If you are going to invest, you may need to grasp the nettle and re-invest the dividends back into the Trust when the price has fallen, maybe when it’s near to it’s high, re-invest into a Snowball higher yielder.

Investment Trust Dividends

If you are going to invest, you may need to grasp the nettle and re-invest the dividends back into the Trust when the price has fallen, maybe when it’s near to it’s high, re-invest into a Snowball higher yielder.

A UK share, an investment trusts and an ETF to consider for a £1,185 second income.

By harnessing a range of different dividend stocks, I’m confident this mini portfolio might pay a large long-term second income.

Posted by Royston Wild

Published 7 July

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services.

Investing in UK dividend shares can never deliver a guaranteed second income. However, holding a portfolio of stocks — whether through direct ownership, or via an investment trust or exchange-traded fund (ETF) — can substantially reduce the risk of dividend disappointment.

A mix of the following London Stock Exchange assets would currently give investors exposure to 169 different dividend-paying companies. And if broker forecasts are accurate, a £15,000 lump sum invested equally across them will provide a £1,185 passive income this year alone.

Here’s why I feel they’re all worthy of consideration.

FTSE 100-listed M&G generates enormous amounts of cash it pays out to investors through a large and growing dividend.

For 2025, its dividend yield is 7.9%, more than double the Footsie average of 3.4%. This is underpinned by the company’s robust balance sheet — its 223% Solvency II capital ratio as of December gives the company ample scope to absorb shocks while still paying a market-beating dividend.

Reflecting this, M&G formally implemented a progressive dividend policy earlier this year. Over time, I’m optimistic this will create great returns as demand grows in the retirement and asset management sectors.

Be mindful, however, that the business will have to paddle hard given high levels of market competition.

With a focus on fast-growing markets, the JPMorgan Asia Growth & Income (LSE:JAGI) aims to provide better-than-normal returns. Today its forward dividend yield is 5.5%.

On the one hand, investing in emerging markets can sometimes be a wild ride. Political and economic turbulence can be common, impacting regional profitability. But then the long-term rewards can also be considerable thanks to breakneck population growth and increasing disposable incomes.

In total, this trust holds shares in 68 companies including Taiwan Semiconductor Manufacturing Company, Alibaba, HDFC Bank and Samsung. And it’s focused on Asia Pacific’s regional heavyweights China, India, Taiwan and South Korea.

As for dividends, the trust’s board voted in March to raise its enhanced dividend to between 1% and 1.5% of net asset value (NAV) per quarter. This could significantly boost the amount of long-term dividend income it provides.

The Global X SuperDividend ETF (LSE:SDIP) does exactly what it says on the tin. What makes it so good is its focus on businesses with turbocharged dividend yields — more specifically, it “invests in 100 of the highest dividend yielding equity securities in the world.”

Another benefit is that it pays dividends out monthly, allowing investors the chance to reinvest their cash earlier for improved compound returns.

I like the fund because it’s well diversified by geography and sector. The US is currently its largest single region, though this still accounts for less than 25% of its portfolio. And in terms of industry, well represented areas include financial services, energy, real estate and basic materials.

This GlobalX fund has greater exposure to cyclical sectors than some other ETFs, however. This could cause it to underperform its peers during economic downturns.

But I believe the positives of holding it still make it worth considering. The dividend yield here is an enormous 10.2%.

Michael Foster, Investment Strategist

Updated: July 7, 2025

Maybe you’ve heard some variation on this fear in the last few years:

A lot of American companies are going to default on their debts.

I know I have. Frankly, pushing back on it was among the most contrarian calls I’ve made during my investment career. And it was tough to stick with. I’ve been in plenty of conversations with bankers, hedge fund managers and other Wall Street types who thought a default wave was right around the corner.

But it wasn’t. And it isn’t now—even though the fear remains. And we’re going to tap this ongoing misconception for a cheap (but getting less cheap every day) 8.6% dividend in just a second.

What I think many people tend to forget about this default panic is that it was once so prevalent that, in 2022 and most of 2023, it caused the market to heavily mark down high-yield corporate bonds (a.k.a. junk bonds).

High-Yield Bonds Took a Hit—Then Rallied in Late 2023

It never came to pass. As a result, we saw corporate bonds surge at the end of 2023, as you can see in the benchmark SPDR Bloomberg High Yield Bond ETF (JNK) above. And that surge in JNK has kept rolling, despite the April tariff selloff.

That’s put longer-term investors in a great spot. Junk? Not to them!

“Junk” Bonds Shake Off Fears

Not only did defaults not rise—they stayed in what I consider the “safe zone,” helping fuel demand for high-yield bonds.

Since COVID, we’ve seen business-loan delinquencies at around 1%, rising to around 1.3% over the last year. That rise is pretty much insignificant, historically speaking.

Defaults were lower in the mid-2010s, but interest rates were near zero then. Yet in the last few years, rates soared, then started to move lower—and corporate defaults still stayed relatively low.

And if you look at just the default rate for speculative-grade bonds—the worst-rated and most uncertain corner of the corporate-bond universe—defaults have been falling for a while now. Analysts expect them to fall even further throughout the rest of the year. That’s in large part due to an expected decline in rates, strong corporate profits and a surprisingly resilient US economy.

That positive outlook has, in turn, helped keep demand for high-yield corporates so high that they’ve spent most of 2025 outperforming the S&P 500—a rare feat indeed. And they’ve done it while showing almost no volatility.

Stocks Wobble, High-Yield Bonds Stair-Step Higher

With the stock market now fully recovered and starting to outperform high-yield bonds, it’s only natural to worry if this trade has gotten a bit crowded. But some new data from the New York Federal Reserve suggests that, in fact, risk in the corporate-bond market is near an all-time low.

Source: Federal Reserve Bank of New York

The Corporate Bond Market Distress Index (CMDI) isn’t well-known among most investors, but insiders know it as a reliable indicator of bond weakness.

After a recent small spike due to the tariffs, the CMDI is falling again and is at a historic low as of this writing. The New York Fed says this “improvement in market functioning is reflected in both the investment-grade and the high-yield CMDI sectors.” In other words, both low-risk and high-risk bonds are in a much healthier position than they used to be.

Many fund managers have known this for a while, so they’ve been buying up corporate bonds. Wealth managers have realized this, too, and have jumped in—helping shrink discounts for corporate-bond closed-end funds (CEFs). Today, bond CEFs have a 4.1% average discount to net asset value (NAV, or the value of their underlying portfolios) far below their average of around 7.5%.

A (Still) Cheap High-Yield Bond Fund Paying 8.6%

Some high-yield bond CEFs are bucking the trend with wider discounts. One is the Western Asset Inflation-Linked Opportunities & Income Fund (WIW), which has a 10% discount that’s been narrowing—moving closer to that 7.5% bond CEF average.

WIW’s Discount Shrinks

That narrowing discount isn’t the only thing the fund has going for it; with an 8.6% yield and 325 holdings, WIW has two other key strengths: broad diversification and a huge income stream.

WIW lowers risks even more than the typical CEF, which will likely shrink its discount further. One factor at play here is the fund’s focus on inflation-linked bonds. The vast majority of its holdings (now about 80%) are in TIPS, a kind of US government bond that pays out more income if inflation rises.

Now, hang on a second, you might be wondering. What about all of that corporate-bond risk? Exactly. Since WIW only holds about 20% of its portfolio in corporate bonds, it isn’t at risk if the corporate bond market suddenly worsens.

And if it does worsen, WIW may attract a flood of income investors seeking a safe haven—like US government bonds. That really should already be happening, since WIW’s total NAV return (the best measure of management’s talents) has been beating the corporate bond market and the S&P 500 in 2025:

WIW Beats Bonds and Stocks in 2025

These are a couple of reasons why WIW’s discount should shrink further. But even if that doesn’t happen, its portfolio value should keep rising as investors look for safety.

And if we see a tariff-driven rise in inflation, WIW should benefit again, since its cash flow rises with inflation. As a result, the fund is positioned to rise regardless of how the market moves, yet it trades at a discount more than double the average CEF bond fund!

This situation can’t last. The fact that it still exists makes WIW a great place to invest while the market catches up—and collect an 8.6% dividend while you wait.

Thursday 10 July

Amedeo Air Four Plus Ltd ex-dividend date

BlackRock Latin American Investment Trust PLC ex-dividend date

Cordiant Digital Infrastructure Ltd ex-dividend date

Invesco Asia Dragon Trust PLC ex-dividend date

JPMorgan Asia Growth & Income PLC ex-dividend date

Merchants Trust PLC ex-dividend date

Polar Capital Holdings PLC ex-dividend date

Schroder UK Mid Cap Fund PLC ex-dividend date

The Global Smaller Cos Trust PLC ex-dividend date

Volta Finance Ltd ex-dividend date

Not naval gazing, that’s a totally different topic for boys and girls.

The updated Snowball plan.

Current cash for re-investment £431.00, expected dividends £493.00.

Unless an unexpected event occurs, the Snowball will have to wait for August for any cash to be re-invested.

Moving onto investment trusts, June’s most-purchased trusts mainly saw more of the same, though we did have one intriguing new entry:

| Top five most-bought investment trusts |

| 1. Scottish Mortgage (SMT) |

| 2. City of London (CTY) |

| 3. JPMorgan Global Growth & Income (JGGI) |

| 4. Greencoat UK Wind (UKW) |

| 5. Tiger Royalties & Investments (TIR) |

Source: AJ Bell, Bestinvest and interactive investor

The most interesting addition to this week’s investment trust list is Tiger Royalties (TIR), which has featured on Kepler Trust Intelligence just once before. TIR combines a portfolio of small-cap mining companies such as African Pioneer and Galileo Resources, with a recent move into cryptocurrencies and artificial intelligence.

TIR recently acquired Bixby Technology, which itself aims to invest in technology enterprises, for £325,000. Bixby’s first purchase was AROK, which allows people to invest in so-called utility meme coins, which TIR says are a type of crypto asset built to represent the live fiscal value of a social movement. It then invested in TAO Strategies Singapore, which operates on the Bittensor blockchain network.

Shares have been on a rollercoaster ride in the past month, rising initially c. 450%, but falling by c. 50% since.

We’ll very quickly run through the top four, as they’re long-time favourites. Scottish Mortgage (SMT) continues to be in vogue, as it benefits from US growth stocks’ recovery post-Liberation Day.

Dividend hero City of London (CTY); and core, global equity income option JPMorgan Global Growth & Income (JGGI) rode high on the equity side, too.

Elsewhere, a renaissance in the renewables sector has kept wind farm owner Greencoat UK Wind (UKW) in demand. Shares have risen c. 20% since April – almost as much as some US tech stocks – to trade at a five-month high.

Published on July 4, 2025

by Val Cipriani

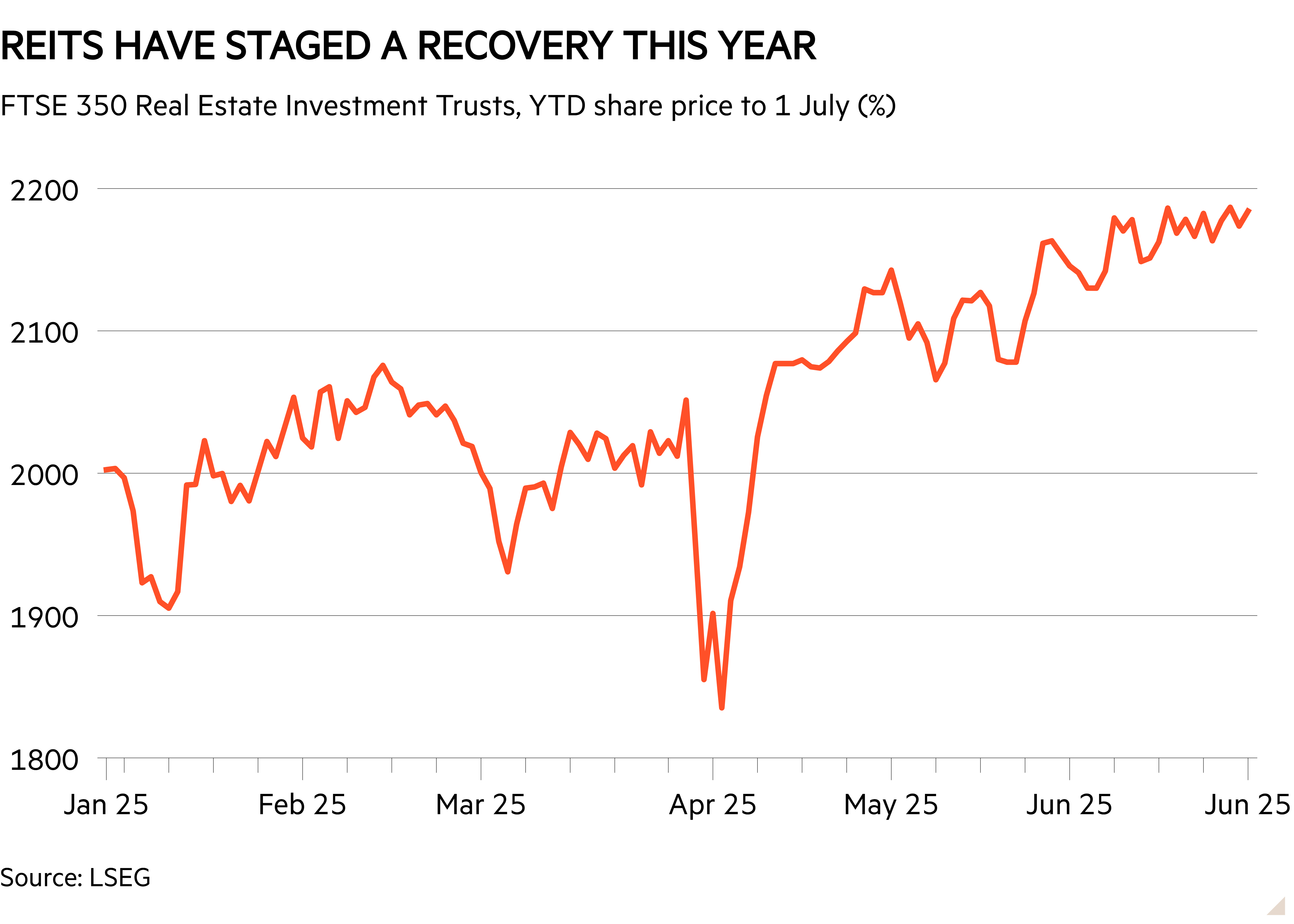

After three fairly abysmal years, real estate investment trusts are having a solid 2025 – the FTSE 350 Real Estate Investment Trusts index returned 11 per cent between the start of the year and 25 June.

But with interest rates only coming down at a snail’s pace, a flurry of corporate activity has done some of the heavy lifting for the sector.

Last week, Warehouse Reit’s (WHR) board recommended an offer from rival Tritax Big Box (BBOX), higher than the previously announced offer from Blackstone; in June, PRS Reit (PRSR) said it received a cash proposal from real estate investment management firm Long Harbour. And this is just the latest news.

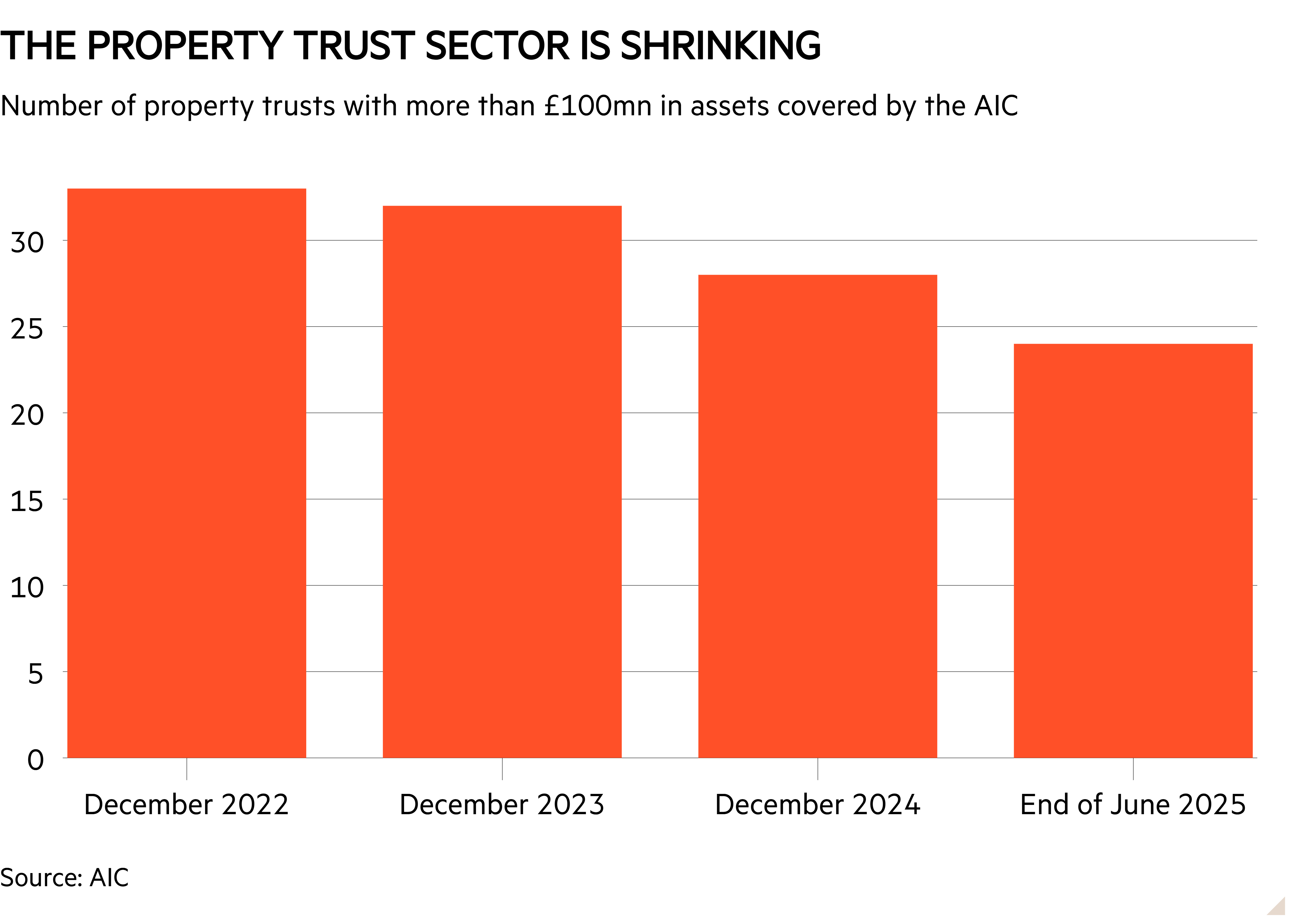

Investors are being left with fewer options, particularly if they wish to access specialist areas of the sector.

Nobody seems shocked that M&A is happening at pace. The UK-listed property sector has often been criticised for being too fragmented, and higher interest rates and shares trading at a discount to net asset value (NAV) have provided a catalyst for consolidation and dealmaking.

In theory, a consolidated sector is not automatically a smaller one, at least in terms of sheer asset value. Some think that listed buyers are actually better positioned than private equity buyers, as demonstrated by the bidding wars for Assura (AGR) and Warehouse Reit.

“Borrowing costs are so elevated that private equity funds, which typically use more debt than Reits for acquisitions, are now at a disadvantage,” says Edoardo Gili, senior analyst at Green Street. “Perhaps counter-intuitively, we therefore expect the Reit market to keep growing, as long as borrowing rates remain high in the UK.”

Some of the biggest Reits, particularly LondonMetric (LMP) and partly Tritax Big Box, are showing an “entrepreneurial” mindset, demonstrating focus and ambition to scale up. This is a pretty new approach in the UK market,” says John Moore, wealth manager at RBC Brewin Dolphin. The other big players in the sector might have to take note or risk being left behind.

Analysts also agree that there is more corporate activity to come. “There are too many small-scale and inefficient Reits in the UK that should be consolidated within broader companies,” says Gili.

On this note, it is worth keeping in mind that there are technically two types of Reits: trading companies such as LondonMetric, which are under the FCA listing category of “equity shares”, and those such as Tritax that list as “closed-ended investment funds”, and as such are covered by the Association of Investment Companies.

Most of the biggest players in the sector, including the giant Segro (SGRO), are in the first group, while the second category has been shrinking fast, as the chart below shows.

Cost disclosure rules, which campaigners argue have been contributing to discounts across the investment trust sector, would apply to the second group but not the first.

Meanwhile, private equity buyers are by no means out of the picture. Richard Williams, property analyst at QuotedData, notes that discounts still look wide – for example, as of 25 June, the average was 15 per cent for the AIC UK commercial property sector, and 11 per cent for the residential sector.

“With share prices where they are, there remains ample opportunity for private equity to bag more portfolios on the cheap and reap the benefits of the valuation uplifts to come at the expense of shareholders,” he says.

If you had bought MRCH at the start of 2005 the price was 372p and the dividend was 18.3p a yield of 5%

The current dividend 28.4p a yield of 7.6% on buying price, current yield if you bought today 5.16%.

You would have sat thru thick and thin and there will always be plenty of thin.

You have achieved the holy grail of investing of having a share yielding 7.6% on buying price, producing income at cost of zero, zilch nothing if you took out your stake and also income from the re-invested dividends into your Snowball.

If you buy into a Investment Trust that owns shares to pay your dividends, you will buy into their enhanced dividend yield as in the earlier working example of CMPI which owns Investment Trusts to do the same.

Above are shares from CMPI, see below.

If you want to make a dummy portfolio to learn more about the Trusts in your Snowball, the above could be a good starting point.

Maybe avoid the really low yielders as they will be a drag on your income.

A target yield of around 7%.

7% because it double your income over ten years, if you can re-invest your dividends at 7% plus.

A passive income plan built around investing in dividend shares could be a simple but potentially lucrative way to earn money without working for it.

Posted by Christopher Ruane

Published 5 July

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more.

One popular way to earn passive income is investing in shares that pay dividends. It is an approach that can be tailored to someone’s individual financial circumstances.

It can also be pretty lucrative, especially if that someone has patience to wait and adopt a long-term approach to investing.

As an illustration, here is how they could target a monthly average passive income of £841 from an initial investment of £20k.

Let me explain how I arrived at that number. It is based on an investor compounding £20k at 9% annually for two decades, then generating a passive income from it at a 9% yield.

That compounding could involve both capital gain and any dividends paid. Share prices can fall though, and that also would affect the overall performance, so the final figure is by no means guaranteed.

As for a 9% yield 20 years down the line, based on today’s market there are some quality shares yielding that much – but careful selection is important. Some shares have high yields because investors doubt that the dividend can be sustained.

What sort of shares do I have in mind here? As an example, one I think investors should consider is FTSE 100 asset manager M&G (LSE: MNG).

For some years, it has had a policy of aiming to maintain or grow its dividend annually. It has recently simplified that to a policy of targeting annual increases in the dividend per share. I see that as a vote of confidence by the company’s board.

That is likely music to shareholders’ ears, especially as M&G already yields an impressive 7.8%. That is over double the FTSE 100 average.

The company has a number of strengths, including a large customer base, strong brand and long experience in asset management.

A recent tie-up with a Japanese financial services firm could help bring in more funds to manage. I see that as positive, because one of the risks that has been concerning me about M&G shares is that policyholders have been withdrawing more funds than they put in. That is a risk to profits.

All shares have risks, of course. One simple way smart investors aim to mitigate them is to diversify across different shares. Twenty grand is ample to do that.

It is also important to choose high-quality shares trading at attractive prices. It can be hard to know whether shares really fit that bill. Like billionaire investor Warren Buffett, I therefore stick to businesses I feel confident I can understand.

It is all very well having a passive income plan – but how can someone turn it into reality? A useful first step, in my view, is to set up a way to put the £20k to work in the market. Actually, it is possible to start with less, but the passive income streams would be proportionately smaller.

To do that, an investor could compare some different options for a share-dealing account, Stocks and Shares ISA or share trading app.

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑