering a smoother and more resilient outcome”.

The Shard, London, towers over a Union flag.

For the UK, Admans identifies two valuation-led conviction-based funds that focus on different parts of the market cap spectrum – and also different stages of the recovery cycle.

The large-cap bias of Invesco UK Opports (UK) (No Trail) (Acc) means that “its opportunity set is global in revenue terms, with many holdings generating cash flows well beyond the domestic economy,” he explains.

The managers look for companies trading at discounts to their own history and to peers, often where uncertainty, regulation or cyclical pressure has weighed on investor sentiment.

“This leads naturally to exposure to established, cash-generative franchises, particularly in areas such as financials, healthcare and consumer staples, where balance sheets and dividends provide support while valuation normalises,” he adds.

Aberforth Smaller Companies Ord

investment trust, in contrast, is firmly focused on small businesses with balance sheet strength and sustainable dividends, but “where mispricing has been both more persistent and more pronounced” than the Invesco fund.

ASC’s portfolio comprises around 80 companies, but is very much conviction-led, with “stakes of over 10% in 28 companies” and a strong focus on active engagement with management as part of the turnaround process.

As Admans points out, the pairing works because “Invesco provides exposure to UK-listed franchises that can re-rate as pessimism fades, offering income and stability while investors wait; Aberforth complements this with exposure to deeply undervalued smaller companies, where any improvement in liquidity, confidence or M&A activity can drive outsized returns.”

Meanwhile, for smaller company aficionados, Ryan Lightfoot-Aminoff, an analyst at Kepler Partners, suggests the pairing of Rockwood Strategic Ord

investment trust and IFSL Marlborough UK Micro Cap Gr P Acc fund for their contrasting style and approaches to portfolio construction.

RKW, says Lightfoot-Aminoff, has done very well through “building a highly concentrated portfolio of out-of-favour micro caps, taking sizeable stakes and helping to instigate a turnaround, with the goal of selling after around three to five years”.

The Marlborough fund, in contrast, comprises a highly diversified portfolio of around 150 of the smallest companies in the market, filtering out some parts of the economy before analyzing and picking stocks, “with a preference for growth stocks”.

The contrast in terms of concentration, active engagement and growth versus value tilts makes them a useful pairing for this rich hunting ground.

Peter Walls, manager of Unicorn Mastertrust B, a fund of investment trusts, highlights the fact that although smaller companies can outperform larger counterparts in most markets, “there are periods when they lag behind and then catch up in short order”.

Because it’s so hard to know when those reversals will occur, it particularly pays investors to be diversified across both large and small companies. In Europe, he suggests Fidelity European Trust Ord

and The European Smaller Companies Trust PLC

0.23% to cover the market-cap spectrum.

Both have well-regarded managers, but “Fidelity European has nearly all its assets invested in companies valued at more than £10 billion, while ESCT holds companies with an average market capitalisation of £1 billion and rarely strays above £3 billion”.

Taking a more growth/value-based tack, Ben Yearsley, an investment consultant at Fairview Investing, selects the Montanaro European Smaller Ord

fund for a fairly concentrated portfolio of small to mid-cap quality growth companies with strong balance sheets, “often in niche areas that are growing”.

He pairs that with WS Lightman European R Acc, a “proper value fund looking for cheap companies that have started to turn the corner”. Again, though, a robust balance sheet is a must.

Silhouettes of people walking in Chaoyang district, Beijing, China.

For effective risk-managed exposure to China’s growth story, Admans selects Jupiter China Equity Fund U1 GBP Acc, a core large-cap fund with a preference for well-established businesses.

“It aims to capture long-term earnings growth through policy-supported structural themes, such as domestic consumption, expansion of the region’s financial market, and digitalisation, while maintaining risk discipline in a volatile and politically sensitive market,” he says.

His suggested pairing is Fidelity China Special Situations Ord FCSS

which fishes in the same ocean but takes a much more idiosyncratic approach. Because FCSS is “structured as an investment trust, it has the flexibility to use gearing, take short positions, and invest selectively in less liquid or under-researched parts of the market”.

The fact it is an investment trust also gives potential for a further performance ‘kick’ when sentiment improves towards China and the discount narrows. “The pairing works because it separates core exposure from opportunistic return drivers,” Admans adds.

For effective coverage of the Japanese market, Ben Mackie, a senior fund manager at Hawksmoor Fund Managers, also combines investment trusts and funds with contrasting investment styles and market cap exposures.

His first pick is Nippon Active Value Ord NAVF

investment trust, which has a high-conviction portfolio with a small-cap focus. “The managers take significant stakes in smaller companies trading on cheap valuations and follow a strategy of active engagement that can range from constructive advice on operational matters to corporate activity,” Mackie observes.

“NAVF is one of the purest ways of playing the Japanese corporate governance reform story, while the managers’ willingness to effect change and unlock value at individual companies drives idiosyncratic returns.”

Lazard Japanese Strategic Equity EA Acc GBP is selected as a good complement. Mackie explains that while its fund managers can go down the market-cap spectrum (and recently have) the portfolio tends to have a bias to larger companies.

He adds: “Although valuation conscious and often contrarian, the portfolio is managed in a pragmatic manner resulting in balanced, style agnostic exposure to the Japanese market. Stock selection should be the main driver of returns with the high-conviction portfolio a bottom-up collection of convex positions, with a risk management overlay to ensure sensible factor and sector diversification.”

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company’s or index name highlighted in the article.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑